The Tax Liabilities of China Business Trips

Aug. 13 – Individuals sent to China on business for a cumulative period of time that exceeds 90 days may be liable for individual income tax in China, regardless of if they entered China on a business visa (F) or an employment visa (Z).

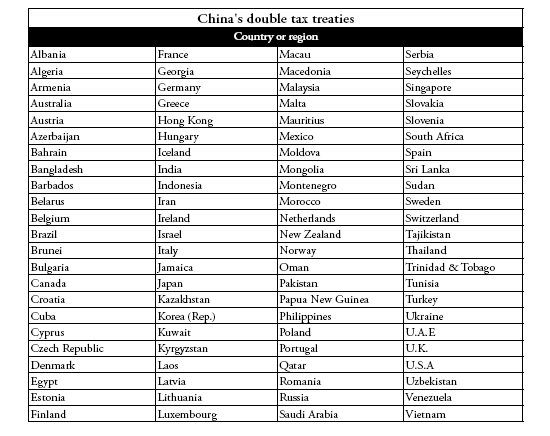

The SAT uses the so-called 90 or 183 day rule to determine whether a foreigner in China is required to pay IIT. For residents of countries that have signed a double tax treaty with China, an individual will be taxed if they spend more than 183 days in China in a calendar year. They will have to pay IIT in China based on the days they effectively spent in the country; if they spent 184 days within a calendar year, than they will have to pay taxes on all income sourced from China.

Residents of countries that do not have a double tax treaty with China will become liable for individual income tax after only 90 days in China.

Individual income tax in China is related to work performed in China, regardless of where the payment for that work is made. The tax administration has been known to request proof of salary payment from the foreign country such as W2 forms for U.S. nationals to determine IIT liability.

In September 2009, the State Administration of Taxation issued Circular 124 further regulating the tax administration for non-residents availing of the benefits provided by double tax treaty arrangements on their income in China. Foreign executives based in China for limited periods over a 12 month time frame currently may not have to declare taxable income in China if their stay is less than 183 (for residents of countries with a double tax treaty) or 90 days (for residents of countries without a double tax treaty).

For more information or advice on China’s tax regime, please contact Dezan Shira & Associates at tax@dezshira.com.

Related Reading

The China Tax Guide (Fourth Edition)

The China Tax Guide (Fourth Edition)

Contains a entire chapter on expatriate individual income tax in China

- Previous Article China Exempts Outsourcing Companies from Business Tax

- Next Article Joint Ventures the Only Way Ahead in China’s Media Market