Investing in China’s Education Industry

By Roy K. McCall

China has the longest education tradition of any country. Beginning in the Han Dynasty, education formed the basis of China’s meritocracy for climbing the social ladder into the emperor’s presence. Educational rigor has fundamentally shaped China’s ambitious spirit and tenfold economic growth in the past two decades. This may never have happened without China’s respect for competitive pressure fostered by its long veneration of education.

One of the fastest growing education market segments in the country is K-12 (after school tutoring for kindergarten through 12th grade). Spending on K-12 has been growing faster than the Chinese economy and in 2014 may amount to around US$66 billion. Chinese households now spend 30 percent of their income on education, higher than both Korea (22 percent) and Japan (10 percent).

Yet, the proportion of households with children enrolled in additional K-12 education is only 30-35 percent, compared to 70-90 percent in Korea. In China, no one company dominates the market, with none controlling more than 1 percent of the total share and the top five sharing just 3 percent. China’s K-12 education market is large, growing and fragmented.

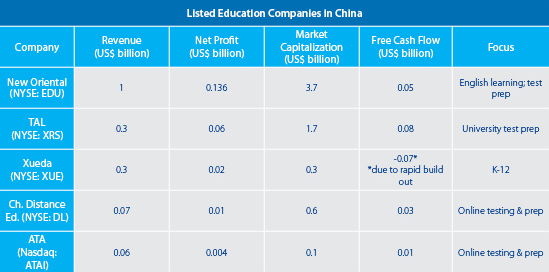

In recent years, several Chinese K-12 firms have listed on the New York Stock Exchange. During the past three years these stocks have suffered, like most Chinese stocks listed abroad, as a result of investor cynicism over reporting transparency. But in the past year, investor interest in these listed stock has revived. Early in 2014 this group of educational stocks tripled in value from their lows in the past two years, then fell back around 20 percent by mid-May but still trade at generous (20-30x) P/E ratios. Clearly, the market is voting with confidence in their prospects for profit generation.

Another education segment is online professional testing, used to certify professionals in areas of accounting, law and finance. Taken together with vocational training, this education market may be worth roughly US$30 billion. Two such listed companies are China Distance Education (NYSE: DL) and ATA (Nasdaq: ATAI). Both are expanding in double digits, with DL by far the fastest growing, at roughly 40 percent.

China’s education industry presents a rich, albeit immature, field of investment opportunities, with its highest growth in niche markets. One example of a firm that overextended itself and lost shareholder confidence as a result is AMBO Education, which failed to file financial statements and was delisted from the NYSE in 2013.

At least two opportunities should be directly obvious to foreign investors. As China becomes more affluent, more families can afford to educate their children abroad and will need to pay for language and entrance testing preparation.

At least two opportunities should be directly obvious to foreign investors. As China becomes more affluent, more families can afford to educate their children abroad and will need to pay for language and entrance testing preparation.

Secondly, as China’s population ages, more people might be willing to pay for professional examination preparation and testing. As reputations are challenging to build in a fragmented market where scale is the key to success, investors will need patience to succeed.

Roy K. McCall CFA/CPA was invited by the PRC Ministry of Education in 1995 to teach at the MBA level in China, where he wrote a private text for his students Measuring, Managing and Improving Performance – integrating strategy, marketing and finance.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

![]()

Adapting Your China WFOE to Service China’s Consumers

Adapting Your China WFOE to Service China’s Consumers

In this issue of China Briefing Magazine, we look at the challenges posed to manufacturers amidst China’s rising labor costs and stricter environmental regulations. Manufacturing WFOEs in China should adapt by expanding their business scope to include distribution and determine suitable supply chain solutions. In this regard, we will take a look at the opportunities in China’s domestic consumer market and forecast the sectors that are set to boom in the coming years.

Strategies for Repatriating Profits from China

In this issue of China Briefing, we guide you through the different channels for repatriating profits, including via intercompany expenses (i.e., charging service fees and royalties to the Chinese subsidiary) and loans. We also cover the requirements and procedures for repatriating dividends, as well as how to take advantage of lowered tax rates under double tax avoidance treaties.

Industry Specific Licenses and Certifications in China

In this issue of China Briefing, we provide an overview of the licensing schemes for industrial products; food production, distribution and catering services; and advertising. We also introduce two important types of certification in China: the CCC and the China Energy Label (CEL). This issue will provide you with an understanding of the requirements for selling your products or services

in China.

- Previous Article End of the Line: Terminating an Employee in China (Part 1)

- Next Article With Reboot of Import Tariffs, A Sooty Future Awaits for Foreign Coal in China