China’s Economy in 2023: GDP Grew by 4.5% in Q1

China’s economy expanded 4.5 percent in the first quarter of 2023, marking the highest growth since the first quarter of last year. This was above the 4 percent forecast made by Wind and Reuters, which indicates that China’s economic recovery is right on track. That said, China still faces long-term persistent challenges to maintain its growth momentum.

On Tuesday, April 18, China’s National Bureau of Statistics (NBS) released the official economic data for the first quarter, showing China’s economic recovery is right on track following the country’s shift away from some of the most stringent COVID-19 restrictions in late 2022.

Among others, the first-quarter gross domestic product (GDP) grew 4.5 percent, higher than the 4 percent growth forecast made by Wind, a Chinese data provider, and a Reuters poll of economists. It also marked the highest growth of China’s economy since the first quarter of last year. In 2022, China’s GDP expanded by just 3 percent, missing the official growth target of “around 5.5 Percent” that was set during the 2022 Two Sessions.

This stronger-than-expected GDP growth in Q1, together with the surprise double digit export and retail growth in March, have spurred optimism in markets regarding China’s economic rebound.

Nevertheless, China’s recovery may not be even across all sectors. To maintain growth momentum, the Chinese government will need to work harder to address lingering domestic risks and external conditions.

In this article, we look into China’s key economic indicators in Q1 2023.

GDP

In the first quarter of 2023, China’s GDP growth has beat market expectations.

According to preliminary estimates, China’s GDP in Q1 2023 reached RMB 28,499.7 billion (US$4,145.5 billion), up by 4.5 percent year on year (YOY) at constant price. Quarter-on-quarter, the Chinese economy grew 2.2 percent from the fourth quarter of 2022.

| China’s GDP Growth (Quarterly) | |

| Quarter | GDP growth (YOY) |

| Q2 2022 | 0.40% |

| Q3 2022 | 3.90% |

| Q4 2022 | 2.90% |

| Q1 2023 | 4.50% |

In terms of economic contribution by industry, the value added of the primary industry grew 3.7 percent year-on-year (YOY) in the first quarter; that of the secondary industry grew 3.3 percent YOY; and that of the tertiary industry grew 5.4 percent.

Industrial production growth

In the first quarter, the industrial production recovered gradually.

The industrial output of companies above a designated size (those with a main business income of over RMB 20 million or approx. US$2.9 million) grew 3.0 percent YOY in the first quarter, 0.3 percentage point higher than that in the fourth quarter of 2022. In March alone, the value added of industrial enterprises above the designated size grew 3.9 percent YOY, 1.5 percentage points higher than that in the first two months, but slightly lower than Reuter’s forecast of 4 percent.

Looking at the specific industries, the value added of mining increased by 3.2 percent, manufacturing increased by 2.9 percent, and production and supply of electricity, thermal power, gas, and water increased by 3.3 percent. The value added of equipment manufacturing increased by 4.3 percent, which is 2.5 percentage points higher than that in the first two months.

In terms of types of ownership, the value added of state holding enterprises was up by 3.3 percent, share-holding enterprises was up by 4.3 percent, and private enterprises was up by 2.0 percent. However, the value-added of enterprises funded by foreign investors or investors from Hong Kong, Macao, and Taiwan was down by 2.7 percent.

In terms of goods, the production of solar cells and new-energy automobiles (NEVs) were up by 53.2 percent and 22.5 percent, respectively. In line with this, China’s car exports jumped nearly 60 percent in first quarter on NEV shipments.

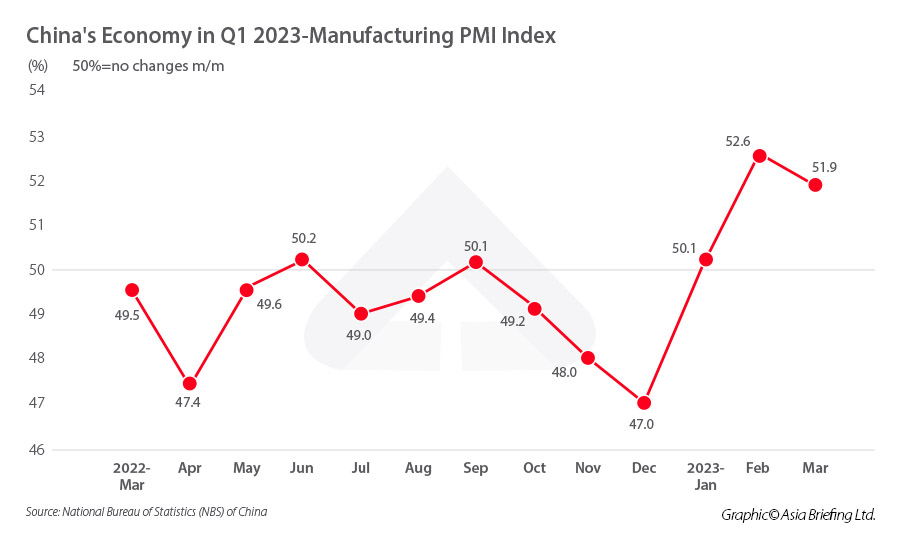

At the beginning of April, the NBS released the manufacturing purchasing manager’s index (PMI), an index compiled through monthly surveys of purchasing managers, reflecting a change in economic trends.

In March 2023, the PMI of China’s manufacturing industry was 51.9 percent, higher than the threshold (a reading of below 50 indicates a contraction, and above 50 indicates expansion). But this reading is 0.7 percentage points lower from the previous month. In February, the manufacturing PMI reached 52.6, up from 50.1 in January and 47 in December, and marked the highest reading since April 2012.

Service sector recovery

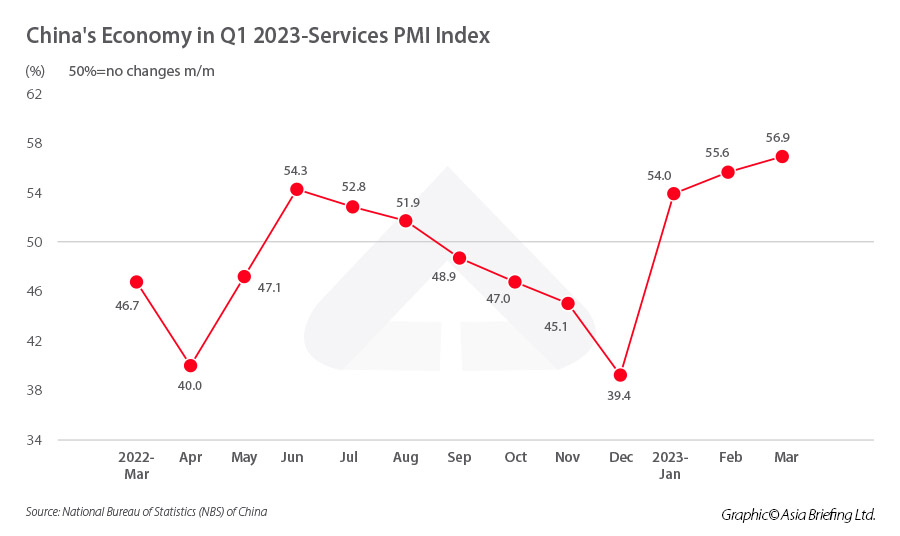

In the first quarter, China’s service sector experienced an accelerated recovery, especially for contact-intensive services.

The value added of services went up by 5.4 percent YOY in Q1 2023, 3.1 percentage points higher over that in the fourth quarter of 2022. Specifically, the value added of accommodation and catering, information transmission, software and information technology services, financial intermediation, leasing and business services, and wholesale and retail grew 13.6 percent, 11.2 percent, 6.9 percent, 6.0 percent, and 5.5 percent, respectively.

In March, the service PMI stood at 56.9 percent, increasing 1.3 percentage points from the previous month. More specifically, the business activity index for industries like retail, railway transportation, road transportation, air transportation, and leasing and business services were above 60.0 percent.

Retail sales

In the first quarter, the total retail sales of consumer goods reached RMB 11,492.2 billion (US$1,671.6 billion), up by 5.8 percent year on year, as compared to a 2.7 percent decrease in Q4 2022.

Sector-wise, the retail of goods grew 4.9 percent and catering grew 13.9 percent. Specially, the sale of upgraded goods went up markedly, among which the retail of gold, silver and jewelry of enterprises above the designated size grew 13.6 percent.

The online retail segment grew 7.3 percent, accounting for 24.2 percent of the total sales of consumer goods.

In March alone, the total sales of consumer goods went up by 10.6 percent YOY, 7.1 percentage points higher than that in the first two months.

Investment

In the first quarter, the investment in fixed assets (excluding rural households) rose 5.1 percent YOY, the same as that of the previous year. Specifically, the investment in infrastructure and manufacturing grew 8.8 percent and 7.0 percent YOY, respectively, while the real estate investment continued to decline.

On the other hand, the investment in high-tech industries grew fast, of which the investment in high-tech manufacturing and high-tech services grew 15.2 percent and 17.8 percent, respectively.

In terms of high-tech manufacturing, the investment in manufacturing of electronic and communication equipment and in manufacturing of medical equipment, measuring instrument, and meter grew 20.7 percent and 19.9 percent, respectively.

In terms of high-tech services, the investment in e-commerce services and services for transformation of scientific and technological achievements grew 51.5 percent and 51.3 percent, respectively.

Meanwhile, the investment in the health sector grew 21.6 percent.

Import and export

In the first quarter, the total value of exports grew 8.4 percent despite weak external demand. In contrast, the total value of imports only went up by 0.2 percent.

In March, the total value of imports and exports increased by 15.5 percent YOY, among which the export grew 23.4 percent and the imports grew 6.1 percent.

This surprise double-digit export was largely due to a surge in demand from Southeast Asia and countries along the Belt and Road Initiatives (BRI), according to official data. Among others, trade in goods between China and BRI countries surged 16.8 percent YOY in the first quarter. Trade in goods between China and Regional Comprehensive Economic Partnership (RCEP) countries grew 7.3 percent, among which export grew 20.2 percent.

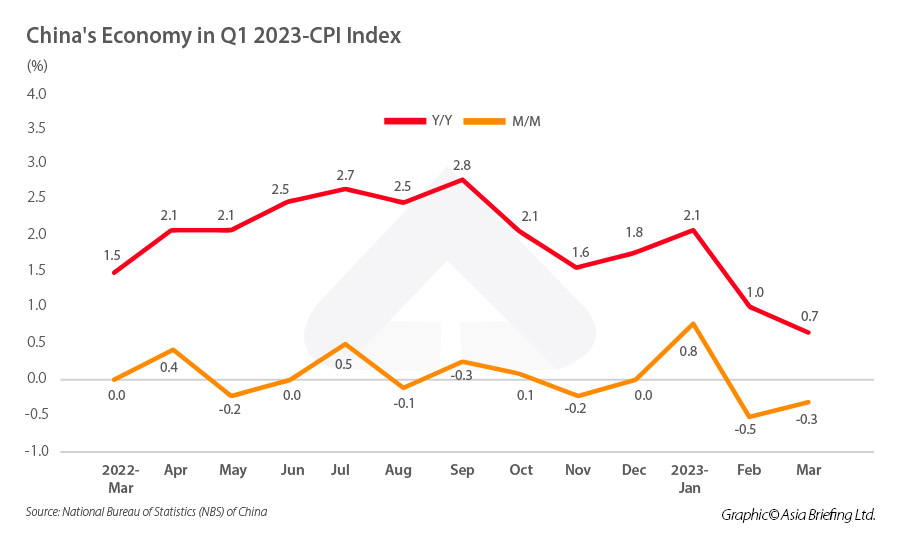

Low inflation

In the first quarter, consumer inflation was mild while the producer price for industrial products dropped YOY, reflecting the fact that the demand has not recovered enough to boost prices.

The consumer price index (CPI) rose by 1.3 percent YOY in Q1 2023. The core CPI, excluding the price of food and energy, grew by 0.8 percent YOY. The food price growth is also moderating –the price of fresh fruit was up by 11.0 percent, pork was up by 8.5 percent, grain up by 2.5 percent, and fresh vegetables were down by 2.9 percent. In March, the CPI only went up by 0.7 percent YOY – an 18-month low.

The producer prices index (PPI) for industrial products went down by 1.6 percent YOY. Specifically, the PPI in March dropped by 2.5 percent year on year.

This data has sparked debate about whether China’s economy is headed for deflation. However, Fu Linghui, spokesman of the NBS, said there will be no deflation in China now or in the future.

According to Fu, the slowing growth of CPI is mainly because of the impact of some seasonal factors, such as the drop in fuel prices due to weak global demand and the big discount offered by auto enterprises due to expiration of automobile subsidies and China’s adjustment of emission standards. In the second half of 2023, the price index will be back at a reasonable level, with China’s economy recovering continuously.

Key takeaways

The key economic indicators in Q1 2023 demonstrate a solid start to China’s economic recovery in the post-COVID era. Based on current trends, China’s GDP growth target of “around 5 percent” for 2023 is still relatively modest and achievable. In its most recent report in April, the International Monetary Fund (IMF) maintained its growth forecast for China at 5.2 percent for this year, saying the country’s reopening raised hopes for “positive spillovers” to the rest of the world.

However, on the other hand, China’s economic rebound appears uneven, with unemployment in the youth demographic being still comparatively high and consumer spending having much room to grow.

Against this background, the Chinese government is likely to mobilize more resources to further revitalize the economy with policy adjustments to support businesses, spur consumption, and encourage investment.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Relaciones UE-China: comercio, inversión y desarrollos recientes

- Next Article China’s Changing Labor Market – Trends and Future Outlook