Triggering China Permanent Establishment Status for Short-Term Expatriate Employees

Care is required when assessing the PE boundaries when engaging in short-term projects in China without possessing a legal establishment in the country

Jan. 28 – With many foreign companies with no China presence sending expatriate staff on short term contracts to work in the country, special consideration needs to be paid to what constitutes triggering permanent establishment (PE) status, and the increased tax liabilities of doing so. The details for how this occurs vary, and are buried in the details of the many and various double tax agreements that China has with other countries.

In double taxation agreements (DTAs), the concept of permanent establishment determines whether a contracting state can tax the business profits of a resident enterprise of the other contracting state.

A PE generally refers to “a fixed place of business through which the business of an enterprise is carried on in a country.” However, PE also includes the provision of services by an enterprise through the dispatch of its employees or other personnel to the Contracting State if it continues within the Contracting State for a period or periods aggregating more than six months or 183 days within any twelve month period.

Currently, China has DTAs in place with 97 countries plus Hong Kong and Macau. Previous DTAs adopt the six months rule, while new DTAs utilize the 183 days rule. Countries adopting the six months rule include Switzerland, Norway, Italy, France, U.S., Germany, New Zealand and the UK. Countries adopting the 183 days rule include Singapore, Hong Kong, Macau, Belgium, and Finland.

How are six months counted?

According to Circular No. 403, provision of services in China for a single day in a month is considered as provision of services for that entire month. However, if no expatriate is in China to perform relevant services for 30 consecutive days, one month is deducted.

This method of calculation was invalidated in January 2011. However, there has been no regulation replacing it so far and tax authorities continue to adopt this method of calculating the six month period.

How are 183 days counted?

Circular 75, released by the SAT in September 2010, provides a detailed interpretation of the 2007 DTA between China and Singapore, and is often applied to similar provisions in China’s many other tax treaties.

We can examine the China-Singapore DTA as a case study below:

According to Circular 75:

- The 183 days is counted from the date on which the employee(s) of the Singaporean enterprise first arrives in China to provide the services, until the date on which the services are completed and delivered;

- Days spent in China by all employee(s) of the Singaporean enterprise on the same project should be counted;

- If multiple employees work in China on the same day, that day should be counted as one day but not repeatedly. For example, where a Singapore enterprise dispatched 10 personnel to work in China for 3 days for a certain project, the employees will be deemed to have worked in China for 3 days, rather than 30 days;

- Where a service project lasts for several years, but the 183-day threshold is met within only one 12-month period, a PE will still be constituted with regard to the entire project.

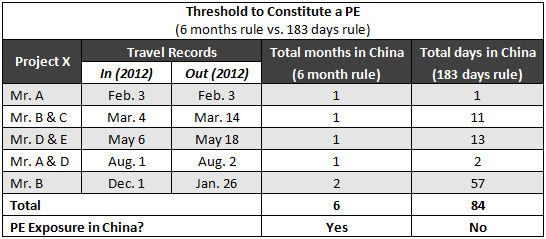

As reflected in the table below, the threshold for constituting a PE is much lower under the six month rule. Therefore, depending on whether the six months rule or 183 days rule applies, the result of whether a PE is constituted varies.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For advice on the potential tax liability status for companies without a presence in China and for assistance with individual short-term employees tax status in the country, please email tax@dezshira.com or visit www.dezshira.com.

Related Reading

An Introduction to Doing Business in China

An Introduction to Doing Business in China

Asia Briefing, in cooperation with its parent firm Dezan Shira & Associates, has just released this 40-page report introducing everything that a foreign investor should be familiar with when establishing and operating a business in China.

Annual Compliance, License Renewals & Audit Procedures

Annual Compliance, License Renewals & Audit Procedures

In this issue of China Briefing Magazine, we discuss annual compliance requirements for China foreign-invested entities and detail the full audit processes for representative offices, wholly foreign owned enterprises, and joint ventures in China. We also discuss IIT liability for expatriates in China, IIT rates and calculation methods, permissible tax deductions, and how working for a permanent establishment can change tax liabilities.

The Asia Tax Comparator

The Asia Tax Comparator

Here we discuss corporate income tax, value-added tax, business tax, goods and service tax, withholding tax, and individual income tax as these apply in China, India, and Vietnam, and in the popular holding company destinations of Hong Kong and Singapore. This includes tax rates, descriptions, incentives, and deadlines, as well as main FDI source countries/regions and industry-specific notes.

Double Taxation Avoidance Agreements

Double Taxation Avoidance Agreements

In this issue, we look at the evolution of the legal framework of double taxation agreements in China, including the foundations of anti-avoidance, obligations in reporting offshore transactions, how to qualify as a beneficial owner and how to claim treaty benefits. We also outline the interpretations given in Circular 75 of the China-Singapore DTA, which was the first time that the Chinese tax authorities really opened up about DTA interpretations.

- Previous Article China’s SAT Releases Clarifications on Capital Gains Under DTAs

- Next Article Hong Kong and Italy Sign Comprehensive DTA