GBA IIT Subsidy in Shenzhen: Updated Application Rules and Deadline

On August 6, 2021, Shenzhen announced its latest Guide for applying to the Greater Bay Area (GBA) individual income tax (IIT) subsidy for the 2020 tax year (hereafter referred to as ’2020 Application Guide’).

From August 16, 2021, to September 30, 2021, eligible overseas talents can file their applications for the 2019 and 2020 tax years subsidies through the Shenzhen government’s online service platform.

In this article, we explain major changes to Shenzhen’s latest implementation rules for the GBA IIT subsidy application, as well as the impact they may have on applicants. We also offer our advice on how to prepare to ensure a smooth application process.

Major changes to Shenzhen’s IIT subsidy application rules

Shenzhen’s 2020 Application Guide has two main updates from the 2019 IIT subsidy application implementation rules:

- Minimum taxable income requirements removed for foreign talents – the eligibility requirement for foreign talents to earn more than RMB 500,000 in taxable income is not mentioned in Shenzhen’s 2020 Application Guide.

- Maximum IIT subsidy added – Shenzhen’s IIT subsidy for the 2020 tax year is capped at RMB 5 million, which wasn’t mentioned in the implementation rules for the 2019 tax year subsidy.

Qualified talents are allowed to re-apply for the subsidy for the 2019 tax year, but the retroactive application still needs to follow Shenzhen’s 2019 GBA IIT subsidy application requirements, not the 2020 implementation rules. It is important to note that no more overdue applications for the 2019 tax year subsidy will be accepted after the new deadline of September 30, 2021.

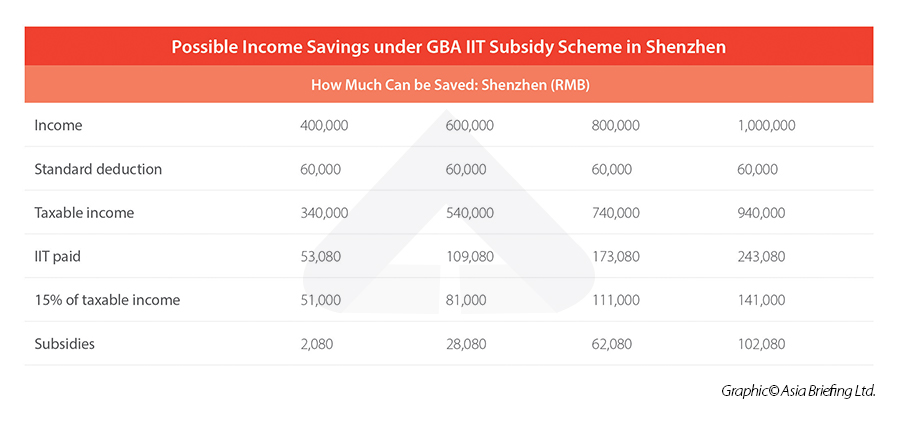

Thanks to the updates in the 2020 Application Guide, more talents will be eligible to apply for an IIT subsidy for the 2020 tax year in Shenzhen. Below we present a table showing how much income can be saved with the subsidy and which groups can benefit the most under the new implementation rules.

Calculating the IIT subsidy amount

Generally, to calculate the subsidy amount, applicants can follow the formula below:

The subsidy amount = the amount of IIT paid in Shenzhen in 2020 – taxable income × 15%

Based on this formula, we estimated how much income tax a candidate can save for four different annual salaries. The results are in the following table.

The policy update mainly benefits foreign talents who earned between RMB 400,000 and RMB 600,000 in the 2020 tax year. This is because, based on the rules for the 2019 tax year, foreign talents with an annual income of less than RMB 600,000 may not be eligible for the subsidy in Shenzhen. It is a positive development that talents who were ineligible for the 2019 subsidy can now benefit from the policy for the 2020 tax year subsidy. However, it remains unclear whether the requirements will change for the following tax years leading up to 2023.

In the calculation of taxable income, we only take the fixed standard deduction of RMB 60,000 into consideration (the calculation excludes other deductions, such as additional itemized deductions). For more calculation details and assumptions, you can refer to our previous article: IIT Subsidies in the Greater Bay Area: How Much Can be Saved.

Making the requisite preparations

Last year, talents in nine cities applied for the 2019 GBA IIT Subsidy for the first time. Based upon the application guides in the nine cities and our observations of the application cases, we recommend applicants make the following preparations prior to submitting the application:

- Assess your eligibility for the IIT subsidy.

- Coordinate with your employer if you received wages or a salary from them. In Shenzhen, both the applicant and the company need to register for an account on the specified online service platform. Your company’s support and involvement in the application process are essential.

- Ensure consistency in the personal information submitted. Personal information, such as type of identity document and ID number, which is used to register an account on the specified online service platform, should be consistent with the personal information used for IIT declaration. If you used different identity information to declare and pay taxes, then you need to reach out to the tax department to correct and align the identity information. This often happens when an applicant’s passport is renewed.

- Complete the Annual Final Tax Settlement on Comprehensive Individual Income in time for the relevant tax year.

- Make sure you have a valid Chinese bank card to receive the subsidy.

Dezan Shira & Associates has an experienced team of tax accountants, lawyers, and ex-tax officials based in the GBA who can help with matters related to foreigners’ IIT calculation and subsidy application, as well as derive practical solutions to your human resource arrangement needs in the GBA. Please feel free to email us at China@dezshira.com.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Will Foreigners be Subject to China Social Insurance in Shanghai?

- Next Article China BITs: How to Use Investment Agreements