China’s FDI Trends: Sources, Destinations, and Key Sectors

China, positioned as the world’s second-largest recipient of foreign direct investment (FDI), is undergoing significant shifts. In this article, we analyze the emerging trends within China’s investment landscape.

China has been witnessing a shift in the foreign investment landscape in recent years. After a significant FDI growth of 20.2 percent in 2021, the growth rate slowed to 8 percent in 2022, before hitting an 8 percent decline in 2023.

Key factors contributing to the dramatic rise and fall include China’s extensive and extended enforcement of COVID-related restrictive measures until the end of 2022, uneven recovery of China’s economy after reopening its border, rising geopolitical tensions, increasing supply chain diversification pressure, as well as concerns about policy predictability for several sectors.

Despite the challenges, China is still one of the largest FDI destinations and consumer markets in the world. China’s unparalleled supply chains are also not easily replaceable in the short term. Ambitious businesses aiming for global success cannot afford to overlook it. Furthermore, the Chinese government has intensified its initiatives to attract foreign investment by optimizing the business environment for international companies and investors.

Under these circumstances, foreign investors need to have an up-to-date understanding of the nuanced dynamics of China’s FDI landscape, in addition to giving careful consideration to the country’s economic momentum, policies, and regulatory developments.

In this article, we outline major trends and dynamics in China’s FDI, along with the government’s efforts to create a more favorable environment for foreign investors in the near future.

FDI sources into China

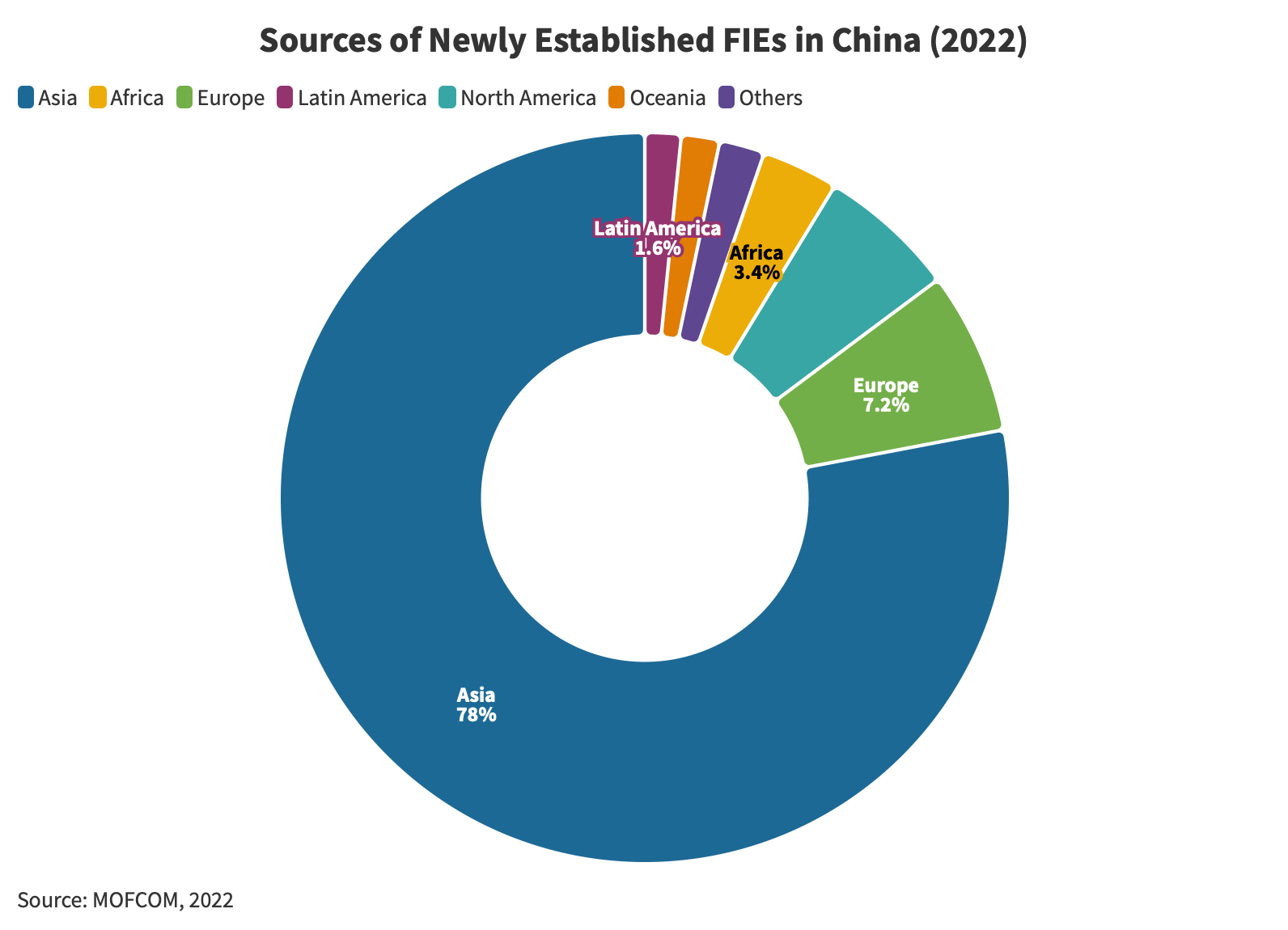

FDI sources by region

Significant trends come to light when examining the regional distribution of investment sources flowing into China. In 2022, Asian regions took the lead, contributing significantly with 78 percent of the newly established foreign-invested enterprises (FIEs) and a substantial 86.5 percent of the overall realized FDI. This reflects China’s robust economic ties and partnerships within the Asian continent.

In contrast, other regions played varying roles. African markets contributed 3.4 percent to the newly established FIEs but made a minimal impact, accounting for just 0.2 percent of the total realized FDI. European markets, on the other hand, with a 7.2 percent share in newly established FIEs, demonstrated a slightly lower influence in terms of the total realized FDI at 6.3 percent.

A unique scenario unfolded in the case of Latin American sources of FDI, where the share of newly established FIEs stood at 1.6 percent; however, these investments significantly influenced the total realized FDI, at 4.9 percent. This implies a relatively greater influence stemming from investments in Latin America.

North American markets held a 6.1 percent share in newly established FIEs, but their influence on the total realized FDI was limited, standing at 1.5 percent. Similarly, Oceanic countries/regions contributed 1.7 percent to the newly established FIEs, with a modest impact on the total realized FDI at 0.6 percent.

All in all, Asian nations lead the way when it comes to China’s FDI.

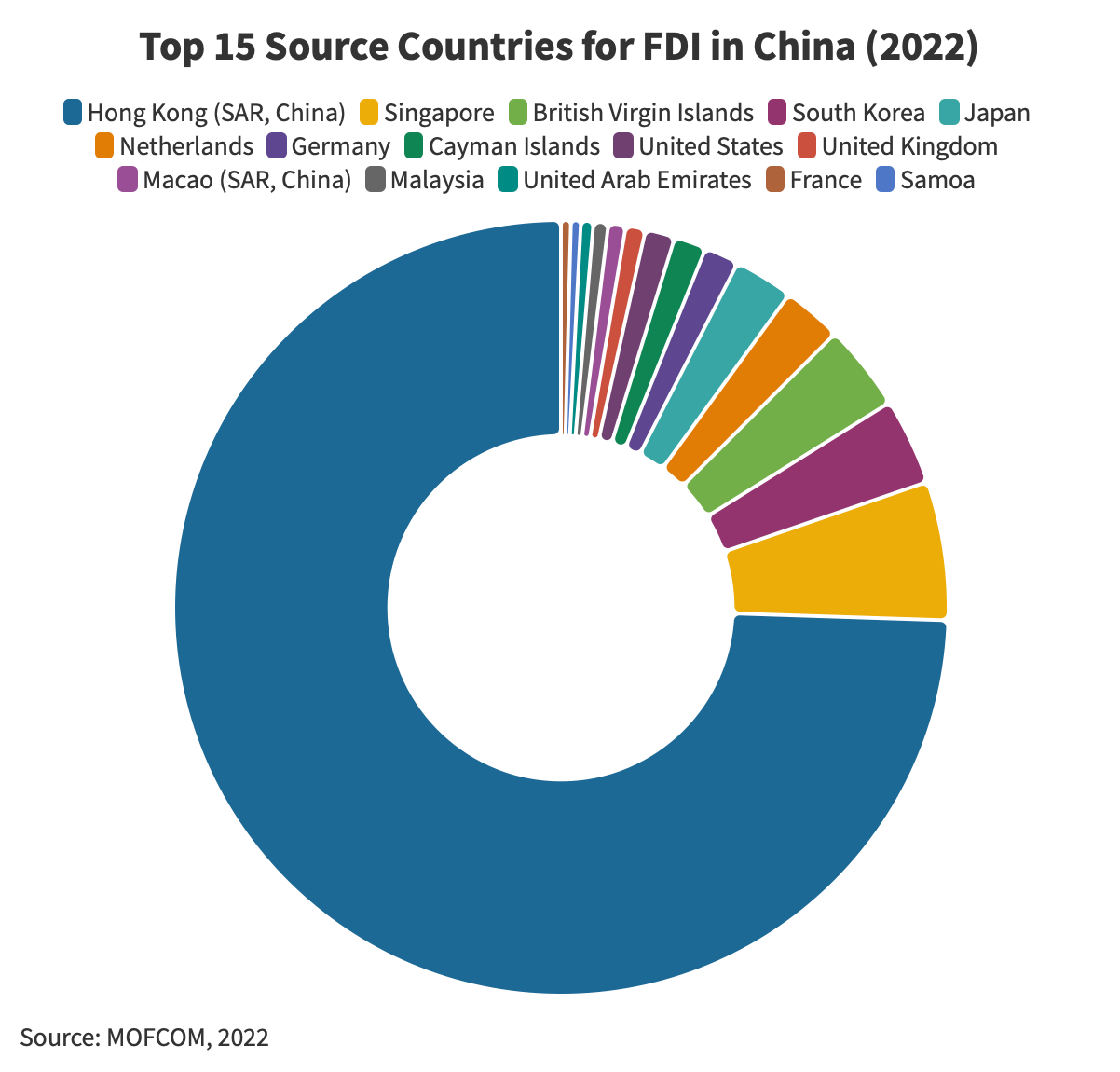

Top 15 FDI sources of China in 2022

According to the MOFCOM data, in 2022, China’s primary sources of FDI remained stable. When classified by the nationality or registration location of investors, newly established FIEs from the top 15 sources collectively amounted to 25,413, constituting 66 percent of the total FIEs nationwide. The actualized FDI value amounted to US$183.8 billion, representing 97.2 percent of the national aggregate.

| Top 15 FDI Sources of China in 2022 |

||||

| Country/Region | Newly established FIEs | Share (%) | Realized FDI Value (US$100 million) | Share (%) |

| Total | 38,497 | 100.0 | 1,891.3 | 100.0

|

| Hong Kong (SAR, China) | 15,814 | 41.1 | 1,372.4 | 72.1 |

| Singapore | 1,176 | 3.1 | 106.0 | 5.6 |

| British Virgin Islands | 218 | 0.6 | 66.3 | 3.5 |

| South Korea | 1,593 | 4.1 | 66.0 | 3.5 |

| Japan | 828 | 2.2 | 46.1 | 2.4 |

| Netherlands | 103 | 0.3 | 44.9 | 2.4 |

| Germany | 422 | 1.1 | 25.7 | 1.4 |

| Cayman Islands | 157 | 0.4 | 24.2 | 1.3 |

| United States | 1,583 | 4.1 | 22.1 | 1.2 |

| United Kingdom | 609 | 1.6 | 16.0 | 0.8 |

| Macao (SAR, China) | 2,313 | 6.0 | 12.4 | 0.7 |

| Malaysia | 309 | 0.8 | 11.3 | 0.6 |

| United Arab Emirates | 37 | 0.1 | 9.6 | 0.5 |

| France | 185 | 0.5 | 7.6 | 0.4 |

| Samoa | 65 | 0.2 | 7.5 | 0.4 |

| Source: MOFCOM FDI Statistics, 2022 | ||||

International financial hubs play a key role in channeling foreign financial inflows into China. According to official records, a significant portion of China’s incoming FDI stock in 2022 flowed through Hong Kong, with the Virgin Islands also contributing substantially. These financial centers provide conducive conditions and services for international investors, often located in third countries.

Trends and changes in FDI sources

The current geopolitical landscape has led to a reduction in U.S. investments within China, particularly in sectors deemed crucial to U.S. national interests. In contrast, the Middle East, particularly the Gulf Cooperation Council (GCC) countries, is set to increase its investment presence in China, fueled by improving bilateral diplomatic and economic relations.

The six GCC nations, namely Saudi Arabia, Kuwait, the United Arab Emirates (UAE), Qatar, Bahrain, and Oman, possess substantial sovereign wealth funds, collectively amounting to an estimated US$4 trillion. Remarkably, less than 2 percent of this considerable wealth is currently invested in Asia, including China. Forecasts highlight this much-anticipated shift, with GCC investments potentially growing to US$10 trillion, allocating up to US$2 trillion to China alone by 2030.

It is noteworthy that despite formal restrictions imposed by the U.S. government on certain investments in China, American FDI could potentially find alternative and more discreet channels. This might involve investors strategically repackaging their funds in financial hubs like the UAE before redirecting them to China.

Meanwhile, significant business developments between GCC countries and China are evident. In March 2023, Saudi Arabia’s announcement of collaboration with China for the construction of oil refineries valued at RMB 83.7 billion (US$11.83 billion) signifies a strengthening economic bond. Furthermore, the kingdom’s decision to join the China-led Shanghai Cooperation Organization highlights an improving diplomatic relationship, potentially facilitating talks on trading oil in renminbi.

Naturally, the UAE also plays a pivotal role in enhancing Sino-GCC cooperation. In May 2023, the UAE signed three agreements with Chinese nuclear energy organizations, facilitating China’s entry into the GCC region.

Moreover, in the third quarter of 2023, Saudi Arabia, the UAE, and Qatar collectively signed investment and partnership agreements with China worth more than US$5 billion. These agreements span diverse sectors, including energy, research & development, industrial/green projects, and finance.

Hence, with the deepening collaboration between China and the Middle East, the anticipation is that the roster of joint events and agreements will not only grow but also pave the way for the emergence of fresh avenues for FDI into China.

The table below provides some insights into the changes observed in the top 15 FDI sources in China, precisely with the UAE, Malaysia, and Samoa emerging as new top-origin countries. Looking at the EU region as an important source of FDI to China, the Netherlands, Germany and France are acquiring new ground.

| Top FDI Sources in China: 2021-2022 Comparison |

||

| Rank | 2021 | 2022 |

| 1 | HK | HK |

| 2 | Singapore | Singapore |

| 3 | BVI | BVI |

| 4 | South Korea | South Korea |

| 5 | Japan | Japan |

| 6 | US | Netherlands (↑5) |

| 7 | Cayman Islands | Germany (↑2) |

| 8 | Macao | Cayman Island (↓1) |

| 9 | Germany | US (↓3) |

| 10 | UK | UK |

| 11 | Netherlands | Macao (↓3) |

| 12 | Taiwan (No longer) | Malaysia (New) |

| 13 | Mauritius (No longer) | UAE (New) |

| 14 | Switzerland (No longer) | France (↑1) |

| 15 | France | Samoa (New) |

| Source: MOFCOM FDI Statistics, 2022 | ||

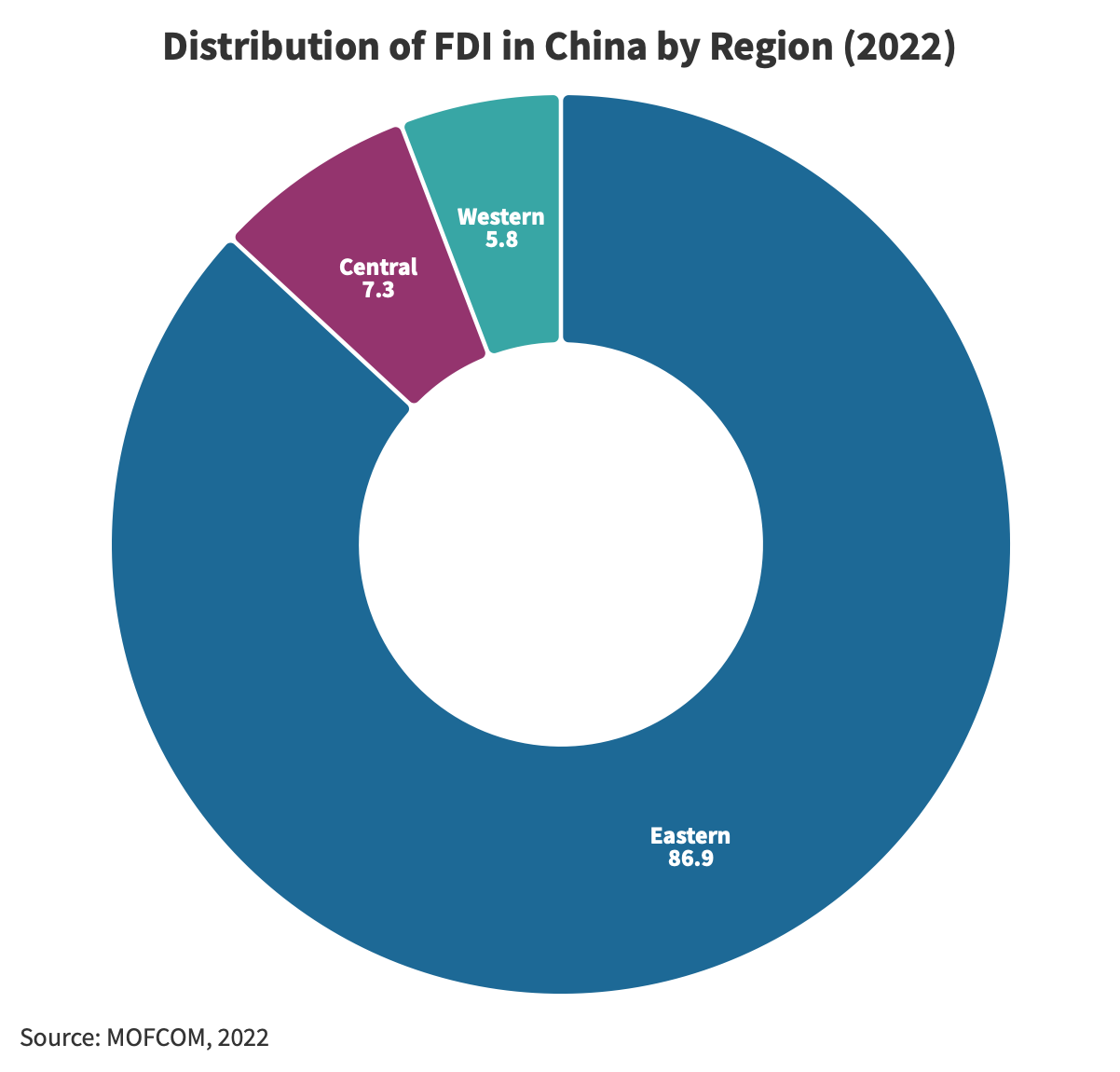

FDI destinations within China

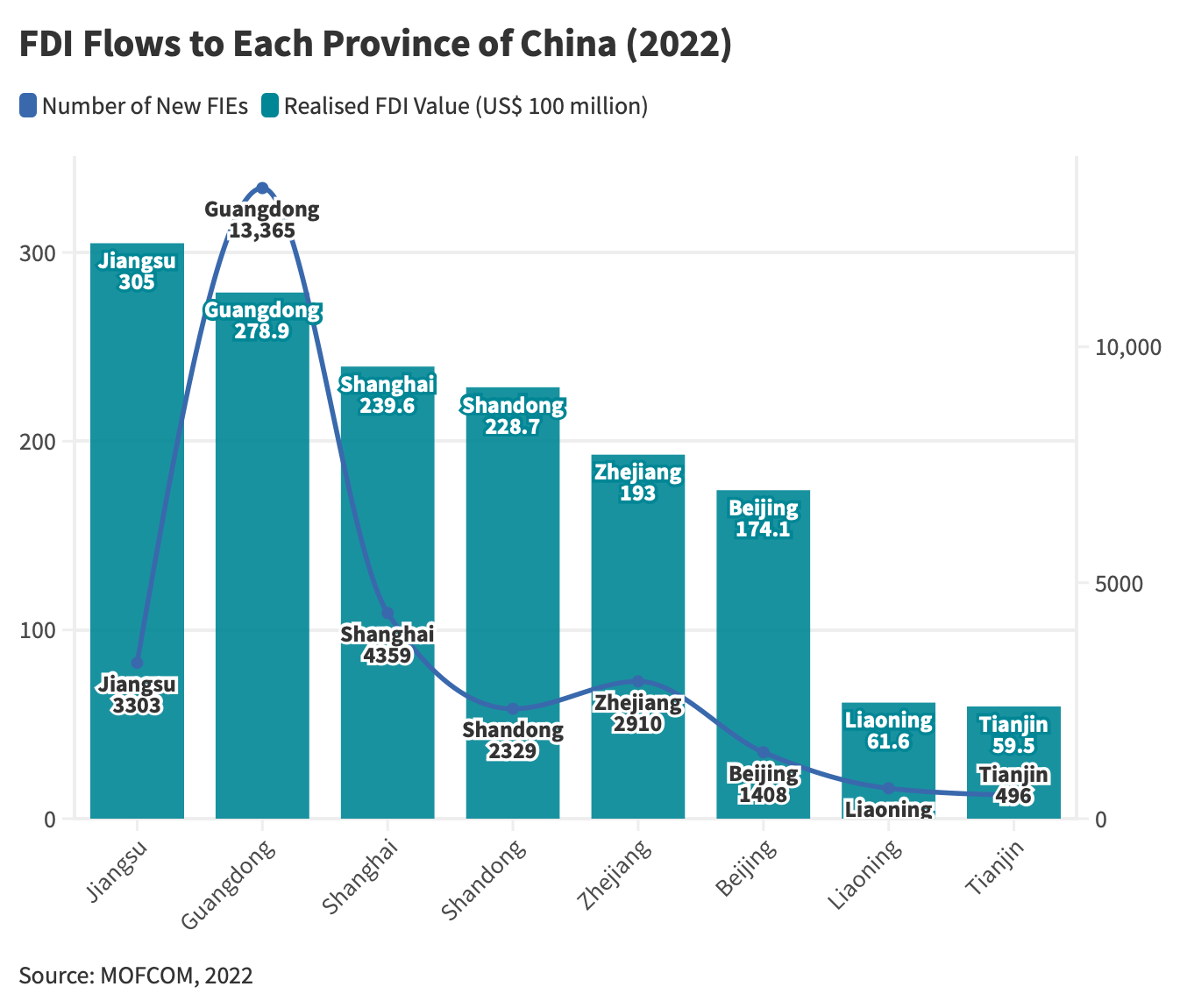

In 2022, China experienced strong FDI dynamics, with the top 10 provinces contributing significantly to the national total. The provinces leading in both the number of newly established FIEs and realized FDI value included Guangdong, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Beijing, Hainan, Sichuan, and Jiangxi, collectively constituting 86.2 percent and 86 percent of the national total, respectively.

A regional breakdown further sheds light on the distribution of FDI across China. In 2022, newly established FIEs in the eastern, central, and western regions accounted for 86.6 percent, 7 percent, and 6.4 percent of the national total, while realized FDI value mirrored this pattern at 86.9 percent, 7.3 percent, and 5.8 percent, respectively.

This data highlights the economic importance and attractiveness of the eastern region as a prime destination for foreign investment in China. The central and western regions, while contributing significantly, played comparatively smaller roles in terms of both newly established FIEs and realized FDI value.

Delving deeper into regional analysis, it is worth noting how, in the Yangtze River Economic Belt region, newly established FIEs accounted for 36.6 percent, while realized FDI value accounted for almost half of the overall national volume, reaching 48 percent.

As for provincial distribution, Guangdong, Shanghai, and Jiangsu accounted for the highest share of newly established FIEs in 2022, with 13,365, 4,359, and 3,303 respectively. They were also the regions with the highest concentration of realized FDI value, as shown in the figure below.

FDI distribution by industries and sectors

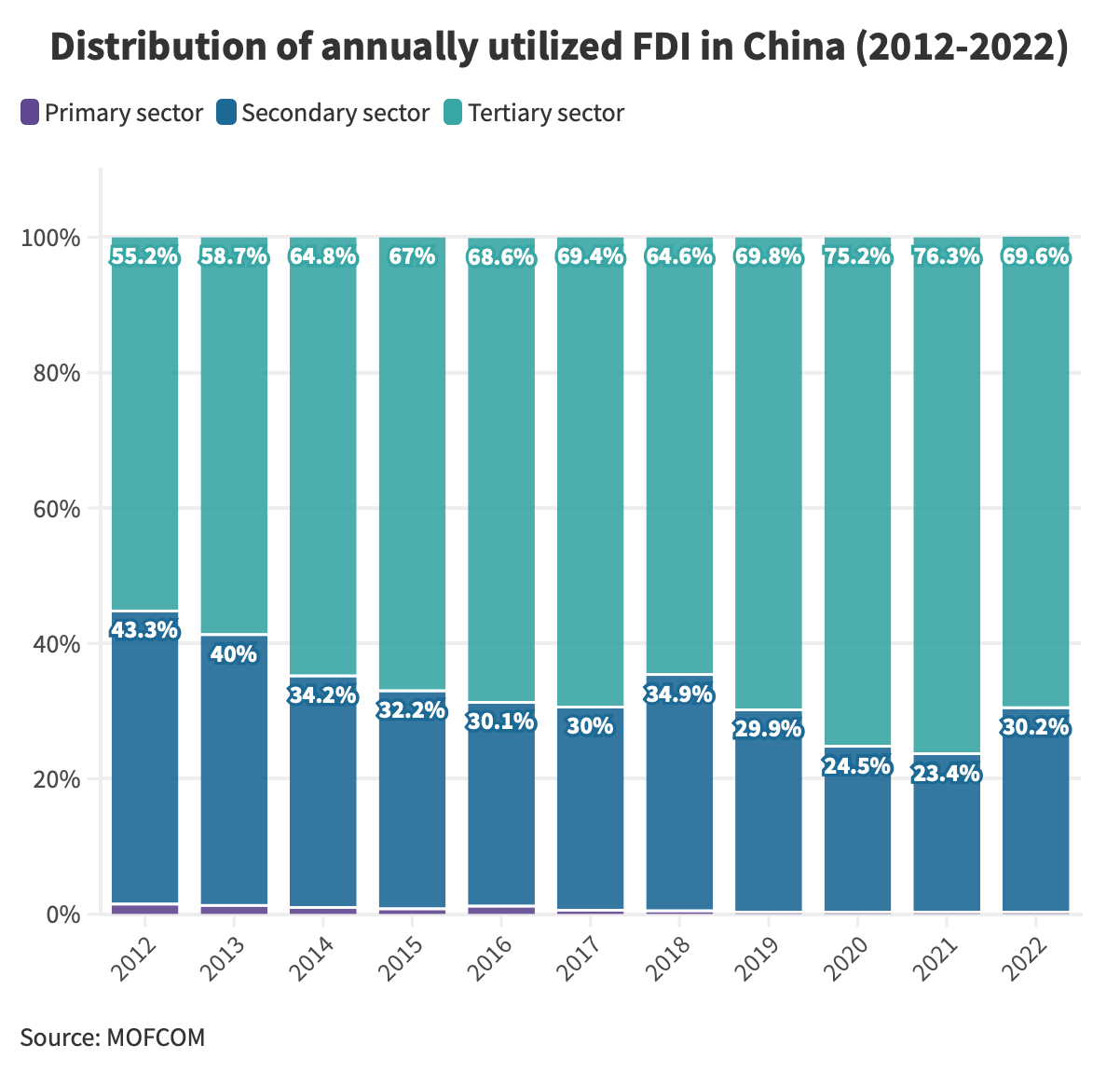

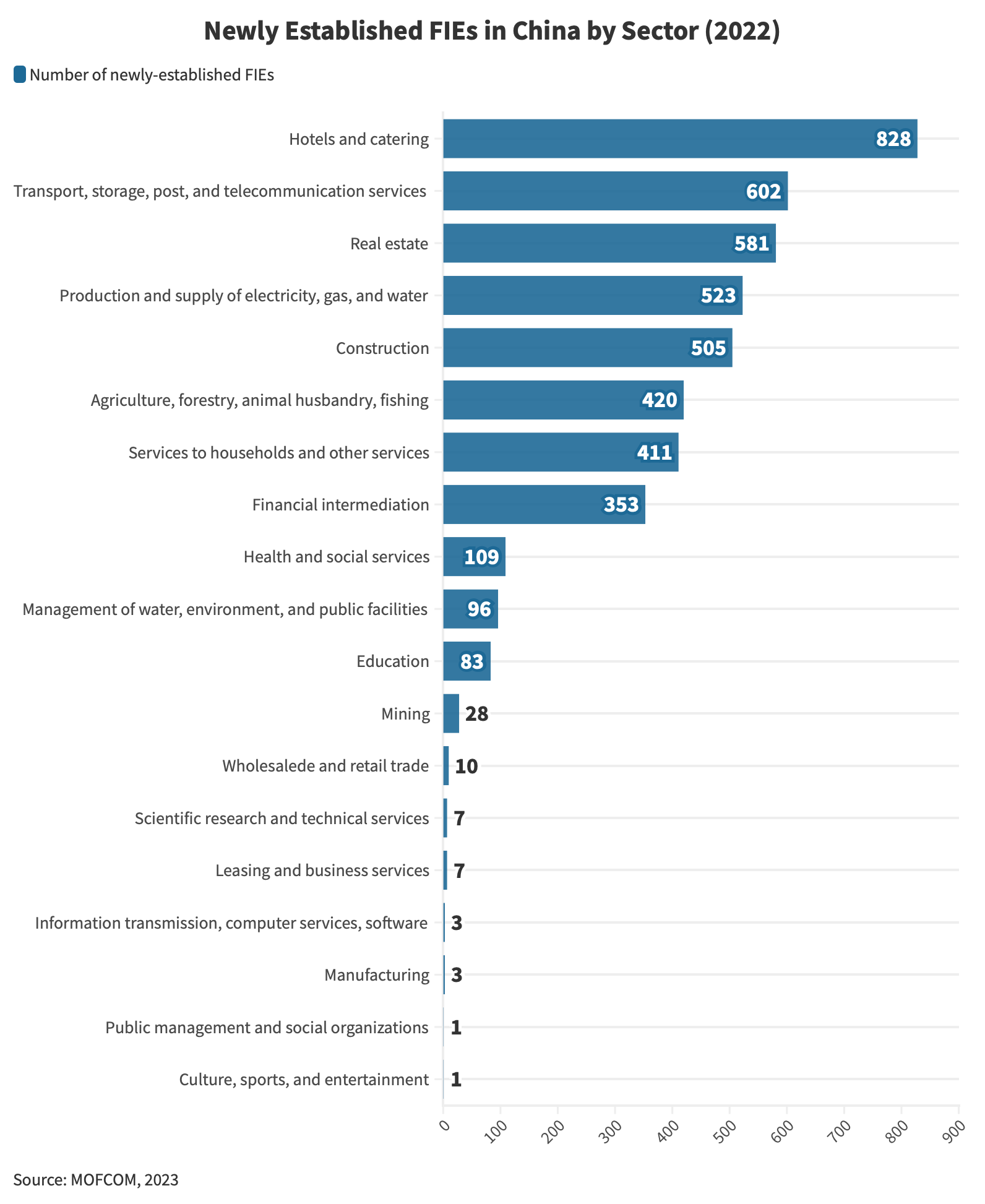

In 2022, FDI in China showcased some level of diversification among industries. Newly established FIEs in the tertiary industry took the lead at 87.1 percent. Contributions from the primary and secondary industries were minimal at 0.9 percent and 12 percent, respectively. This pattern was reflected in realized FDI values – contributing 69.6 percent, 30.2 percent, and 0.3 percent, respectively.

This trend underscores the growing significance of service-oriented areas in harmony with China’s evolving economic dynamics, with the primary recipients of investment flows encompassing the following sectors:

- Manufacturing;

- Leasing and business services;

- Scientific research and technology services;

- Information transmission;

- Software and information technology services;

- Wholesale and retailing;

- Real estate; and

- Finance.

Focus on advanced manufacturing and modern services

China’s strategic shift towards high-quality industrial development appears to have significantly influenced FDI inflows, channeling it into advanced sectors, such as pharmaceutical manufacturing, electronic information manufacturing, and automotive manufacturing. Concurrently, productive service industries including financial services, information services, and research and development (R&D) are witnessing increased FDI. This departure from traditional low-end manufacturing underscores China’s dedication to fostering innovation and elevating its industrial landscape.

By looking at the high-tech industry, the following pattern emerges:

- Investment in high-tech manufacturing accounted for US$182.1 million, constituting a 2.2 percent share of the total; and

- Investment in high-tech services totaled US$501.4 million, making up a significant 26 percent of the total – that is, the largest share.

As manufacturing gradually opens up, China is also actively intensifying efforts to liberalize modern service industries. The 14th Five-Year Plan provides a systematic framework for the opening of sectors like telecommunications, the internet, and culture. Pilot initiatives, mirroring successful implementations in free trade zones (FTZs), are expected to pave the way for nationwide adoption—a pivotal step in China’s evolution towards a service-oriented economy.

How is China planning to attract foreign investment in the future?

In August 2023, China’s State Council released a new set of opinions on boosting inbound FDI. These measures, totaling 24 suggestions, address key areas to improve the business environment for foreign companies and investors, and offer a peek into the government’s plans to create a more inclusive, transparent, and supportive landscape in order to attract, retain, and provide equal opportunities for foreign investment in China.

Priority tasks include:

- Emphasis on key sectors: Encouraging foreign investment in crucial research and technological fields, such as biomedicine and pharmaceuticals, to support the development of innovative products and services.

- Diversification of investment channels: Encouraging qualified investors to establish investment companies and regional headquarters and supporting programs like the Qualified Foreign Limited Partnership (QFLP) to attract foreign companies and investors.

- Green energy support: Providing more support to foreign companies in consuming green energy, promoting green power consumption, and facilitating participation in green electricity certificates and cross-provincial green power trading.

- Equal participation in government procurement: Ensuring equal participation for FIEs in government procurement activities, revising procurement laws, and clarifying standards for goods “produced in China.”

- Intellectual property rights (IPR) protection: Strengthening IPR protection by refining administrative systems for patent infringement disputes, enhancing enforcement, and taking a resolute stance against IPR infringement.

- Streamlined visa and residency procedures: Facilitating visa and residency procedures for foreign employees, particularly executives and technicians, to attract and retain skilled international talent.

- Efficient cross-border data transfer: Addressing challenges related to cross-border data transfer by establishing “green channels” for qualified FIEs, conducting security assessments, and piloting a list of “general data” that can be freely transferred.

These propositions are not merely speculative ideas; in fact, some have already materialized into tangible policies. In October 2023, the government took concrete steps by releasing a set of new draft regulations aimed at easing restrictions on cross-border data transfer (CBDT) for foreign companies and multinationals.

Simultaneously, there has been a proactive effort to simplify visa application procedures, with the government establishing unilateral temporary visa-free arrangements with several countries (including the EU, Malaysia and Singapore).

These initiatives not only reflect the current state of China’s proactiveness but also provide a glimpse of the future trajectory of the country’s investment environment. As these changes take root, they pave the way for an even more favorable landscape for global investors.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates also has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Dubai (UAE). We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, and Bangladesh.

- Previous Article China’s Social Security System: An Explainer

- Next Article Preparing for the Year of the Dragon: HR Strategies and Travel Trends During Chinese New Year 2024