Optimizing Employee Take-home Pay in China through Annual Bonuses (Part 2)

SHANGHAI — According to a survey conducted by China Youth, 36.2 percent of employees considered their annual bonus to be a major factor in whether or not they will change jobs in the next year. When determining bonuses, it is critical that employers pay close attention to the calculation of individual income tax (IIT), as this can considerably diminish employee take-home pay. In this second part of a two-part article, we discuss how to calculate IIT for foreign employees, as well as provide tax planning advice for employers.

IIT on the annual bonuses of foreign employees should be calculated based on their residency status in China, as explained below.

- For foreign employees with residency in China

If a foreign employee has residence in China, he/she shall be subject to the same IIT calculation method as Chinese employees (see part one of this article). The employer should first divide the lump-sum annual bonus by 12 to determine the applicable tax rate and quick deduction amount. The applicable formula will be:

IIT on lump-sum annual bonus = lump-sum annual bonus x applicable tax rate – corresponding quick deduction amount

- For non-resident foreign employees

According to “Guo Shui Fa [1996] No.183”, a non-resident foreign employee’s annual bonus should be regarded as an additional one-month of his/her wage, meaning that the lump-sum annual bonus should be used directly (rather than the lump-sum annual bonus divided by 12) to determine the applicable tax rate and quick deduction amount. The Tax Law stipulates that no expenses shall be deducted from this amount.

For example, if non-resident foreign employee “A” receives a lump-sum annual bonus of RMB 40,000, according to the chart given in part one of this article, the applicable tax rate should be 30 percent, and the quick deduction amount should be RMB 2,755. The applicable IIT should be calculated as follows:

IIT on lump-sum annual bonus = RMB 40,000 x 30% – RMB 2,755=RMB 9,245

Additionally, if a non-resident foreign employee works both in China and overseas at the same time (e.g., the employee works in a multinational company), the IIT on his/her annual bonus should be calculated based on how many months he/she has resided in China.

NOTE: The employee should be taxed for a full month even if he/she only works for one day in that month within China. The applicable formula shall be:

IIT on lump-sum annual bonus = (lump-sum annual bonus x months working in China / 12 months) x applicable IIT rate – corresponding quick deduction amount

For example, if foreign employee “B” receives a lump-sum bonus of RMB 60,000 and he works for five months and two days within China. According to the chart, the applicable tax rate should be 25 percent (RMB 6000 x 6 months / 12 months = RMB 30,000), and the quick deduction amount should be RMB1,005. IIT should be calculated as:

IIT on lump-sum annual bonus = (RMB 60,000 x 6 months / 12 months) x 25% – RMB 1,005 = RMB 30,000 x 25% – RMB 1,005 = RMB 6,495

Notably, if a non-resident foreign employee happens to be the director or senior manager of an enterprise registered in China (including a branch, regional headquarters or representative office), the IIT on his/her annual bonus should be paid based on his/her tenure as a senior manager, even if he/she also works outside of China. The employer should use the employee’s lump-sum bonus to directly determine the applicable tax rate and quick deduction amount. The applicable formula will be:

IIT on lump-sum annual bonus = lump-sum annual bonus x applicable tax rate – corresponding quick deduction amount

As previously mentioned, employers are able to reduce the overall tax burden of their employees through careful balancing of salaries and bonuses. To illustrate, if an employee “C” receives an annual bonus of RMB 420, 000, and another employee “D” receives a total of RMB 420,001, assuming their salary income is higher than the deductible amount of expenses stipulated in the Tax Law, then:

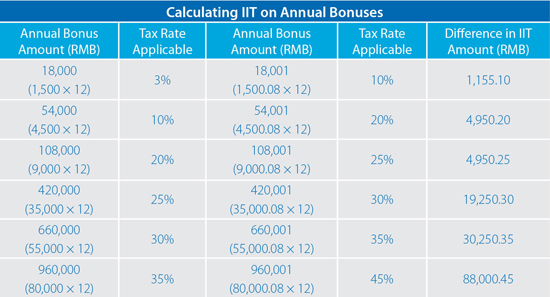

In the example above, D’s lump-sum annual bonus is actually RMB 1 more than C’s, but D’s take-home pay turns out to be RMB 19,249.30 less than C’s. This is the so-called “more is less” phenomenon in China’s annual bonus system. Thus, employers should pay close attention to numbers hovering around the threshold of each progressive tax bracket (see chart below).

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com.

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com.

Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

Related Reading

The China Tax Guide: Tax, Accounting and Audit (Sixth Edition)

The China Tax Guide: Tax, Accounting and Audit (Sixth Edition)

This edition of the China Tax Guide, updated for 2013, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in China, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who need to be able to navigate the complex tax and accounting landscape in China in order to effectively manage and strategically plan their China operations.

Social Insurance in China

Social Insurance in China

In this issue of China Briefing Magazine, we introduce China’s current social insurance system and provide an update on the status of foreigners’ participation in the system. We also include a comprehensive chart of updated average wages across China, which is used to calculate social insurance contribution floors and ceilings. We hope this will give you a better understanding of the system in China.

Revisiting China’s Value-Added Tax Reform

Revisiting China’s Value-Added Tax Reform

In this issue of China Briefing Magazine, we review recent steps taken by the Chinese government to reform its value-added tax policy. Specifically, we examine the sectors covered by the new Pilot Reform program with a focus on tax rates, taxpayer status and the calculation of VAT. We also include a VAT Pilot Reform Rates Chart, which overviews each affected industry’s tax rate and VAT exempted services.

- Previous Article Logistics in the Shanghai Free Trade Zone

- Next Article Tax, Accounting, and Audit in China 2014-2015 (Pre-Orders Open)