China Plus One Series: Investment Opportunities in Thailand

In recent years, many foreign companies based in China have started planning to move investment to alternative locations in Asia to supplement their operational capacity.

In this series, we profile potential destinations for foreign investors looking to strategically diversify their presence in the Asian market.

A “China plus one” strategy is one where investors complement their core China operations with investment in another country to lower costs, diversify risks, and access new markets.

Thailand has long been a key gateway into economic powerhouses, such as China and India, as well as fast-growing countries in the Indochina and Greater Mekong subregion.

Owing to its strategic location and well-connected road transport networks, Thailand is a key and strategic trading hub in Southeast Asia.

Its dominance comes not only from economic prowess – being the second largest economy in the region – but also its diplomatic influence – as a founding member of the Association of Southeast Asian Nations (ASEAN) and an instrumental actor in the formation of the ASEAN Free Trade Agreement.

Here we introduce Thailand’s economy and investment opportunities and assess its potential as a China plus one location.

Economy and industries

Thailand has made notable progress in social and economic development in the last four decades, shifting from a low-income to an upper-income country in less than a generation.

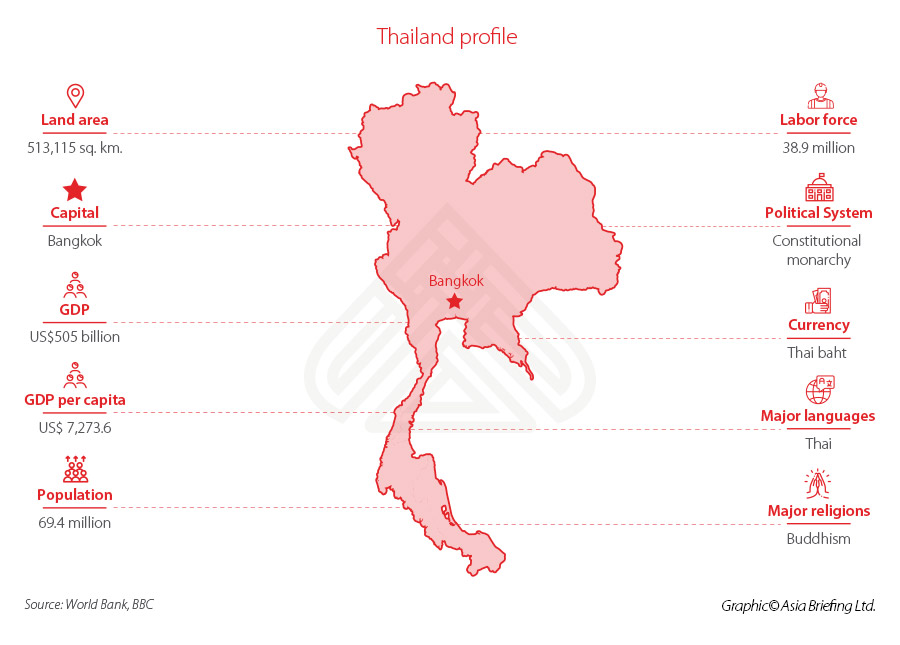

Growing at a steady 3-4 percent rate year-on-year over the five-year period from 2013 to 2018, Thailand’s GDP recorded a US$505 billion in 2018.

Despite the recent slowdown in its GDP growth in 2019, Thailand continues to demonstrate considerable economic resilience, and presents a strong outlook for the coming years.

Its economy depends on a mix of support from public investment funds, government stimulus measures, and revenue from high-growth industries.

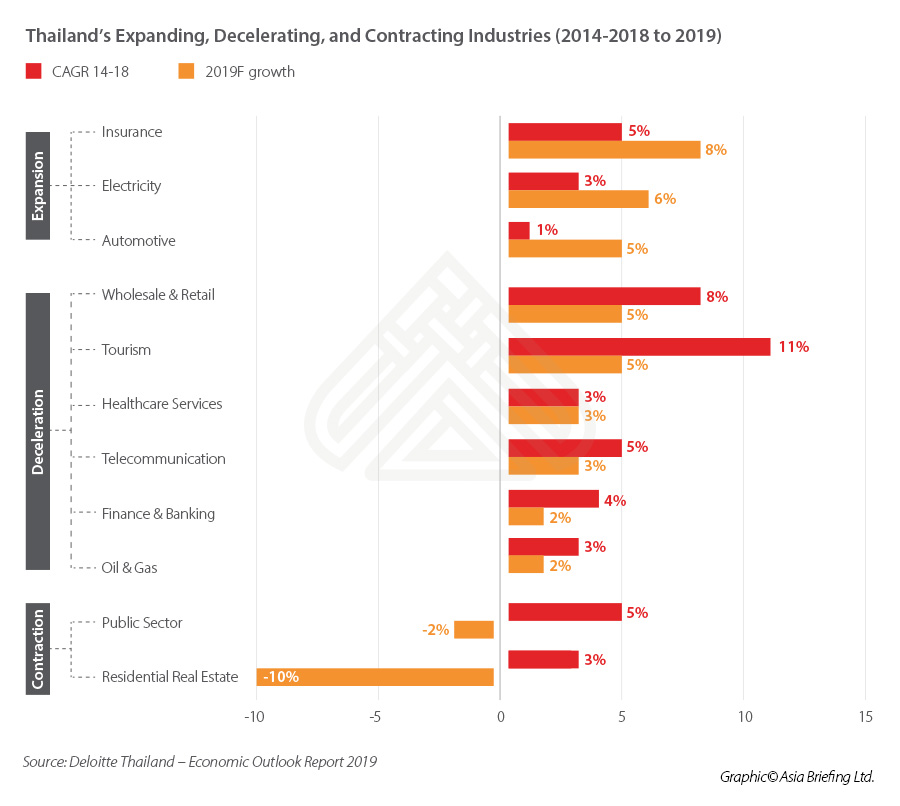

Long-standing traditional sectors, such as tourism, telecommunications, and banking remain strong, albeit showing a slight deceleration in recent years.

On the other hand, emerging industries like insurance, electricity, and automotive have all grown rapidly, reporting a 3-4 percent year-on-year growth.

See the infographic below for a more detailed explanation of the expanding, decelerating, and contracting industries.

Trade, investment, and business

Thailand offers an attractive business environment among the high-growth Southeast Asian countries and was ranked third in the region (or 21 out of 190 economies) for ease of doing business, according to the World Bank’s Ease of Doing Business index in 2020.

In recent years, Thailand has made it easier to start a business, including the creation of a single window for registration payment, reducing the time taken to obtain a company seal, improved handling of construction permits, as well as streamlining legal provisions for company liquidation.

Trade and FTAs

Thailand, formerly, an agriculture economy, is now a leading exporter of manufactured goods in industries, such as clothing and textiles, agricultural products (particularly rice, palm oil, rubber, sugar, and seafood), electrical appliances, plastics, and automobiles and automotive parts. Tourism is also a longstanding and significant contributor to the Thai economy – with Bangkok surpassing London, Paris, Dubai, and Singapore as the top destination city for tourists in the world.

China, US, Japan, and Australia are Thailand’s top four principal import and export destinations. China takes the top spot for both Thailand’s import and export relationships – 12 percent for Thai goods exported to China and 20 percent for Chinese goods imported to Thailand.

Thailand is currently party to seven multilateral treaties and six bilateral treaties as seen in the table below.

Investment opportunities

Foreign direct investment also plays an important component in the development of Thailand’s economy. Driven by both the abundant natural resources and cost-effective labor force, Thailand is consistently one of the most popular FDI destinations in the region.

According to the UNCTAD World Investment Report 2019, FDI flows rose to US$10.49 billion in 2018, growing by 62 percent from the previous year, the steepest growth seen in ASEAN. This was largely due to significant inflows from Asia, led by investors from Japan, Hong Kong, and Singapore

Manufacturing, and financial and insurance activities attract nearly 70 percent of all FDI inflows into Thailand. Real estate, commerce, and information and communication are key investment areas.

In many cases, a foreign entity cannot own more than 49 percent of an individual enterprise across a number of sectors. Exceptions for majority foreign ownership exist for certain types of industries and are often granted for projects approved by the Thai Board of Investment.

The government’s “Thailand 4.0” development plan encourages investment into value-based, digital, innovation-driven, as well as services-based industries.

The ten targeted industries include automotive, electronics, high-value tourism and medical tourism, efficient agriculture, food innovation, automation and robotics, aerospace, bioenergy and bio-chemicals, digital technology, and healthcare.

On September 6, 2019, Thailand introduced a stimulus package called “Thailand Plus” that contains a wide variety of measures to attract foreign investment. Thailand Plus covers seven key points, including the introduction of new tax incentives and deductions as well as reforms and initiatives designed to improve the ease of doing business. The package was reportedly designed for companies affected by the US-China Trade War and were planning to relocate full or part of their operations to another country in Asia.

Thailand offers many advantages for investors looking to grow their business, not the least of which includes its well-developed infrastructure, skilled workforce in a number of sectors, pro-investment policies, and strong export industries.

Business costs

According to the Thailand Board of Investment, the typical costs of starting and operating a business in Thailand are as follows:

- Visa and work permit (1-year, multiple entries- US$163);

- Company registration (US$163-US$8,156);

- Tax, legal and accounting fees (US$1,305);

- Rent (US$22.84 per sqm.);

- Utility costs (electricity: US$0.15-0.18 per kw/h);

- Construction costs

- Industrial building – standard low-rise factory (US$456.96- US$578.82)

- Office building – medium quality (US$761- US$913)

- Labor; and

- Transportation (for example, car park US$365- US$609.29).

In Thailand, the minimum wage depends on the province in which you are located but ranges from 308 baht (US$9.92) to 330 baht (US$10.81). The unemployment rate in Thailand has also remained relatively steady at 1.2 percent from 2017-2019.

Thailand’s Special Economic Zones and Eastern Economic Corridor

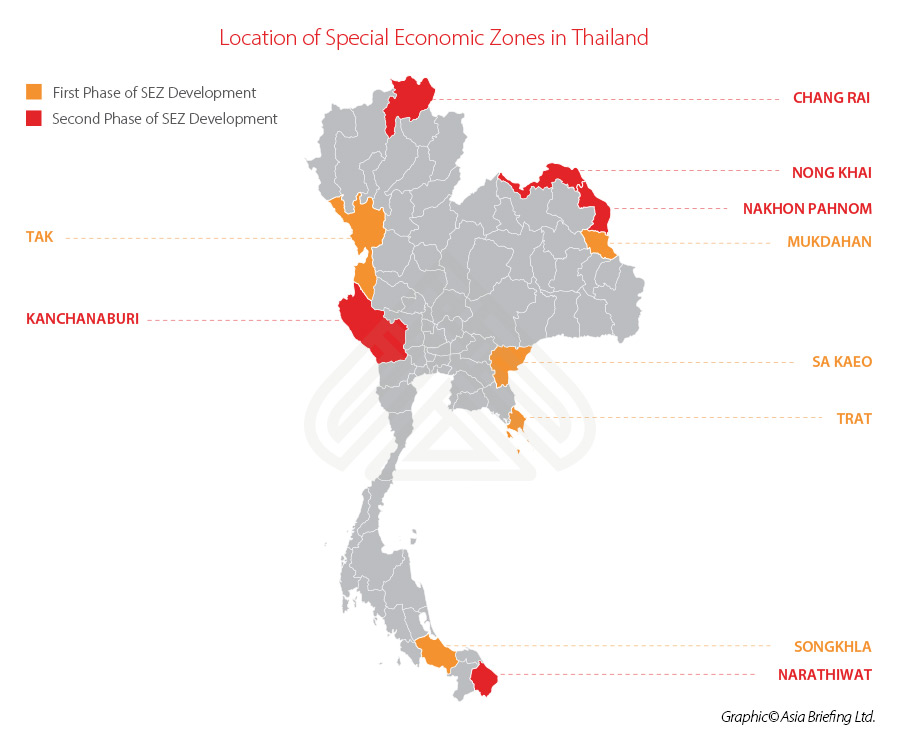

The government provides a full range of incentives for businesses operating in 13 industries located in any of the currently operational five Special Economic Zones (SEZs). Each of the SEZs has its own target industries, which are categorized by the area where the SEZ is situated.

The 13 industries are:

- Agriculture, fishery, and related businesses;

- Ceramics;

- Garments, textiles, and leather;

- Home furniture;

- Jewelry and fashion accessories;

- Medical equipment;

- Automobiles, engines, and parts;

- Electrical appliances and electronics;

- Plastics;

- Medical products;

- Logistics;

- Industrial estates; and

- Activities that support tourism.

Thailand introduced is first SEZ in 2015, with an initial roll-out of five pilot zones, later expanding to another five zones in 2016 (see map below).

Businesses within these zones can enjoy a range of different incentives from the Thailand Board of Investment, such as:

- Eight-year corporate income tax (CIT) exemption;

- An additional 50 percent reduction in CIT for five years;

- Exemption from import duty on raw materials and inputs used in the production of products;

- Reduced or waived import duty on machinery;

- Double deductions for expenses related to transportation, electricity and power supplies for 10 years;

- A 25 percent deduction of investment costs on the installation or construction of facilities used, beginning from the date in which revenue is generated;

- Permission to bring foreign experts and technical staff together with their spouses and dependents into Thailand; and

- Permission to employ foreign unskilled workers in the promoted project, according to the conditions prescribed by BOI.

Further, as part of Thailand’s 4.0 Strategy, the government has earmarked the Eastern Economic Corridor (EEC) as a pilot area-based development zone to attract investors, with emphasis placed on businesses in 10 additional industries such as – digital, medical services, logistics and aviation, and smart electronics.

The EEC, covering 13,000 sq.km, offers foreign investors access to even more favorable policies, including:

- Corporate income tax exemption up to 15 years;

- Exemption of import duty on machinery, raw, and essential material used for export products and products used for R&D;

- Financial incentives for investment in R&D, innovation, or human resources development in targeted industries;

- Permit to own land used for BOI promoted projects; and

- Facilitation for visas and work permits.

SEZs take advantage of Thailand’s growing border trade with neighboring countries and enhance growth in the 13 target industries. To support this, the EEC is being developed in the eastern provinces of Rayong, Chonburi, and Chachoengsao to encourage investment into next-generation industries that use innovation and high technology.

Businesses looking to invest in Thailand should contact their local professional advisers to find out the details of the opportunities and incentives available to foreign businesses under the Eastern Economic Corridor (EEC) and the SEZs in Thailand.

Thailand’s 4.0 blueprint opens new opportunities for investors

Thailand has been widely cited as a success story due to its rapid ascent to upper-income country status.

Its extensive trade links not only in ASEAN but with the wider Asian region, pro-investment policies, and robust infrastructure makes it an attractive investment destination for new and growing businesses.

As the government implements its 4.0 strategy, signposting the direction of the country’s future development, many opportunities lie in its increasingly diversified industries.

Traditional industries like tourism, automotive, and telecommunications continue to report healthy growth, while industries like fintech, healthcare, and advanced technology manufacturing are fast emerging.

To explore investment opportunities in Thailand, investors should familiarize themselves with Thailand’s company law, taxation, and SEZ. Investors are advised to work with local professional service agencies to develop a long-term strategy and action plan for investment.

Related Reading

China Plus One Series: Indonesia’s Appeal to Foreign Investors in Asia

China Plus One Series: Indonesia’s Appeal to Foreign Investors in Asia

China Plus One Series: Cambodia’s Appeal to Foreign Investors

China Plus One Series: Cambodia’s Appeal to Foreign Investors

China’s Support Policies for Businesses Under COVID-19: A Comprehensive List

China’s Support Policies for Businesses Under COVID-19: A Comprehensive List

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, and Thailand in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article Why China’s COVID-19 Stimulus Will Look Different Than in the Past

- Next Article Dezan Shira & Associates Announce South America Presence