China’s Industrial Power Rates: A Guide for Investors

China’s electricity prices for industrial consumers depend upon the category of industry, type of electricity usage, and region where it is located. China Briefing briefly offers a rundown of how the power rates are fixed in the country.

The cost of electricity consumption is an important factor of production for businesses in the industrial sector, especially in high energy-consuming industries, such as iron, steel, non-ferrous metals, building materials, and chemical industries.

Although China is losing its edge in some labor-intensive sectors, it is moving up the value chain in the manufacture of higher-technology products. To lower electricity costs for manufacturing, the Chinese government has rolled out measures from time to time to bring down the general industrial power rates.

Currently, the average industrial power rate in China is around US$0.084/kWh – somewhere in the middle when compared to the rest of the world. Among OECD member countries, the industrial power rate is the highest in Italy at US$0.185/kWh and the lowest in Sweden at US$0.060/kWh.

But China’s industrial power rates vary from region to region and are based on different voltage levels and transformer capacities. Understanding the power costs in China is therefore a challenging but necessary consideration at the pre-investment stage for foreign investors.

Here, we provide a brief rundown of the regional and industrial power rates in China.

Manufacturing power costs in China

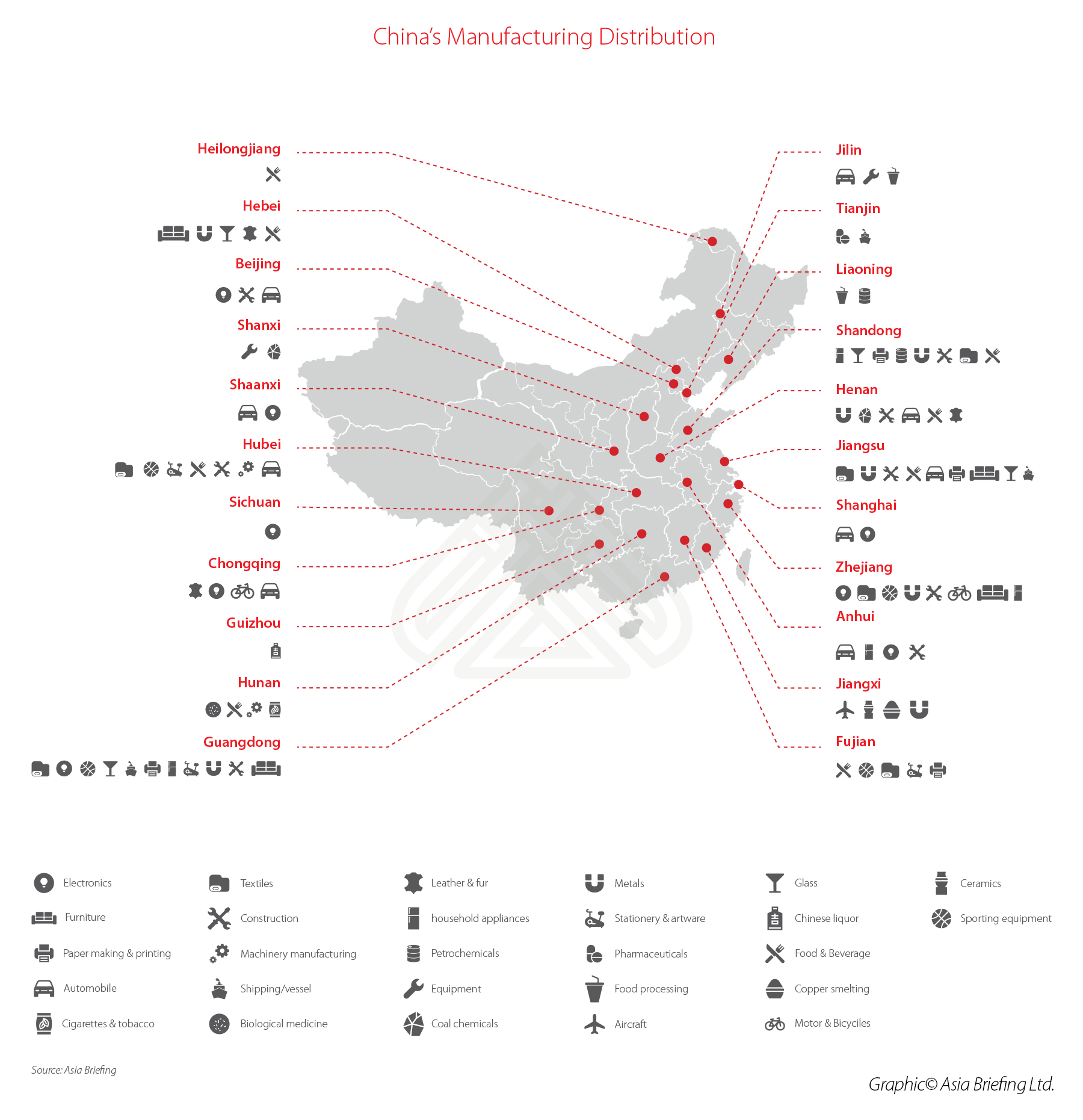

So far, more than 60 percent of China’s manufacturing is concentrated in its eastern coastal provinces, such as Guangdong, Zhejiang, and Jiangsu.

Recent government initiatives are, however, pushing several industries inwards, to central and western provinces and out of China’s major cities. Densely populated central and western provinces like Sichuan, Henan, Shaanxi, and Guizhou have shown a higher growth rate of manufacturing value-added output lately.

In terms of price fixing, China’s electricity rates are highly regulated by the National Development and Reform Commission (NDRC), but actual prices in the provinces are determined by distribution network operators. This is why power rates vary across different regions in the country.

Before deciding where to invest, it is important for investors to study the prevalence of other plants in the region and their energy costs. Investors can base their estimates on the size of their setup and local industrial operations to roughly calculate their electricity consumption costs.

How does China fix its electricity prices?

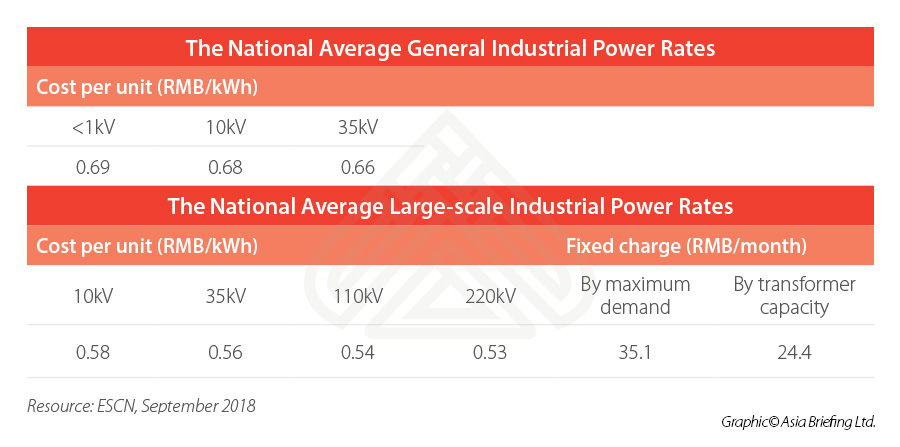

China charges electricity fees according to four types of electricity usage, namely residential electricity, agriculture production electricity, general commercial and industrial electricity, and large-scale industrial electricity.

Industrial electricity consumption has two categories – the general commercial and industrial electricity category and large-scale industrial electricity category.

General commercial and industrial electricity mainly involves small and medium-sized enterprises (SMEs) with the total transformer capacity of no more than 315 kVA and are charged only according to the cost per unit based on three voltage levels – 1kV, 10kV, and 35kV.

Large-scale industry users have the total transformer capacity of above 315 kVA. The cost of consumption in this category is broken down into two parts:

- cost per unit based on four voltage levels – 10kV, 35kV, 110kV, and 220kV, and

- the fixed charge based on maximum demand or transformer capacity.

For the electricity cost per unit, the general commercial and industrial electricity price is usually significantly higher than that in the large industrial electricity category.

China’s industrial power rates by region

ESCN, a Chinese power industry association, sorted out the general industrial power and large-scale industrial power rates by region as of September 2018.

The top manufacturing clusters like Guangdong, Zhejiang, and Jiangsu usually have slightly higher than average industrial power rates. The central and western regions have relatively lower industrial power rates.

In terms of the costs of each voltage level in the general commercial and industrial electricity category – the rates in Beijing, Shanghai, Jilin, and Hubei are always among the highest. Meanwhile, Shanxi and Hebei have the cheapest general industrial power rates.

In the large-scale industrial electricity category, Beijing, Shanghai, Tianjin, and Zhejiang have the most expensive costs per unit, compared to other regions.

Beijing, Shanghai, and Zhejiang also have high fixed charged electricity fees per month.

However, power costs per unit in the large-scale industry in Shanxi, Shaanxi, Liaoning, Hebei, and Guizhou are more competitive.

Gansu, Qinghai, and Ningxia have very low-priced industrial power rates, but the manufacturing sector is comparatively underdeveloped in these areas, though Qinghai and Ningxia have recently experienced relatively accelerating manufacturing.

Price trends, policy environment, and other decision-making factors

China’s average industrial power rate is cheaper than in some European countries, but not more competitive than in the US.

The Chinese government is aware of the importance of controlling the cost of electricity and has been calling for improving transparency in the state-controlled power industry and cutting industrial power rates to lower costs for small and middle-sized enterprises to attract business and steady employment. The general commercial and industrial electricity prices are projected to decline further.

At the same time, China’s electricity grid is reliable and does not require the back-up power generation needed in other lower cost manufacturing destinations in Asia like India, Vietnam, Myanmar, and Cambodia.

However, what should be noted is that in China, electricity prices are used as leverage to make macroeconomic adjustments, such as to discourage low-level but high energy-consuming industries.

Large industrial enterprises with relatively backward production technology or those enterprises that fail to meet environmental protection requirements will face higher power costs or even penalties and could lose their pricing advantages.

Industrial power rates, power rate structures, and related energy policies vary widely by region in China and can be amended over time.

Companies that consume large amounts of electricity are advised to invest in a through analysis of power costs before making location decisions.

The analysis should also be considered in the context of other location drivers, such as overall operational costs, quality of labor, speed to customers, and many other factors.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article The ‘996’ Work Culture That’s Causing a Burnout in China’s Tech World

- Next Article Online Gaming in China: New Rules for Approvals, Regulators to Vet Content