Coffee Trading in China

In a nation of avid tea drinkers, coffee continues to gain ground.

By Nathan Barlow

Oct. 18 – Coffee first made its initial appearance in China when a French missionary in the 1890s planted beans throughout Yunnan Province. Over the next hundred years, coffee would go largely unnoticed but, as is the case with many things in China, the market has changed quite a bit over the last 20 years.

This is part two of a three-part series detailing various facets of China’s coffee industry, and this article focuses on trading coffee in China. Part one, introducing the China’s coffee industry, can be found here, while part three, detailing domestic production, can be found here.

With regards to coffee trading in China, there are essentially two key methods for importing coffee into the country:

- Using a broker; or

- Through direct trade.

Importing from a broker is often easier and minimizes the complex import challenges associated with bringing beans into China from numerous countries with varying regulations. Using a broker is specifically advantageous for small-scale coffee roasters or cafés that require a wide range of beans sourced from different countries in relatively small quantities. However, direct trading is more advantageous for café franchises or large-scale roasters that import a high quantity of beans.

Importing

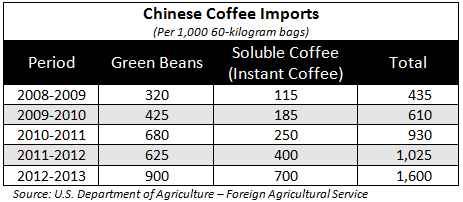

China has seen a rapid increase in the amount of coffee coming into the country in recent years, with coffee imports increasing by roughly 43 percent over 2012-2013.

From 2007 to 2011, China imported 137,000 tons of coffee. Of that, 103,900 tons were imported from Vietnam – accounting for over 75 percent of China’s coffee imports and 90 percent of ASEAN’s total coffee exports to China. In addition, during the first half of 2012, China had already imported 15,000 tons of coffee from Vietnam – continuing this trend.

Exporting

China’s coffee exports are unique because one province in the south, Yunnan Province, accounts for nearly 98 percent of the country’s total coffee production (followed by Hainan Province as a distant second).

Of Yunnan’s total coffee harvest, about 70 percent is exported to various countries throughout the world, including Germany, Japan, South Korea and the United States.

Establishing a Trading Company

Before establishing a trading company in China and importing/exporting coffee, it is important to understand the numerous rules and regulations associated with doing so. Firstly, you have to understand what it is exactly you are trading in both Chinese and English, and the corresponding classification standards. Below is a list of the various coffee related items for import along with their respective HS Code and Chinese name.

- Shells/Husks 0901901000 (咖啡豆荚及咖啡豆皮)

- Instant Coffee 2101120000 (以咖啡为基本成分的制品)

- Concentrated Coffee 2101110000 (咖啡浓缩精汁)

- Coffee Bean:

- Unroasted coffee with caffeine – 0901110000 (未浸除咖啡碱的未焙炒咖啡)

- Roasted coffee with caffeine – 0901210000 (未浸除咖啡碱的已焙炒咖啡)

- Decaffeinated roasted coffee – 0901220000 (已浸除咖啡碱的已焙炒咖啡)

To establish a coffee trading company in China, the most common entity type used is the foreign-invested commercial enterprise (FICE). A FICE is a common structure for conducting business in China as it is the most appropriate type of business structure available for foreign traders wishing to conduct the following activities:

- Expand their sourcing platform and take direct care of logistics and quality control;

- Purchase for the purpose of reselling finished or semi-finished products in China as an intermediary between Chinese suppliers and foreign China-based clients;

- Import goods to China to sell directly, either in wholesale or retail;

- Establish a fully operational China sales and after sales platform; and

- Act as a business support and liaison office for their overseas headquarters, including setting up other branches and employing staff on a national basis.

For more information regarding the scope of business covered under a FICE, the difference between a wholesale/retail FICE, and basic set-up requirements of a FICE, please see our article “Establishing a Trading Company in China” or contact the experts at Dezan Shira & Associates at china@dezshira.com.

Requirements for handling import-export food labeling

- Application form for import and export food-labeling verification;

- Business license from the producer and distributor;

- Seven food label samples – the samples should be complete labels that are identical to those which will actually be used during the import-export and retail processes;

- When claims have been specifically emphasized on the food labeling (for instance: natural ingredients, high calcium, low in calories), or there are claims about age, wine storage time, or other special qualities, the producers or distributors should provide explanatory materials for these characteristics;

- The imported food labeling should also include the official certificate allowing its sale in the country of origin and certificate stating its production origin;

- The exported food labeling should also provide the export sanitation license – applicants should affix the official seal to the application materials;

- All of the imported food’s information that is in English must be translated to Chinese;

- Two copies of all the application materials must be provided (including translations of the imported food label) and seven food label samples are required – one of each for an entrusted third party inspection organization, one application copy and six food label sample copies for the General Administration of Quality Supervision, Inspection and Quarantine;

- Ensure that the characters, images, and symbols on the food label samples are legible and complete – the food label samples must be submitted in paper format and no larger than A4 paper; and

- For imported food that requires a Chinese food label to be attached to it, the Chinese label should be attached in a fixed position on the principal layout page. The applicant should submit a complete label with the Chinese food label attached (the position and content of the attached food label in Chinese should be the same as the one which passed the earlier verification).

We cover the certifications for goods imported into China in detail in the October issue of China Briefing Magazine, titled “Selling to China.”

Dezan Shira & Associates is a specialist foreign direct investment practice providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email china@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across Asia by subscribing to Asia Briefing’s complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

Selling to China

Selling to China

In this issue of China Briefing Magazine, we demystify some complexities of conducting business in China by introducing the main certification requirements for importing goods into the country; the basics of setting up a representative office; as well as the structure and culture of State-owned enterprise in China. Finally, we also summarize some of the export incentives available in several key Western countries.

Trading With China

Trading With China

This issue of China Briefing Magazine focuses on the minutiae of trading with China – regardless of whether your business has a presence in the country or not. Of special interest to the global small and medium-sized enterprises, this issue explains in detail the myriad regulations concerning trading with the most populous nation on Earth – plus the inevitable tax, customs and administrative matters that go with this.

E-Commerce in China

E-Commerce in China

In this issue of China Briefing Magazine, we cover the current laws pertinent to the e-commerce industry in China, as well as introduce the steps involved in setting up an online shop in the country in order to help provide foreign investors with an overview of the e-commerce landscape in China.

Sourcing From China

Sourcing From China

In this issue of China Briefing Magazine, we outline the various sourcing models available for foreign investors and discuss how to decide which structure best suits the sourcing needs of your business. Perhaps the most important factors to consider when choosing a sourcing structure are your staffing requirements, your need for operational flexibility, and which option offers the greatest cost efficiencies. We compare how each of these factors match up with the available sourcing platforms in order to help foreign businesses find the best option for their specific sourcing needs.

- Previous Article Shanghai Gov’t Issues Q&A on Shanghai Free Trade Zone Administrative Measures

- Next Article China to Boost Rights of Small and Medium Investors