China’s Wealthiest Cities – Highest Disposable Income

Op-Ed Commentary: Chris Devonshire-Ellis

Nov. 10 – In our recent series of examining China’s new demographics, we’ve looked at the fastest growing cities, the fastest growing provinces and discussed how growth is going to move from the coastal regions to the inland regions.

As we noted, China’s coastal regions will experience a slowdown in growth as they become more affluent and accordingly, expensive. Competition will also increase as numbers of companies attracted by the higher disposable income in the coastal regions bring, in turn, more people wanting to sell to them. That’s not to say that such cities don’t provide great markets to sell to – they will. But where are they?

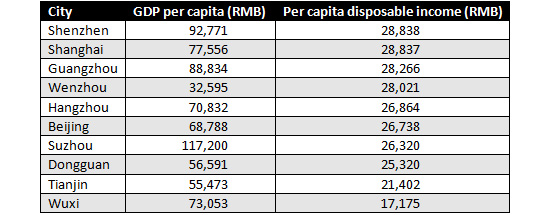

Here, we provide a list of the top 10 cities in China, ranked in terms of highest amount of disposable income:

As the observer will note, these cities are all within an hour or two of China’s eastern seaboard. None are considered “inland” cities in the manner of such Chengdu or Wuhan would be. The demographics make for interesting reading, not least because Shenzhen, rather than Shanghai, tops the list, with residents both earning more and having more disposable income.

However, Shenzhen is also becoming more expensive. The average wage may be far higher at RMB92,771 against Shanghai’s RMB77,556, yet the Shenzhen resident only has RMB1 more in disposable income than his Shanghai counterpart. Shanghai then, could be considered better value for money in pocket as a percentage of wage. But that ability for Shenzhen residents to put more cash through their banks may provide them with more leverage in purchasing or raising loans for housing for example. More cash, more credit.

It’s also interesting to note the still relatively obscure cities of Wenzhou and Wuxi making the top 10. While foreign investment in these cities is constant, it is nowhere near the levels of those in Shanghai or Tianjin by comparison. Here, a combination of lower costs and local industries have raised the living standards and disposable income levels of the residents in these cities. Less reliant on foreign investment, they have developed their key industries themselves, Wenzhou long being a source of private funding for domestic businesses on a national basis (some very old, serious family money is concentrated in the city) much of that interestingly enough sourced from overseas. Wenzhou is the primary recipient of overseas Chinese funding, put to good use by the local, well entrenched, private economy. Wuxi meanwhile, has developed quietly on its own. It’s one of China’s oldest cities and has long offered cost refuge for businesses wanting proximity to the markets of nearby Shanghai but without the overheads.

The demographics of selling to these cities will differ from those we mentioned in the fastest growing cities comparison. While those were all inland, the wealthiest coastal cities will develop a more sophisticated type of consumer. More likely to buy on brand and quality than cheapness, they will seek more advanced and cutting edge technologies than their inland counterparts. However, the numbers dictate that for every woman in Wenzhou who will buy a genuine LV handbag, there will be 30 in Hefei who will buy a pair of brand name sneakers, such as Adidas. The overall growth then will be in the inland cities, as the spike of wealth in the cities we mention here becomes ever higher.

China is accordingly becoming more diverse as a consumer market. Higher growth levels will push inland city consumers to where the 10 cities we mention here already are within the next 10 years. However, the top 10 cities mentioned here by that time will be getting closer to Western Europe in terms of disposable income and spending power. Brands selling to China need to know who is where, and which markets provide the consumer they want to target.

Chris Devonshire-Ellis is the principal and founding partner of Dezan Shira & Associates, establishing the firm’s China practice in 1992. The firm now has ten offices in China, five in India, and two in Vietnam. For advice over China strategy, trade, investment, legal and tax matters please contact the firm at info@dezshira.com. The firm’s brochure may be downloaded here.

Chris also contributes to the Asia Briefing publications India Briefing, Vietnam Briefing, and 2point6billion.com.

Related Reading

China’s Fastest Growing Cities: The Demographics

China’s Fastest Growing Provinces: The Demographics

- Previous Article State Administration of Taxation to Allow Firms to Deduct Losses from Taxable Income

- Next Article China’s Trade Surplus Swells, Yuan Continues to Rise