Devonshire-Ellis: China-ASEAN Trade Routes Key for 2015 Development

Chris Devonshire-Ellis has highlighted the various China-ASEAN trade routes as specific areas of high growth for 2015 at the Dezan Shira & Associates annual meetings currently taking place in Shanghai.

The firm, which specializes in foreign direct investment tax-law, compliance and strategic investment issues on behalf of global mid-cap manufacturers, has 12 China offices, as well as a significant presence in India, Singapore and Vietnam, and Alliance members in Indonesia, Malaysia, the Philippines and Thailand.

“Although China’s domestic growth has been slowing, its trade with ASEAN has been significantly increasing,” he said. “The China-ASEAN trade corridor is one of the few remaining and dependable growth dynamics concerning investment and opportunities for business development impacting directly upon China growth.”

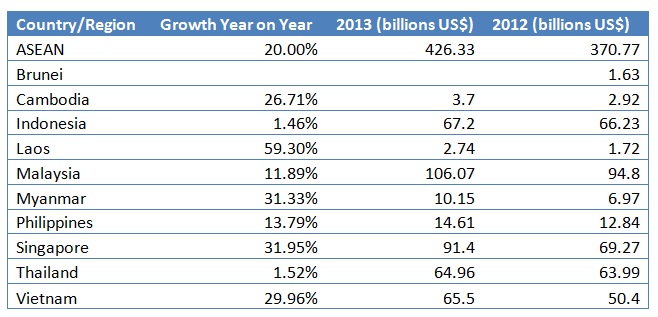

China-ASEAN trade overall reached some US$ 368 billion in 2013, and has been growing at rates of about 20 percent per annum over the past decade, according to HSBC. “Our firm has plans in place to deepen our involvement in this trade space, providing the legal, tax and compliance services to support the development of those active in the emerging trade bloc. Understanding the ASEAN dynamics will be crucial for foreign investors in China to continue to adapt to the new emerging Asia supply chain and to access those high bilateral growth rates and convert them into their own business models and bottom line results,” he said. As an example, China-Vietnam bilateral trade grew by nearly 30% and Singapore by 32% last year as manufacturers and sourcing businesses started to increase trade flows and services with ASEAN and seek alternatives to China manufacturing.

China and ASEAN signed a Free Trade Agreement that has seen tariffs on 90 percent of all goods traded between six of the ASEAN nations reduced to zero. The remaining four nations – Cambodia, Laos, Myanmar and Vietnam – are expected to come into compliance by the end of 2015. “The Vietnam situation especially will be a significant event in China next year,” continued Devonshire-Ellis. “The Vietnamese Government is not only expected to be in compliance with the treaty, but also to reduce Vietnam’s corporate income tax rate to 20 percent next year, meaning it will be a major competitor to China for light manufacturing investment. It will be the Vietnam component price that starts to matter during 2015 and certainly into the rest of the decade.”

China’s Bilateral Trade Growth With ASEAN & Member Nations

“The ASEAN-China trade routes are key, starting next year,” stated Devonshire-Ellis. “Yet within ASEAN there are a variety of different countries. Of these, Brunei is essentially an oil play, while infrastructure in Cambodia, Laos and Myanmar remains undeveloped, and the drag on logistics tends to wipe out any cost advantages. This leaves the ASEAN6 – Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam – as of key importance to the China and international supply chain.

“Of these, Singapore is unique in that it is the de facto financial capital of the region. It also has a fully convertible currency and is an approved RMB international trading hub, meaning that settlement in RMB can be conducted through a Singapore-based treasury function, as it can be with the various ASEAN currencies. Singapore is therefore an important treasury services function for Asia as it is the only country able to offer currency convertibility and easy access to the entire region. As China sourcing businesses and manufacturers expand into Asia, Singapore offers an attractive base for dealing with multiple treasury and administration issues such as payroll, in addition to coordinating work on cross-border tax issues such as pan-Asian transfer pricing complexities. It is also an excellent hub for siting Joint Ventures between partners from countries such as China and India with those from other ASEAN countries.”

“Challenges to China businesses therefore are purely cost-based,” he explained. “As the national working age increases, so do labour costs. Yet as companies seek to maintain margins, part of the current China portion of the global supply chain must now relocate. An example is with Apple, whose main supplier, Taiwan’s Foxconn, made the decision last year to relocate assembly of the iPhone and iPad from China to Indonesia.

“With the China-ASEAN Free Trade Agreement now about to come into full effect with Vietnam’s AEC compliance in 2015, the China-ASEAN trade routes will become far more useful for both the export and import of goods to and from China,” Devonshire-Ellis continued. “Final products, even those sold onto the Chinese domestic market, will no longer be 100percent component-sourced from China. Businesses must take advantage of the new ASEAN manufacturing cost dynamics in order to maintain a competitive edge from 2015 and beyond.”

The Dezan Shira Asian Alliance, Country Partners: Back row, L-R: Michael Machica, Philippines; Jennifer Lu, Hong Kong; Alberto Vettoretti, China; Nippita Puhdeetanabul, Thailand; Michell Suharli, Indonesia; Mattaya Deejingjing, Thailand; Chris Devonshire-Ellis, Singapore; Huyen Hoang, Vietnam; Tarun Manik, India; Anthony Ng, Malaysia; David Lee, Singapore; Christopher Heng, Malaysia.

Dezan Shira & Associates have formed a partnership with firms also in Indonesia, Malaysia, Philippines and Thailand, complementing the practices existing offices throughout China, India, Singapore and Vietnam. Plans are also underway to secure accounting and legal permits and to establish offices in Cambodia, Laos and Myanmar in 2016. Rebranding of the entire group to the Dezan Shira Asian Alliance will take place during 2015 and creates a 28 office practice with over 800 professional staff, making Dezan Shira one of the largest and most powerful firms in Asia. This is reflected in the success of the firm’s ASEAN Briefing website, which launched earlier this year and has become the practice’s fastest growing Asian regulatory, legal and tax advisory platform with nearly 80,000 readers created from zero over the past ten months. Total visitors to all Asia Briefing websites have also exceeded two million during 2014.

|

Chris Devonshire-Ellis is the Founding Partner and Chairman of Dezan Shira & Associates, and the Publisher of Asia Briefing. He began the Dezan Shira & Associates practice from a single office in Shenzhen in 1992. Today it is a multinational firm with 28 offices throughout China, India and ASEAN employing several hundred staff, advising foreign investors on their strategic planning, legal and tax advisory across Asia. He is now based from the firms Singapore office. For further information, please email chris@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

![]()

Manufacturing Hubs Across Emerging Asia

Manufacturing Hubs Across Emerging Asia

In this issue of Asia Briefing Magazine, we explore several of the region’s most competitive and promising manufacturing locales including India, Indonesia, Malaysia, Singapore, Thailand and Vietnam. Exploring a wide variety of factors such as key industries, investment regulations, and labor, shipping, and operational costs, we delineate the cost competitiveness and ease of investment in each while highlighting Indonesia, Vietnam and India’s exceptional potential as the manufacturing leaders of the future.

The Gateway to ASEAN: Singapore Holding Companies

The Gateway to ASEAN: Singapore Holding Companies

In this issue of Asia Briefing Magazine, we highlight and explore Singapore’s position as a holding company location for outbound investment, most notably for companies seeking to enter ASEAN and other emerging markets in Asia. We explore the numerous FTAs, DTAs and tax incentive programs that make Singapore the preeminent destination for holding companies in Southeast Asia, in addition to the requirements and procedures foreign investors must follow to establish and incorporate a holding company.

Adapting Your China WFOE to Service China’s Consumers

Adapting Your China WFOE to Service China’s Consumers

In this issue of China Briefing Magazine, we look at the challenges posed to manufacturers amidst China’s rising labor costs and stricter environmental regulations. Manufacturing WFOEs in China should adapt by expanding their business scope to include distribution and determine suitable supply chain solutions. In this regard, we will take a look at the opportunities in China’s domestic consumer market and forecast the sectors that are set to boom in the coming years.

Manufacturing in Vietnam to Sell to ASEAN and China

Manufacturing in Vietnam to Sell to ASEAN and China

In this issue of Vietnam Briefing Magazine, we introduce our readers to manufacturing in Vietnam as a key part of their business strategy within the ASEAN region and beyond. Specifically, we explain the new ASEAN Free Trade Area, outline what foreign investors can look forward to when creating their manufacturing presence in the country, and introduce the country’s key tax points.

- Previous Article Devonshire-Ellis: China Business Will Be Harder Next Year

- Next Article China Law Trends in 2015