How to Localize Your Global ERP to China

Multinational companies expanding their global ERP to China must localize the system configurations to meet local compliance mandates. As ERP localization is a complicated process that requires capable technical and professional support, we discuss best approaches and present itemized lists.

Once it’s been verified that your organization’s Enterprise Resource Planning (ERP) system can be adapted for China, and the decision to localize the existing global ERP for China is the most suitable ERP path for your organization, the next important step is to map out which global standards should remain unchanged to meet headquarter expectations. Simultaneously, you need to identify mandatory localizations or preferable adjustments to adhere to local compliance and fulfill local needs for optimal outcomes.

In this article, we look into essential localized configurations and share some on-the-ground experiences for successful localization.

What to localize?

Considering the objectives, we classify localization into two categories—mandatory configurations for compliance and non-mandatory integrations with local and international modules for optimized

performance and better user and business adoption.

Mandatory configurations for compliance

Although ERP covers almost all core business processes, the mandatory improvements necessary for the system to align with China’s regulations predominantly revolve around finance module functionalities. These functionalities are chiefly guided by two key documents:

- Accounting Law of the People’s Republic of China (amended in 2017, hereinafter referred to as the “PRC Accounting Law”)

- Notice of the Ministry of Commerce on Issuing the Good Accounting Informatization Practice for Enterprises (effective from January 2014, hereinafter referred to as the “Good Practices”)

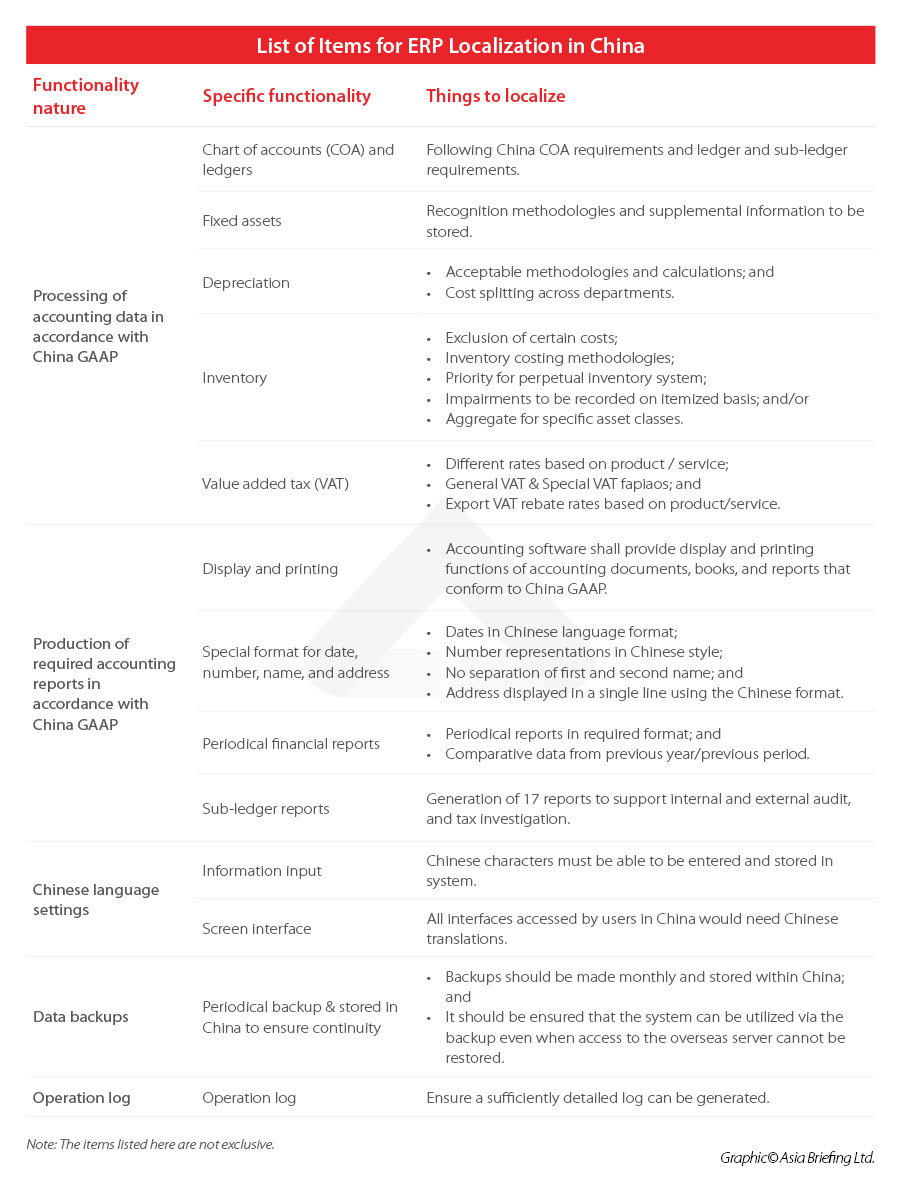

Broadly speaking, the system must possess the capability to handle accounting data and generate financial reports that adhere to the China accounting standards (hereinafter referred to as “China GAAP”). Besides, there exist additional specific requirements regarding language for information input, report generation, and interface; distinct name, date, and address formats; and provisions for data storage and backup.

In the table below, we provide an itemized list to be followed to meet the China standards for effective ERP localization. To be noted, for each item listed in the table, there are more detailed requirements to meet considerations based on relevant regulations and local compliance practice. Take the settings of VAT within the ERP system as an example. In addition to the basic setting (input VAT rates, output VAT rates, VAT rebate rates) in each operational module, such as the purchase and sales modules, there are further requirements regarding settings for journals in the finance module.

According to Regulations on the Accounting Treatment of Value-added Tax (Cai Kuai [2016] No. 22), the ERP system shall set up the three level accounts for VAT as required and make sure journals can be generated according to the regulatory stipulations. Besides, a cross-check between the account in the accounting system and the data in the VAT return should be done to ensure the

account balance numbers are correct, as the VAT accounts are also linked to the VAT filing return submitted to the tax authority every month.

To achieve this, considering input VAT information is basically generated and extracted from purchase transactions within the purchase module of the ERP system, the ERP system needs to set up a

mechanism to mark/separate the verified input VAT in the tax system and the unverified input VAT, then set the correct accounting entries in the general ledgers. The debit amount of account “Input VAT” in each month should be consistent with the verified input VAT in the tax system. Similar requirements exist for output VAT as well.

Moreover, companies and ERP vendors can find corresponding rules regarding the billing information that the ERP system needs to output, the VAT invoice issuing rules, and the written back of key VAT invoice information to the corresponding ERP invoice report, etc.

Integrations for optimized performance

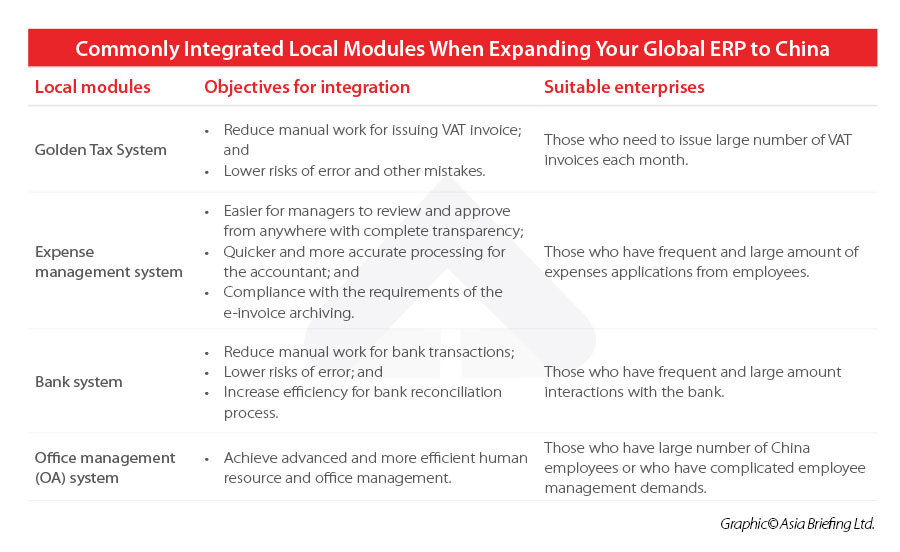

When expanding and localizing a global ERP for your China operations, it’s commonplace to receive suggestions for integrating specific external local or non-local modules into the system. Typically, these integrations are not mandatory in the sense that failing to integrate them won’t impede your ERP system’s approval with the local tax bureau or hinder compliance with statutory mandates. However, these integrations can hold equivalent, if not more, importance for your organization. They play a pivotal role in enhancing your company’s back office automation, freeing employees from performing frequent yet cumbersome manual tasks, boosting accuracy and efficiency, and thereby achieving streamlined business management. Consequently, your organization will be better equipped to navigate China’s demanding compliance landscape.

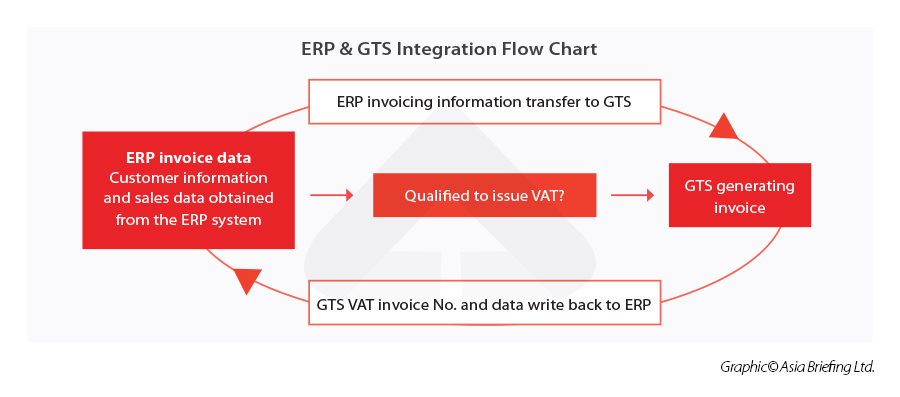

Considering your business’s unique circumstances, commonly integrated local modules are listed in the table below. We also provide an example by demonstrating the considerations for integration with China’s Golden Tax System.

Under the PRC tax laws and regulation, Chinese enterprises are required to issue VAT invoices (i.e., the fapiaos) in a very specific format stipulated by the tax authorities when selling products or providing labor services to their customers. Such VAT invoices cannot be generated from an ERP system or other accounting software. Rather, companies are required to obtain blank VAT invoices (either in paper or digital form) from the tax authorities within the approved quotas, and issue and track the VAT invoices as well as make VAT filings within the designated tax control system (i.e., the “Golden Tax System”, hereinafter referred to as the GTS). Correspondingly, only VAT invoices issued in this way can be used as the supporting documentation for income recognition and tax filing by their customers. In practice, during VAT invoice issuance, many companies capture the sales details from their ERP system or other sales system, then manually input into the online GTS for fapiao issuance. The procedure is time-consuming and easily causes the wastage of blank VAT invoices due to typos or other errors. This especially creates inconvenience to companies who need to issue large numbers of VAT invoices each month.

To address this situation, the China State Taxation Administration requested the GTS vendor to develop a public interface and enable enterprises to integrate their ERP system or sales system with

the GTS. This has facilitated the automatic import of sales data into the GTS for fapiao issuance. Under the proactive promotion of the GTS by the tax authorities, ERP and GTS integration has garnered increasing adoption among Chinese enterprises. Many enterprises have this function added to the task list within their ERP implementation projects.

In addition to the local integrations, it’s also not rare for companies to integrate some other international modules, such as Microsoft’s PowerBI, Sharepoint Online, PowerApps, manufacturing execution system (MES), product lifecycle management (PLM), client relationship management, and bar code scanner or radio frequency identification devices (RFID), to their ERP systems based on their specific business needs and priorities.

Tips for successful localization

Building upon these collective insights, it becomes evident that ERP localization is a highly specialized undertaking. Engaging a proficient ERP and financial service provider is key to the success of ERP localization and integration. Typically, the vendor standards listed below are regarded as significant, based on our experience:

- The vendor ought to possess extensive experience in the realm of ERP localization, spanning service provision and advisory roles, which encompasses comprehensive expertise in the following domains:

» IT;

» Accounting standards and financial reports;

» Human capital management and HR and payroll administration; and

» Legal and compliance management and advisory. - The vendor should be familiar with the local business environment and industry best practices and thoroughly understand your company’s business processes.

- The vendor should have bilingual working capabilities and is able to cooperate seamlessly with both the HQ and the China subsidiaries of the company in an efficient and friendly way.

- The vendor should have certifications and qualifications applicable to the IT aspects of ERP implementation, such as Data Protection Officer (DPO) Certification in the privacy compliance field, Certified Information Systems Security Professional (CISSP) in the information security field, and vendor-specific certifications within China (Dynamics ERP, XERO, MSSP, Microsoft 365, etc.).

Furthermore, considering that ERP localization is a choice that aligns with headquarters and overseas teams, but might not necessarily be in the best interest of China-based staff and operations, it is

advisable for overseas headquarters to engage in comprehensive discussions regarding the ERP localization strategy with their China teams. It is essential to listen to their demands and considerations in a productive manner.

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, Dubai (UAE), and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article Moving Production to Inland China – An Alternative to Reshoring

- Next Article China Cybersecurity and Data Protection Regulations – 2023 Recap and 2024 Outlook