Conducting Due Diligence in China and India

Op-Ed Commentary: Chris Devonshire-Ellis

Sept. 16 – One of the side benefits of having a presence in two of the largest countries in the world is the bilateral trade issue. In both China and India, our firm Dezan Shira & Associates handles principally foreign direct investment into each country. That includes legal establishment advice, tax considerations, business advisory and ongoing compliance issues such as accounting, payroll and so on.

Sept. 16 – One of the side benefits of having a presence in two of the largest countries in the world is the bilateral trade issue. In both China and India, our firm Dezan Shira & Associates handles principally foreign direct investment into each country. That includes legal establishment advice, tax considerations, business advisory and ongoing compliance issues such as accounting, payroll and so on.

While traditionally about 45 percent of our client base is from North America and a further 35 percent from Europe, increasingly our presence in China and India is resulting in an upsurge in the amount of clients we have from these two countries. That it should is no real surprise – bilateral trade reached US$60 billion last year and is growing at 40 percent annually. That’s a fact noted by the president of the Industrial & Commercial Bank of China, who stated upon opening his bank’s first branch in Mumbai yesterday that India’s economic performance over the last few years has attracted the bank to the country, and that the bank “would like to facilitate trade and economics between the two countries.”

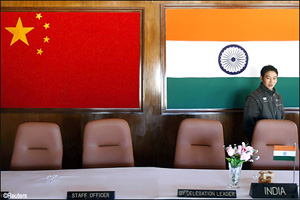

That’s a position Dezan Shira & Associates obviously endorses. However, the relationships between China and India have not always been easy. The two countries fought a brief war in 1962, and there remain on-going territorial disputes. Additionally, many Indian businessmen were financially burned in China in the early boom years of the 1980s, where perhaps Chinese honesty was not all it should have been. India too, has been played up in China as being dirty and poverty-stricken. The result has been a business environment between the two that remains cautious, yet is obviously blossoming. As a consequence of that caution, our firm has had from both sides a steady stream of due diligence requests concerning the checking out of companies in both countries. This knowledge of course is of equal value to other foreign investors or traders with China and India.

There are a number of differences between them, not least a double layer of due diligence sometimes required in China, as some 85 percent of its larger, international businesses are state-owned. That can require an examination of government and any political risks that may ensue. Chinese businesses are keen to stress government involvement as they know it implies a type of guarantee. However, all too often it can mask promises made that are not in fact legally supportable. In India however, it’s the reverse, as about 85 percent of its larger international trading companies are privately held, which makes examining them rather easier. A further difference lies in that India has a reasonable public records infrastructure, whereas in China much is cloaked in secrecy and public records are not always readily available.

We can examine the basic issues between the two as follows:

Due Diligence in China

There are three primary reasons we get asked to conduct due diligence on a company in China. At the basic end, it to ascertain the company are who they say they are (and exists). This type of enquiry normally comes from businesses who want to either buy from or sell to a Chinese company, and the work involves checking the business license and related documentation, creditworthiness and supplier worthiness. We may also examine the contractual agreement with the China entity to ensure it sufficiently protects the foreign party (Dezan Shira & Associates have long had a legal services team in each of our offices) and deals with issues such as arbitration, payment of applicable taxes and duties and so on. In cases where the contract value is sufficiently large, a site visit may also be undertaken. It is this type of work that is most common – foreign trade with China is of course huge, and there are hundreds of thousands of overseas SMEs all looking to do business with Chinese companies.

Such due diligence is not expensive in fact, and can fairly readily be undertaken. It helps of course that our practice has its own extensive China presence (12 offices) and that we’ve been in business in China for nearly 20 years. Still, it does sometimes surprise me the number of times we are also contacted to recover a debt, or deal with problems that have arisen in China. In all such instances, no due diligence was undertaken beforehand.

These problems are indicative that undertaking at least an early, basic form of due diligence in China both provides greater peace of mind, significantly reduces risk of a bad transaction, and also alerts the China side that you’re not going to be monkeyed around. It should also be pointed out that in China, it is relatively easy to develop accounts receivables and bad debt from Chinese companies as they seem to often regard it as their right to lessen the impact on their business of actually paying out cash. It should also be recognized that many companies in China are experiencing cash flow difficulties at this moment. Due diligence checks on the company’s previous behavior and current ability to meet obligations should be a prerequisite, especially in the current economic climate.

Moving up the due diligence path, we start to get beyond the basic legal administration aspect of due diligence in China and begin to include some of the financials. This phase kicks in either with more substantial contractual arrangements, or when a client wishes to establish a joint venture, or other business partnership with a Chinese company. Here, the previous steps apply but with the addition of examining in more detail the company legal structure, ownership, third party relationships, inventory of assets and their value, the operating P&L, and audited accounts. This last part is where difficulties can arise, as the official audited accounts as presented to the government are often not the true position of the company. China is not efficient or effective in auditing its domestic businesses, and tax evasion is rife. Although the deliberate understating of profits may seem of little concern to the JV partner, it is symptomatic of a problem that needs to be addressed should the JV proceed, and that is getting accounts into compliance. This is of especial concern to U.S. corporations and FCPA/SOX compliance. You don’t want to inherit non-compliant problems from a Chinese partner well-used to ducking and diving.

On the legal side, work conducted should include examining the status and true value of land use rights, as these are typically used by the Chinese side to justify their equity position. It is important that these are not inflated, are the correct type of rights, and are checked off against the local land bureau records. There are more cases of overstating the value of land use rights than any other mechanism to try and get the foreign investor to put in more cash. More legal work continues with the negotiation and structuring of contracts, and especially JV contracts. If the company is partly or fully state owned, additional research may need to be done to ascertain exactly which level of government is involved, whether any favoritism exists because of this (this can instead end up as a liability), and any political risk in terms of the personnel involved.

The last area revolves around the intensive due diligence that needs to be done when preparing a prospectus for listing. This involves all of the above, yet specific care needs to be taken when evaluating hidden liabilities. These can arise in a number of ways, from inventory problems, to underpayment of social welfare and human resources, to on-going litigation, obscure third party transactions, and a whole host of accounting and compliance issues. A lack of detailed due diligence in this area, coupled with greed by many PE firms, has led to an explosion of exploitative Chinese companies acquiring listings in North America, as Paul Gillis outlined in the Wall Street Journal this week. This could, and should, have been avoided by the execution of properly structured and inquisitive due diligence at the front end.

We have written extensively about due diligence in China over the years, and have been involved in many examinations. It always has been a core part of our China practice. Recent additional intelligence from the firm concerning due diligence in China can be obtained here:

Running Background Checks on Chinese Companies

Analyzing Chinese Financial Reporting

Reevaluating China Joint Ventures and M&A

Due Diligence in India

One of the main issues in India that differs from China is the concept of a democratic state, which means that there is rather more diversity among different Indian states than among China’s provinces. This diversity extends more in India to differences in laws that will affect the foreign investor, including issues concerning employment, land use, and scope of permissible activities. In China, although there is variance, in India this is more pronounced. This means that state laws in India need to be examined, especially for bigger ticket investments, in addition to company evaluation.

However, as in China, the same criteria broadly apply in terms of identifying key areas of due diligence. One aspect that is an advantage in India is that the various government departments that hold records are both far more accessible in India than in China, and are actually rather better organized from an IT perspective. The fact that in India, legislation is always translated accurately into English – which is an official language in India (it is not in China) also makes it easier for the foreign investor to extract and understand due diligence intelligence.

Once again, the larger volume of the due diligence work in India we conduct is at the more basic level, which is indicative of an increasing number of international SMEs coming to trade with Indian companies. Fairly basic checks, such as examining the business license and checking creditworthiness, are relatively straight forward in India and an additional bonus is that filed accounts are also kept on public record, as are details of any legal actions. This means that discreet checks can be conducted on an Indian company without the business being aware it is being examined. Again, these basic level checks are not expensive and will reveal much about the level of transactional risk associated with the target business.

More detailed checks need to be undertaken when entering into partnerships or joint ventures in India, and it can be key to ascertain exactly who you are dealing with. This means examining not just the company, but the directors and shareholders if need be, and their own creditworthiness and third party business and political connections. Due to the structuring of India’s social welfare system, what would normally be one entire company elsewhere can be split up into different entities in India. The reason for this is that Indian companies must contribute to their employees Provident Fund (social welfare) when they reach a headcount of 20 employees. That triggers a mandatory overhead of 12 percent of employees’ salary to be paid by the employer, and means that what often would normally be business divisions are instead divided up into separate legal entities. This has obvious implications when wanting to get involved with a partnership, joint venture or M&A in India, as the foreign investor needs to be sure he has both a contract with the correct entity and that all the necessary component parts of the business are involved! This is less of a problem with larger MNCs, but can be an issue when making arrangements with successful medium sized businesses that have not yet adapted their business model to fit a more corporate structure.

Accounts of course need to be examined, as do business licenses and permits in the required industry. On the whole, India is more flexible than China in its business licensing as concerns foreign investment, and relatively wide scopes of business can be attached to a single license in a manner that is not always possible in China. However, restrictions are in place for foreign investment in a number of key areas, especially the retail sector, and care needs to be taken when structuring the proposed foreign investment into these industries. As is the case in China, what may be permissible for domestic participation may be limited when foreign enterprises becomes involved.

However, by and large, Indian companies tend to be less opaque than their Chinese counterparts, and the level of transparency tends to be rather better the further up the corporate ladder. This may have something to do with the makeup of Indian companies, where state involvement extends only to the larger and nationally strategic industries. With a free media and courts, and a government that stands aside, Indian entrepreneurs are more encouraged to be in compliance – or face imprisonment – than in China, where often issues are dealt with “internally.” We see less obvious attempts to obscure the truth of corporate background in India than in China. I may also add that Indian companies have a better habit of paying their bills than Chinese companies do, a behavioral factor that (when coupled with the necessary due diligence) creates, in my experience, less inherent risk of bad debt or later transactional problems.

Land use issues can also be problematic in India, with politicians sometimes eager to get involved and whip up trouble, especially in a democracy and in particular if poorer people such as Farners, could be displaced. Unlike China, these individuals have the vote in India, and that can mean political interference from local politicians, especially if they need to be seen on the side of the underprivileged. Accordingly, it can be important to conduct local studies to evaluate the potential for any political capital being made from a potential investment. It happens – Tata Motors, who had already purchased land and broken ground on a new factory, faced demonstrations and political pressures to pay more. The standoff became so intense the company gave the project up and relocated it elsewhere (probably not without wrangling tax concessions from the state, but that’s another story). Still, land use rights, a fair deal and the ownership of the land, together with the local political landscape, do need to be taken into consideration in India. West Bengal for example, until recently, had a communist party government in place, and although they have subsequently been voted from office, their policies towards labor protectionism and unionization were often too much for investors to swallow. The local political environment needs to be taken into account rather more in India than it does in China. It is, quite simply, the democratic effect that kicks in.

We have conducted many due diligence and research exercises in India, where we also have the national benefit of a five-office infrastructure. Recent additional intelligence concerning the conducting of due diligence in India can also be obtained here:

Conducting Due Diligence in India

I am often asked about the differences between China and India in business. While in many ways they can be the same, in as many ways again they can be completely different. It is the local knowledge that counts, and the understanding of this across China, where provincial level influences, especially as local regulations, but also local policies, can determine the potential success or failure of an investment. The same is true of India. Acquiring due diligence knowledge and intelligence from on-the-ground resources is a must. Especially with growth rates of 8 percent each and the huge domestic markets China and India possess, the demand to conduct business with companies in both countries has never been greater. That due diligence plays a part in determining who is successful is beyond a doubt in these emerging, yet globally vibrant economies.

Chris Devonshire-Ellis is the founding partner of Dezan Shira & Associates. The firm provides legal establishment, tax compliance, and due diligence services throughout China and India. To contact the firm in China, please email china@dezshira.com. To contact the firm in India, please email india@dezshira.com. The firm’s web site is located at www.dezshira.com, while the brochure may be downloaded here.

Related Reading

Doing Business in China

Doing Business in China

Our 156-page definitive guide to the fastest growing economy in the world, providing a thorough and in-depth analysis of China, its history, key demographics and overviews of the major cities, provinces and autonomous regions highlighting business opportunities and infrastructure in place in each region. A comprehensive guide to investing in China is also included with information on FDI trends, business establishment procedures, economic zone information, and labor and tax considerations.

Doing Business in India (Second Edition)

Doing Business in India (Second Edition)

This book aims to provide a basic overview of all topics related to doing business in India – history, business etiquette and culture, and how to invest into the country, in addition to a detailed, state-by-state demographic and geographic overview and a comparison with China.

Doing Business in East China

Doing Business in East China

China Briefing’s recent “Doing Business in East China” book written specifically for Indian businesses has been made available for complimentary PDF download on the Asia Briefing Bookstore. Covering the regions of Shanghai, Jiangsu Province and Zhejiang Province.

Conducting Due Diligence in China

Conducting Due Diligence in China

In which we take the overseas executive through varying stages of legal, financial and operational due diligence and highlights common areas of concern. Importantly, the report discusses areas of manipulation that can exist in the examination of Chinese companies, including legal documentation, techniques of assessing financial statements, asset checks such as land use rights, fraud within human resources claims and how to evaluate government involvement and liabilities.

China Briefing – Financial Management

China Briefing – Financial Management

This issue of China Briefing details FCPA regulations, fraudulent accounting practices within Chinese companies and due diligence issues for IPO listings. It also covers PRC GAAP regulations, compliance with them and the differences between EU and U.S. standards.

Increased Expat Costs in China May Relocate Many to India

- Previous Article China Supports London’s Development as Offshore RMB Market

- Next Article China to Simplify Forex Control System