Twenty Lessons in Managing an SME in China – Free Download

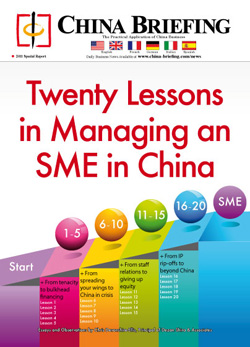

May 6 – China Briefing has just released a complimentary PDF download, written by Chris Devonshire-Ellis, of the development challenges and management lessons learned over 20 years of building his consultancy business in China. Taken from the much-viewed series of articles published online here, the PDF provides a neat package with illustrations useful to all China entrepreneurs looking at setting up a business in China.

May 6 – China Briefing has just released a complimentary PDF download, written by Chris Devonshire-Ellis, of the development challenges and management lessons learned over 20 years of building his consultancy business in China. Taken from the much-viewed series of articles published online here, the PDF provides a neat package with illustrations useful to all China entrepreneurs looking at setting up a business in China.

With the trials, tribulations and challenges posed over the past 20 years, Chris has extracted his own, first hand experiences of business management in China and turned them into 20 lessons that small business individuals or new-to-China entrepreneurs can relate to and learn from.

Covering everything from handling debt and creditors, having IP problems, and delegating management duties, to gorilla marketing techniques and managing a business during a national crisis such as SARS, this account will be useful to anyone starting a business in China and to anyone who is developing or consolidating a China business.

Content includes:

- Lessons 1 – 5: Tenacity to Bulkhead Financing

- Lessons 6 – 10: National Development to China Crisis Management

- Lessons 11 – 15: Staff Development to Giving Up Equity

- Lessons 16 – 20: IP Rip Offs to Beyond China

The PDF may be downloaded, free of charge, by accessing the Asia Briefing Bookstore here.

Other new China Briefing titles released in the last month

Conducting Due Diligence in China

Conducting Due Diligence in China

Featuring basic due diligence that business entrepreneurs can conduct themselves for free, and reaching as far as corporate due diligence for taking companies to listing, this report takes the overseas executive through varying stages of legal, financial and operational due diligence and highlights common areas of concern.

The Foreign Corrupt Practices Act and its Impact on China Subsidiaries

The Foreign Corrupt Practices Act and its Impact on China Subsidiaries

This issue of China Briefing Magazine is dedicated to helping companies understand the Foreign Corrupt Practices Act and establish controls to prevent (and, if necessary) resolve FCPA noncompliance.

Establishing Representative Offices in China (Fourth Edition, includes all recent legal changes)

Establishing Representative Offices in China (Fourth Edition, includes all recent legal changes)

This guide is a practical overview for the international businessman to understand the rules, regulations and management issues regarding establishing Representative Offices in China, including detailed description of 2010 regulatory updates.

China Tax Guide (Fifth Edition)

China Tax Guide (Fifth Edition)

Updated for 2011, this tax guide offers a comprehensive overview of all the taxes foreign investors are likely to encounter when establishing or operating a business in China. It details all applicable taxes, when, where and how much needs to be paid, and contains overviews of China’s tax laws and administration.

Transfer Pricing in China (Second Edition)

Transfer Pricing in China (Second Edition)

This book deals with all aspects of transfer pricing in a practical perspective, from designing and implementing a transfer pricing system, to managing China compliance and preparing for an audit.

Intellectual Property Rights in China (Second Edition)

Intellectual Property Rights in China (Second Edition)

From covering protocol for dealing with trade fairs, to the application processes for trademarks, patents, copyright and licensing, as well as dealing with infringements and enforcement, this book is a practical reference for those concerned with their IPR in China.

- Previous Article Complimentary China-Asia Weekly Business Update Now Available

- Next Article China Renewable Energy Industry Report: May 9