Is a “Meatless Meat” Revolution Really Underway in China?

In late-April, Shanghai held a plant-based meat festival with both foreign and domestic companies displaying their products. The festival sparked a range of commentary, with some claiming that a “meatless revolution” was beginning to take place.

China has, without question, a long history of consuming tofu as a central part of its diet. And, Chinese companies have been producing plant-based meats for decades.

Even before plant-based meats were commercialized, Chinese Buddhists had devised vegetable-based versions of classic Chinese dishes with the growth of vegetarianism in the 6th century AD.

However, the Chinese Buddhist laity are not required to practice vegetarianism. Entrenched in Chinese culture is the idea that the basic elements of any meal includes both meat and vegetable dishes – two parts that are not considered to be able to compensate for each other.

Only 50 million people – around 3.6 percent – of the Chinese population are estimated to be vegetarian. By contrast, 11 percent of Australians and 40 percent of Indians claim to practice vegetarian diets.

So is a modern day “meatless meat” revolution really underway in China?

China’s plant-based meat market

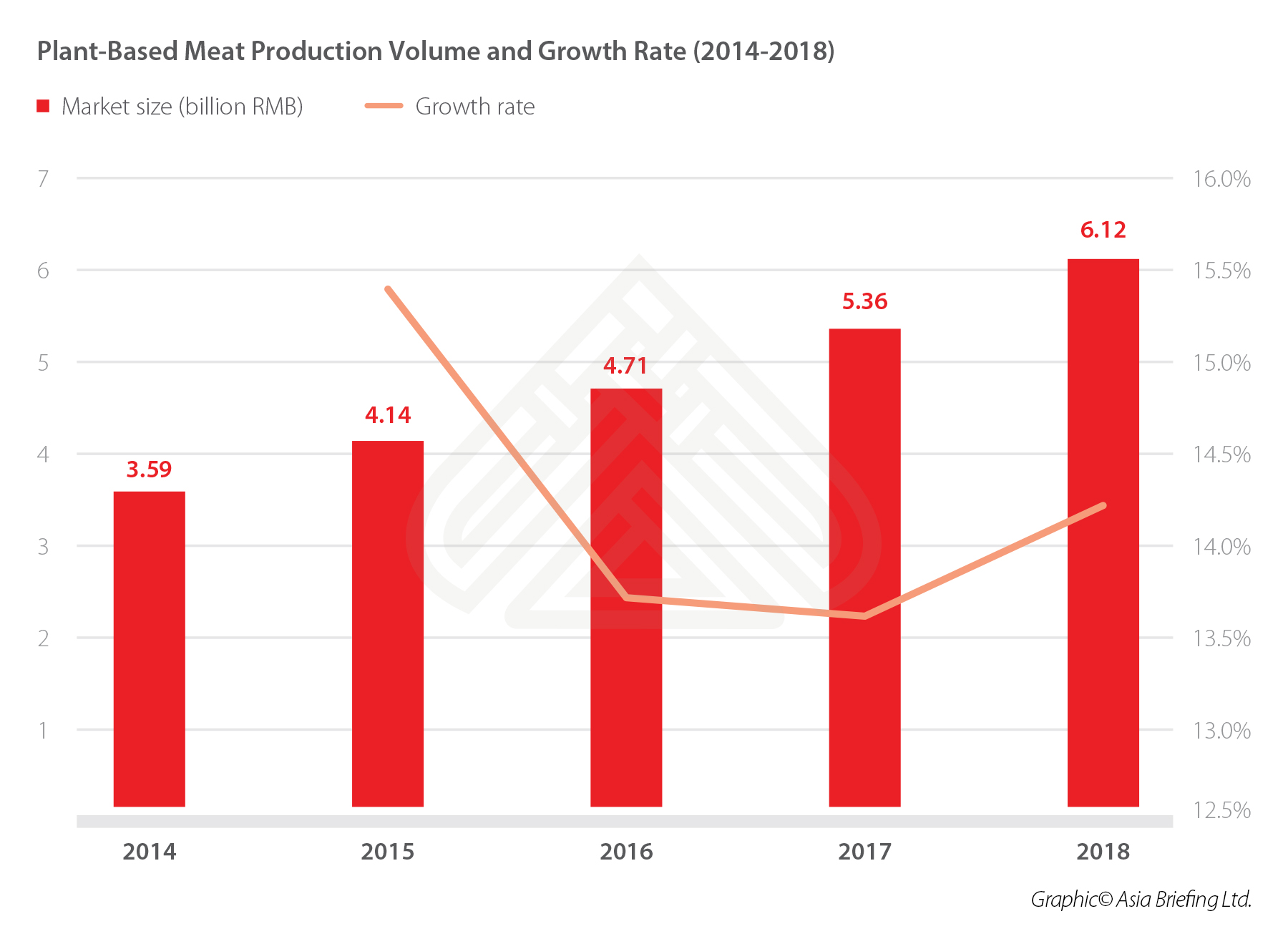

According to an industry report by The Good Food Institute, a non-profit in the United States, the Chinese plant-based meat market has grown at an annual rate of 14.3 percent since 2014. Although the base of China’s GDP is much larger, this is around twice the size of the national annual GDP growth rate for the same period.

In 2018, the country’s plant-based meat market was valued at RMB 6.12 billion (US$910 million), 33 percent bigger than the market in the US (US$684 million). Still, the US market did exhibit a 23 percent growth rate against a backdrop of 2.2 percent GDP growth. On a per capita basis, the US also consumes just over three times what China does.

The market in China is growing quickly but given the low rates of vegetarianism it is not immediately clear what is driving the growth of China’s plant-based meat market.

Changing consumer trends – away from pork and poultry

Chinese eating habits are changing. In 2016, the Chinese released new dietary guidelines recommending that personal meat consumption be reduced with the aim of producing an overall reduction of 50 percent by 2030.

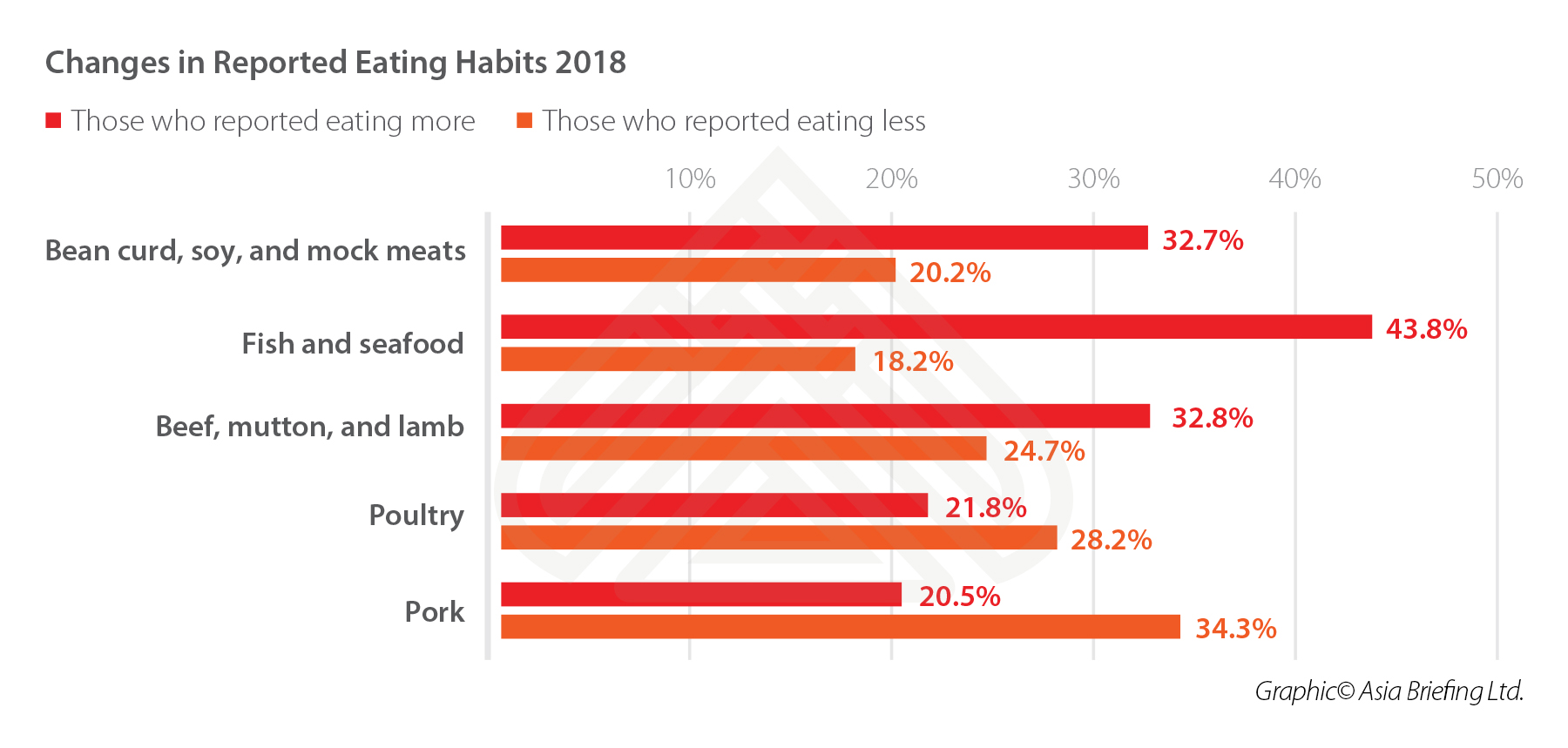

In a 2018 survey conducted by the New Zealand Institute of Plant and Food Research, 2,000 respondents, mainly from tier-one Chinese cities, reported that they were eating less pork and poultry. On a net basis, 13.8 percent reported eating less pork and 6.4 percent were eating less poultry.

Soy products (including plant-based meats) did replace this to some extent, rising a net 12.5 percent. However, fish and seafood were the protein source that rose the most – 25.6 percent.

Health concerns are the central growth driver

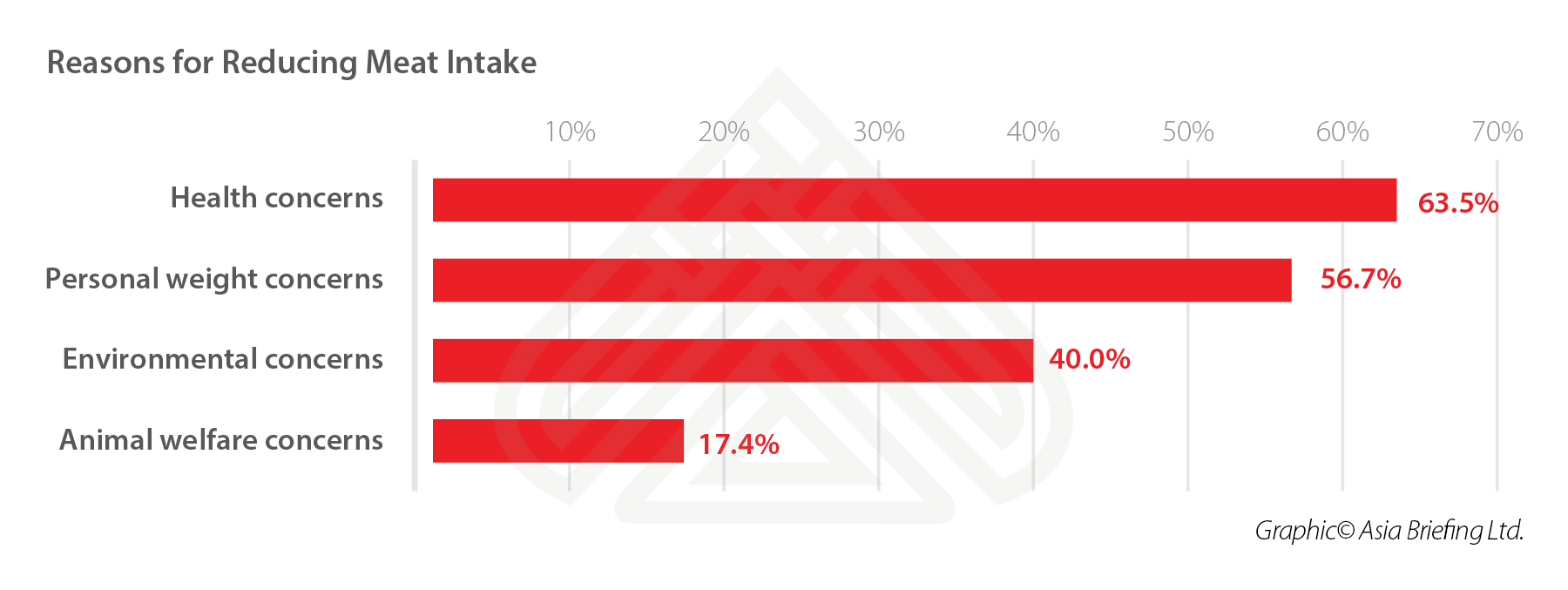

The major reasons given for reducing meat intake were perceived health benefits (63.5 percent of respondents), managing personal weight (56.7 percent), and environmental concerns (40 percent). Only 17.4 percent claimed they reduced their meat intake due to concerns for animal welfare.

The survey also found that consumers view pork, red meat, and poultry as the three unhealthiest food groups of the 13 surveyed. The three largest factors consumers noted would be important in choosing a meat substitute product were “low in fat”, “additive free”, and “high in protein”.

Wealth also seems to play an important part in driving growth too. Currently, 43.6 percent of all plant-based meat consumption is in the tier-one cities – Beijing, Shanghai, Guangzhou, and Shenzhen. These four cities make up a mere four percent of China’s population and have a per capita consumption of plant-based meat that is over twice as high as in the US.

Individual health outcomes and their respective income levels have been linked in countless studies. As more Chinese cities experience the concentration of wealth and expand their middle-class population, the market for plant-based meat will likely out-grow the US’ on a per capita basis.

Lobster vs. soybean – competition in the Chinese market

Currently, the plant-based meat market is extremely fragmented in China. No brand has a market share of more than three percent. The most well-known Chinese providers are Whole Perfect Food (齐善素食) and Godly (功德林).

The problem for current plant-based meat brands is that Chinese consumers seem to be replacing pork and poultry with seafood more often than with meat substitutes.

Both seafood and meat substitutes are considered to have a similar nutritional composition, but the taste of seafood appears to be more attractive to Chinese consumers.

Because of this, plant-based meat products need to compete with seafood in two respects: their nutritional value needs to be marketed effectively, and they must be able to replicate the taste of the meat they intend to replace.

The American firm, Omnipork seems to have realized this. Omnipork boasts of a product that tastes like pork and has zero cholesterol. Their entry into the Chinese market also coincides with an outbreak of African swine fever – expected to kill 130 million pigs in China and is already pushing up the price of pork.

Nevertheless, meat exporters should not be worried about losing market share in China.

Meat will remain extremely popular and is forecast to grow at around 11.9 percent between 2017 and 2027, according to the United Nations. Although plant-based products are growing in popularity quickly, a large-scale revolution that significantly steers China away from meat has yet to sweep the nation.

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Dalian, Beijing, Shanghai, Guangzhou, Shenzhen, and Hong Kong. Readers may write china@dezshira.com for more support on doing business in China.

- Previous Article How to Hire a Foreign Intern in China

- Next Article How China’s New Income Tax Law Affects Expatriates