The China Alternative – Thailand

The China Alternative is our series on other manufacturing destinations in Asia that are now starting to compete with China in terms of labor costs, infrastructure and operational capacity. In this issue we look at Thailand.

The China Alternative is our series on other manufacturing destinations in Asia that are now starting to compete with China in terms of labor costs, infrastructure and operational capacity. In this issue we look at Thailand.

By Teja Yenamandra and Jennifer Park

Mar. 25 – While usually famous for its beautiful women and the sport of muay thai, Thailand is also increasingly becoming an attractive destination for foreign capital.

Thailand was once an agricultural economy, but reformed itself into an industrial powerhouse in the 1970s. Between 1984 and 1994, Thailand had the fastest economic expansion of any nation in the world, but such rapid growth tended to have a destabilizing effect on social and political institutions, creating vacuums for corruption, and civil strife. Thailand has long been the subject of criticism for its poor infrastructure, as improvements are often delayed by cost and indecision.

Located squarely in Southeast Asia, the nation shares a border with Burma, Laos, Cambodia and Malaysia. It shares a maritime boundary with Vietnam, Indonesia and India.

The nation’s political, commercial, industrial, cultural center is Bangkok – one of the most well-known cities in Southeast Asia. Thailand is the world’s 50th largest country by total area (smaller than Yemen and larger than Spain) and is roughly the size of the American state of Wyoming. It is the 21st most-populous country, and has approximately 64 million people. Roughly 95 percent of the nation practices Buddhism.

Interestingly, the country’s form of government is a constitutional monarchy, with King Bhumibol Adulyadej reigning since 1946 and holding the record for the world’s longest-serving current head of state. The current prime minister, Abhisit Vejjajiva, has promised to hold an election this year, but tensions between opposing political forces and the eventual death of the current king may potentially be destabilizing in the months ahead.

Corruption also remains a major issue. The nation’s Anti-Corruption Commission said that Thailand is losing close to 100 billion bhat (roughly US$3.3 billion) per year because of official corruption.

Analysts predict that real GDP will grow by 4.3 percent in 2011, contrasted with the rapid 7.8 percent growth in 2010. However, with higher commodity prices, inflation may rise in the country. Thailand’s current account balance will remain in a surplus, and thus limit its exposure to foreign economic shocks, but its percentage of GDP will fall from roughly 5 percent to 2.5 percent over the next five year period.

According to predictions made by the Economist Intelligence Unit, economic policy will continue to support low-income groups such as taxi drivers and workers with menial jobs with government spending.

Thailand’s financial institutions did not suffer tremendously from the Global Financial Crisis, as their exposure to foreign credit markets remain limited. In June 2009, the government released its Capital Market Development Master Plan, which will aim to guide the economy in 2010-2014. The plan will attempt to introduce more financial products, stronger legal safeguards, and a gradual economic opening up.

Thailand’s export industry rebounded in 2010 after a poor 2009 year due to the world economic crisis. Exports grew by 28.1 percent from 2009, with their combined value reaching US$195.3 billion. Imports also soared in 2010, rising 38 percent since the past year.

Given that Thailand’s natural resources include tin, rubber, timber, lead, and fish, it is not surprising that the country’s main export goods are computers, electrical devices, rubber, jewelry, and fishery products. Thailand is the world’s second largest tungsten producer and third largest tin producer. Thailand is also known for its tourism, textiles and garments, and agricultural processing. Thailand’s main export destinations in 2009 were the United States (10.9 percent), China (10.6 percent), Japan (10.3 percent), Hong Kong (6.2 percent), Australia (5.6 percent), and Malaysia (5 percent).

Thailand’s main imported goods are capital goods, intermediate goods and raw materials, consumer goods, and fuels. They mainly come from its neighboring Asian countries like Japan (18.7 percent), China (12.7 percent), Malaysia (6.4 percent), Singapore (4.3 percent), and South Korea (4.1 percent). The United States (6.3 percent) and the UAE (5 percent) are also Thailand’s frequent importing nations according to the CIA’s 2009 data. Roughly US$157 billion went into Thailand’s importing in 2010.

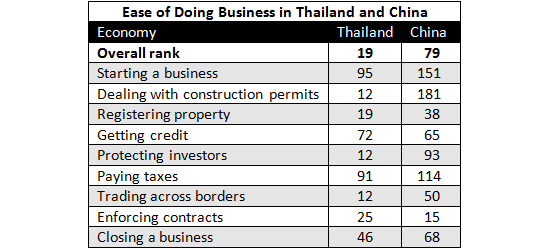

According to Economy Rankings conducted by International Finance Corporation (2010), Thailand is ranked 19th out of 183 nations regarding the ease of doing business, just below Japan ranked 18th. Although it is ranked relatively low in terms of ease of starting a business (95th), getting credit (72nd), and paying taxes (91st), it is relatively easy to obtain construction permits (12th), protecting investors (12th), and trading across borders (12th) as well as enforcing contracts (25th) in Thailand. The increased transparency and simplicity of customs procedures and crucial elements of trade facilitation now makes doing business in Thailand even easier. The trading process has shifted to paperless and corruption has also diminished over the years. If we compare this with China, where dealing with constructions permits can be extremely difficult (ranked 181st) and paying taxes even more difficult than is in Thailand (114th), Thailand may be a good alternative destination for those planning to start business in Asia.

The largest overseas investor in Thailand at the end of 2009 was Japan, followed by Singapore and the United States. The most popular foreign direct investment sector was manufacturing. Retail and wholesale trading, non-banking financial institutions, and real estate were also targets of foreign direct investment.

The largest overseas investor in Thailand at the end of 2009 was Japan, followed by Singapore and the United States. The most popular foreign direct investment sector was manufacturing. Retail and wholesale trading, non-banking financial institutions, and real estate were also targets of foreign direct investment.

Foreign direct investment reached US$4.71 billion from January to October 2010, which was a 17.7 percent increase from the same 10-month period in 2009. In 2010, an improved benefit for foreign investors with regional operating headquarters in Thailand was that businesses may now qualify for a full waiver of corporate taxes for 15 years on income earned from services for companies overseas. Indeed, the trend of rising favorability for foreign investment is one that contrasts directly with the trend occurring in China at this time.

Various incentives are provided through Thailand’s Board of Investment and the Industrial Estate Authority of Thailand to attract foreign capital. Policy states that preference is given to investment projects that are located in provincial areas (in particular, Greater Bangkok). Agricultural projects, ones related to technological and human resource development, projects that improve public utilities and infrastructure, and ones that pose solutions for natural resource conversation are also given special treatment.

Thailand was among the first countries in Asia to introduce programs to promote foreign investment. Under the Investment Promotion Act, both tax and non-tax incentives are provided.

Some examples are:

- Value added tax (VAT) is applied at a rate of 0 percent to exported goods. Customs duties on exported goods are generally exempted except on certain goods and agricultural products

- Import duty reduction/exemption on machinery and raw or essential materials

- Corporate income tax exemption for one to eight years

- Double deduction from taxable income of transportation, electricity, and water costs

- Tax exemption for dividends paid out of the exempted profits during the tax exemption period

- Tax exemption for fees for goodwill, copyright, or other rights received from a promoted activity

- Exemption from customs duties on imported goods is granted to member countries of certain international organizations or agreements such as the Association of Southeast Asian Nations, the ASEAN Free Trade Area, the Thailand and Australia Free Trade Agreement, the Thailand and New Zealand Free Trade Agreement, the Japan-Thailand Economic Partnership Agreement, and the Agreement on Comprehensive Economic Cooperation between the Association of South East Asian Nations and the People’s Republic of China

Industrial operators are given the right to own land in the industrial estate’s area, to obtain work permits for foreign technicians and experts, and to remit foreign currency freely abroad. Those who set up shop in Export Processing Zones are provided further tax-based privileges.

Regional operating headquarters, a company incorporated in Thailand in order to provide managerial, technical, or supporting services (“qualifying services”) to its associated branch, are also given additional tax benefits. Privileges include a reduction of corporate tax income from 30 percent to 10 percent on net profits derived from services, royalties, and interests on loans, tax exemption from dividends received from associated enterprises, and accelerated depreciation for buildings used in regional operating headquarters.

The investor must submit an application form along with supporting documentation to the BOI to be considered for incentives. The processing of an application typically takes two to three months.

Like other large industrializing nations in the region, Thailand is a member of the World Trade Organization and thus is bound by the Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS).

Under Thai law, the principal forms of business organization are sole proprietorship, partnership (unregistered ordinary partnership, registered ordinary partnership, and limited partnership), limited company (private company limited and public company limited), representative office, branch office, regional office, and regional operating headquarters.

The Foreign Business Act requires Thai-majority ownership in activities such as farming, fishery, land trading, mining, wholesale/retail, restaurant, and various service activities. Other laws such as the Telecommunications Act, Insurance Act, Financial Institution Business Act, Travel Agency Business and Guide Act, and Private School Act also limit foreign equity ownership.

Regarding infrastructure, there are currently 39 major airports in Thailand and the railway system is the most popular means of transportation. The railway stretches from Bangkok to even remote areas in Thailand. The railroad also crosses over into neighboring countries such as Malaysia and Singapore. Trains are well-equipped for longer trips and are clean as well as punctual.

Active international trade is conducted through Thailand’s ports. Klong Toey Port on the Chao Phraya River is where approximately 85 percent of Thailand’s trade takes place. Much international trade also occurs at the deep seaports located on the eastern coast and the southern coast of Thailand.

Thailand’s public transportation is in the process of being overhauled to compensate for Bangkok’s notoriously congested traffic jams. Interestingly, Thailand is within the world’s top-five markets for pickup trucks, illustrating both Thailand’s high level of commerce as well as the degree of congestion present in the developing nation.

Thailand’s telecommunications industry has come a long way over the past decade, measured by the increase in usage of fixed-line telephone systems and the wide-spread availability of cellular, paging and other technology. However, Thailand’s teledensity remains very low, indicating both an opportunity for potential growth in the sector, as well as a potential hindrance to conducting business.

Related Reading

The China Alternative

The China Alternative

Our complete series on other manufacturing destinations in Asia that are now starting to compete with China in terms of labor costs, infrastructure and operational capacity.

China’s Neighbors

China’s Neighbors

This unique book is an introductory study of all 14 of China’s neighbor countries: Afghanistan, Bhutan, India, Kazakhstan, Kyrgyzstan, Laos, Myanmar, Mongolia, Nepal, North Korea, Pakistan, Russia, Tajikistan and Vietnam.

Operational Costs of Business in China’s Inland Cities

Operational Costs of Business in China’s Inland Cities

It is widely held that land and labor costs in inland provinces offer quite significant cost savings over major east coast and southern cities. In this issue, we take a quick look at the numbers behind these beliefs.

Coastal China, Inland China, India or Vietnam for Your Sourcing Business?

- Previous Article Rising Demand, Supply Shortage to Cause Logistics Costs in China to Skyrocket

- Next Article Xinjiang to Become More Accessible for Foreign Investors