What does the Yangtze River Delta Integration Mean for Businesses in China?

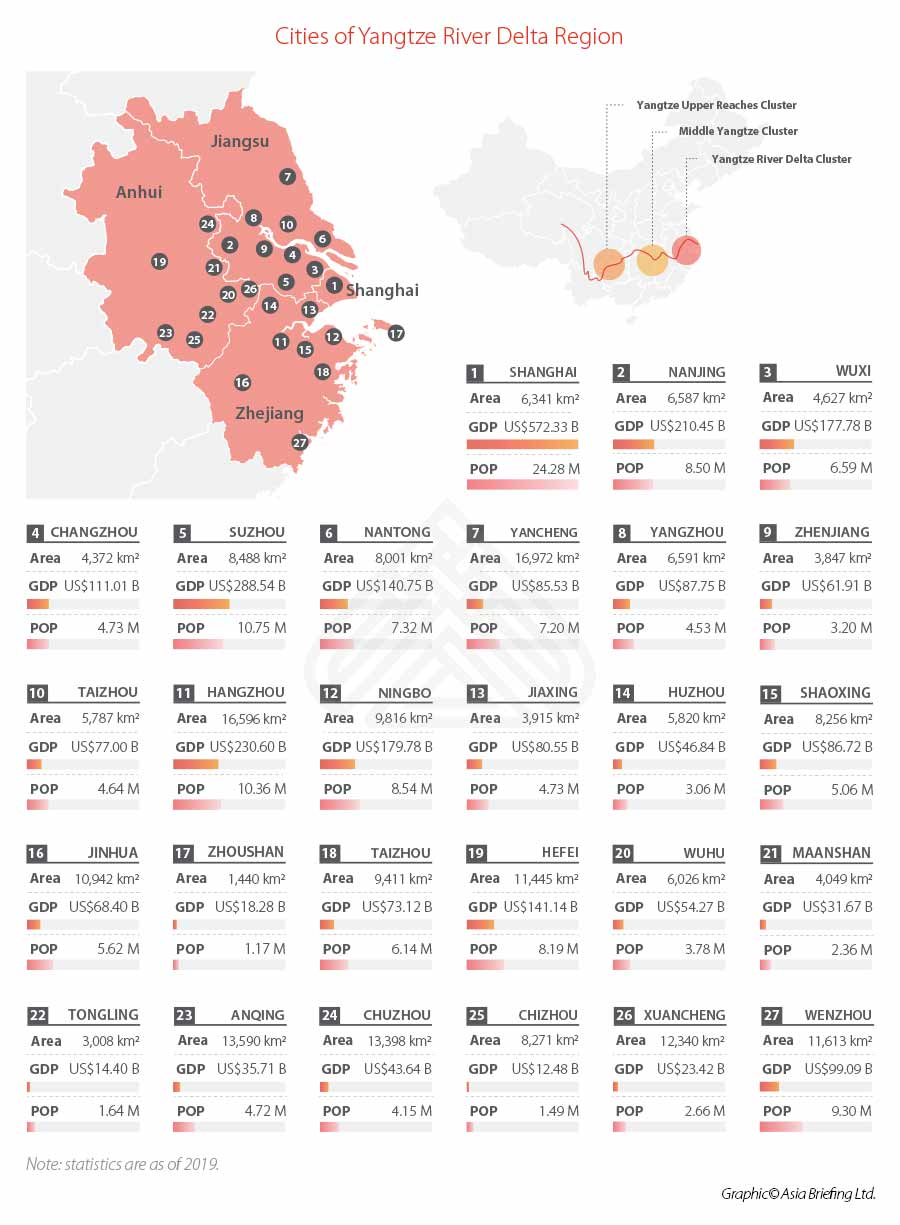

We discuss why the Yangtze River Delta region, which covers the three provinces of Jiangsu, Anhui, and Zhejiang as well as the city of Shanghai, has been chosen to lead China’s dual circulation strategy, what policies have been introduced or are expected in the region, and opportunities for businesses.

Last month, Chinese President Xi Jinping visited Hefei, the capital city of Anhui province, and reiterated advancing the “integrated” and “high-quality” development of the Yangtze River Delta (YRD) region.

Integrating the YRD region is not new and may not sound as exciting as the integration of the Guangdong-Hong Kong-Macao Greater Bay Area (GBA). But this time, Xi’s speech brought the YRD region back under the spotlight of China’s great economic development strategic plan. That means the YRD region has now been assigned by authorities at the top to lead China’s economic revival in the face of an increasingly uncertain external environment.

In other words, the Yangtze River Delta will showcase China’s new ‘dual circulation’ strategy (DCS) in action. DCS is a two-pronged development strategy that seeks to spur domestic demand in addition to catering to export markets and will create conditions that will allow domestic and foreign markets to boost each other. It is slowly becoming the underlying policy refrain to accompany China’s actions to recoup loss of growth momentum due to the coronavirus outbreak.

At the symposium in Hefei, Xi emphasized three major “historical missions” of the YRD region:

- Nurturing an unimpeded “small economic circulation” in the YRD region, to propel the “big circulation” in the domestic market and boost the “two-way circulation” between China and the rest of the world;

- Pioneering in technological and industrial innovation; and

- Improving the level of opening-up in the context of rising trade protectionism.

The three key missions of the YRD region will guide the roll-out of local government policies, and more importantly, gives us insight on what businesses in this region can expect over the next five years.

Why has the Yangtze River Delta been chosen to spearhead economic growth?

The idea of integrating the YRD region has long been one of President Xi’s pet projects – proposed back in 2003 when Xi was the Communist Party Secretary of Zhejiang province. The integration project was officially announced as a national strategy at the end of 2018 when Xi delivered the speech at the opening ceremony of the first China International Import Expo (CIIE) in Shanghai.

The YRD region, covering three provinces Jiangsu, Anhui, and Zhejiang as well as the city of Shanghai, has long been viewed as a jewel in the crown of China’s economic transformation.

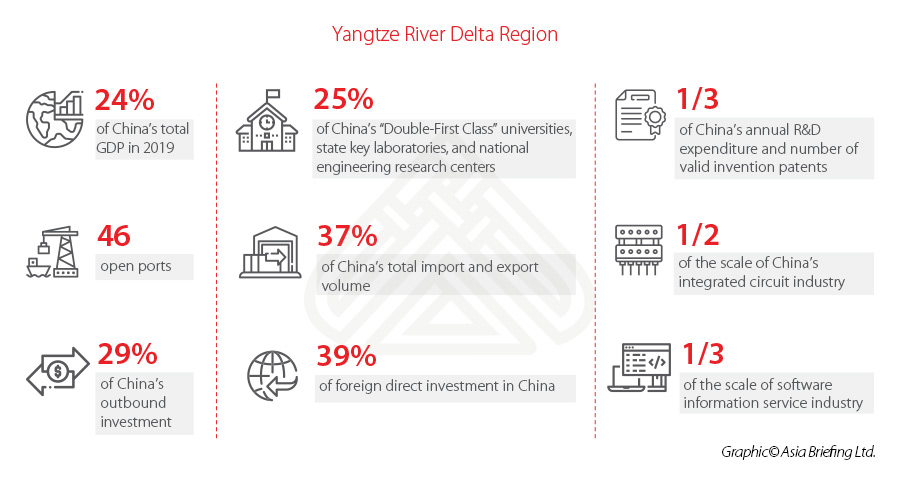

This region accounts for about a quarter of China’s total economic output, one third of China’s annual research and development (R&D) expenditure, one third of the number of invention patents in force in China, and one third of China’s gross export, foreign direct investment (FDI), and outbound investment.

Compared with other delta regions, the YRD has a rich talent pool, advanced development of science and technology, developed manufacturing sector, relatively complete supply chain network, and great market potential with a relatively dense and affluent population. It seems obvious that the region has been chosen to lead China’s new economic “dual circulation” pattern of development, which was proposed to offset the impact from external shocks.

How the YRD region fits into China’s dual circulation strategy

The development of the YRD region will focus on the keywords – integration, high-quality, and opening-up.

Integration – building a unified market and unimpeded domestic circulation

China has a huge domestic market, but one main obstacle is that the market is not unified, which becomes a drag on its overall economic efficiency. Regional integration plans, such as the integration of the YRD region, Greater Bay Area, or Jing-Jin-Ji region, are seen as a solution to this problem.

To integrate the YRD region, on December 1, 2019, the State Council rolled out the Master Plan for Integrated Regional Development of Yangtze River Delta, aiming to achieve urban-rural integration within the region and integrated development of high-tech industries, infrastructure, the ecological environment, and public services by 2025.

The integration project will not be easy as it requires coordination among local governments, who are often engaged in a competitive relationship to showcase higher economic development.

To achieve the integration, Xi urged that local governments make efforts to “break administrative barriers, enhance policy coordination, and enable the easier flow of production factors (smooth flow of land, labor, capital, technology, and data) within the YRD region.”

Successful integration will require better construction of infrastructure (including what is promoted as “new infrastructure”), cooperation among local governments, industrial collaboration, among other concerns.

We’ve seen some development in certain areas. For example, since last December, the State Taxation Administration (STA) has the taken the lead to boost tax efficiency for YRD integration by rolling out measures to optimize regional tax services, such as facilitating cross-provincial tax service, compiling unified lists of tax-related matters, and realizing taxpayer information sharing among local tax bureaus.

On August 25, three tax bureaus of Shanghai’s Qingpu District, Suzhou’s Wujiang District, and Jiaxing’s Jiashan Country jointly released the first list of tax-related matters that can be universally handled in any of the three jurisdictions, which could facilitate the cross-provincial operation and mobility of enterprises.

As another example, on September 12, Shanghai and the three other provinces released the Agreement on Mutual Recognition and Application of Electronic Certificates in the YRD Region, in a move to facilitate the cross-provincial recognition on electronic certificates, such as business licenses, drivers’ licenses, citizen’s ID cards, and qualification certifications of road transport practitioners. This move will also facilitate the easy movement and growth of businesses, entrepreneurs, and workforce in the region.

The “small economic circulation” within the YRD region might take time to realize, but once successful, it will mean better market efficiency and more choices and a bigger market for businesses.

High-quality – developing science and technology and moving up the supply value chain

At the Anhui symposium, Xi expressed his wish that Jiangsu, Anhui, Zhejiang, and Shanghai in the YRD region should work together and gather the scientific research capabilities to make breakthroughs in key technologies in vital fields like integrated circuits (IC), biomedicine, and artificial intelligence (AI) as soon as possible and foster the innovative development of micro, small, and medium-sized technology-based enterprises.

The YRD region already stands on solid ground – the region owns 25 percent of China’s “Double-First Class” universities, state key laboratories, and national engineering research centers and accounts for half of the industrial scale of China’s integrated circuits industry and one third of the scale of China’s software information service industry.

However, as China faces the growing prospects of technology decoupling with the US, the region will need to bear greater responsibility to achieve key technological breakthroughs.

Certain support has already been promised to attract companies in the strategic industries. For example, Lingang New Area of Shanghai Free Trade Zone (FTZ) will offer a lowered corporate income tax (CIT) rate of 15 percent to enterprises engaged in the production, development, or R&D of products in integrated circuits, AI, biomedicine, and civil aviation industries.

Another keyword associated with high-quality development is the “digital economy” – economy based on digital computing technologies, for example, the digitization and intelligent transformation of industrial supply chains.

Last December, the Master Plan for YRD integration proposed to build a “digital YRD region” with the coordinated generation of new information infrastructure, or “new infrastructure”.

Still, the YRD region has a good foundation in this respect. According to the White Paper on The Development of China’s Digital Economy (2020) released by the China Academy of Information and Communications Technology, Shanghai’s digital economy now accounts for more than 50 percent of its GDP, while Zhejiang and Jiangsu provinces account for more than 40 percent.

Shanghai is ramping up the construction of 5G network and data centers. On February 10, Shanghai released the Opinions on Further Accelerating the Construction of Smart Cities. By 2022, the city aims to build itself into a leader of new smart cities in the world and an important hub of the international digital economy network.

On April 29, Shanghai rolled out the Action Plan on Promoting the Construction of New Infrastructure (2020-2022).

On August 18, Shanghai opened the Lingang Xinqiao Emerging Industrial Park in the Lingang New Area of Shanghai FTZ. At the opening ceremony, the industrial park signed the first batch of around 20 international digital economy industry projects.

Opening-up – boosting two-way circulation between China and the rest of the world

Currently, Beijing is upholding the banner of globalization with promises to further open its market to counter the trade protectionism initiated by the US President Donald Trump.

The YRD region, as one of most international and economically dynamic regions in China, will function as a key bridge for the ‘circulation’ between China and the rest of the world, amid a slowing global economy and rising tensions with the US.

The Master Plan for YRD integration mentioned that it will also realize freedom in investment, trade, international transport, and facilitate entry and exits for foreign talents. The key projects behind this goal would be building the Lingang New Area of Shanghai Free Trade Zone (FTZ), boosting the development Shanghai as an international financial center, and improving the business environment to attract more multinational corporate headquarters and global talents.

New policies introduced in the Shanghai FTZ to expedite foreign trade impact financial arrangements and customs and streamline administration procedures. These will also help foreign investors in China sell their China-manufactured products to Belt and Road (BRI) markets. In fact, the Shanghai FTZ also allows products manufactured elsewhere in Asia to be exported via the zone to the large Chinese markets, or to other buying destinations through its offshore trade policies.

Shanghai is further opening up its financial sector and pilot schemes on finance are being rolled out in Lingang New Area, which could mean more opportunities in financial service market (for example, MNCs are now encouraged to set up global or regional fund management centers in Shanghai) as well as local and cross-border financing opportunities. Besides, the city plans to build its North Bund as an extension of Shanghai’s financial and commercial center.

More business environment reform measures have been introduced to streamline bureaucracy and promote fair competition. On April 13, Shanghai passed the Regulation on Improving the Business Environment with eight chapters, which lays out a number of provisions in five major areas, namely market environment, government services, public services, supervision and law enforcement, and rule of law guarantee.

What can businesses expect from the YRD integration plan?

The integration of the YRD region is still vague in terms of project scope and authorities should draft out detailed implementation measures.

In the meantime, macroeconomic obstacles waiting to be settled include revving up sluggish domestic demand that is still recovering from the ongoing pandemic, China’s high reliance on debt for growth, an environment that favors state-owned enterprises, as well as tensions with the US.

So, the integration plan will not be achieved overnight. Nevertheless, China’s top officials have a strong track record on the region and will likely draw up YRD integration strategies in a practical way in the 14th Five-Year Plan period (2021-2025).

Enterprises doing businesses here or looking for business opportunities in the YRD region should keep a close watch on the policy trends in this region. If your business needs advice on operational, tax, legal, HR, or technology solutions, please contact our China offices at china@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article China’s Civil Code: Implications for E-Commerce Firms

- Next Article How to Create a Culture of Sustainability in the Workplace