Conducting Due Diligence on Chinese Financial Statements

Jun. 10 – When it comes to conducting due diligence on Chinese financial statements, it is common to find that accounts have often been incorrectly prepared. In order to gain a better understanding of the value of the business, adjustments need to be made.

In this article, we will focus on understanding and analyzing the typical accounts of Chinese financial statements, including the balance sheet and income statement. In our firm’s 18 years of experience in China, when called upon to examine accounts prepared by Chinese businesses, we have consistently found that accounts we have analyzed have always been incorrectly prepared. This can be due to several factors, incompetence, as well as more serious cases of deliberate attempts to deceive.

Regardless, accounts can be understood and errors or specific acts of misrepresentation uncovered. We will conduct some simple analysis to demonstrate how these can be spotted.

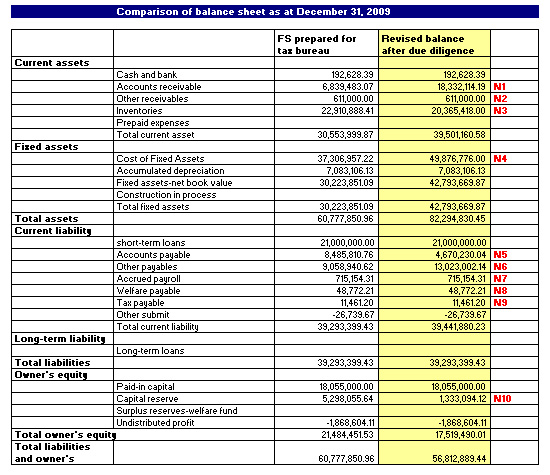

In the balance sheet, we focus on accounts receivable; other accounts receivable; fixed assets; construction in process; accounts payable; other payable; and payroll payable.

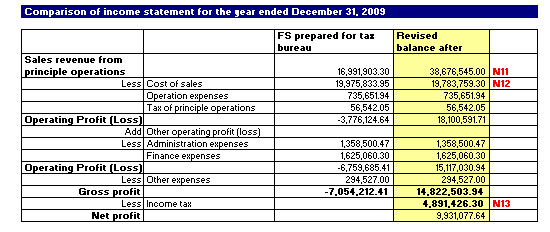

In the income statement, we analyze: sales income; cost of goods sold; expenses; and income tax.

All the usual mistakes are identified according to our practical experience and have come from live cases. The cases we analyzed came from projects we conducted in the past. Most of them are Chinese private companies; some of them are medium sized FIEs.

The balance sheet

1) Accounts receivable

Typical weaknesses

- Many businesses in China cannot prepare an AR aging analysis as the communication between the sales department and financial department is poor

- It is common practice for businesses to attempt to hide sales to reduce taxable income, and as such, the accounts receivable is usually under-reported

2) Other accounts receivable

Typical weaknesses

- Many irrelevant transactions are often recorded in the Other Receivable account (for example, there may be an internal loan between two related companies, with this being recorded into the account of other AR and not listed as a transaction in the investment account)

3) Fixed assets

Typical weaknesses

- Often self-established fixed assets are not included into the FA account, and the relevant depreciation is not taken accordingly

- The cost for establishing the fixed assets is recorded in the Expenses account or Cost account but not capitalized

- Only a small number of companies conduct periodic counting and post FA label correctly

4) Construction in process

Typical weaknesses

- Some self-established fixed assets are not recorded in this account nor later transferred to the FA account

- Original supporting documents related to CIP are not properly filed and documented

5) Accounts payable

Typical weaknesses

- Sometimes the enterprises will book irrelevant transactions in payable

6) Other payable

Typical weaknesses

- Please refer to the introduction of accounts receivable

7) Payroll payable

Typical weaknesses

Often there will be an ending balance of the payroll account, however, we note many Chinese companies delay part of all of the employees’ salaries

The income statement

1) Sales income

Typical weaknesses

- It is common that the company management does not record all sales revenue in the financial statements prepared for the tax bureau (for example, for some cash sales, the target company will not include them into the financial statements and will maintain them in an internal sales book)

- Sometimes the sales will be delayed as recognized in order to reduce the sales volume in the current accounting period

2) Cost of goods sold

Typical weaknesses

- In many cases, the businesses did not adopt a sound cost carrying forward method to record and allocate costs

- Often businesses will record irrelevant items in the Cost account such as self-established FA cost.

3) Expenses

Typical weaknesses

- Many businesses book non-deductible expenses in the expense account, such as fixed assets cost, penalties and so on. The inappropriately recorded expenses will be adjusted out by the auditor at the end of each year

- Some expenses have exceeded the limitation of deduction as listed in China’s tax law

4) Income tax

Typical weaknesses

- In almost all cases, income tax will be under-reported by most companies; their P&L usually shows a loss at the end of the financial year

Summary

The points mentioned above are only a general level introduction of typical problems when assessing Chinese private enterprises or small to medium sized FIEs. Investors in China should be aware of relevant risks when making investment decisions and obtain professional advice when assessing Chinese financial statements.

Notes

The target company is a Chinese private company, carbon industry, located in Shanxi Province of China. The company records and maintains a set of finance statements which is prepared for tax purposes. They also maintain an incomplete internal financial data which includes sales, accounts receivable and accounts payable. Internal finance data is not prepared as the format of financial statements. One point that needs to be mentioned is the local management does not prepare complete and accurate cost information.

N1: 1) The company would not like to disclose all accounts receivable in the financial statements prepared for the tax bureau due to under-reporting of sales revenue as mentioned in N11. 2) In most cases, reconciliation between the target company and customers is not conducted timely and properly.

N2: Please note that for some key transaction accounts such as other receivables and other payables, the target company usually records some questionable transactions. Even if there are no variances between the data before and after the adjustments, the account needs attention from the acquirer.

N3: 1) In most cases, the private company maintained their financial books manually, and so could not accurately update inventory movement in time. The variances between actual stock and book figures usually was adjusted manually by an accountant. 2) Physical inventory counting is not conducted properly, no sound investigation work has been performed.

N4: In some cases, the fixed assets ending balance is not accurate since: 1) If the target company is a Chinese manufacturing company, the acquirer should mention that some equipment is made by the company, not purchased from outside vendors. 1)-1 VAT implication: According to Chinese tax law, VAT related to fixed assets purchasing can not be deducted from the current period’s input VAT. In order to deduct more VAT, the company does not include the materials to produce the equipment into the original value of fixed assets, but records the materials into the current period’s expense account. 1)-2 Corporate income tax implication: Recording these materials into an expenses account instead of amortizing it as a fixed asset will deduct more expenses in the current period and allow the company to under-pay their corporate income tax accordingly. It will be very hard for the auditors to trace back the accurate influenced amount. As such, the revised figure is maintained the same as the original figure in our revised financial statements, however this issue has been identified to the acquirer.2) In other cases, the target company might purchase some fixed assets from vendors and not request an invoice, as compensation, the purchasing price will then be lower. The target company does not include this part of the fixed assets into the FA account. As such, the fixed assets included in the FA account might be under-reported.

N5: Like accounts receivable, the target company management also maintains an internal record for accounts payable. The transaction accounts such as AR, AP, other receivables and payables needs to be noted by the acquirer carefully.

N6: As mentioned above, other receivables and payables needs to be noted significantly. In this case, the target company management reduced the ending balance of other payables by RMB3.96 million. The amount is part of the inter-company liability and the reduced RMB9 million was recorded in the debit of capital reserved account.

N7: We usually see the following situations when a due diligence is conducted: 1) There is an ending balance in the payroll account since some target companies usually postpone paying salary to their staff. 2) Errors might occur in the calculation of the salary payable.

N8: Some target companies do not accrue complete social-welfare for their staff which might be challenged by the social welfare bureau.

N9: In some cases, the target company does not issue VAT invoices to customers. As such, the VAT will be under-reported.

N10: Please refer to N6.

N11: In most cases, there are two possibilities for an incorrect ending sales account balance. 1) Cut-off issue: In the acquisition of a Chinese private company, the acquirer needs to understand how revenue is recorded in the company as it quite often departs from the GAAP (for example, sales revenue of FY2009 can be delayed and recorded in FY2010, as in this example, for the purpose of delaying tax payment). 2) Incomplete sales data: Sometimes, a target company’s management does not record all sales revenue in the financial statements prepared for the tax bureau for the purpose of tax evasion. For example, the target company may conceal cash sales by not putting them into the financial statements but maintain the records in an internal sales book only.

N12: Target companies often cannot establish an appropriate costing carry forward method to record accurate cost.

N13: Under-reported sales revenue will influence corporate income tax directly.

Sabrina Zhang is the national tax partner for Dezan Shira & Associates. The firm provides business advisory and financial due diligence work on target companies throughout China. For assistance please contact legal@dezshira.com.

Related Reading

Mergers and Acquisitions in China

Mergers and Acquisitions in China

- Previous Article Shenzhen Raises Minimum Wage

- Next Article State Council Approves Shenzhen SEZ Expansion