Entering China’s Infant Formula Market: Regulations, Opportunities, and Challenges

China’s infant formula market has grown due to a rising middle class, lower breastfeeding rates, and new policies. Concurrently, there is intense competition between local and international infant formula brands, along with the introduction of new regulatory standards. We discuss how foreign companies can successfully bring their infant formula products to this market.

Over the past few years, the overall market for Chinese infant formula has continued to grow, despite a slower rate of expansion. This growth is primarily driven by the country’s substantial population and expanding middle class, declining rates of breastfeeding, and the influence of China’s “three-child policy”.

The dynamics of the market have ignited fierce competition among both international and domestic Chinese infant formula brands. Consequently, new regulations for infant formula product registration have been introduced this year. Foreign brands that want to establish themselves in this sector must understand how the new compliance norms apply to them and adhere to critical reporting requirements.

Market analysis

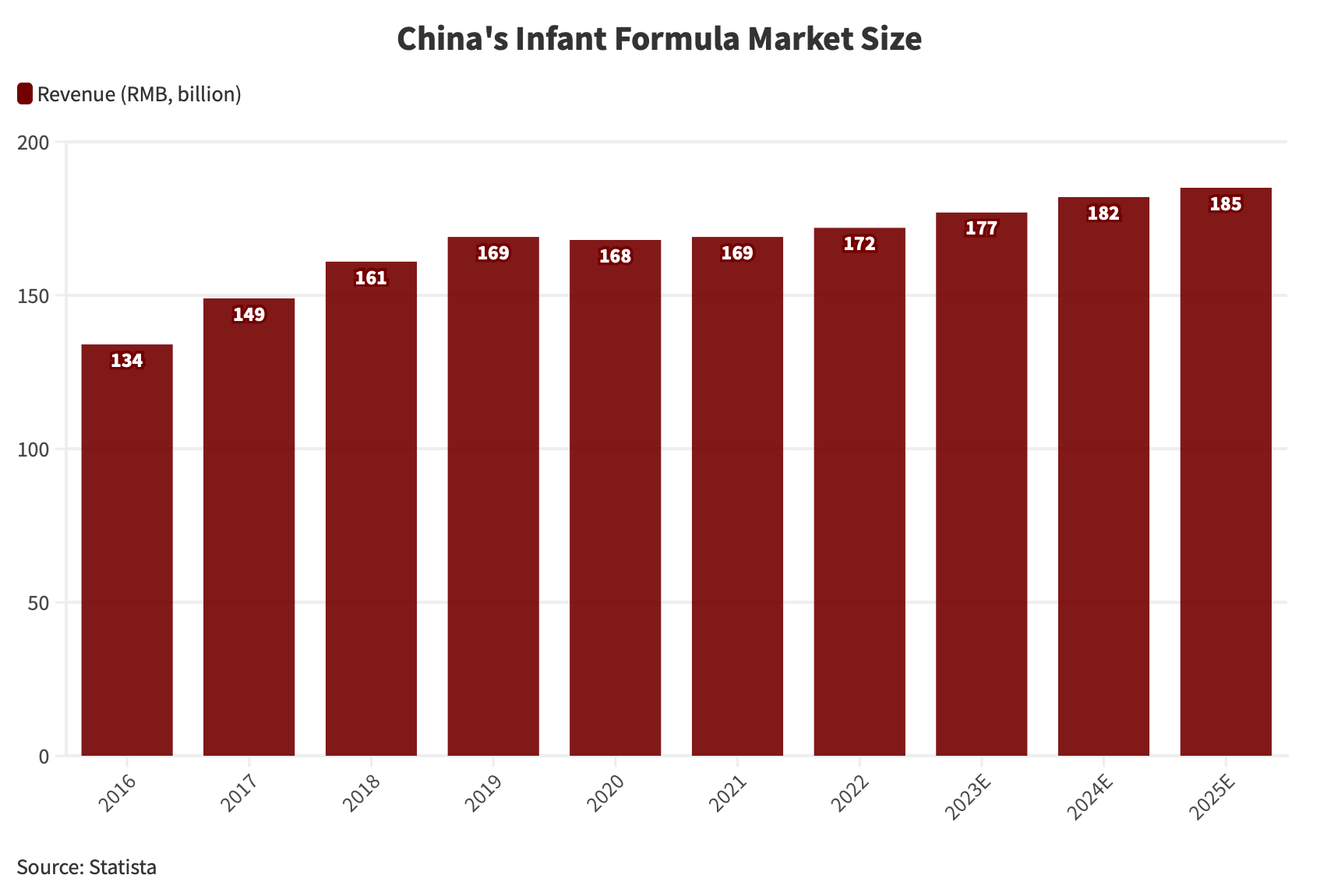

Data suggests that the Chinese infant formula market was projected to achieve a value of approximately RMB 172 billion (US$23.6 billion) in 2022.

Leading segments

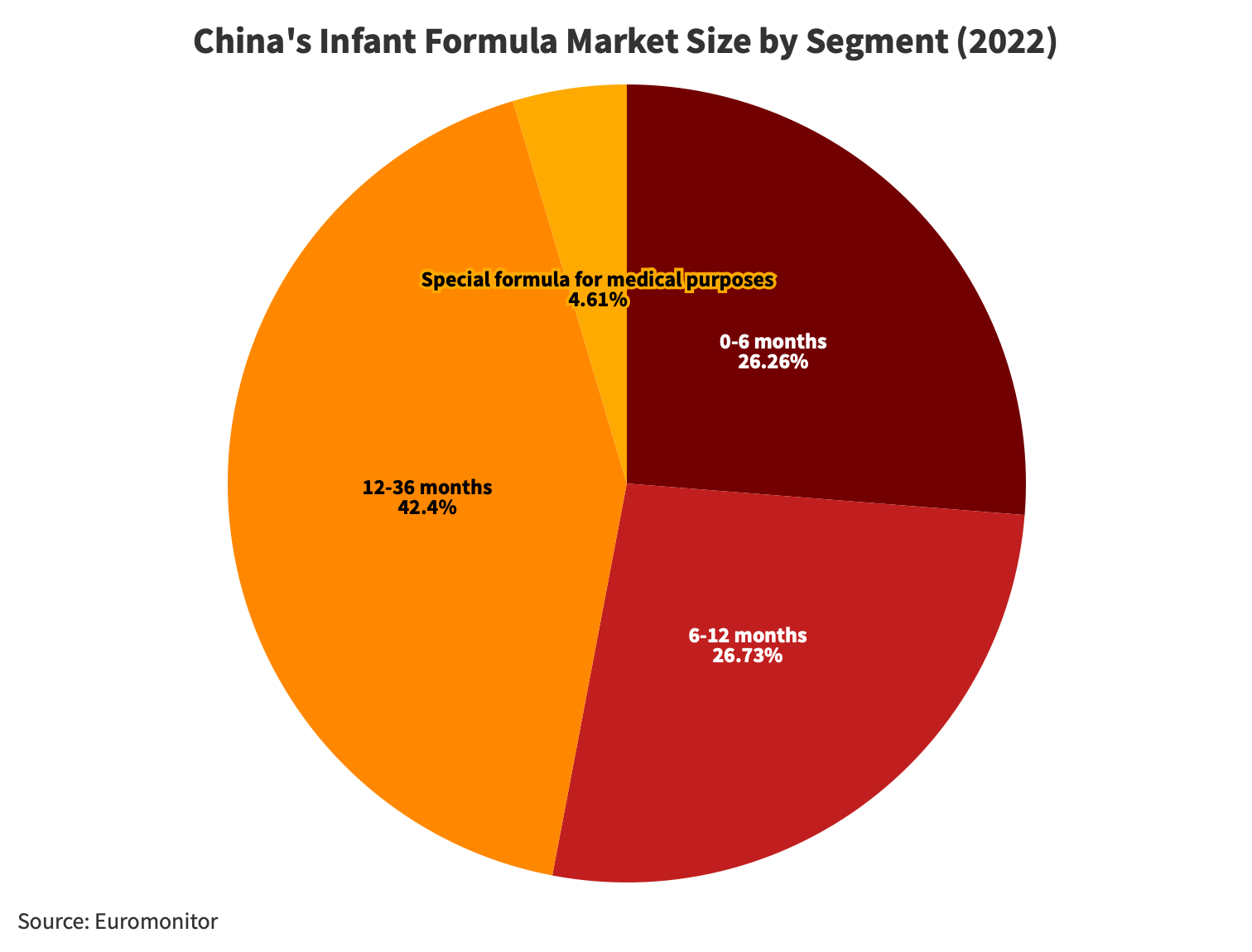

Looking at the breakdown of China’s infant formula market by different age groups, it’s clear that the baby stage, which includes the first and second stages (ages 0-12 months), makes up more than half of the market share. The toddler stage, which covers the third stage (ages 12-36 months), along with other stages (3-6 years), accounts for 47 percent of the market.

Within the baby stage, the first and second stages are almost equal, comprising 26.3 percent and 26.7 percent, respectively. The third stage makes up 42.4 percent of the market. Despite the third stage covering twice the time span of the first and second stages combined, its actual consumer market size isn’t twice as big. This is because, after the second stage (12 months), some parents opt for other foods to replace or supplement formula feeding. Additionally, as children reach 36 months, many parents stop using formula altogether.

Key distribution channels

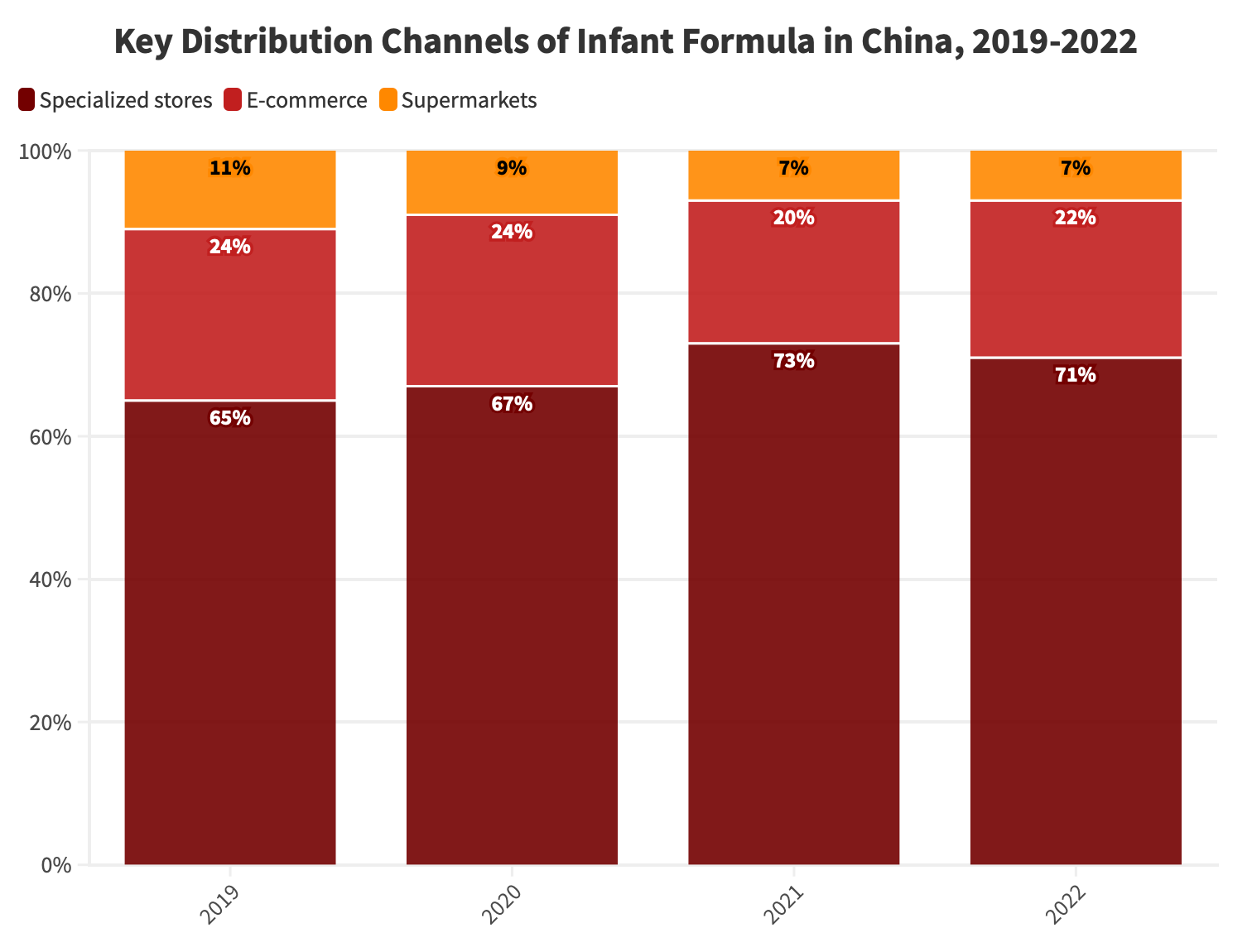

Looking at the distribution channels for maternal and infant formula consumption in recent years in China, it’s evident that specialized stores for mothers and babies have consistently accounted for the majority of consumption, ranging between 65 percent to 73 percent over four years. In contrast, offline supermarkets have shown a clear decline, dropping from 11 percent to 7 percent steadily.

Online e-commerce channels maintained a 24 percent share in both 2019 and 2020, with a slight dip to 20 percent in 2021. However, they rebounded to 22 percent in 2022, primarily due to the rapid growth of short videos, livestream shopping, and the rise of content-driven e-commerce.

Notably, the phenomenon of market concentration is particularly pronounced in online e-commerce, especially in cross-border e-commerce channels. Leading businesses in these channels are known for their stable product quality and longstanding reputation, making them among the most important factors for maternal and infant formula consumers when making purchasing decisions. Additionally, factors such as convenient logistics and prices lower than offline stores are also significant incentives influencing consumer decisions in favor of online channels.

Market share

Foreign brands once occupied almost 60 percent of China’s infant formula market share.

With time, China’s market regulations have become stricter and the quality of locally-made baby formula has improved, resulting in the growth of the popularity of domestic brands. By 2022, among the top five infant formula brands in China, three were Chinese firms.

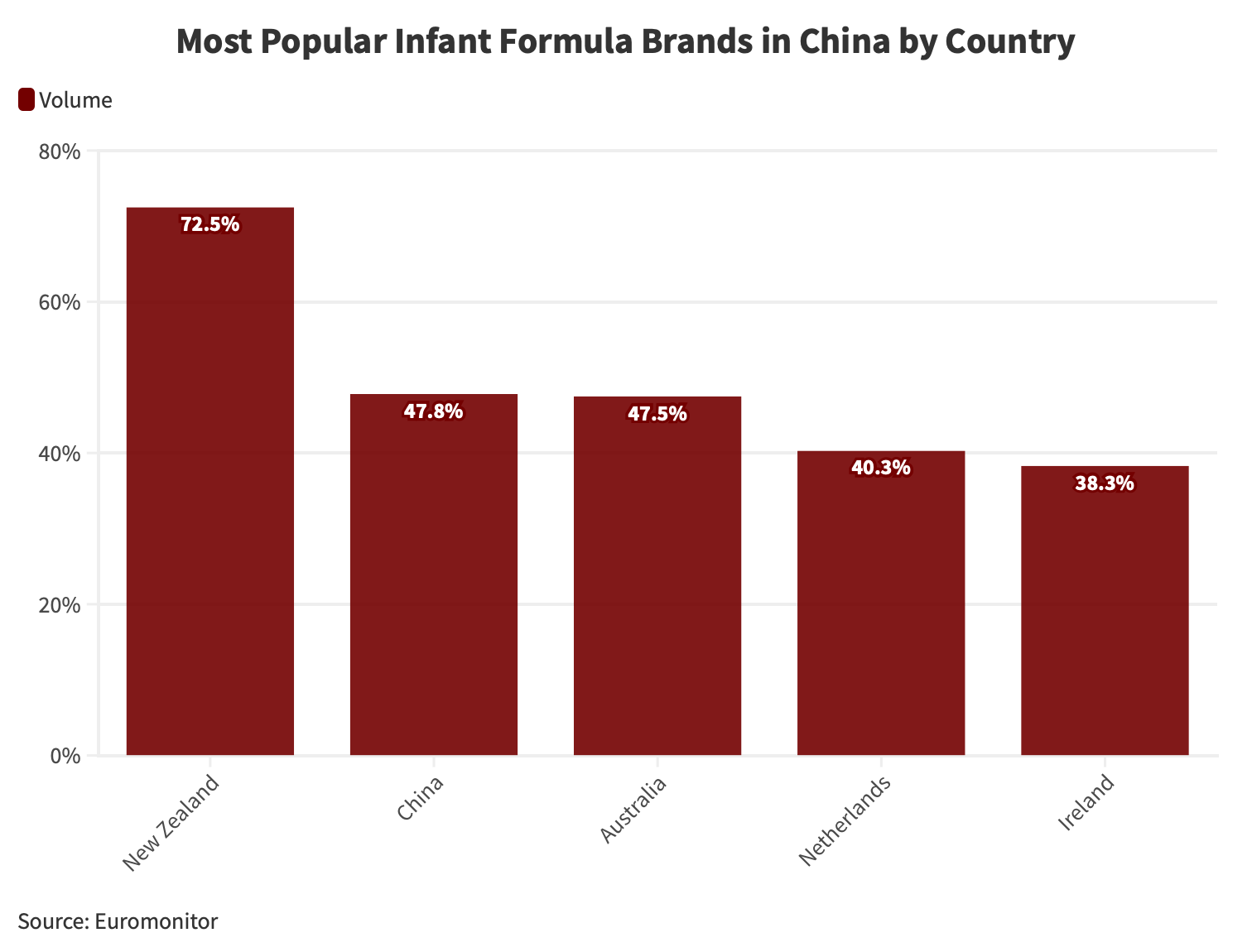

When it comes to the country of origin of infant formula products, most Chinese consumers (72.5 percent) still prefer New Zealand. China and Australia are next, with 47.8 percent and 47.5 percent, respectively. The Netherlands and Ireland come after, with 40.3 percent and 38.3 percent preference rates, respectively.

Strategic insights from Chinese brands

Cultural and nutritional preferences

Chinese infant formula products are tailored to local preferences and nutritional requirements. They are formulated based on extensive research into Chinese breast milk and the unique nutritional needs of Chinese infants. Foreign brands need to overcome the challenge of aligning their products with these preferences and effectively communicating the suitability and benefits of their offerings to the Chinese consumer base.

Market penetration strategies

Chinese domestic brands have excelled in expanding their market share through the Mother-and-Baby Store (MBS) channel, especially in lower-tier cities. This distribution strategy is deeply rooted in local consumer behavior and preferences. Foreign brands must carefully devise strategies to effectively penetrate this channel or identify alternative distribution channels that resonate with the Chinese audience. Failure to do so could hinder their ability to access a substantial portion of the market.

Branding and marketing

The Chinese infant formula market is highly competitive in terms of branding and marketing. Domestic brands have made substantial investments in marketing activities, such as product placement and celebrity endorsements, leveraging the familiarity and relatability of local personalities to build trust among consumers.

Foreign brands must develop culturally sensitive and impactful marketing campaigns that resonate with Chinese consumers while differentiating themselves from local competitors.

Market access

The infant formula market in China has not been without its share of challenges. A particularly noteworthy incident occurred in 2008 when a grave scandal erupted involving contaminated formula milk, shaking the foundation of consumer trust. The event involved the deliberate contamination of infant formula with a harmful chemical called melamine, which is typically used in plastics and fertilizers.

This incident underscored critical deficiencies in China’s food safety regulations at the time, leaving its populace grappling with a crisis of confidence in domestically produced baby milk products. The Chinese government swiftly intervened by imposing stringent measures and safety standards for formula milk manufacturers, effectively overhauling the regulatory landscape.

Ever since, China has been implementing stricter safety requirements for its infant formula market.

For a complete guide on how to export food products to China, click here.

Competent authorities and responsibilities

China’s infant formula market is under the vigilant eye of several regulatory bodies, each with a distinct remit and responsibilities:

- State Administration for Market Regulation (SAMR): The SAMR, and in particular, the Special Food Safety Supervision and Management Department under it, is responsible for market supervision and administration, including overseeing special food categories like infant formula and managing recipe registration.

- National Health Commission (NHC): This body is tasked with drafting national standards, registering new food ingredients, and contributing to the overall food safety landscape.

- General Administration of Customs of China (GACC): This body manages customs inspection, quarantine, and declaration for imported infant formula products, ensuring adherence to safety requirements. Overseas food manufacturer registration also falls under their purview.

Key steps to export infant formula to China

The table below provides a step-by-step guide to the key procedures required to export infant formula to China. It is important to note that these requirements apply to infant formula export to China through general trade. For infant formula selling to China through qualified cross-border e-commerce channels, these requirements could be exempted.

|

Required Steps to Export Infant Formula to China |

|

| Import permit at state level | Infant formula products can only be exported to China from countries that have passed the national assessment. This assessment determines the countries/regions permitted to trade with China. The full Catalogue can be accessed on the GACC website. |

| Overseas manufacturers registration | As per the Regulations of the People’s Republic of China on the Registration and Administration of Overseas Manufacturers of Imported Food (hereinafter, ‘Decree 248’), all imported food products, including infant formula, require overseas manufacturers to be registered. This step involves recommendations from competent authorities in exporting countries. |

| Inspection and quarantine | Imported infant formula undergoes thorough food sanitation inspection, irrespective of its form. GACC has notified specific inspection and quarantine requirements under Decree 248 and 249 released in 2021 and 2022, respectively. These clarify the new conditions for the quarantine and inspection of dairy products. |

| Exporter and importer filing | Overseas exporters and importers in China must register with GACC, fostering transparency and accountability in the import process. |

Recipe registration of infant formula products

Since January 1, 2018, all infant formula products, whether manufactured in China or imported into the country, are required to obtain a registration certificate from the competent department under the SAMR. The registration number obtained must then be visibly displayed on the product’s label and instruction booklet.

To register, the below materials are required to be submitted:

- Formula registration application for infant formula milk powder products;

- Proof of the applicant’s qualifications;

- Quality and safety standards for raw materials;

- Product formula;

- Research and development justification report for the product formula;

- Production process description;

- Product inspection report;

- Documentation demonstrating research and development capabilities, production capabilities, and testing capabilities; and

- Draft labels and instructions along with their claimed explanations and supporting materials.

Each company is generally limited to applying for a maximum of nine formula products, which are divided into three series. These series encompass infant formula (Stage 1, for 0-6 months), older infant formula (Stage 2, for 6-12 months), and young children formula (Stage 3, for 12-36 months).

For foreign applicants, it is mandatory to appoint a Chinese Responsibility Agent (CRA) to oversee the registration process. The CRA can either be the Chinese branch of the foreign applicant or an external third-party consulting company. The recipe registration certificate is valid for five years. The renewal of the registration should be made six months before the expiration of the recipe registration certificate.

The revised Measures for the Administration of Recipe Registration of Infant Formula Products

In February 2023, the SAMR introduced the amended Measures for the Administration of Recipe Registration of Infant Formula Products (hereinafter, ‘new infant formula recipe registration regulations’). Compared to previous regulations, the new infant formula recipe registration regulations introduced the following changes:

- Strict formula registration and detailed inspection requirements: It emphasizes the importance of conducting on-site inspections and outlines the specific situations where these inspections are necessary. Additionally, it highlights that during these on-site inspections, samples from the actual production process must be taken for dynamic testing. It also explicitly prohibits any attempts to circumvent the registration process, such as through disguised packaging.

- Enhanced labeling standards and consumer protection: The new regulations stress the importance of clear and accurate product labeling to safeguard consumer rights. Specifically, the document mentions that if a product’s name includes any reference to animal-derived ingredients, all milk proteins, including fresh milk, milk powder, and whey protein, must exclusively come from the species indicated in the product name.

- Promoting research and development innovation and improving the business environment: This indicates a broader strategy aimed at enhancing product quality and diversity. By fostering innovation, it aims to create an environment where businesses are motivated to develop new and improved products.

Labeling requirements of the infant formula

In addition to the labeling requirements stipulated in the new infant formula recipe registration regulations, the labeling guidelines for infant formula products must adhere to national standards, such as GB 13432-2013 for the labeling of specialized dietary foods, GB 7718-2011 for prepackaged food labeling, and GB 28050-2011 for nutrition labeling on prepackaged foods. Additionally, regulations such as Decree 248 require the inclusion of the registration number of overseas manufacturers on imported infant formula product packaging.

A synopsis of these prerequisites is provided in the table below.

|

New Labeling Requirements for Each Stage |

|

| Stage | Labeling requirements |

| Stage 1 (infants 0-6 months) | The label must indicate the product’s category, properties (such as whether it’s milk-based or soy-based), and its intended age range.

The infant formula label must include the statement: ‘Breast milk is the best source of nourishment for infants aged 0-6 months. This product can be used to meet the needs of infants when breast milk is insufficient or unavailable.‘ The use of images featuring infants and women is prohibited on labels. Terms like ‘humanized milk‘ or ‘maternized milk’ should not be utilized. Instructions for usage should be provided on the label following the guidelines outlined in GB 10765-2021. |

| Stage 2 (infants 6-12 months) | The product’s classification, characteristics (such as product form), and appropriate age groups must be clearly indicated on the label.

Instructions for usage must align with the guidelines set forth in GB 10767-2021. |

| Stage 3 (toddlers 12-36 months) | Overseas exporters and importers in China must register with GACC, fostering transparency and accountability in the import process. |

| Linoleic Acid (LA) | The labels must clearly display the categories of infant formula intended for special medical use, such as lactose-free formulas, along with the specific medical conditions they are applicable to. For infant formula designed for premature or low birth weight babies, the label should also provide information about the formula’s osmotic pressure. For products intended for infants older than 6 months, the label should indicate that if used for special medical conditions in babies older than 6 months, supplementary food must be added.

The label should include the phrase ‘Under the guidance of a doctor or clinical nutritionist‘ for such specialized formulas. Labels must not feature images of babies or women, and terms like ‘humanized‘ or ‘maternized‘ or similar expressions should be avoided. Usage instructions must adhere to the specifications outlined in GB 25596-2010. |

| Source: Chemlinked | |

Additionally, the new regulations also forbid the use of the following terminology on the infant formula product labeling:

- “Imported milk source;”

- “Originating from overseas farms;”

- “Imported raw ingredients;” and

- “Non-polluted milk source.”

Notably, other unclear messaging must also be avoided.

Nutrient requirements for infant formula

China’s National Food Safety Standards for Infant Formula Food (GB 10765-2021), National Food Safety Standards for Larger Infant Formula Food (GB 10766-2021), and National Food Safety Standards for Toddler Formula Food (GB 10767-2021) (hereinafter referred to as the “new national standards”) feature revised ranges for essential nutrients, both minimum and maximum values.

Indeed, the primary goal of these regulations is to establish a consistent nutritional makeup for these products, guaranteeing that infants receive the requisite nutrients safely and effectively. The adjustments in nutrient values are designed to enhance the overall health and well-being of infants who consume these formulas. These are shown in the table below.

|

2023 Nutrient Requirements for Infant Formula |

||

| Nutrient | Minimum value | Maximum value |

| Protein | 1.8 grams per serving | 4.5 grams per serving |

| Fat | 0.3 grams per serving | 6.0 grams per serving |

| Linoleic Acid (LA) | N/A | 1400mg LA/100 kcal |

Choline, Selenium, and Manganese

Under the new national standards, Choline, Selenium, and Manganese are now required to be included in Stage 1 and Stage 2 formulas, as they are regarded as substantially contributing to the overall well-being of infants.

Sugar and fructose

The addition of sugar/fructose is permitted in Stage 1 and Stage 2 formulas is no longer permitted. This limitation aims at alleviating concerns about dental problems during the critical growth phase and mitigates the risk of fostering a dependency on formulas with added sugars.

Lactose content

The new national standards in China also bring about a significant alteration pertaining to lactose levels. Lactose, a natural sugar present in milk, plays a crucial role in nourishing and aiding digestion in infants. The revised standards now mandate that all infant formula products adhere to specified lactose content criteria.

This modification is intended to guarantee that infants obtain adequate quantities of this vital nutrient, contributing energy and fostering their overall growth and development.

Seizing opportunities in China’s infant formula market

Meeting the rising demand for premium products

With Chinese parents becoming more conscious about the nutritional content of infant formula, brands can stand out by offering products with organic and high-quality ingredients. Indeed, premium, and organic product segments, are still largely dominated by foreign brands.

A notable example comes from Feihe International, a major player in the market, that has emphasized the use of organic ingredients in their formula products. They have witnessed increased consumer trust due to this commitment to quality sourcing.

E-commerce and digital marketing strategies

E-commerce is a vital channel in China. Foreign brands like Aptamil have succeeded by partnering with platforms like JD.com and Tmall. By offering convenient online purchasing and engaging promotions, they’ve effectively reached consumers even in lower-tier cities.

At the same time, foreign brands can learn from domestic competitors in leveraging local influencers who play a crucial role in dictating Chinese consumer behavior, especially through their online presence on social media platforms like WeChat and Xiaohongshu.

Collaborations and partnerships

Joint ventures provide access to local expertise and distribution networks. For instance, Reckitt Benckiser partnered with a Chinese dairy company, merging their infant nutrition business. This allowed them to combine global knowledge with local insights, enhancing their market position.

In addition, distributors play a pivotal role in reaching consumers. Being strategic in distributor selection is crucial. Mead Johnson Nutrition established a strong partnership with Beingmate, a Chinese infant food company, forging a collaboration that facilitated market entry and offered mutual benefits in terms of distribution reach.

These strategies can empower foreign brands to navigate the complexities of the Chinese infant formula market, capturing the attention and trust of Chinese parents while addressing their evolving preferences and needs.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Chinas Lieferkette für Elektrofahrzeuge und ihre Zukunftsaussichten

- Next Article China Amends Civil Procedure Law: Impact on Foreign Companies