China’s Startup Landscape – Industries, Investment, and Incentive Policies

China is home to a vibrant startup landscape and some of the world’s most innovative companies. With the help of government incentives for technological development and innovation and an increase in venture capital investment, China has succeeded in fostering the second-largest number of unicorn companies in the world. We look at how China’s startup landscape and venture capital investment have developed over the last few years and outline the supportive policies that are currently available to young companies and entrepreneurs.

China’s startup landscape has expanded significantly over the last decade and is quickly catching up with other major economies to become one of the world leaders in entrepreneurship, innovation, and investment.

Encouraged by government incentives and the promise of rapid growth and returns, overseas venture capital (VC) investment has poured into China over the past few years, which has fostered the second-highest number of “unicorn” companies in the world after the US. The development of startup companies – in particular, technology-based companies – is closely aligned with the Chinese government’s goals to foster the development of strategic and emerging industries, such as artificial intelligence, integrated circuits and semiconductors, and biotechnology, among others. In addition, fostering entrepreneurship may also help to alleviate underemployment, particularly among young people, which is another concern for the government.

For these reasons, China has rolled out various incentive and support policies for entrepreneurship, small businesses, and VC and angel investment.

Overview of China’s startup landscape

According to the Global Startup Ecosystem Index by StartupBlink, which assesses countries’ startup economies, China ranked 10th in the world and the first in East Asia in 2022. The top cities for startups in China were Beijing, Shanghai, and Shenzhen, with other major cities including Hangzhou, Guangzhou, Chengdu, Wuhan, Changsha, and Nanjing.

Given the relatively loose definition of a startup, there are no concrete figures on the number of startup companies in China. However, according to Forbes China, there were over 368 “unicorns” in 2022 (privately held startup companies with a valuation of over US$ 1 billion), with 74 new ones added from the previous year. Meanwhile, Chinese economist Ren Zeping estimates the total valuation of China’s unicorns in 2022 to be at RMB 9.4 trillion (approx. US$1345.5 billion).

Some major names in China’s startup space include Shein (e-commerce, valued at RMB 97.5 billion (approx. US$14.1 billion) in 2022), DJI (high-end hardware, valued at RMB 100 billion (US$14.5 billion) in 2022), WeBank (fintech, valued at RMB 200 billion (US$28.9 billion) in 2022), and ByteDance (new media, valued at RMB 2.3 trillion (approx. US$332.8 billion).

Beyond the billion-dollar companies, the number of startups is likely in the tens of thousands. The Ministry of Industry and Information Technology (MIIT) states that in 2022, an average of 23,800 new companies were established every day, and the number of micro, small, and medium-sized enterprises (MSMEs) exceeded 52 million.

Among these were 70,000 so-called “specialized, refined, special, and innovative” small and medium-sized companies (专精特新 – referring to companies with strong business specialization, refined management, specialized processes, and a high level of innovation). These included 8,997 “little giants”, which are pioneer companies that dominate certain market segments and have great potential for innovation.

China’s startups by industry

Startups in China are concentrated mostly in a handful of high-tech and innovative industries. These include high-end hardware, new vehicles, medicine and healthcare, enterprise services, software services, supply chain logistics, e-commerce, fintech, new media, and “new consumption” (new types of consumer behavior and consumer business models enabled by digital technology).

According to research by Ren Zeping, the largest proportion of unicorns were in e-commerce, healthcare, and hardware, with around 12.9 percent of unicorns being in e-commerce and healthcare and 12.1 percent in hardware. By market valuation, the largest sector by far was new media, which accounted for 28.2 percent of the total valuation of all unicorns in China, although this result may have been skewed by the inclusion of TikTok owner ByteDance, which is the single largest unicorn by valuation in both China and the world. This was followed by fintech, with fintech unicorns accounting for 16.1 percent of the total valuation.

Various high-tech sectors are also receiving significant attention in the startup space. According to IT Juzi, a startup database and information service provider, of the 327 companies in the new economy that were established and received financing at the end of 2022, 36 were in biotechnology and drug manufacturing, 23 were in integrated circuits (IC), 18 were in new materials, 17 were in new energy, and 14 were in metaverse industry applications.

Projects that received funding in the IC industry, which is an important growth industry for the Chinese government, included FPGA chips, lidar, packaging materials, new-generation semiconductor materials, and automotive-grade chips.

There were also some startups in more niche and emerging industries that received funding in 2022, such as companies operating in the NFT, pet services, sodium-ion batteries, camping, and perovskite materials for solar energy batteries.

VC funding and investment

Investment in Chinese startups has been on the rise for the last decade, and interest in the Chinese market from venture capital firms has also increased. According to a report from Crunchbase, China surpassed the US as the number one destination for venture capital (VC) investment for the first time in the second half of 2018, although this was driven largely due to the large sum of funds raised by Ant Financial.

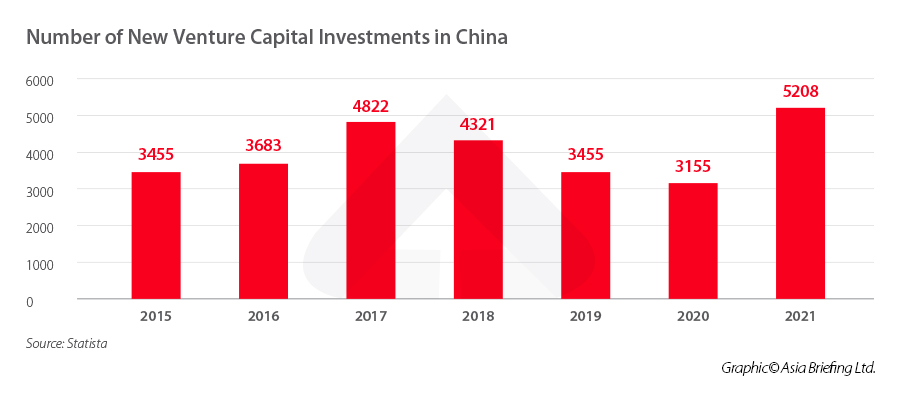

According to data from Statista, the number of new VC investments in China has risen steadily since 2010, and reached 5,208 investments worth a combined RMB 371 billion (approx. US$53.7 billion) in 2021, following a slowdown in 2019 and 2020.

VC funding into China appears to have dropped once again in 2022, according to research by Crunchbase, with total funding falling from US$88.5 billion in 2021 to US$44.2 billion in 2022. This reflects the downward trend in VC funding experienced in many markets across the world, including Asia, due to the impact of inflation and high-interest rates in international markets.

However, Crunchbase also noted that there were nonetheless a few major investment projects in China, which include US$2.5 billion raised by EV company GAC Aion New Energy Automobile and US$1.5 billion raised by Shein.

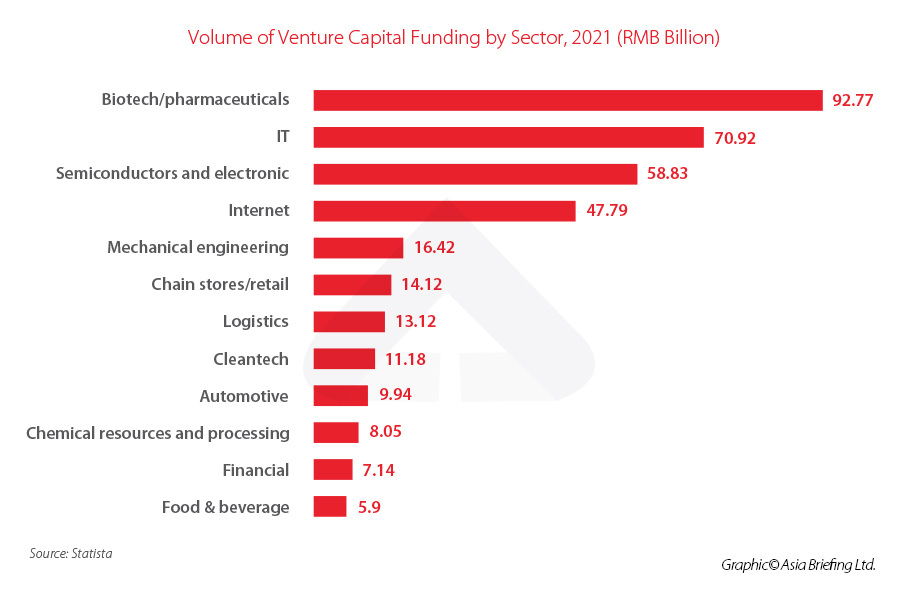

According to data from Statista, in 2021, the sectors that received the highest volume of VC funding were biotechnology and pharmaceuticals, IT, semiconductors and electronics, and internet industries.

US VC firms continue to dominate, but a number of Chinese companies have emerged and are making strides in the industry. Among the 121 top VC firms that were included in the Hurun Global Venture Capitalists 2022 Half-Year Report, 86 were established in the US and 24 were established in China. Among the top 10 VC firms (the firms that had invested in the largest number of unicorn and “gazelle” companies), two were Chinese – Tencent and China International Capital Corporation (CICC).

Other major VC firms that have invested in China include Sequoia Capital (ByteDance, Shein, and Envision Energy), Softbank (ByteDance and Guazi.com), and IDG-Accel, a joint venture between Chinese investment firm IDG Capital and US VC firm Accel.

Major Chinese firms investing in startups include Tencent, CICC, Qiming Venture Partners, and CITIC Capital.

Profile of young entrepreneurs in China

A survey of entrepreneurial youth groups conducted in 2021 by the University of International Business and Economics (UIBE) in Beijing showed that entrepreneurs were highly educated, with over 85 percent holding a college degree.

In terms of funding, over 90 percent had startup capital of less than RMB 500,000 (approx. US$72,337), which mainly came from personal or family savings or loans from relatives and friends. Meanwhile, financing was mainly achieved through bank loans and partnerships.

Among the entrepreneurs surveyed, 70 percent were starting a company for the first time, whereas 50 percent of those over the age of 33 already had experience starting two or more companies.

The most common structures for a startup were sole proprietorships and partnerships.

On average, entrepreneurs start making a profit within three years of starting the company, and more than half of startups achieve significant expansion in the initial stage.

Finally, the entrepreneurs cited insufficient startup funds, social resources, and knowledge reserves as the main difficulties faced by young entrepreneurs.

Government incentives for startups

In 2015, the Chinese government announced a program to establish “Demonstration Bases for Mass Entrepreneurship and Innovation”, which aim to foster innovation and entrepreneurship by optimizing the policy system for innovation and entrepreneurship and building a number of low-cost, convenient, and open “maker spaces”, or incubators, for incentivizing innovation and entrepreneurship.

The plan called for the creation of new service platforms, such as “maker spaces”, that can effectively meet the needs of the public for innovation and entrepreneurship and have strong professional service capabilities.

It also encouraged the cultivation of angel investors and VC institutions and called for making investment and financing channels smoother.

The government has announced three different rounds of construction of these demonstration bases, and by the end of 2022, there were 212 such bases in China, according to the National Bureau of Statistics (NBS).

Preferential tax policies for technology companies and small companies

The Chinese government has several preferential policies for supporting the establishment and operation of startups. There are also a vast range of preferential tax policies for micro, small, and medium-sized enterprises (MSMEs) and small and low-profit enterprises (SLPEs), which some startups may be eligible for (depending on factors such as their annual profits and the size of their workforce).

The preferential tax policies available for MSMEs and SLPEs include:

- All types of SLPEs in China can enjoy a reduced corporate income tax (CIT) rate of 20 percent in combination with a reduction of their tax base;

- VAT incentives, including reduced VAT levy rate, increased VAT threshold, and VAT exemptions, in some cases; and

- IIT incentives for small business owners.

There are also tax incentives aimed at encouraging tech innovation, which many startups may be eligible for. These include:

- A reduced 15 percent CIT rate for high-tech and new technology enterprises (HNTEs); and

- A reduced 15 percent CIT rate for advanced technology service enterprises (ATSEs). ATSEs are also eligible for a zero VAT rate for the provision of certain offshore services.

China also provides a super deduction on R&D expenses for various types of enterprises, including:

- For technology SMEs (TSMEs): As of January 1, 2022, if the R&D expenses of TSMEs do not form intangible assets and are included in the current profits and losses, on the basis of actual deduction, an additional 100 percent of such R&D expenses could be deducted from the taxable income amount; if the R&D expenses have formed intangible assets, they can be amortized before CIT at 200 percent of the actual cost of intangible assets.

- For manufacturing enterprises (except tobacco manufacturing), starting from January 1, 2021, if the R&D expenses do not form intangible assets and are included in the current profits and losses, on the basis of actual deduction, an additional 100 percent of such R&D expenses could be deducted from the taxable income amount; if the R&D expenses have formed intangible assets, they can be amortized before CIT at 200 percent of the actual cost of intangible assets.

- For other enterprises (except tobacco manufacturing, lodging and catering, wholesale and retail, real estate, leasing and commercial services, and entertainment), starting from January 1, 2023, if the R&D expenses do not form intangible assets and are included in the current profits and losses, on the basis of actual deduction, an additional 100 percent of such R&D expenses could be deducted from the taxable income amount; if the R&D expenses have formed intangible assets, they can be amortized before CIT at 200 percent of the actual cost of intangible assets.

Preferential policies and incentives for graduates

The Chinese government is hoping to get more university graduates into entrepreneurship in order to alleviate the high rates of youth unemployment.

In September 2021, the Office of the State Council published a set of guiding opinions on supporting employment and entrepreneurship of graduate students, which included policies such as increasing funding for innovation and entrepreneurship education, providing tax incentives for graduates who become self-employed in the year in which they have graduated, preferential tax policies for small enterprises, encouraging financial institutions to provide financial services to college students entrepreneurial projects, and increasing the maximum loan amount for graduate students, among others.

Meanwhile, in early 2022, the National Development and Reform Commission (NDRC), along with the Ministry of Education (MOE) and other government agencies, issued a notice on promoting the employment and entrepreneurship of graduate students, which included a List of Inclusive Policies to Support College Graduates’ Entrepreneurship and Employment. The list contains a range of preferential policies for graduate students to start their own businesses.

These supportive policies include (but are not limited to):

- Allocation of around 30 percent of space in government-invested incubators and entrepreneurial platforms for free use for college graduates and rent subsidies for those who start businesses in the incubators in some cases;

- Deduction of actual payable value-added tax (VAT), urban maintenance and construction tax, education surcharge, local education surcharge, and individual income tax (IIT) for college graduates engaged in individual businesses within three years (36 months) from the month of registration as individual business owners, with an annual limit of RMB 12,000 (approx. US$1,736) per household;

- Application for up to RMB 200,000 (approx. US$28,935) in entrepreneurship guarantee loans for college graduates who start their own businesses. For qualified borrowers who start a business in partnership or organize to start a business together, the loan amount may be appropriately increased; and

- A one-time entrepreneurial subsidy for college graduates within two years of leaving school who start small or micro-enterprises for the first time or have been engaged in self-employment for more than one year. The specific measures and amounts are determined by each province, region, or municipality.

Preferential tax policy for VC and angel investors

In 2018, China’s Ministry of Finance (MOF) and State Tax Administration (STA) issued Tax Policies for Venture Capital Enterprises and Individual Angel Investors [Cai Shui (2018) No. 55] to support the development of venture capital in China. This policy is available from January 1, 2018, to December 31, 2023.

The preferential income tax policy provides income tax deductions for companies and individuals that invest in seed-stage or startup technology-based companies for a period of two years.

The specific policy for different types of companies and individuals is as follows:

- VC companies that have directly invested in technology-based startups or seed-stage companies through equity investment for a period of two years can deduct 70 percent of the investment amount from its taxable income in the year when the equity has been held for two years; if the amount is not enough for the deduction in the current year, it can be carried forward and deducted in the following tax year.

- For limited partnership VC enterprises that have directly invested in technology-based startups or seed-stage companies in the form of equity investment for a period of two years, the partners are eligible for the following deductions:

- A legal entity partner can deduct 70 percent of the investment amount from the share of income received from the partnership; and

- Individual partners can deduct 70 percent of the investment amount from the operating income that individual partners receive from the partnership.

- Angel investors who have directly invested in technology-based startups or seed-stage companies through equity investment for a period of two years may deduct 70 percent of the investment amount from the taxable income obtained from the transfer of equity.

Furthermore, if an individual angel investor has invested in multiple technology startups, and one of them is liquidated, then the taxable income obtained by the investor from the transfer of equity to other startup technology companies can be deducted within 36 months from the date of liquidation. This is provided the angel investor has not already deducted 70 percent of the investment amount from the taxable income (of the startup being liquidated).

The future of China’s startup environment

China is home to a thriving startup scene, and the growth trajectory is expected to continue for many years to come. Startup companies in China have the unique advantage of having direct access to one of the world’s largest and fastest-growing consumer bases, as well as a large and increasingly well-educated labor force. China’s well-developed technology industry, supply chains, and infrastructure are also conducive to fostering smaller companies as they can readily provide the resources, capital, and business opportunities.

At the same time, the government is likely to continue to employ supportive tools, such as subsidies and tax incentives, to develop key and emerging industries that it sees as crucial for securing China’s future growth and prosperity.

There are nonetheless challenges facing China’s startup landscape, including an unstable global economy and worsening US-China relations.

Several Chinese technology startups have already been placed on the US “entity list”, including drone maker DJI, SenseTime, and Megvii. In addition, the Biden Administration is currently mulling further limits on US investment in China, which could decrease investment from some of the biggest VC firms in the world to Chinese startups. Previous export bans on key technologies and products, such as the ban on exports of chip technology, are also hampering the development of certain Chinese technology sectors. Finally, the US is also considering a nationwide ban on TikTok, which would significantly harm its parent company ByteDance, and could set a precedent for the operations of Chinese internet companies in the US market in the future.

Whereas these developments are likely to pose challenges to China’s technology startups in particular, they are likely to further galvanize the government’s efforts to support technology startups in an effort to increase self-sufficiency.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Ethical Review of Science and Technology in China: Draft Trial Measures

- Next Article 5 settori chiave da tenere sott’occhio in Cina nel 2023