Investing in China’s Entertainment Industry

By Dezan Shira & Associates

Editors: Zhou Qian and Matthew Zito

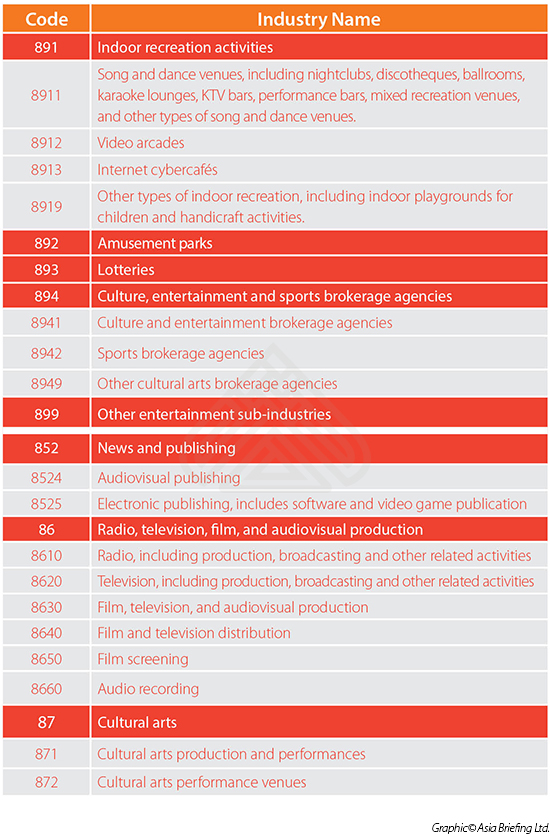

One problem in discussing the entertainment industry in China is the misalignment between what is typically referred to as “show business” in the West versus the administrative definition of the “entertainment industry” (娱乐业) in China. The former typically encompasses a wide range of creative performances and media products including animation, dance, film, music, radio, television, theater; whereas in China, these sub-sectors are split between at least two major industry classifications administered by the National Bureau of Statistics (NBS). According to the NBS’s Industrial Classification for National Economic Activities (GB/T 4754-2011), the “entertainment industry” is divided as appearing in the top-left.

As seen from this, under its administrative definition in China, “the entertainment industry” does not extend to the performance, production or distribution of any type of mass media (film, television, music, etc.). Instead, these items are mostly found under the broader category of the “Cultural, Sports and Entertainment Industries”, in which the “entertainment industry” is but one sub-sector.

When combined, these two categories cover what is broadly referred to as the entertainment industry according to Western convention. In the remainder of this series, we adopt the term in this broader sense, including the production and distribution of mass media.

Legal Considerations

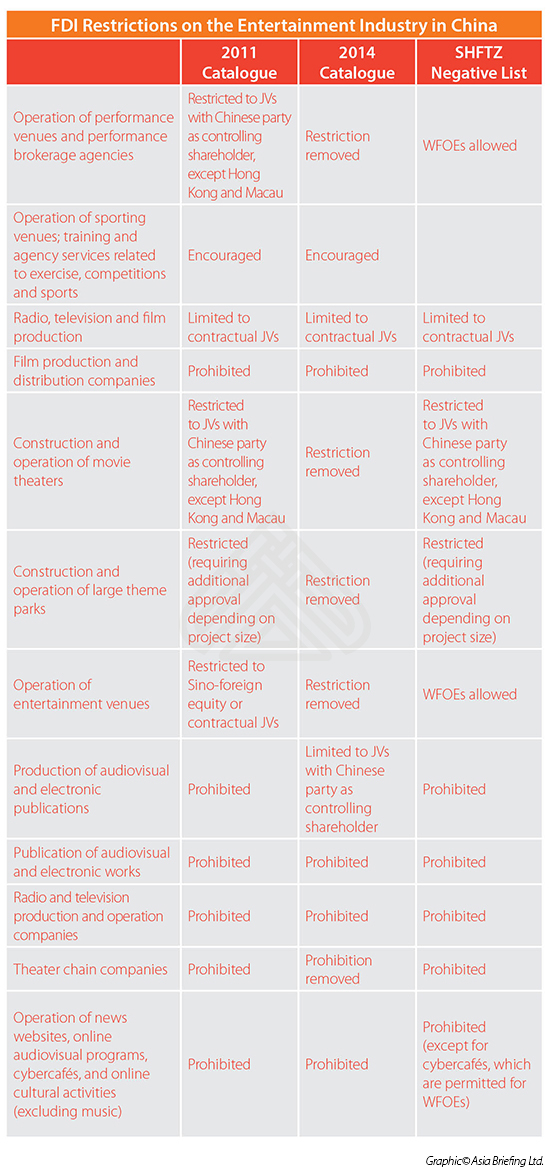

Historically, the entertainment industry in China has been subject to some of China’s tightest restrictions on foreign investment. Recently, however, these have given way to targeted liberalization measures. In the chart below, we compare the treatment of various sub-sectors of the entertainment industry according to three governing documents:

(1) the 2011 “Catalogue for the Guidance of Foreign Investment,” which divides industries into those encouraged, restricted or prohibited for foreign investment; (2) an update to the Catalogue released as an “opinion-seeking draft” in November last year (“2014 Catalogue”); and (3) the “Negative List” of industries expressly prohibited for foreign investment in the Shanghai Free Trade Zone.

Planning Your Business Scope

In China, a company’s operations are defined by its business scope, a one-sentence description of the industry(s) it is authorized to operate in. For foreign businesses especially, it is imperative that company operations be reflected accurately in their business scope, as this is connected to the “Catalog for the Guidance of Foreign Invested Enterprises” (“Catalog”) governing foreign investment into China.

An enterprise’s business scope is administered by two state bodies—the Ministry of Commerce (MOFCOM) and the local Administration of Industry and Commerce (AIC) of registration—and is printed on its business license along with other registered information such as its name, registered capital, and legal representative.

Keeping your company’s commercial operations within the range of activities set out in its registered business scope is important for several reasons. In addition to the legal risk of disingenuously operating in an unregistered domain, doing so can also be detrimental to a company’s ability to issue official VAT invoices (fapiao) to its clients.

It is impossible to issue invoices for activities outside of one’s business scope, which is necessary for offsetting the VAT liability of both the selling company and its purchasers. Being unable to receive fapiao can result in hesitancy on the part of one’s business partners, and higher costs for the company itself. It is therefore critical that companies carefully plan their business scope prior to initial incorporation in China, else undergo the onerous and time-consuming process of changing this later.

For the entertainment industry specifically, there is the added issue of mentioning “cultural activities” in the business scope of a foreign-invested enterprise. Doing so can often trigger a review by the China Cultural Bureau and lead to additional licensing requirements for the company and heightened scrutiny of the visa applications of its workers.

|

|

![]()

China Investment Roadmap: The Medical Device Industry

China Investment Roadmap: The Medical Device Industry

In this issue of China Briefing, we present a roadmap for investing in China’s medical device industry, from initial market research, to establishing a manufacturing or trading company in China, to obtaining the licenses needed to make or distribute your products. With our specialized knowledge and experience in the medical industry, Dezan Shira & Associates can help you to newly establish or grow your operations in China and beyond.

Double Taxation Avoidance in China: A Business Intelligence Primer

Double Taxation Avoidance in China: A Business Intelligence Primer

In our twenty-two years of experience in facilitating foreign investment into Asia, Dezan Shira & Associates has witnessed first-hand the development of China’s double taxation avoidance mechanism and established an extensive library of resources for helping foreign investors obtain DTA benefits. In this issue of China Briefing Magazine, we are proud to present the distillation of this knowledge in the form of a business intelligence primer to DTAs in China.

Strategies for Repatriating Profits from China

Strategies for Repatriating Profits from China

In this issue of China Briefing, we guide you through the different channels for repatriating profits, including via intercompany expenses (i.e., charging service fees and royalties to the Chinese subsidiary) and loans. We also cover the requirements and procedures for repatriating dividends, as well as how to take advantage of lowered tax rates under double tax avoidance treaties.

- Previous Article Human Resources and Payroll in China 2015 – New Publication from China Briefing

- Next Article Outlook on Light Manufacturing in China: March 2015