How Beijing is Driving China’s Services Sector Expansion

- China’s services sector is steadily improving its market accessibility, most demonstrably through new reforms targeting key industries in Beijing.

- In September 2020, Beijing released the Work Plan for the Construction of a New Service Industry Comprehensive Demonstration Zone – marking the fourth and latest round of Beijing’s service industry opening-up.

- The Work Plan, directed at nine key industries, expands existing industry clusters and parks and implements institutional and supply-side reform. The new pilot zone will be a testing ground for new innovative policies that can be replicated and scaled for the service industry opening-up at a national scale.

On September 4, President Xi Jinping delivered a speech at the 2020 China International Fair for Trade in Services (CIFTIS) throwing his support behind the development of Beijing’s Comprehensive Demonstration Zone.

Shortly after, Beijing released its Deepening the New Round of Service Industry Opening-up and Comprehensive Demonstration Zone Work Plan (“the Work Plan”), which laid out comprehensive reform measures set to impact nine key services industries. Notably the plan involves relaxing market access, expanding the development of existing industry parks, and ongoing institutional and supply-side reform.

China’s services industry continues to play an increasingly prominent role in its economic growth – as an inevitable consequence of the country’s upwards shift in the value chain.

According to government reports, in 2020, the services industry’s share of the national economy grew to 54 percent of the GDP, and in the same year, contributed to 60 percent of the nation’s total economic growth. Beijing announced service industry openings in 2015, 2017, 2019, and 2020.

Given this apparent trend, Beijing is now playing a critical role in spearheading reform and generating new momentum for China’s future market reforms.

Doing Business in Beijing

If you are interested to know more about how China is opening up its services sector, join us on May 25 for our upcoming webinar: Crash Course on Doing Business in Beijing.

Key features of Beijing’s Services Industry Comprehensive Demonstration Zone Working Plan

The New Round of Service Industry Expansion and Opening up Comprehensive Demonstration Zone Work Plan (“Service Industry Opening-up Work Plan 2020”) is comprised of the basic framework of “1+2+4”.

This refers to one work plan to build the comprehensive demonstration zone.

The Work Plan’s two five-year development goals are:

- To optimize the business and policy environment for the service industry opening-up by 2025 by focusing on trade and investment convenient, marketization, and rule of law; and

- To establish an open system of service industry that adheres to international standards of economic and trade by 2030.

And finally, the plan lays out four major tasks comprised of 120 policies and measures that will make possible the gradual opening of the Beijing service sectors. These are:

- Deepening the reform and opening-up of key services industries;

- Promoting the expansion and opening-up of key parks;

- Forming institutional innovation system in line with international standards; and

- Optimizing the supply factors for the service industry.

What does this mean in practice?

Relaxed market access

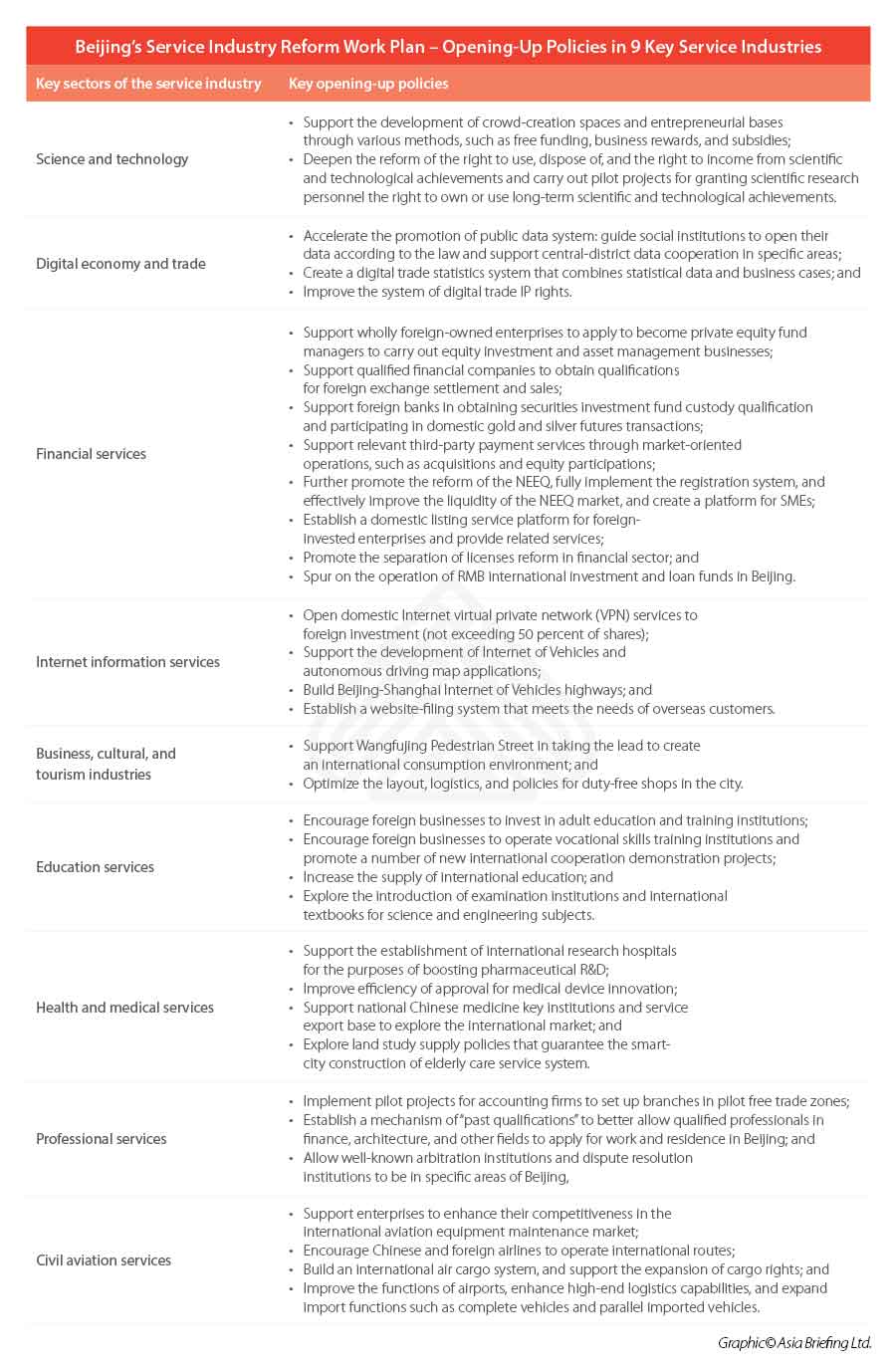

In practice, there are nine key sectors selected to undergo reforms for widened market access. These are:

- Science and technology services;

- Digital economy and trade;

- Financial services;

- Internet information services;

- Business and cultural and tourism industries;

- Education services;

- Health and medical services,

- Professional services; and

- Civil aviation services.

Of the nine sectors, the financial services industry has received the most attention with 26 newly announced policies — by far the most extensive number of measures introduced under a single industry.

Measures incorporated within this section either relax market access restrictions or optimize the market environment in which businesses operate.

For example, under the Work Plan, measures further liberalizing market access include allowing foreign telecom companies to own as much as 50 percent of joint ventures in providing virtual private networks (VPN) – which is seen as an important step to improving the cross-border flow of information.

In addition, within the financial services industry, a slew of new measures have been introduced including supporting wholly foreign-owned enterprises to become private equity fund managers, permitting foreign banks to obtain fund custody licenses, and allowing eligible foreign banks the ability to trade gold and silver futures and to act as lead underwriters in the interbank bond markets. Other areas which will benefit from market access include adult education and training institutions and international research hospitals for pharmaceutical R&D.

Some more important market access stimulus measures include:

- Deepening reform on the right to use, dispose of, and generate income on scientific and technological achievements;

- Promoting and establishing a transparent and public data system and free funding; and

- Business rewards and subsidies for the development of crowd-creation spaces and entrepreneurial bases.

Notable policies for further opening-up each of the nine sectors have been tabled below.

Expansion and opening-up of key industry parks

The Work Plan also promotes the expansion and opening of key industry parks to pull resources and centralize incentive for the accelerated growth of sectors the government deems to be priority.

For example, the Zhoungguancun National Independent Innovation Zone – China’s technology hub in the capital that is often compared to Silicon Valley – will form the basis for creating a venture capital cluster, which will carry out a pilot program introducing a new preferential corporate income tax for eligible companies.

Under the pilot program, eligible venture capital companies registered in this zone will be exempt from corporate income tax according to the proportion of individual shareholders at the end of the year to encourage long-term investments. Additionally, such companies will be subject to a tax-free income threshold on technology transfers of RMB 20 million (US$2.94 million) – up from the previous RMB 5 million (US$740,000) – as well as other fiscal and taxation privileges.

In Haidian Park – inside the Zhongguancun National Independent Innovation Zone — the restriction on the foreign shareholding of information service business on the App Store will be removed and foreign investment participation in the provision of software as a service (SaaS) will be actively encouraged in accordance with laws and regulations

Digital trade development projects will also be carried out in the Zhongguancun Software Park and the Beijing Daxing International Airport Economic Zone – by way of exploring the application and scalability of digital certificates, electronic signatures, cross-border data flows, authentication and origin label identification systems, as well as new businesses, such as data auditing.

The map below illustrates some of the zones already in place in Beijing, and how the government intends to expand them.

Institutional innovation system and supply side reform

The remainder of the measures introduced by the Work Plan fall under two broad camps:

- Institutional innovation – that denotes measures for restructuring the systems in which businesses currently operate; and

- Optimizing supply factors – that refers to supportive measures to boost production factors such as labor, land, capital, and data.

Most notably, the Work Plan states that Beijing will support the trial implementation of a cross-border service trade negative list management model to be applied in specific regions within the municipality, mirroring the national cross-border negative list that is set to be released by the end of 2020.

In addition, a pilot program will be launched to test out the integration of domestic and foreign currencies – for example promoting foreign investors to use domestic-foreign exchange accounts and allowing foreign institutions to conduct foreign-exchange settlement and sales transactions in according with the regulations.

See below for a summary of the measures listed within the last two headings of the Work Plan.

Beijing as a trailblazer for national service sector reforms

As mentioned earlier, Beijing initiated four rounds of service sector openings – in 2015, 2017, 2019, and 2020 – over the course of five years.

These previous rounds of reform saw Beijing make gradual steps towards improving market access. Notably in 2019, Beijing allowed the establishment of wholly foreign-owned entertainment venues and performance agencies for nationwide operations, opened VPN to foreign investment for the first time, and lowered the barrier to market entry for elderly care institutions.

Driven by these pilot policy developments, latest government figures showed that Beijing’s service industry now accounts for 83.5 percent of its GDP, which is nearly 30 percent higher than the national total. And in 2018, Beijing’s service trade import and export showed an annual growth of 10 percent – making up one-fifth of the whole country’s service trade import and exports.

Unlike previous rounds of reform, the emphasis in the 2020 reforms focuses on laying the foundation for more conducive business environment – such as promoting industry parks and strengthening IP and right to use, dispose of and generate income scientific and technological achievements to facilitating greater and bolder steps in innovation. This differs slightly from the emphasis on opening-up additional markets that was witnessed in previous reform rounds.

Alongside this, Beijing simultaneously released three further action plans with regards to the “Construction of 3 Free Trade Zones in Beijing, Hunan & Anhui”, “Promoting the Innovation and Development of the Digital Economy”, and “Establishment of International Big Data Exchange in Beijing”.

Taken together, these plans will also play a big role in providing the necessary technological foundation and cross-border business environment for the continued growth of the services sector.

Investment outlook of China’s services sector

China’s service industry already outsizes manufacturing as a proportion of the country’s GDP, with services trade growing at an average annual rate of 4.7 percent in the last five years.

Moving forward, services will continue to play a dominant part in the Chinese economy, as it sees this as not only being key to sustainable economic growth, but also a way to increase competitiveness and cooperation on the international stage.

The service industry is unique in that it is depends on many soft factors of labor input (such as expertise and innovation) for its production.

For this reason, it is widely believed that for the services industry to grow, it needs an open and transparent business environment that allows cross-border connectivity of information, data, capital, and personnel.

Beijing’s latest Comprehensive Demonstration Zone Work Plans aims to achieve this, and echoes many of priorities of the central government – such as relaxing foreign investment restrictions, promoting more convenient cross-border flows of capital, attracting professional talent, securing IP and data protection, and digitalizing business processes.

The plan aims to provide the basis for a replicable and scalable model to accelerate reform at a national scale.

Already, China’s 2020 National Negative List has cut down on the number of measures restricting foreign investment access in the services sector – with reforms rolled out in the fields of financial, infrastructure, and transportation.

In addition, China has touted the release of a foreign investment negative list for services, which will be the first of its kind and is expected to be released before the end of 2020.

The Work Plan will form a solid reference point for policymakers when drafting the 14th Five-Year Plan – set to be released this October – which again is expected to heavily focus on the development of the services industry, particularly the knowledge-intensive and tech-related subsectors.

Businesses should closely monitor new developments happening within the services industry as it will continue to be a priority area for innovation and growth for China.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, Thailand, United States, and Italy, in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article Trade Secrets’ Protection in China: What is Changing?

- Next Article China to Allow Entry of Foreigners with Valid Residence Permits