US Tariff Exclusion for Chinese Imports: What is the Status?

In 2018, US President Donald Trump’s administration imposed four rounds of additional tariffs on approximately two-third of Chinese imports to the US under Section 301. Despite hopes to the contrary, President Joe Biden has kept the tariffs in place since taking office in January 2021.

However, to avoid harm to American interests, US trade authorities initiated a tariff exclusion process from June 2019 for Chinese products subject to additional tariffs – US$34 billion (List 1), US$16 billion (List 2), US$200 billion (List 3), and US$120 billion (List 4A) trade actions. The Biden administration has also continued to extend tariff exemptions on these products as they expired, based on public feedback.

Most recently, the US Trade Representative issued a notice in March 2022, extending tariff exemptions on a total of 352 products that had expired in 2019 and 2020.

In this article, we explain what tariffs are currently in place, including retaliatory tariffs by China on US products, and provide an overview of the latest extensions of tariff exemptions.

Current tariffs and tariff exemptions

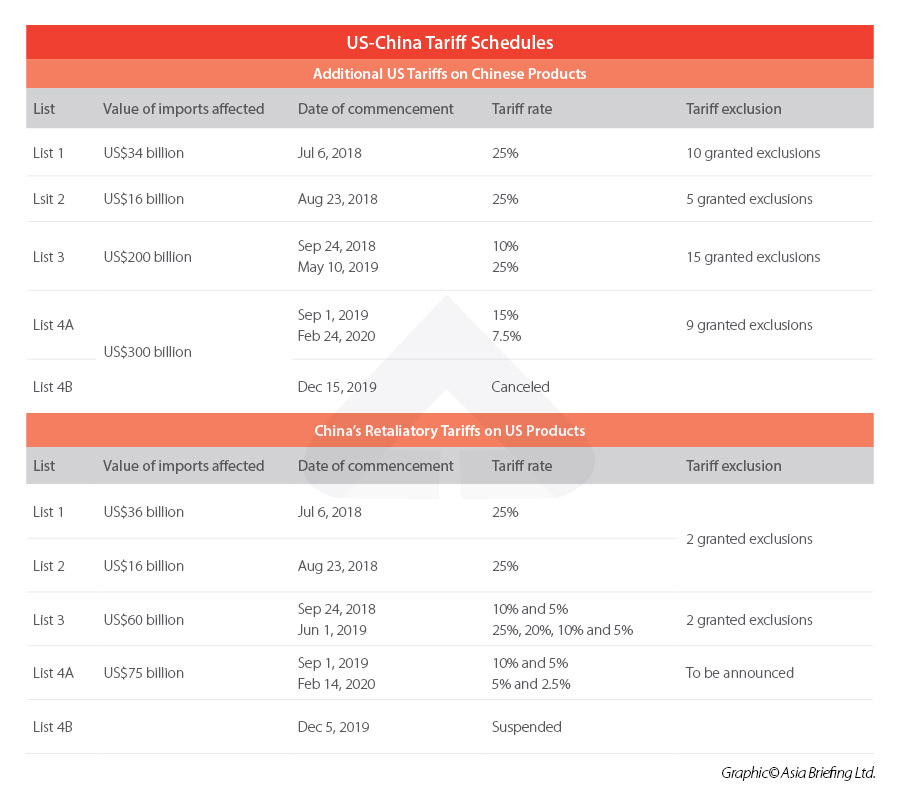

The US has imposed tariffs on around US$300 billion worth of Chinese goods for import. These products have been divided into four different lists – also known as tranches – with the first three lists approved in 2018 and the last list approved in 2019.

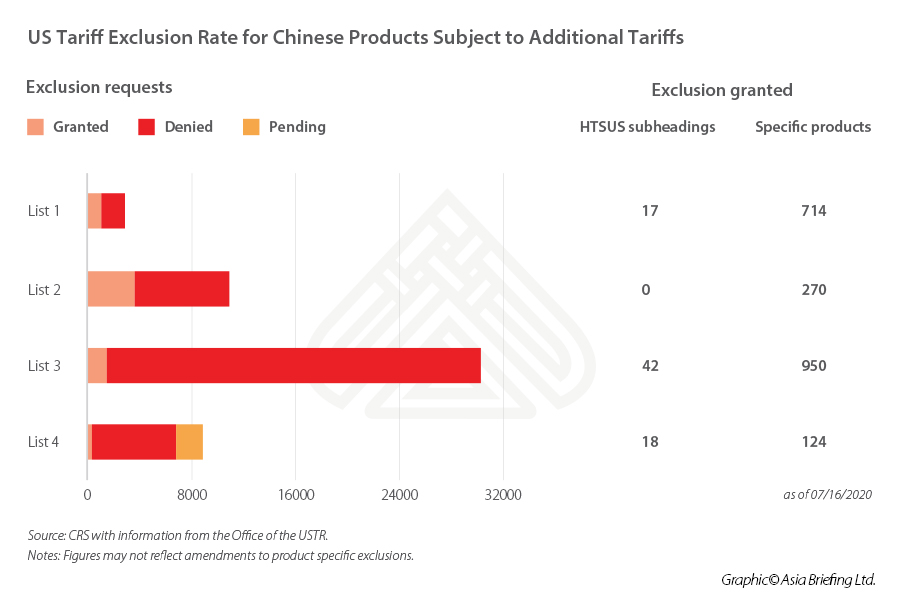

To date, the exclusion process has closed for each of the four lists of Chinese products and a total of 39 exemption lists have been published by the USTR to benefit Chinese imports. The exemption rate is not high.

While the exemption rates for List 1 and 2 are at 36 percent, the exemption rate for List 3, which covers more consumer and assembled goods, is only 5 percent.

Most of the exclusions were granted for a period of under one year from the date of their issuance, with the most recent expiration taking effect on October 1, 2020.

However, while the US has imposed additional tariffs on Chinese imports in the course of the US-China trade war, beneath the headlines, the USTR has put in place a tariff exclusion process to exempt certain Chinese imports from additional tariffs.

Chinese goods in either one of the following four Section 301 lists were allowed to apply for tariff exemption through the USTR.

- List 1 – US$34 billion worth of Chinese products, effective from July 6, 2018;

- List 2 – US$16 billion worth of Chinese products, effective from August 23, 2018;

- List 3 – US$200 billion worth of Chinese products, effective from September 24, 2018; and

- List 4A – US$120 billion worth of Chinese products, effective from September 1, 2019. (List 4, including List 4A and 4B, originally covered US$300 billion worth of Chinese products, scheduled to be effective from September 1, 2019 and December 15, 2019. However, after the US and China signed their Phase One Trade Agreement on January 15, 2020, the tariffs scheduled to take effect from December 15, 2019 were canceled.)

So far, the exclusion process for products on all four lists have been completed and a total of 39 batches of exemptions have been granted.

However, statistics show that the US government is not generous in granting tariff exclusions to avoid undermining the enforcement of Section 301. The exemption rate for Lists 1 and 2 are around 36 percent on average, while the exemption rate for List 3, which covers more consumer goods and assembled goods, was only five percent.

According to Congressional Research Services (CRS), the public policy research institute of the US Congress, until January 31, 2020 – the USTR received a total of 52,746 exclusion requests, pertinent to all four trade actions (lists). Of these, 45,942 (87 percent) requests have been denied, 6,804 (13 percent) have been granted.

Exclusions for products needed to fight COVID-19

In March 20, 2020, the USTR announced it would work with the US Department of Health and Human Services to “ensure that critical medicines and other essential medical products were not subject to additional Section 301 tariffs.” Consequently, the US did not impose tariffs on certain medical items, such as ventilators, oxygen masks, nebulizers, facemasks, surgical drapes, medical gowns, and gloves.

That same month, the USTR also began soliciting opinions on whether it should remove more products on Section 301 and whether it should waive tariffs to help combat the COVID-19 pandemic. The USTR then decided to extend 80 product exclusions that were set to expire at the end of 2020 and imposed new exclusions for nine additional medical care products. The exclusion on these 99 products was later extended in March 2021 until September 30, 2021.

With COVID-19 still spreading in the US in the latter half of 2021, the USTR initiated another round of public comment to ascertain whether these exclusions should be extended for another six months. On November 16, 2021, following consultation from the public, the USTR announced that the tariff exclusions would be extended for six months, until May 31, 2022.

Extension of exclusions on 352 products

In March 2022, the USTR announced that it would reinstate tariff exemptions on 352 Chinese products. The tariff exclusions on these products had expired in 2019 and 2020 and were reinstated after consultation with US agencies and the public, which was initiated in October 2021. A total of 549 products were initially up for consideration for reinstatement of tariff exemptions, but only products that met certain criteria were ultimately chosen for the extended exclusions.

According to the notice on the exclusions posted on the USTR website, the public was invited to comment on whether the products or similar products can be sourced from other countries, whether there have been any changes to the product supply chain or industry development, whether importers had made any effort to source the product from elsewhere, and whether the product could be produced in the US.

The reinstatement of the tariff exemptions, therefore, suggests that the products can currently not be sourced or produced from countries other than China. The list covers a wide range of products, including industrial chemicals and machinery, auto parts, textiles, consumer electronics, and foodstuffs.

The reinstated product exclusions will apply retroactively from October 12, 2021, and end on December 31, 2022.

Archived: 39 batches of product exclusion granted

So far, 39 exclusion lists and 16 extensions for exclusions have been released on the USTR website.

For List 1 (US$34 billion trade action) – 10 batches of exclusions and six extensions for exclusions have been granted. Details can be found here.

For List 2 (US$16 billion trade action) – five batches of exclusions have been granted. Details can be found here.

For List 3 (US$200 billion trade action) – 15 batches of exclusions have been granted. Details can be found here.

For List 4A (US$120 billion trade action) – nine batches of exclusions have been granted. Details can be found here.

Archived: Application process for tariff exclusion

The tariff exclusion process enabled interested persons in the US, including third parties (such as law firms, trade associations, and customs brokers) to submit requests for exemption from additional duties at the USTR website https://exclusions.ustr.gov. Businesses would be asked to identify a specific product, the supporting data, and the rationale for the requested exclusion.

The USTR evaluates the exclusion application case-by-case and regularly updates the status of each pending request on the Exclusions Portal at https://exclusions.ustr.gov/s/PublicDocket . (You may search here for the status of your tariff-exclusion request).

The US government considers the following factors when processing tariff exemption requests:

- Whether the particular product is available only from China, and whether the company made any efforts to source the product from non-Chinese suppliers.

- Whether the imposition of additional duties (since September 2018) on the particular product has or will cause severe economic harm to the requester or other US interests.

- Whether the particular product is strategically important or related to ‘Made in China 2025’ or other Chinese industrial programs.

In addressing each factor, the requester needed to provide support for their assertions.

Any tariff exemption on the product(s), if granted, would be retroactive and be valid for one year starting from the imposition of the additional duties.

Compared with China’s own exemption procedures, the US tariff exclusion process additionally involves seeking opinions from other relevant interested parties.

The USTR also requires a more detailed description of the particular product, including its physical characteristics, function, application, principal use, and any other unique physical features that distinguish it from other products.

Editor’s Note: This article was originally published on July 2, 2019 and was last updated on March 31, 2022. See here for our article explaining China’s tariff exclusion process.

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done so since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

Dezan Shira & Associates has offices in Vietnam, Indonesia, Singapore, United States, Germany, Italy, India, and Russia, in addition to our trade research facilities along the Belt & Road Initiative. We also have partner firms assisting foreign investors in The Philippines, Malaysia, Thailand, Bangladesh.

- Previous Article China’s Hydrogen Energy Industry: State Policy, Investment Opportunities

- Next Article Belt and Road Weekly Investor Intelligence #75