Foreign Investment into China Falls as Capital Sources Change

US FDI may be declining, but Beijing has replacements from the Middle East

By Chris Devonshire-Ellis

Foreign investment into China has declined significantly since May this year, with four consecutive months all showing double-digit falls. September’s FDI fell by 34 percent compared to the same month last year, with the falling numbers indicating the biggest decline in FDI since monthly figures became available in 2014. September recorded inbound FDI of US$10 billion.

However, the reasons for this are less to do with China becoming unattractive – its consumer market fundamentals remain positive, but the declines are more to do with geopolitical changes working their way into China investment sentiment, most notably from the United States. Constant political pressure from Washington on US domestic investors to steer away from China has been having an effect, with these latest figures showing the effects of the disappearing “tail” of US private equity and corporate M&A deals drying up.

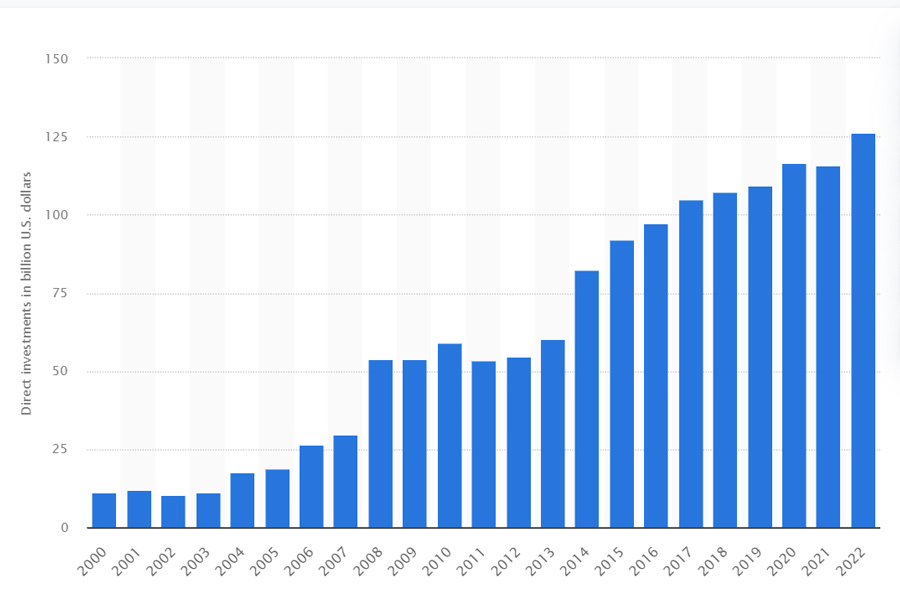

US historical FDI into China (billions of dollars)

Source: Statistica

This also comes after the Biden administration released an executive order directing the US Treasury to create a new regulatory program to prohibit or require notification of outbound US investments into China in certain sensitive sectors. It was issued on August 9, this year, and is a targeted order designed to slow down investment into China. The biggest impact has been on US private equity and venture capital investments in China. What we are now seeing are the results.

So where does China go from here? Beijing needs an estimated US$100-200 billion of inbound FDI to maintain and develop its growth plans, and as can be seen from the past, has been able to rely upon the United States for much of this. With Washington keen to pull the plug and limit investments into key Chinese strategic industrial development – new tech and specifically AI, Beijing needs to find alternative sources of FDI.

Domestically, it already undertook a massive State development plan during the 2005-2020 period; China’s own infrastructure is relatively good, well connected and not yet in need of expensive maintenance expenditure, although this will change over time. However, China has been spending significant amounts of money in technical development, as well as on securing global supply chains. The amount spent on Belt & Road Initiative projects is in excess of US$1 trillion – roughly equivalent to a decade of its inbound US FDI. On the plus side, many of these are now entering, after some delays (such as Covid), cash-flow generation stages. Some of these projects will later IPO, with the Chinese investors receiving welcome and not insignificant returns on their investments. However, with China also not needing to spend quite to the same degree on BRI projects as it has done in the past, many of these investments will settle down and be realized as annual dividends from Chinese equity stakes.

However even these Belt & Road Initiative dividends will not surpass the previous US FDI spend in China. Instead, that capital is likely to come from the Middle East, and specifically the Gulf Cooperation Council countries. These six nations – Saudi Arabia, Kuwait, the United Arab Emirates, Qatar, Bahrain, and Oman – have collective sovereign wealth funds worth an estimated US$4 trillion in investment capital available. Only a small portion of that – approximately 1-2 percent – is being invested in Asia, particularly China at present. But this is set to change.

This investment capital is expected to grow to about US$10 trillion by the end of this decade. China’s allocation of FDI from the GCC region is expected to reach about 10-20 percent – more than adequately covering any US shortfall.

That viewpoint has also been endorsed by Hong Kong Stock Exchange CEO Nicolas Aguzin, who has stated “Think about what that means. That’s about US$1-2 trillion that will be reallocated in investments.”

FDI into the Middle East has also been increasing, a subject we discussed in some detail in our October 2023 issue of Asia Investment Research “Middle East Foreign Investment Trends” and which contains data on the FDI inflows into the region.

That adds another layer of complexity to China’s FDI – with future investments being potentially sourced from the United States, repackaged in financial hubs such as the UAE, and then sent onto Asia – and China.

There are already signs of increasing engagement between the GCC and China. For example, in May 2023, the UAE signed three agreements with Chinese nuclear energy organizations, which is only the beginning of the nuclear energy goals for the country, and region. ENEC, which is developing the UAE’s nuclear energy sector, signed MoUs with China’s Nuclear Power Operations Research Institute, the China National Nuclear Corporation Overseas, and the China Nuclear Energy Industry Corporation. The meetings took place six months before the UAE hosts the upcoming COP28 global climate summit, amid its strategy to shift 6 percent of its energy needs to nuclear to fulfil its net zero goal by 2050. These nuclear agreements are an entry point into the region for China, which operates more than 53 nuclear energy projects and has about 20 more under construction.

This shift to the Middle East has also seen the a regional IPO boom from 2022 continue into 2023. In Q1 2023, the UAE attracted US$3 billion of investment capital, placing it third worldwide (14 percent globally).

Other examples of GCC funding into China in Q3 this year (2023) are discussed below.

Saudi Arabia

Five agreements were signed including one with the largest disclosed value in Q1.

Saudi Aramco signed agreements with Hangzhou-based Rongsheng Petrochemical to acquire a 10 percent interest in Rongsheng Petrochemical for US$3.6 billion.

Saudi Aramco announced a partnership with NORINCO Group and Panjin Xincheng Industrial Group to build an integrated refinery and petrochemical complex in Liaoning province. The complex will be developed by the JV set up by the three companies, with NORINCO holding 51 percent and Saudi Aramco taking 30 percent.

Saudi Aramco agreed to become a 20 percent stakeholder in a lower-emission tech powertrain JV with Geely and Renault (1st first major oil producer to invest in the automotive business).

Saudi Aramco also signed a MOU with the government of Guangdong province to enter into cooperation in energy, research and development, industrial projects, finance, and talent exchange.

VSPN announced a US$265 million investment from Savvy Games Group, (PIF) becoming the largest shareholder. VSPN has become a leading global esports operator and hosted a series of gaming esports tournaments.

UAE

Emirates Airlines have agreed to increase its China operations in response to strong travel demand, boosting connectivity to its gateways: Guangzhou, Shanghai, and Beijing.

Qatar

Oricell Therapeutics, a China-based innovative pharmaceutical company committed to the development of tumor cellular immunotherapeutics, announced the close of a US$45 million Series B1 investment round after the completion of a US$125 million Series B fund-raise in July 2022. This round was led by global investors RTW Investments and QIA, with participation from existing investors, including Qiming Venture Partners and C&D Emerging Industry Equity Investment.

Summary

China requires about US$2 trillion in financing over the coming decade to power its own investments and national development – the GCC appears to be the answer. To some extent, the GCC is also a beneficiary of the current geopolitical instability as oil prices are rising. At present a barrel of crude oil sells for about US$100 – a growing number of analysts feel this has the potential to rise to US$150 over the coming months, providing additional financing for the Gulf nations and making it easier for them to allocate investments into Asia.

While the China doomsayers will take a lot of mileage from the latest FDI inflow data, they miss the point – one era of US funded China FDI is coming to an end. However, this is a transitory phase, not a terminal dead end. Another source of FDI into China is beginning – with the Middle East to be a major source of foreign investment into China – and Asia.

A secondary element will also kick in – the loss of opportunities for US investors as they are pushed out of China by alternative capital sources. On this issue, China is already ahead of the global investment trends.

About Us

Dezan Shira & Associates assist foreign investors into Asia and have done since 1992, having 40 regional offices throughout the region including 13 offices in China and one office in Dubai. For assistance in evaluating the China-Middle East potential and markets, please email us at asia@dezshira.com or visit us at www.dezshira.com.

- Previous Article Investing in Hangzhou, Zhejiang Province: China City Spotlight

- Next Article Panorama de Comercio e Inversión entre China e Israel.