Trump and China’s 0.4% Trade War Damp Squib

The mainstream media has been full of doomsday scenarios these past few weeks concerning the potential for a China-US trade war given the tariff impositions US President Donald Trump imposed “upon China” to “stop steel dumping” and “protect American jobs”.

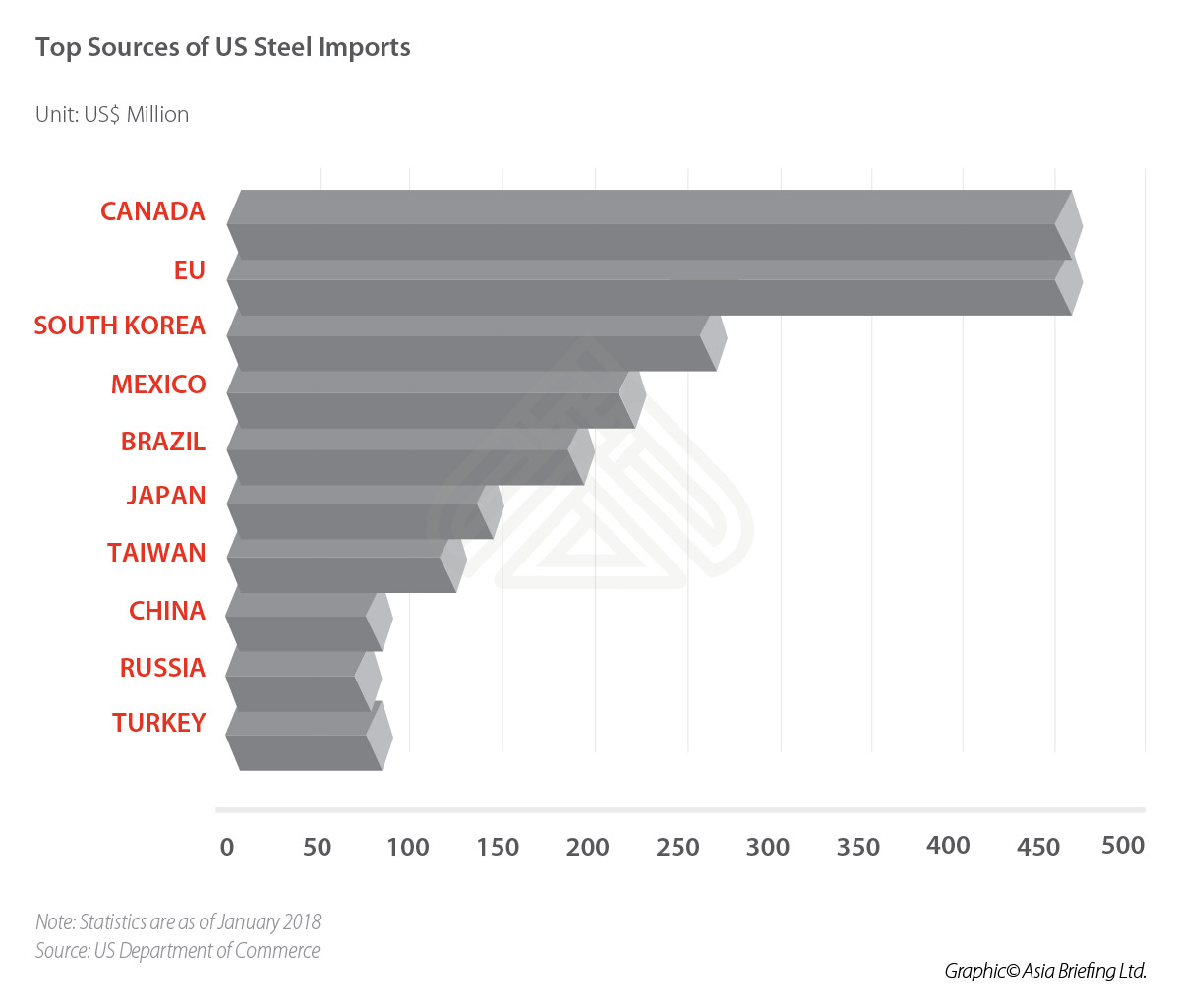

Bearing in mind Trump was elected on the premise of anti-China dumping, the massive trade gap the US has with China, and the “Make America Great Again” slogans designed to both protect and create American jobs, a scenario where Trump would have a go at China to satisfy his voters has always seemed likely. But as I pointed out on Russia Briefing last month, China isn’t a huge supplier of steel to the US.

Washington has since gone on to say that the US will impose tariffs on US$50 billion worth of imported Chinese goods, with US trade representative Robert Lighthizer saying the goal is to target 1,300 product categories. This is apparently intended to “pressure” China to alter its trade practices, regardless of the established realization that China provides the US with a lot of products where the profit margin is made by the US importers, distributors, and price markups rather than Chinese manufacturers per se. Apple, in particular, leaves a measly US$10 or so value in China for every US$800 to 1,000 iPhone 8/X they make, which is why they are the world’s most valuable company – they retain the value and profit.

Another example is in the clothing supply chain. A pair of jeans from a US brand, designed in the US, made in China on German, Japanese, or US machines from US cotton, and processed into cloth in the US on US or Swiss textile machines, and exported to China. The rivets are made from Chilean copper on German machines in China. A US quality control agent inspects them. The jeans are packed into boxes made from recycled US paper waste exported to China (that reduces US landfill pollution) on machines that come from Germany. They are then packed into shipping containers made in China, Korea, or Vietnam, owned by a US leasing firm, funded by US investors, then hauled to port by Japanese, US, or Swedish trucks on trailers made in Korea.

They are shipped on a Chinese or Korean built ship owned by a Japanese, Chinese, Taiwanese, or European shipping company, with a Filipino crew and European officers. A US Company insures them and the whole process is financed by a US trade bank. They are unloaded at a US port by American dockworkers, American customs and clearing agents inspect them, and American security guards protect them. US import taxes are paid, if applicable. They are loaded onto a US built tractor-trailer and delivered to a distribution facility, financed or leased from US bank, employing US workers. They are advertised on US owned TV, radio, and billboards (and online by the US dominated internet) using services from a US ad agency and artists. They are further distributed to the retail outlet or sold on the internet, paid for by a US owned credit card company or bank, and finally are delivered to the customer. When they are worn out, they may be reprocessed into cotton waste products, sent back to China, Bangladesh or Vietnam, where the cycle starts again.

China’s response, among the predictably enunciated political sabre rattling promising hellfire and fury, has been to impose retaliatory tariffs on US$3 billion of US goods, among them fresh fruit, nuts, wine, and pork, as well as recycled aluminum and steel pipes.

According to the Office of the United States Trade Representative, in 2016 China-US bilateral trade was worth about US$650 billion, with US exports to China amounting to US$169.8 billion and Chinese imports at US$478.8 billion, making the US goods and services trade deficit with China US$309 billion.

This means that even if the US imposed tariffs on “US$50 billion” of Chinese imports, that would affect just over 10 percent of total US imports. As for China, its targeted response of US$3 billion of additional tariffs on US imports is actually just 1.8 percent of the total. While the American figure of US$50 billion would certainly have an impact, it remains to be seen if it will actually be carried out. In fact, that amount would only impact an equivalent of 0.42 percent to China’s 2017 GDP. That’s hardly a punishment.

There are other issues. China’s tariff response has been measured and has hit back at exactly the same voters Trump is eager to protect. Rather than swinging an axe at over 1,300 different products, China has taken a measured response, designed to deliberately hurt Trump’s political base. That US$3 billion of imposed tariffs included US pork exports. The American pork industry sent US$1.1 billion in products to China last year, making it the third largest market for US pork. In total, American farmers shipped about US$20 billion of goods to China in 2017. A large part of Trumps voting base? American farmers. They are not very happy right now. In fact, forty-five US trade associations have written to Mr. Trump opposing the tariffs. Only three support them. A copy of that letter can be seen here.

In short, the amount of additional tariffs China has imposed upon the United States equates to just 0.4 percent of the total trade volume. For a trade war, that’s pretty lame. And as for China, they’ve done a good job in educating an Apprentice. The spat will rumble on a little bit more, but a trade war was never the intention, and it won’t happen.

About Us

Chris Devonshire-Ellis is the Chairman of Dezan Shira & Associates, and has written over 20 well-received technical guides to doing business in China in a career stretching over 25 years. The firm provides business advisory, legal, tax, and on-going operational support services to foreign investors in China. Please email china@dezshira.com for further assistance.

- Previous Article Cross Border e-Commerce in China – New Issue of China Briefing Magazine

- Next Article China Slashes VAT Rates in US$64 Billion Tax Cut