How to Calculate Corporate Income Tax in China

All enterprises (except sole proprietorships and partnerships), including all organizations that generate income in China, are subject to corporate income tax (CIT).

CIT taxable income is calculated on an accrual basis, meaning that income items are recorded when they are earned and deductions recorded when expenses are incurred. There are two

ways of calculating taxable income: the direct method and the indirect method.

Direct method

The formula for calculating taxable income under the direct method is as follows:

CIT taxable income = Gross income – Non-taxable income – Tax exempt income – Deductions – Allowable losses carried from previous tax year

Gross income refers to income in currency and non-currency forms received by the enterprise from various sources, including income from the sales of goods; provision of services; transfer

of property; equity investments, such as dividends and profit distribution; as well as interests, rents, and royalties.

Non-taxable income includes fiscal appropriations (e.g., government subsidies to enterprises), governmental administration charges and government funds lawfully collected and brought under relevant laws, as well as other non-taxable income stipulated by the State Council.

![]() Tax Compliance Services from Dezan Shira & Associates

Tax Compliance Services from Dezan Shira & Associates

Tax-exempt income includes:

- Income from interest on government bonds;

- Dividends, bonuses, and other income from equity investment between qualified resident

enterprises; - Dividends, bonuses, and other income from equity investment received from a resident enterprise by a non-resident enterprise with an establishment or premises in China, with

which the income has an actual connection; and - Income of qualified non-profit organizations.

A company’s annual profit in 2015 is RMB 10 million, RMB 80,000 of which is income from equity investment to a resident enterprise. As this type of income is exempt from CIT, the company can deduct it from its annual profit (i.e., RMB 10 million – RMB 80,000) when determining its 2015 CIT taxable income.

Deductions from gross income include reasonable expenditure incurred in relation to income received by an enterprise, such as costs, expenses, taxes (except CIT and VAT) and losses; charitable donations and gifts within 12 percent of the gross annual profit; reasonable depreciation of fixed assets; amortization of intangible assets; amortization of long-term prepaid expenses; inventory

cost; net value of an asset transferred; and other deductions stipulated by laws and regulations.

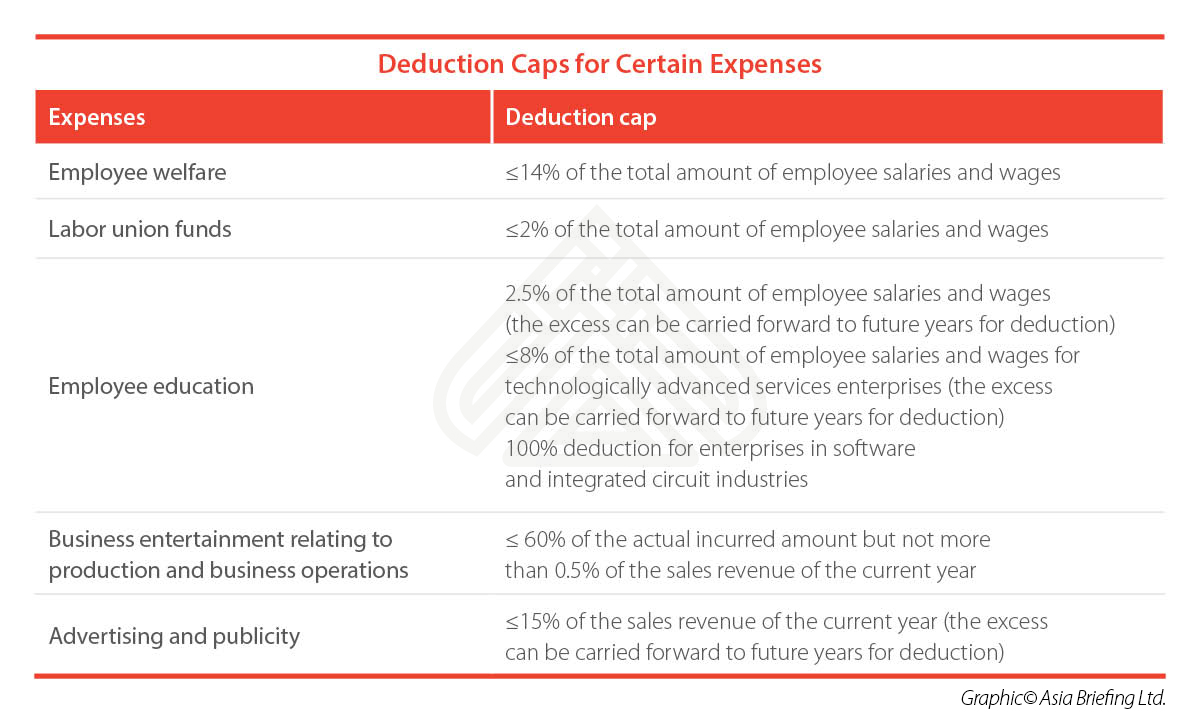

Caps apply when deducting certain expenses from taxable income, such as follows:

Example

A company’s sales revenue in 2015 was RMB 7 million. It incurred RMB 1.5 million in advertising expenses that year. Maximum amount of deductible advertising expense = RMB 7 million x 15% = RMB 1.05 million Therefore, RMB 1.05 million of the RMB 1.5 million in advertising expense can be deducted |

Other permissible deductions include:

- Funds expended for the purpose of environmental protection and ecological recovery in

accordance with applicable laws and administrative regulations; and - Expenses for renting fixed assets to meet production and business operation needs.

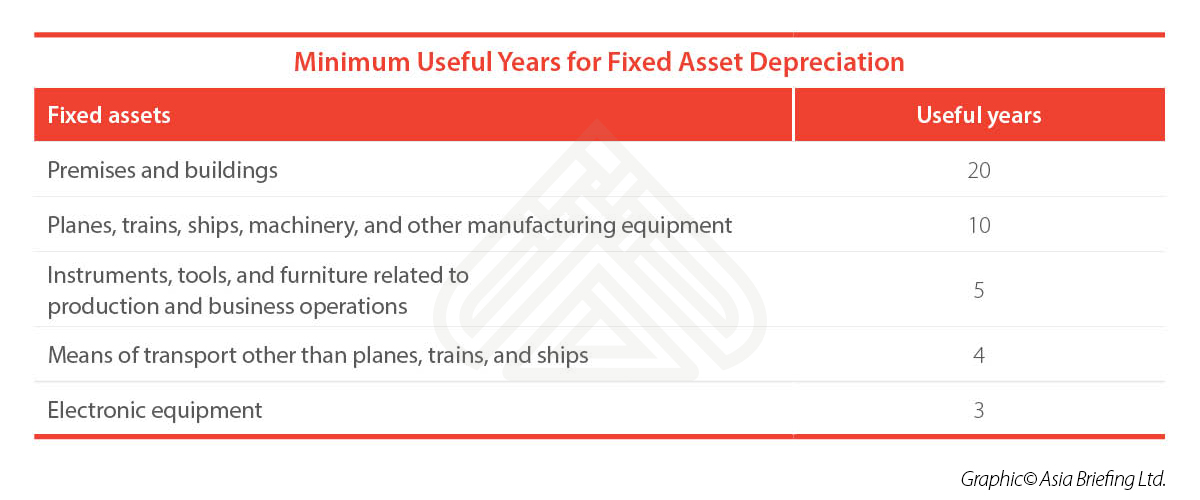

Tax treatment of fixed assets

When calculating CIT taxable income, the reasonable depreciation of fixed assets is deductible. Fixed assets refer to the non-currency assets held and used by the enterprises The straight-line method takes the purchase or acquisition price of an asset, subtract from it the salvage value, and divide this by the total productive years the asset can be reasonably Annual depreciation = (Cost – Salvage value) / Minimum useful years

Example Company A has a piece of manufacturing equipment worth RMB 600,000. The period of minimum useful years is 10 years, and the salvage value is five percent of the original value. Annual depreciation = RMB 600,000 (1-5%) / 10 = RMB 57,000 Company A can deduct RMB 57,000 from its CIT taxable income. |

Non-deductible expenditures include:

- Dividends, bonuses, and other income from equity investment paid to investors;

- Fines for delayed tax payment;

- Penalties, fines, and confiscated property;

- Sponsorship expenditures;

- Non-verified reserves; and

- Other expenditures unrelated to income.

![]() RELATED: Withholding Corporate Income Tax in China

RELATED: Withholding Corporate Income Tax in China

Indirect method

In practice, the indirect method below is more frequently adopted in the annual declaration of CIT:

Taxable income = Gross profit as shown in the accounting book ± Adjustments for tax purpose ± Income/profits to make up for the loss incurred in the previous year

The “adjustments for tax purpose” refers to the discrepancies between applying China’s Accounting Standards for Business Enterprises (ASBEs) and the CIT Law.

Example

Retail company B’s sales revenue in 2015 is RMB 10 million, RMB 1.5 million of which is income from interest on government bonds (which is exempt from CIT). The selling cost is RMB 6 million. The deductible taxes and other relevant expenditures are RMB 1 million. There’s no applicable adjustment for tax purpose and the company also makes profit in The gross profit in the accounting book = RMB 10 million + RMB 1.5 million – RMB 6 million – RMB 1 million= RMB 4.5 million The taxable income for Company B = RMB 4.5 million – RMB 1.5 million + 0 – 0 = RMB 3 million |

|

About Us

China Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, India, Indonesia, Russia, the Silk Road, and Vietnam. For editorial matters please contact us here, and for a complimentary subscription to our products, please click here.

Dezan Shira & Associates is a full service practice in China, providing business intelligence, due diligence, legal, tax, accounting, IT, HR, payroll, and advisory services throughout the China and Asian region. For assistance with China business issues or investments into China, please contact us at china@dezshira.com or visit us at www.dezshira.com

- Previous Article Confusion over Dispute Resolution at China’s New Belt and Road Courts

- Next Article China Eases FDI Restrictions in Free Trade Zones