How COVID-19 Will Transform the Fresh Food Industry in China

The COVID-19 virus, of which the origin is not fully confirmed, is generally believed to have infected its first human host at a wildlife market in the central Chinese city of Wuhan, the epicenter of the pandemic.

The highly contagious novel coronavirus, following the SARS virus in 2003, has reignited concerns on wildlife protection and fresh food safety in China. Consequential measures taken to contain the virus spread, such as city lockdowns, transport restrictions, and delays in resuming businesses, have also begun to upend the country’s fresh food industry and supply chain.

The crisis underscores an urgency Chinese business might soon encounter whereby consumers in the country become more wary of the sourcing and distribution of their meat products and other food supplies.

Given the cultural significance of fresh food in China – this is a time to look at new investment opportunities to tap into. This includes industrial farming, processing, storage, distribution – the whole gamut of the supply chain.

Chinese consumers resort to new shopping habits

With the emergency caused by COVID-19 and capability of coronaviruses spreading across animal species, consumers are concerned about how many similar wildlife markets that sell pangolins, snakes, civets, and other wild animals still exist in China, which could be a breeding ground for zoonotic diseases.

In addition, sporadic outbreaks of bird flu (H5N1 Bird Flu in 1997 and H7N8 Bird Flu in 2013) and African swine fever (ASF), which affect the meat supply in China and lead to the spike in meat prices, also raise questions on the way China’s wet market and meat supply chain operate.

While frozen food consumption is the norm in the US and Europe, Chinese citizens, especially the elder generations, still prefer live seafood, fresh meats, and seasonal fruits and vegetables from the less hygienic local wet markets to ensure freshness. Live animals, like poultry and fish, in wet markets are slaughtered or sold live right next to stalls selling fruit and vegetables.

In recent years, wet markets are losing ground to supermarkets in China, although traditional markets remain the major source of fresh food for most Chinese citizens.

According to a report by Forward, a Chinese industry information provider, in 2018, farmers’ markets accounted for about 53.7 percent of the fresh food sources of Chinese consumers, followed by supermarkets at 40.1 percent; fresh food e-commerce accounted for only 4.9 percent.

During the COVID-19 outbreak in China, farmers’ markets with live poultry trade were ordered to be shuttered temporarily or permanently in many regions across the country. People were reluctant to visit such places, in fear of cross-infection.

Instead, sales of hypermarkets, supermarkets, and e-commerce platforms with last-mile delivery services saw a short-term spike as people opted to go to the supermarkets or order online to stock up on various foods, reduce going out, and stay at home.

According to global consultancy McKinsey, since the Chinese Lunar New Year in late January, the meat sales of large supermarket chains observed year-on-year growth of more than 30 percent, going even as high as 70 to 80 percent.

Daily new users of major fresh food e-commerce and online to offline (O2O) platforms have increased by 50 to 200 percent, and year-on-year growth in transaction volume on these platforms has risen three to four times.

JD Daojia, an online grocery shop under JD.com, China’s second largest e-commerce company, saw its transaction volume increase by 374 percent year-on-year from January 24 to February 2, 2020.

Missfresh, an online fresh food e-commerce platform with its headquarter in Beijing, also saw trading volume increase by 321 percent from January 24 to January 28, compared with the year earlier.

Orders received by Freshippo, Alibaba’s retail supermarket chain, which also provides last-mile delivery services, were five to ten times higher than usual in major cities Guangzhou, Shenzhen, and Chengdu.

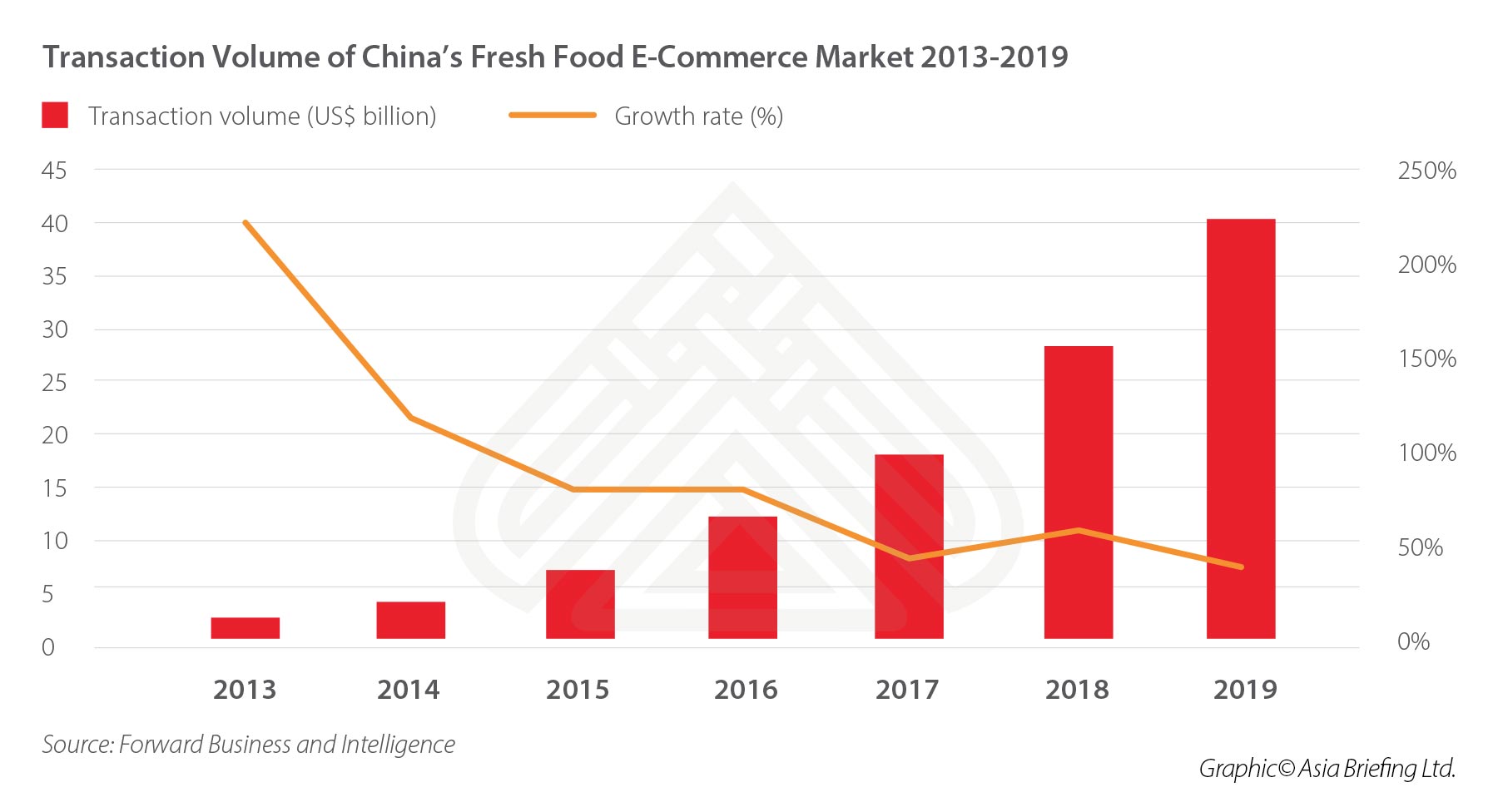

Prior to January, the trading volume of China’s fresh e-commence market had been growing steadily.

With the onset of COVID-19 and several restrictions implemented by healthcare and administrative authorities, consumers have had no choice but to purchase fresh produce online. This intense crisis period could indeed cultivate long-term preferences for online shopping.

Still, China’s wet markets are reportedly reopening and some consumers may return to their old buying habits.

In the long run, however, it is likely that many Chinese consumers, especially young and middle-income groups, will continue to purchase fresh food online.

This consumer preference and shopping behavior will convert more strongly if e-commerce platforms constantly improve their warehousing and distribution capabilities and offer more types of high-quality fresh foods.

State of the cold chain network in China

A cold chain refers to the temperature-controlled supply chain, and includes refrigerated production, storage, and distribution activities, along with the associated equipment and logistics required to maintain desired temperatures.

Cold chain logistics are essential for e-commerce companies to reduce costs and ensure the quality of perishable goods. Naturally, the growth of online fresh food consumption is expected to push investments in cold chain transportation, storage, and other segments.

Logistics costs account for a huge proportion of the cost structure of fresh food e-commerce companies. According to the 2015 China Cold Chain Logistics Development Report released by China Federation of Logistics and Purchasing (CFLP), the cold chain logistics cost accounts for an average of 40 percent of the total cost of fresh food e-commerce companies.

The development level of cold chain networks determines the operation cost and profit distribution of these enterprises.

China’s cold chain logistics market is big. It was worth RMB 295.6 billion (US$41.9 billion) in 2018, showing a growth of 18.8 percent from the previous year – around half of the value of the North American cold chain logistics market (US$81.2 billion in 2018), according to Statista.

However, the construction of cold storage facilities in China is still somewhat backward.

In 2018, the per capita refrigerated warehousing capacity of China’s urban residents was only 0.156 cubic meters, far lower than the 0.5 cubic meters per capita capacity in developed countries.

What’s more, China’s cold storage market is scattered, with a low concentration ratio and strong regional attributes. The capacity of refrigerated warehouses, mainly distributed in the first-tier cities in east China, accounts for more than 36 percent of the country’s cold storage capacity.

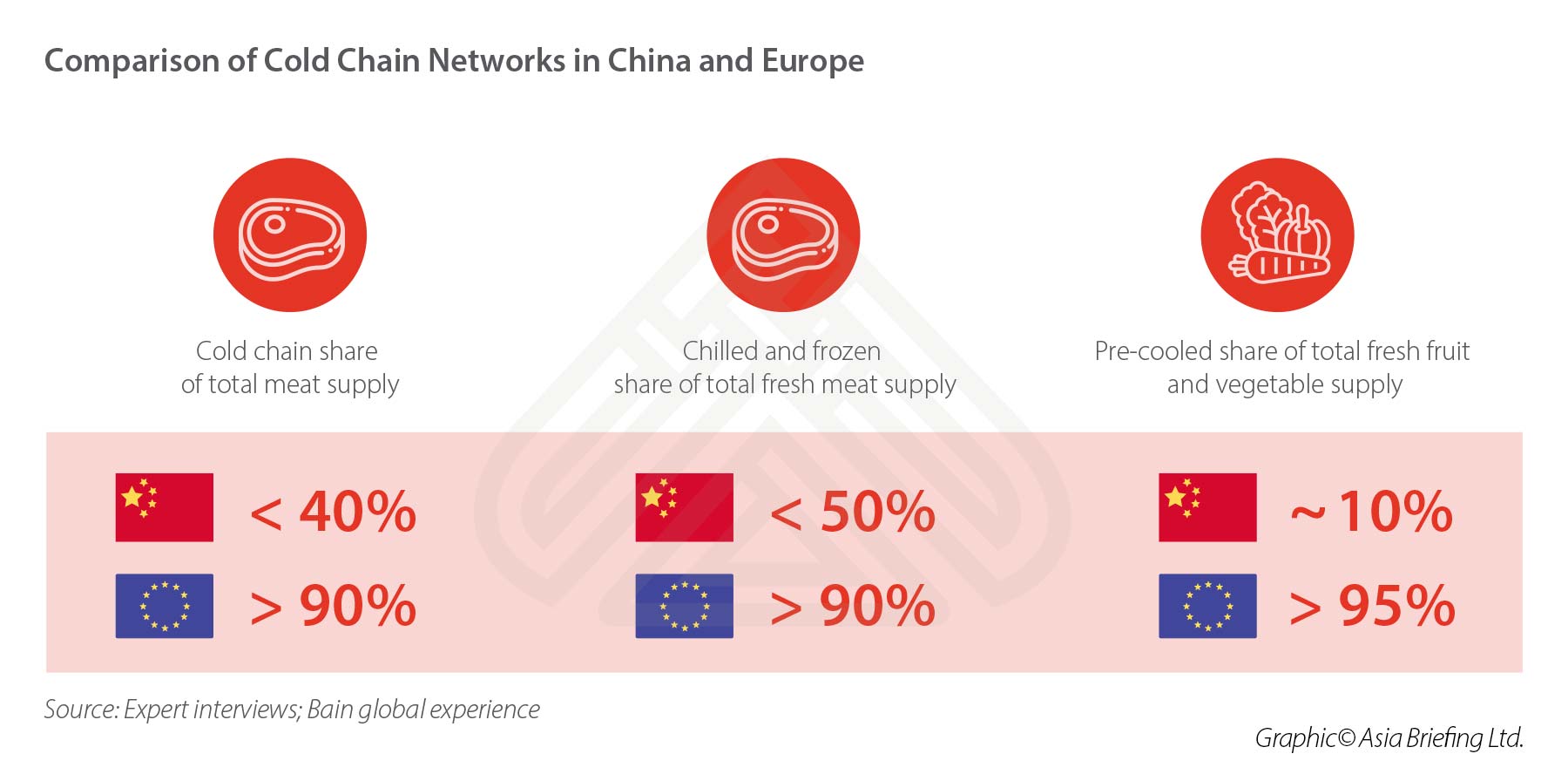

Based on a recent report from Bain & Company, cold chain share of total meat supply in China is less than 40 percent, while in Europe, that share is more than 90 percent. Chilled and frozen share of total fresh meat supply in China is less than 50 percent, while the share in Europe is also over 90 percent.

In addition to this, according to Zhou Yuan, a researcher at the Chinese Academy of Sciences, the proportion of pre-cooled fruit and vegetable market share in China is around 10 percent, while in developed European countries and in the US, the share can be as high as 95 to 100 percent.

Limited by the low-level development of cold chain networks, the annual loss of fruit and vegetables alone amounts to hundreds of billions of RMB.

Consequently, Chinese governments have been rolling out policies to boost the construction of the country’s cold chain network in recent years.

The rise of fresh food e-commerce and Chinese consumers’ desire for higher-quality food after COVID-19 is projected to further drive this need for a more robust cold chain network and large cold chain logistics platforms – to create as unbroken a cold chain as is possible.

Industry automation, consolidation, and integration

In China’s animal husbandry industry, the animal breeding, slaughtering, and processing segments highly rely on manual labor force. However, worker shortage amid the COVID-19 outbreak exposed the shortcomings of this low-automation production model.

The long tail and scattered organization of the country’s animal husbandry supply chains inevitably led to large gaps between demand and supply.

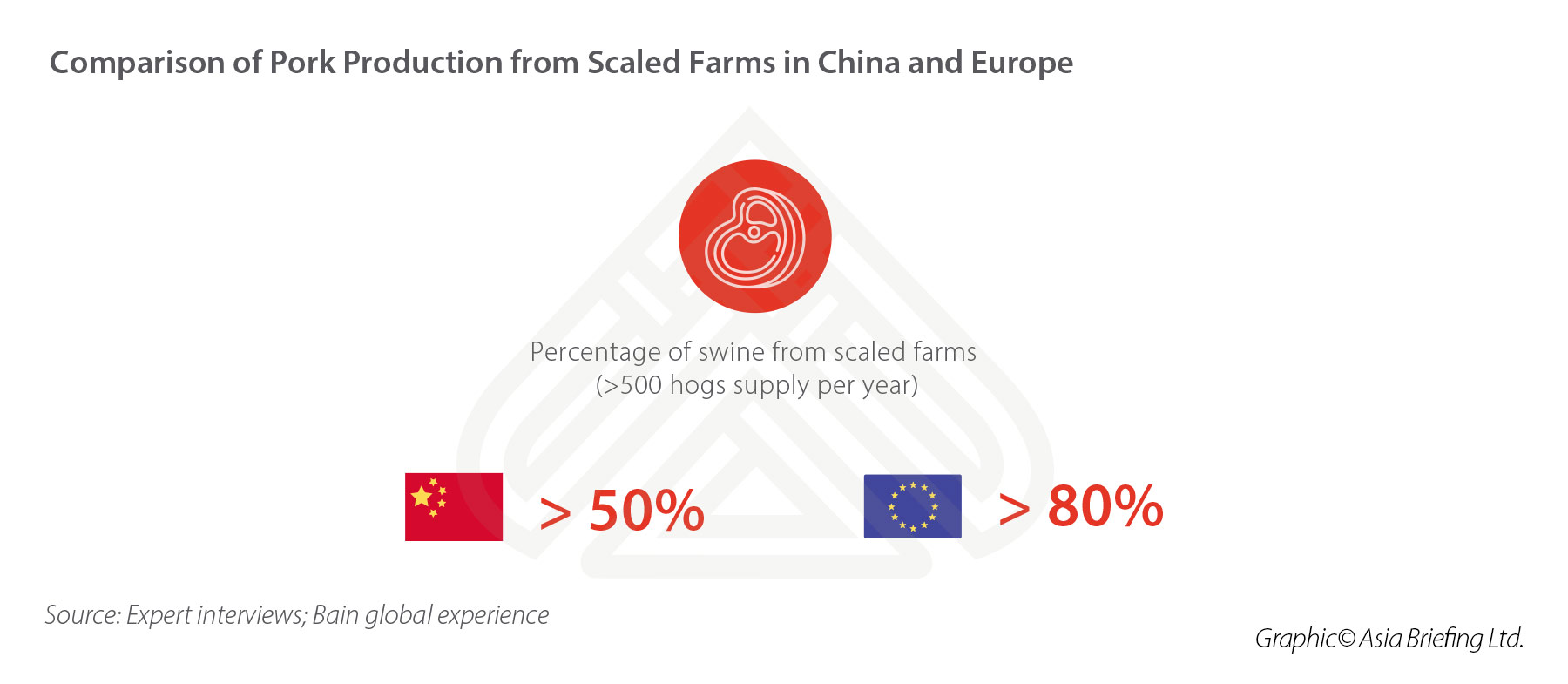

In addition to COVID-19, a bout of African swine fever (ASF) also clobbered the country’s livestock industry. Between 2018 and 2019, a quarter of the world’s pig population died from an ASF outbreak that spread across China.

And this left many small-scale farms financially struggling to survive despite big industrial producers continuing to expand.

China’s government policy appears to have strengthened this trend of consolidating big enterprises.

On March 16, 2020, the State Administration for Market Regulation (SAMR) announced the Implementation Opinions about Supporting Private Enterprises to Breed Hogs and Develop Related Industries (Fa Gai Nong Jing [2020] No.350), aiming to encourage leading companies engaged in breeding, slaughtering, and processing hogs to extend the industry chain at provincial or regional markets. (Hogs are domesticated pigs meant for slaughter for food consumption.)

The document said large hog breeding companies would be guided to build slaughterhouses near their farms, and slaughtering companies could develop processing operations or launch byproducts to improve their product structure.

A range of policy incentives were announced for large hog farms, such as subsidies for purchases of automatic feeding, waste treatment facilities, and easier access to land use.

In addition, the document also encouraged cold storage logistics as China switched to transport of meat rather than live hogs to boost bio-security after the outbreak of African swine fever and COVID-19.

Over the medium- to long-term, we are likely to see the consolidation and vertical integration of China’s animal husbandry industry where large livestock complexes and meat processing enterprises will be able to aggressively expand market share and control the operation of two or more successive stages of processing – from feeding and slaughtering, to creating the final products. We expect that larger players who invest in modernizing production lines will enjoy more benefits in the coming years.

Stricter food safety regulations and enforcement

Since the earlier COVID-19 infections were found in Wuhan’s wildlife market, where bats, snakes, civets, and other animals are sold, China has banned the trade and consumption of wild animals.

On February 24, the Standing Committee of the National People’s Congress, the country’s top legislative body, issued a decision laying the groundwork for amending China’s Wildlife Protection Law.

The decision imposed a permanent ban on the trade and consumption of live wild animals for food – to block the spread of zoonotic diseases, although ending this billion-dollar industry may not be easy.

With increased national and global attention to China’s wild animal protection and food safety, we expect Chinese authorities will enforce stricter food safety regulations.

Take a recent example – on March 18, the SAMR released an announcement to strengthen the safety management of refrigerated and frozen food (SAMR Announcement [2020] No.10), which requires any party commissioned to store and transport food to report to local market regulators when they suspect that the food does not meet laws, regulations, or food safety standards.

In the future, high-level food safety standards and a more mature food tracing and alert system are expected to be built up in China.

Opportunities for meatless meat

The COVID-19 and outbreaks of bird flu and swine fever are making people around the world rethink their diet structure, and consumption of meat products, which might also boost promotion for the meatless meat industry.

On March 16, Impossible Foods, the US artificial meat company, raised about US$500 million in in its latest series F funding round. The funding came after COVID-19 hit the US, with consumers panic-buying at grocery stores. Few days prior, on March 12, Starfield, a Chinese food technology company headquartered in Shenzhen, announced they’d completed the financing of tens of millions of Chinese RMB.

Foreign plant-based meat producers still face a different set of political and cultural hurdles to enter China’s meat market, such as the government’s daunting food regulatory procedures and an invisible food culture. But the outbreak of COVID-19 has increased investor interest in alternative meats and given plant-based meat producers greater confidence to continue to enter the market.

While the overall impact of the pandemic on China’s fresh food and cold chain industry is yet to be determined, we recommend, while taking short-term measures to maintain business operations, companies may also consider making long-term strategy adjustment.

As regulations become stricter, food producers are advised to double down on technology that improves food safety and quality control. When there is industry consolidation and vertical integration, stronger companies can focus on M&A opportunities. Enterprises that make the right moves now will be best placed to thrive in a more regulated market with changing customer expectations.

Related Reading

Investment Opportunities in China’s Healthcare Sector After COVID-19

Investment Opportunities in China’s Healthcare Sector After COVID-19

China’s Support Policies for Businesses Under COVID-19: A Comprehensive List

China’s Support Policies for Businesses Under COVID-19: A Comprehensive List

New Business Opportunities Emerging in China Under COVID-19 Outbreak

New Business Opportunities Emerging in China Under COVID-19 Outbreak

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, and Thailand in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article Why China’s COVID-19 Stimulus Will Look Different Than in the Past

- Next Article New Cross-Border E-Commerce Zones, Extended Tax Incentives for Small Businesses in China