Understanding China’s Rapidly Growing Healthcare Market

China’s healthcare industry is experiencing rapid growth, driven by rising incomes, increasing health awareness, and an aging population. It is also a priority policy area for the government, which is eager to address healthcare gaps and meet rising demand. The industry thus presents a broad range of opportunities for businesses and investors looking to provide innovative and high-quality products and services.

China’s healthcare sector is among the largest and fastest-growing industries in the country. The surge in demand for superior healthcare and services is driving swift growth across various healthcare segments.

Enhancing health outcomes in China has been a top priority of the government for several years. Currently, the government is tackling significant challenges, such as an aging population and unequal access to healthcare in various regions.

Addressing these issues will require substantial investment in expanding and improving healthcare resources and capabilities, thereby presenting significant growth potential for both domestic and foreign firms.

This article presents an overview of China’s healthcare industry, examining recent healthcare indicators and core drivers of market growth.

Overview of China’s healthcare market

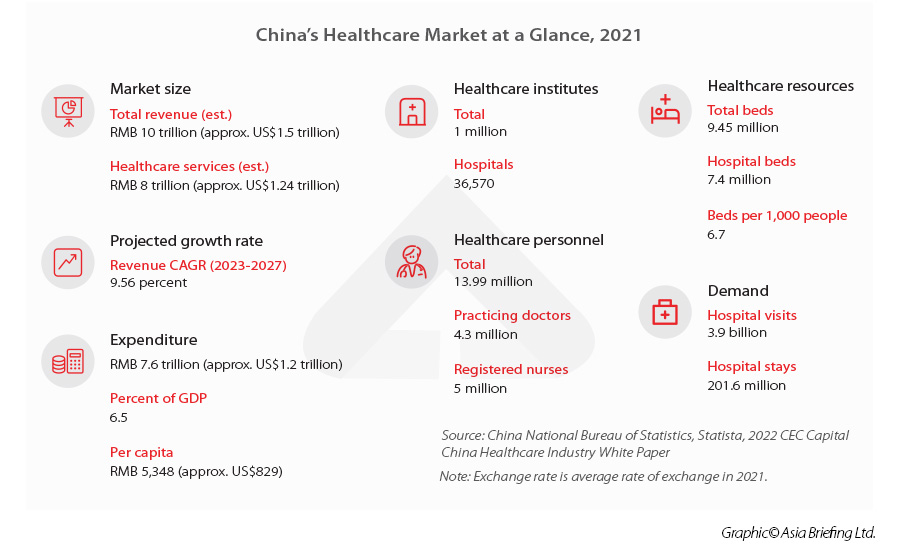

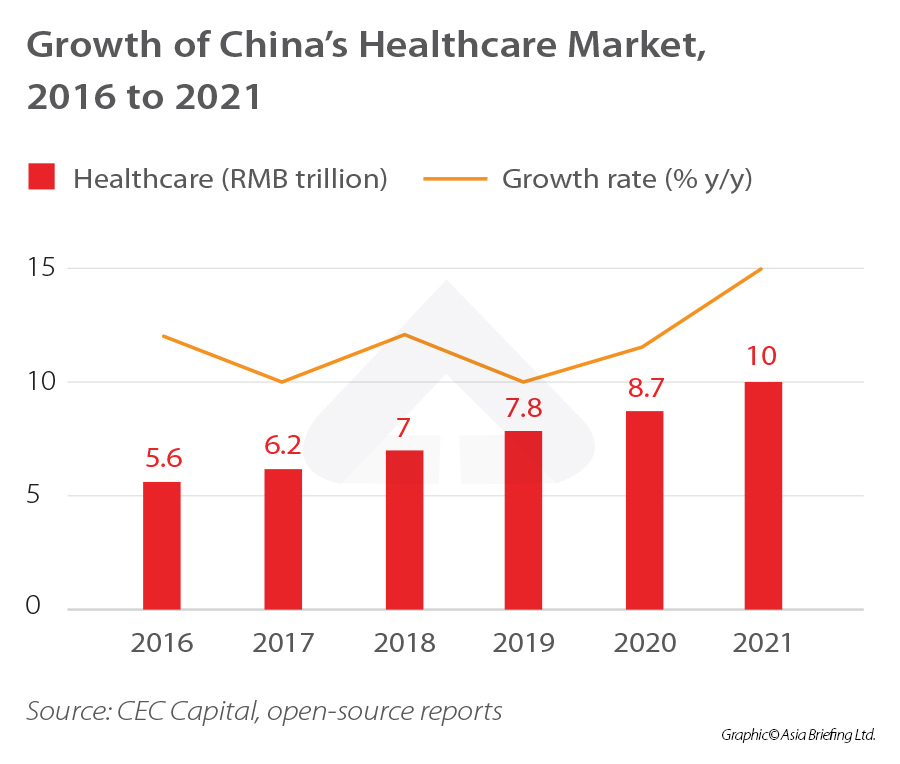

China’s healthcare market has grown at a double-digit rate over the past decade. In 2021, total revenue for the healthcare market was estimated to be around RMB 10 trillion (approx. US$1.5 trillion), according to research from investment bank CEC Capital.

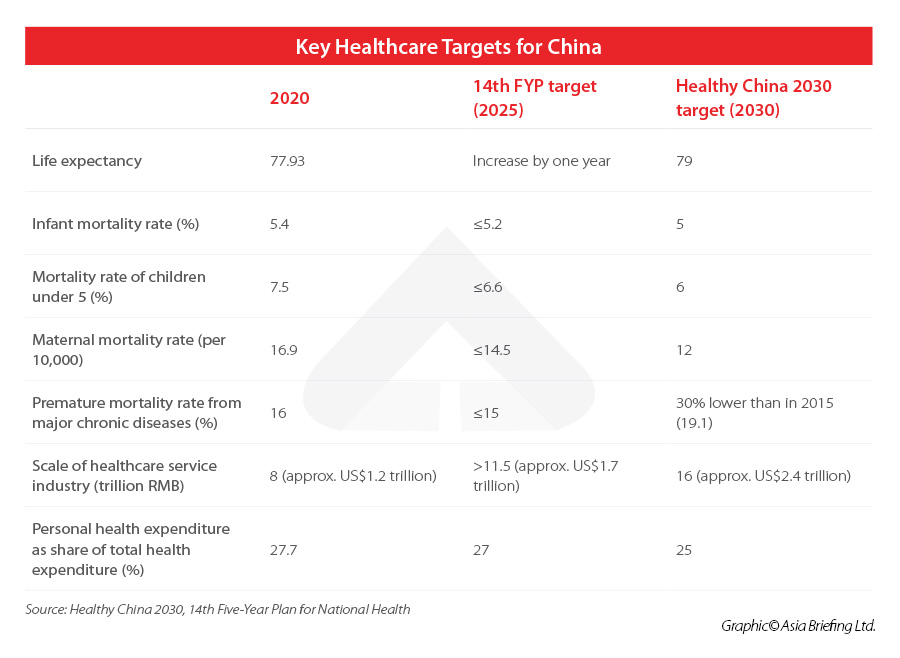

Meanwhile, the “Healthy China 2030” initiative, one of the government’s main blueprints for developing the healthcare industry, aims for the market to reach a value of RMB 16 trillion (approx. US$2.4 trillion) by 2030.

Among some of China’s largest healthcare segments are pharmaceuticals (including biopharmaceuticals), medical devices and equipment, and healthcare services.

Pharmaceuticals

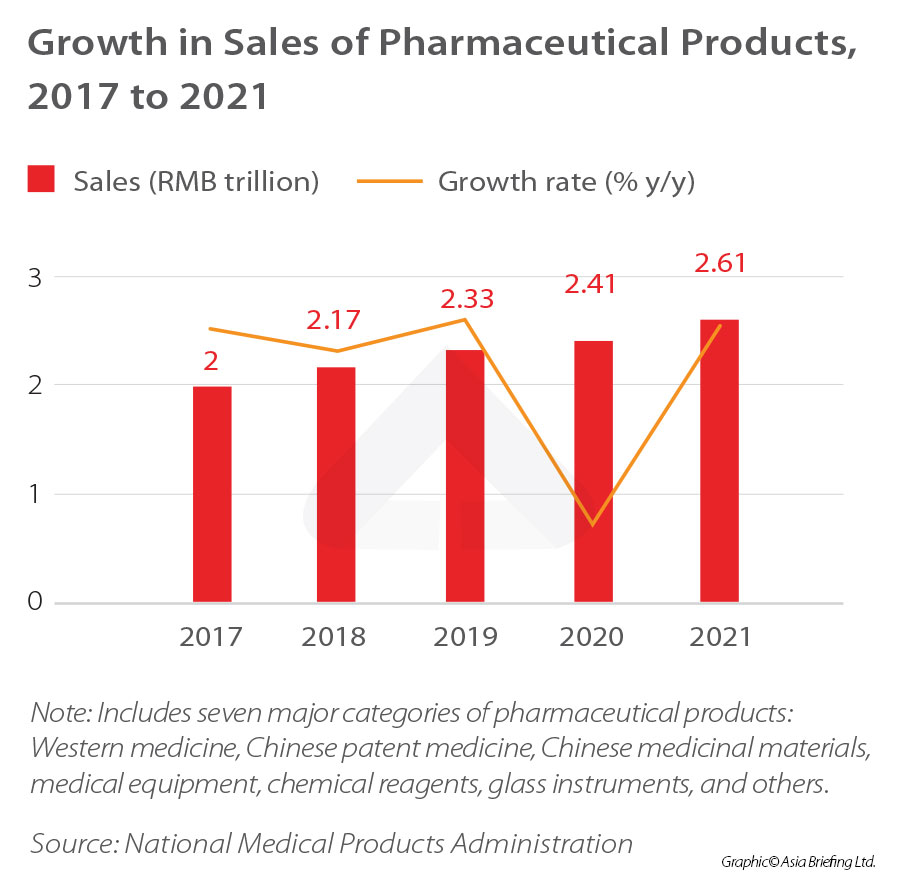

Data from the National Medical Products Administration (NMPA) shows that the sale of seven major categories of pharmaceutical products – western medicine,

Chinese patent medicine, Chinese medicinal materials, medical equipment, chemical reagents, glass instruments, and others – reached RMB 2.61 trillion (approx. US$404.5 billion) in 2021, a realized compound annual growth rate (CAGR) of 5.4 percent since 2017.

Medical devices

China is home to the second-largest medical device market in the world after the US, according to research from management consulting firm Roland Berger, as quoted by the Ministry of Commerce (MOFCOM). In 2022, the Chinese medical device market size reached RMB 958.2 billion (approx. US$142.4 billion), maintaining a seven-year CAGR of 17.5 percent.

According to the report from Roland Berger, the industry is also becoming increasingly consolidated as it is growing. Chinese medical device companies above a designed size (those with a main annual business income of at least RMB 20 million (approx. US$3 million)) accounted for 60 percent of the industry in 2022. That year, there were also over 163 public medical device companies, almost double the number three years prior.

China’s medical device industry is broadly divided into four main sectors: equipment, such as instruments, utensils, and materials; high-value consumables; low-value consumables; and in-vitro diagnostics. Of these, medical equipment accounted for 60 percent of the market in 2021, exceeding RMB 500 billion (approx. US$77.5 billion).

According to a report from market research firm Frost & Sullivan, China’s medical device industry accounted for around 23.2 percent of the global market in 2020. Between 2020 and 2025, the industry is expected to grow at a CAGR of 10.9 percent, and then slow to a CAGR of 6.6 percent between 2025 and 2030. By 2030, the market is expected to be valued at RMB 1.7 trillion (US$278 billion).

The medical device market is currently dominated by foreign players, such as GE HealthCare, Siemens, and Phillips.

However, according to research by Deloitte, the market share of foreign companies has gradually

fallen from 80 percent to 70 percent in the decade leading up to 2019 and is expected to fall further over the next decade as domestic players strive to catch up with international competition.

Healthcare institutions

At the end of 2021, there were over one million healthcare institutions in China, 8,013 more than in 2020. Among these, there were 36,570 hospitals, an increase of 1,176 from 2020, of which 11,804 were public and 24,766 were private. This means there was an average of two hospitals for every 100,000 residents. This number is expected to increase to three for every 100,000 residents in 2022 and 2023, according to data from Statista.

Meanwhile, revenue from hospitals reached US$580 billion in 2021, an increase of 12.9 percent from the previous year. Revenue is expected to reach almost US$1 trillion by 2027, growing at a CAGR of 7.57 percent.

In 2021, people visited hospitals and medical institutions an average of six times, according to data from China’s National Health Commission (NHC). Most of these visits were made to public hospitals. There were a total of 3.27 billion visits to public hospitals that year, accounting for around 84.2 percent of total visits. Meanwhile, there were 610 million visits to private hospitals, around 15.8 percent of the total.

Signs that China’s healthcare market will continue to grow

Growing healthcare expenditure

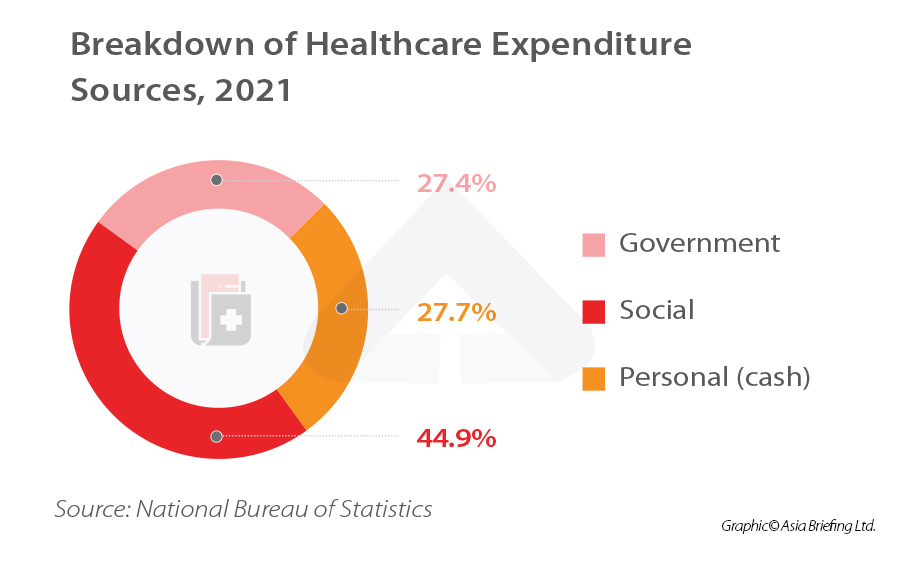

China’s healthcare spending has grown significantly over the last two decades across all sources. In 2021, total expenditure reached RMB 7.6 trillion (approx. US$1.2 trillion), more than doubling from 2015. Healthcare expenditure accounted for 6.5 percent of the annual GDP in 2021, a slight decrease from 2020 when total healthcare accounted for 7.1 percent of total GDP.

Of this, government spending decreased slightly by 5.6 percent year-on-year, while both social and personal expenditure increased by 12 percent and 5 percent year-on-year, respectively.

The reason for the decrease in government expenditure and increase in social expenditure is not entirely clear but could be due in part to the fact that 2021 saw less prevalence of COVID-19, meaning less spending on treatment and prevention as compared to 2020. Meanwhile, the COVID-19 pandemic also increased demand for commercial healthcare as people’s awareness of health issues grew, which could reflect the increase in social spending.

Total spending per capita in 2021 reached RMB 5,248 (approx. US$813.4), up from RMB 5,111 (approx. US$740) in 2020.

There is still a lot of room for China’s healthcare expenditure to grow, as it is still below that of many high-income nations. In South Korea, for instance, healthcare expenditure in 2021 accounted for 8.8 percent of GDP, while Germany and France stood at 12.8 and 12.4 percent, respectively. Healthcare expenditure per capita is also significantly below that of high-income countries; Germany’s healthcare expenditure per capita in 2021 was US$7,383, while South Korea’s was US$3,914.

The government is expected to continue increasing healthcare budgets over the next decade as the aging and increasingly wealthy population put more pressure on healthcare services and infrastructure.

Meanwhile, social expenditure will also have a major role in China’s future healthcare market. According to Chief Macro Analyst at securities firm China Merchants Securities Xie Yaxuan, China’s healthcare expenditure is likely to increasingly come from social and commercial sources, such as insurance expenditures, commercial health insurance premiums, social healthcare aid, and so on.

According to Xie’s predictions, commercial health insurance will reach a scale of between RMB 2 trillion (approx. US$297.2 billion) and RMB 3.4 trillion (approx. 505.2 billion) by 2030. In 2021, it was around RMB 880.4 billion (approx. US$136.5 billion), according to data from the China Banking and Insurance Regulatory Commission (CBIRC). This presents a significant growth opportunity for commercial health insurers.

Healthcare resources still inadequate in certain areas

The availability of healthcare resources in China has improved significantly over the last two decades. China has long had shortages of key resources, such as medical professionals, institutions, and pharmaceuticals. Today, however – at least in urban regions – these have largely caught up with international levels.

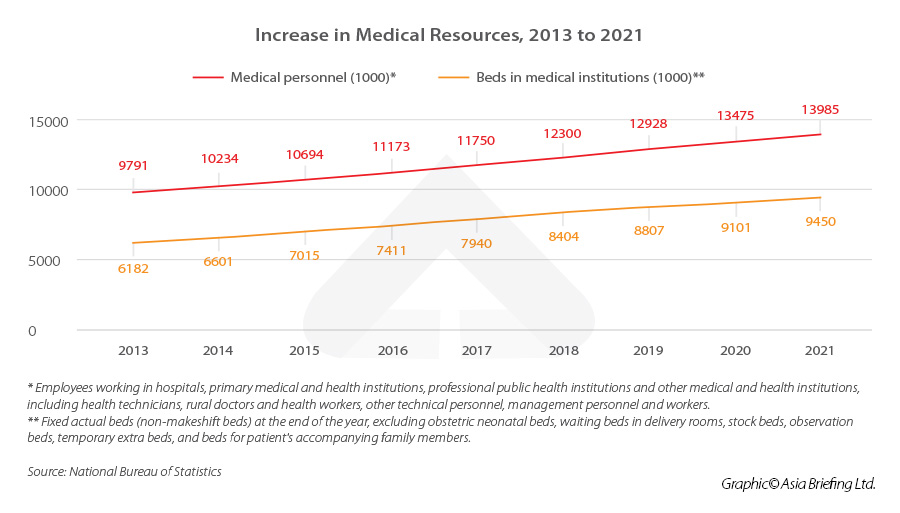

In 2021, there were almost 14 million people working in the healthcare industry, an addition of around 508,000 people from 2020. Of these, 60.6 percent were working in hospitals, 31.7 percent were working in primary healthcare facilities, village clinics, outpatient departments, and so on, and 6.9 percent were working in specialized public healthcare institutions.

But among the healthcare professionals, 4.3 million were practicing doctors (including assistant doctors) and just over 5 million were registered nurses. This means there were around 3.04 doctors and 3.56 nurses for every 1,000 people. This has increased from just 1.8 practicing doctors and 1.7 registered nurses per 1,000 people in 2011, and also exceeds the minimum recommended number of medical professionals per 1,000 people of 2.5 set by the World Health Organization (WHO).

However, there is a clear discrepancy in the distribution of doctors and nurses across different areas of the country. In 2021, there were 3.7 practicing physicians for every 1,000 people in urban areas, versus just 2.4 in rural areas. For nurses, the difference was even bigger, standing at 4.6 and 2.6, respectively. This is a significant concern especially as the smaller cities and towns tend to have populations that are older than average, due to younger workers leaving for the larger cities.

At the end of 2021, there were over 9.4 million beds across all types of medical institutions. This is almost double the number of 2011 when there were a total of 5.16 million beds. Among them, 78.5 percent of beds were in hospitals, of which 70.2 percent were in public hospitals and 29.8 percent were in private hospitals.

The urban-rural divide is also visible with the availability of beds – in 2021, there were an average of 7.5 beds for every 1,000 people in urban areas, but only 6 for every 1,000 people in rural areas.

Redistributing healthcare resources or increasing the availability and capacity of rural healthcare institutions will therefore be an important focus for the government in coming years. Rural areas and smaller cities are also areas with high growth potential, both due to their relative shortages and their older populations.

On the other hand, although China’s medical resources have largely caught up with international levels, the availability of resources will have to continue to grow if it is to keep up with demand. This is because older populations generally have a greater need for medical resources than younger ones. Shortages of medical resources are being experienced even in wealthy nations that have aging populations, such as the US.

In China, this is compounded by the fact that elderly care services are already in short supply. Traditionally, elderly people are looked after by their families, which has to some extent abated the demand for public services. However, as family sizes shrink – and some couples even forego having children altogether – this will no longer be viable for many people.

The 14th Five-Year Plan for the Development of National Aging Undertakings and the Elderly Care Service System, released in 2021, states that there is a need to address various challenges with regard to elderly care services, including the low level of services available in rural areas, the insufficient supply of home and community elderly care and high-quality inclusive services, the shortage of professionals, especially nursing staff, and the lack of scientific and technological innovation and product support in the industry.

Changing demographics spurring an increase in healthcare demand

China’s demographic structure has been changing in recent years, with the population aged 65 years or older growing from 9.1 percent of the population in 2011 to 14.9 percent in 2022, and the fertility rate declining from 11.93 per thousand people to 6.77 per thousand people in 2022.

The rising share of elderly people in China’s population has far-reaching implications for Chinese society and will be an underlying driver for the growth of China’s healthcare market. Elderly citizens, with extended life expectancy, will require social support and healthcare coverage for longer, placing more pressure on the healthcare industry and driving demand for services.

However, the aging population is not the sole factor at play in the growing demand for healthcare services. According to the 14th Five-Year Plan for National Health released by the National Development and Reform Commission (NDRC) in mid-2022, the incidence of chronic disease is rising. Those suffering from them are also getting younger, increasing the need for long-term care. Besides, growing awareness of mental health and psychological disorders is increasing demand for specialized healthcare services and pharmaceuticals.

Moreover, rising incomes and improving living standards mean people are placing higher expectations on the standard of care and more emphasis on improving quality of life. The high-end medical sector is experiencing rapid growth as premium healthcare insurance and services expand beyond high-net-worth individuals to the growing middle class, and from the large coastal metropolises to smaller cities.

The impact of COVID-19 on the development of the healthcare industry

The COVID-19 pandemic had a significant impact on China’s healthcare industry, highlighting critical gaps and prompting urgent action from the government to address them. One notable outcome of these efforts was an increase in the country’s critical care capacity. Government health officials were reporting a rise in ICU beds from 57,160 in 2019 to 138,100 by the end of 2022. In addition, China has also seen growth in primary care facilities like fever clinics, which serve as a first line of defense and help alleviate pressure on hospitals.

The pandemic also catalyzed the digital healthcare space, enabling existing platforms to rapidly expand their user base and motivating traditional healthcare institutions to offer online services to patients for the first time.

Additionally, the pandemic has raised health awareness among the population, leading to increased demand for various healthcare services and products, such as air purifiers, vitamins, probiotics, and health insurance covering critical illnesses and accidents.

However, on the other hand, the COVID-19 response also required diverting significant resources towards infrastructure and frontline workers to prevent the spread of the virus, potentially affecting funding for other areas of the healthcare system.

Overall, the COVID-19 pandemic has presented both challenges and opportunities for China’s healthcare industry, leading to significant investments and innovations aimed at better serving the health needs of the population.

Policies for expansion and development of the healthcare market

Faced with a huge and rapidly aging population, the Chinese government has sought to support the expansion of the healthcare market through a range of policy documents and development blueprints.

Key among them is the “Healthy China 2030” initiative. Released in 2016, this is the government’s core agenda for the development of the healthcare industry and covers strategies for a broad range of development objectives from reducing infant mortality rates to improving air pollution. One of the core goals of the agenda was for the healthcare service industry to reach a value of RMB 16 trillion (approx. US$2.4 trillion) by 2030.

In mid-2022, the NDRC released the 14th Five-Year Plan for National Health, which builds upon the goals of Healthy China 2030 and sets a variety of health targets for 2025.

In addition to policies that seek to expand healthcare infrastructure and raise the quality of care, the Chinese government has also released several healthcare initiatives that focus on long-term disease prevention by improving overall health and well-being of the population. These include the 14th Five-Year Plan Sports Development Plan, which aims to build and expand access to sport and fitness infrastructure to encourage exercise, and the 14th Five-Year Plan for the Protection and Development of Disabled People, which outlines measures for improving the quality of life for disabled people, including improving quality of care.

The healthcare industry has long been one of the government’s highest priority areas for investment. The Catalogue of Industries Encouraged for Foreign Investment has continued to increase the number of items related to healthcare in recent years. The 2022 catalogue added several new medical fields, including R&D and production of drugs for rare diseases and special drugs for children, manufacturing of dental implant systems for implant repair in patients with bone loss, manufacturing of hearing aid and cochlear implants, postpartum maternal and child services in maternity centers, and rehabilitation institutes for autistic children, among others.

China’s healthcare industry outlook

The Chinese healthcare market boasts huge growth potential across a broad range of sectors, driven by a combination of government support and increasing demand due to changing demographics and rising incomes.

The Chinese government has been instrumental in driving the development of the healthcare industry by introducing incentive policies and national strategies for industrial growth.

As China seeks to enhance its healthcare capacity, numerous opportunities will emerge for players in different parts of the supply chain, including drug R&D, equipment production, and caregiving. The modernizing and rapidly evolving industry will also create opportunities for innovative and disruptive companies in areas such as digital healthcare and medtech (medical technology).

Both domestic and foreign companies can tap into the vast and rapidly growing Chinese healthcare market. However, companies must navigate regulatory requirements, adopt new technologies, and deliver high-quality and effective healthcare services that meet the evolving needs of Chinese consumers while aligning with government targets.

In summary, the Chinese healthcare market presents an abundance of opportunities, and with the right strategies, companies can position themselves to take advantage of the market’s potential and contribute to the country’s healthcare development.

(This article was originally included in the China Briefing Magazine issue Investing in China’s Healthcare Sector.)

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, Dubai (UAE), and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article IASB Allows Temporary Exception to Reporting Requirements for Deferred Taxes Related to BEPS 2.0

- Next Article Swiss Companies in China Experience a Post-COVID Confidence Boost