Neither Down nor Out: The Diverging Competitiveness of Manufacturing in China

By Johanna Grusch

SHENZHEN – When China’s manufacturing growth slowed down to less than aggregate economic growth in 2013, concerns were raised that the world’s manufacturing powerhouse was losing its competitiveness. It was assumed that other low-cost emerging economies in the region, such as Vietnam and Indonesia, would lure away investors with existing operations in China, where rapidly rising labor costs were becoming a pressing concern, especially for labor-intensive manufacturing such as in textiles, leather and jewelry. In contrast to this, however, the data on China’s manufacturing output growth in 2014 reveals that China is outperforming not only Western economies but also its regional competitors. According to both Reuters and the United Nations Industrial Development Organization (UNIDO), China’s manufacturing industry grew at its fastest pace in more than two years in July 2014, indicating the re-strengthening of China’s economy and its manufacturing industry in particular.

Rather than indicating a loss in overall competitiveness, the fact that certain manufacturing sectors have relocated to places with lower labor costs within (or without) China is the outcome of the restructuring of China’s manufacturing industries from cheap and fast production to higher value-added and more sophisticated manufacturing. Manufacturing wages in China have been rising at unexpectedly high rates throughout the last decade, at more than 10 percent per year on average, forcing companies in certain manufacturing sectors to rethink their strategies, e.g., to keep production costs down by investing in automated production or even to relocate operations altogether. Some industrializing countries, such as Vietnam and Indonesia, offer significantly lower labor costs amounting to only 50 percent of those in China and are thus especially attractive for companies in labor-intensive industries.

RELATED: The Competitive Advantages of Manufacturing in Vietnam

Nevertheless, some of these emerging economies, such as India, are in fact experiencing similar increases in average wage levels, meaning that they too won’t remain cheap forever. Moreover, local governments in China are working hard to attract companies to stay in their respective jurisdictions; in an effort to prevent such an exodus, some localities have recently been able to lower average wages. Zhongshan, for instance, experienced a wage decrease of 5 percent from 2012 to 2013, while wages in Dongguan decreased by 25 percent in the same time. While this may be only a flash in the pan against a larger trend of wage increases, it exemplifies the determination of local authorities to support and facilitate manufacturing.

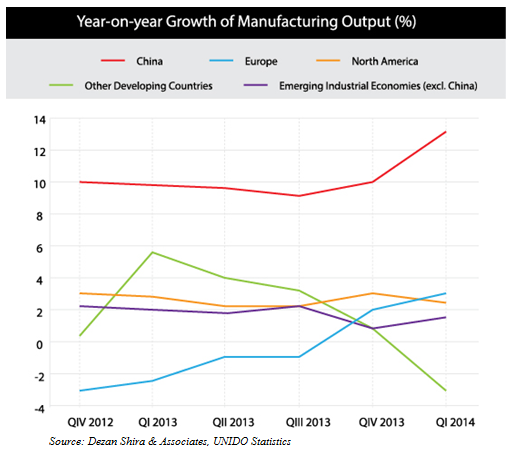

Throughout the recession, China and other emerging industrial economies were able to maintain relatively high growth levels, which nevertheless continuously slowed throughout 2013. In response, the government implemented a series of stimulus packages, such as tax breaks and increased public spending, to revive its economy and boost manufacturing growth. In combination with recovering demand levels from Western economies, this resulted in a highpoint of 13.1 percent of manufacturing growth in the first quarter of 2014, as reported by UNIDO and shown in the graph below. In contrast, the manufacturing output of other emerging industrial economies (excluding China) rose by merely 1.4 percent. In fact, in India, manufacturing output fell by 1.6 percent, while Indonesia, for instance, saw moderate growth levels of 3.8 percent; and while North America’s output stagnated in 2013, overall manufacturing output in Europe is no longer shrinking and has finally returned to healthy growth levels, reaching 3 percent in the first quarter of 2014. China’s performance in terms of manufacturing growth throughout 2013, however, is incomparable to and far outpacing the rest of the world.

What makes China continuously competitive?

Currently, the fastest growing sectors in the global manufacturing industry are communication equipment, medical and optical instruments, office, accounting and computing machinery, furniture, and fabricated metal products – all of which find highly favorable manufacturing conditions in China.

Macroeconomic environment

As highlighted by the World Economic Forum’s Global Competitiveness Report, China’s continued competitiveness is guaranteed not only by industry-friendly stimulus packages, but by the nation’s macroeconomic environment in general—with its public debt-to-GDP ratio among the lowest in the world and inflation levels cautiously kept in check. Together with its overall political stability, despite continuing problems concerning corruption and a lack of accountability, these factors encourage manufacturers to invest in China, rather than its low-cost competitors.

Robust infrastructure and supply base

More importantly, China’s infrastructure for its manufacturing hubs remains superior to any of its regional low-cost competitors. Since the 1990s, China has been by far the largest investor in infrastructure, spending as much as the European Union and the U.S. combined on roads, power, rail, water, telecommunications and airports in 2012. In addition to this, China’s robust raw materials supply base not only provides relatively fast and cheap access to other primary input factors but also lowers production costs, for instance, by reducing the costs of energy, which is largely derived from domestic coal. The combination of these two factors contributes to China’s strong and reliable supply chains, which outperform those of other low-cost countries, and are highly valued by manufacturers for reducing supply chain complexity and costs.

New markets

While most emerging economies’ manufacturing output levels are dependent on exports to other markets in Europe and the U.S., China’s rapidly growing consumer market offers new opportunities to manufacturers. By 2016, it is predicted to overtake the U.S. and become the world’s largest retail market.

RELATED: China’s Domestic Consumer Market in 2020

The government’s determined spending on R&D indicates the country’s efforts to capture these opportunities and leverage them to move away from low-tech, low-skill and low-pay assembly production to advanced and higher-value added manufacturing that can serve increasingly demanding and sophisticated consumers.

New challenges

This development, however, is part of a larger trend that is transforming the Chinese manufacturing sector, bringing with it not only new opportunities but also new challenges. For manufacturers, China’s move up the value-added ladder often means that they can no longer build their profits on cheap labor and fast production, and expect to piggyback on the country’s skyrocketing economic growth. They need to develop strategies to boost their productivity to control costs, refine their products to leverage the Chinese consumer market, and themselves step up the value-added ladder.

RELATED: Adapting Your China-Based Manufacturer to Meet the Country’s Evolving Manufacturing Needs

For companies who cannot or are unwilling to go through this process, relocation to one of China’s regional low-cost competitors will remain an attractive alternative, especially in labor-intensive production sectors. The China-ASEAN Free Trade Agreement will allow them to access China’s growing consumer market from manufacturing bases in the region’s other more advanced manufacturing economies of Indonesia, Philippines, Thailand and Vietnam, where they can take advantage of substantially lower labor costs. With China’s manufacturing output growth regaining pace, however, and the overall economy reviving and maturing, there is a whole range of opportunities waiting to be unlocked for companies that decide to stay in what will remain the world’s factory.

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com.

Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

Related Reading

Manufacturing Hubs Across Emerging Asia

Manufacturing Hubs Across Emerging Asia

In this issue of Asia Briefing Magazine, we explore several of the region’s most competitive and promising manufacturing locales including India, Indonesia, Malaysia, Singapore, Thailand and Vietnam. Exploring a wide variety of factors such as key industries, investment regulations, and labor, shipping, and operational costs, we delineate the cost competitiveness and ease of investment in each while highlighting Indonesia, Vietnam and India’s exceptional potential as the manufacturing leaders of the future.

Guide to the Shanghai Free Trade Zone

Guide to the Shanghai Free Trade Zone

In this issue of China Briefing, we introduce the simplified company establishment procedure unique to the zone and the loosening of capital requirements to be applied nation wide this March. Further, we cover the requirements for setting up a business in the medical, e-commerce, value-added telecommunications, shipping, and banking & finance industries in the zone. We hope this will help you better gauge opportunities in the zone for your particular business.

Using China WFOEs in the Service and Manufacturing Industries

Using China WFOEs in the Service and Manufacturing Industries

In this issue of China Briefing Magazine, we provide a detailed overview of the WFOE establishment procedures as well as outline the typical costs associated with running these entities in China. We hope that this information will give foreign investors contemplating entry into the Chinese market a better understanding of the time and costs involved.

- Previous Article China Regulatory Brief

- Next Article The Past, Present and Future of VAT Reform in China