China’s E-Commerce Market Faces Tightened Regulations

By Dezan Shira & Associates

By Dezan Shira & Associates

Editor: Elizabeth Leclaire

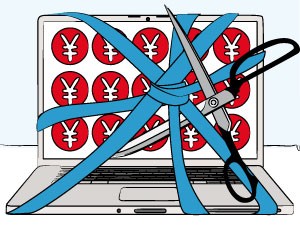

In the midst of a consumer shift to online purchasing platforms, China’s new Method of Network Payment Service Management for Third Party Payment Agents law looks to improve and protect customer rights and privacy within the e-commerce market. The new regulation, currently in its draft stage, limits the RMB amount of consumers’ daily and annual online purchases through third party payment agents.

China’s e-commerce market has grown remarkably fast in recent years, with companies Alipay and Tencent dominating the third party payment agents sector. China is currently home to 270 third party payment agents and over 430 million online shoppers. Over the course of 2015, online payments within the nation are expected to amount to US$1.9 trillion, with Alipay witnessing over 80 million transactions each day.

While the new draft law will present restrictions on private third party payment agents if passed, it is important to note that state-owned payment agents, such as China UnionPay, will not be subject to the regulations.

New Regulations

Under the current draft law, daily purchasing amounts through third party agents will be determined based on the level of customer security checks within the online platform. The regulation is an attempt to mitigate occurrences of theft and fraud within the e-commerce market.

Payment agents that install security tokens and digital signatures as verification methods prior to allowing a transaction will not be required to adhere to daily or annual purchasing payment limits. However, customers will not be allowed to exceed daily purchases of RMB 5000 (US$ 781.55) if the payment agent does not require both a security token and digital signature. This restriction is maintained even if the payment agent provides two alternative customer identification methods.

Payment agents using only one method to verify consumer identities prior to a transaction may not permit daily customer transactions exceeding RMB 1000 (US$156.31).

![]() RELATED: Selling to China Without a Physical Presence

RELATED: Selling to China Without a Physical Presence

Annual Restrictions

Additionally, the draft law offers third party payment agents the option of integrating a customer’s online payment account with all respective existing bank accounts in order to offer an annual maximum purchasing limit. Upon account integration, the annual purchasing amount provided to the customer will again be determined by the level of security required by the payment agents.

For payment agents who require at least five methods of identity verification prior to permitting a transaction, a “comprehensive account” will be available to customers. Comprehensive accounts may be used for the consumption, transfer, or purchase of products and services. Excluding fund transfers between payment accounts and related bank accounts, customers of “comprehensive accounts” will be allowed to purchase RMB 200,000 (US$31,262) worth of goods or services through third party payment accounts annually.

For payment agents that require four or fewer customer identity verifications, yearly transactions through a “consumption account” may not exceed RMB 100,000 (US$15,631).

Additionally, all private third party payment agents are prohibited from opening accounts to financial institutions and serving as an online lending firm, as the draft states this places the agents at too high of a financial risk.

Verification Measures

In order to encourage further identity verification measures, the draft law prescribes a list of encouraged methods by which payment agents may confirm customer identities and purchase intentions prior to a transaction:

- A permanent password, known only to the customer;

- Identification documents, such as digital certificates or electronic signatures;

- Physical customer characteristics, such as fingerprints;

Impacts of New Legislation

In order to mitigate fears that the draft rule will cause widespread consumer inconvenience, China’s Central Bank released a statement that approximately “61.3 percent of [online] customers spent or transferred no more than 1,000 yuan in 2014, while 80.1 percent spent or transferred less than 5,000 yuan.”

However, the pending legislation has been met with significant backlash from both third party payment agents and customers, who fear the new regulations will significantly diminish China’s currently thriving e-commerce market. According to a survey reported by China Daily, roughly 60 percent of respondents expressed that the daily transaction limits will impact their life, while over 80 percent indicated that the annual transaction cap would affect their online shopping habits.

![]() RELATED: Trends in China’s E-Commerce Market

RELATED: Trends in China’s E-Commerce Market

Previous Regulations

This is not the first time China has sought to heighten customer security within the nation’s skyrocketing online consumer market. In 2014, the government released the Internet Trading Measures, which looked to improve customer rights and discourage the sale of fake or damaged goods.

Under the 2014 legislation, customers gained the right to return the vast majority of goods (excluding perishables, digital downloads, etc.) within seven days of purchase without be required to present a reason. Furthermore, whereas before only the merchant selling the product or service was liable if found selling fake or damaged products, the legislation also made third party agents responsible.

As additional measures, last year’s regulations required third party payment agents to receive buyer consent prior to sending advertisements to customers, disclose the method and scope of collecting consumer information, and allow negative comments on products to remain published on payment agent websites.

Conclusion

The draft law places a new roadblock a sector recently made open to foreign investment. Complete foreign ownership of e-commerce companies was made legal in June of this year, but the pending legislation may create further difficulties for foreign companies hoping to enter a lucrative but domestically dominated e-commerce market.

The draft law is open to public opinion until August 28th, 2015.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

![]()

Selling to China

Selling to China

In this issue of China Briefing Magazine, we demystify some complexities of conducting business in China by introducing the main certification requirements for importing goods into the country; the basics of setting up a representative office; as well as the structure and culture of State-owned enterprise in China. Finally, we also summarize some of the export incentives available in several key Western countries.

Importing and Exporting in China: a Guide for Trading Companies

In this issue of China Briefing, we discuss the latest import and export trends in China, and analyze the ways in which a foreign company in China can properly prepare for the import/export process. With import taxes and duties adding a significant cost burden, we explain how this system works in China, and highlight some of the tax incentives that the Chinese government has put in place to help stimulate trade.

. E-Commerce in China

E-Commerce in China

In this issue of China Briefing Magazine, we cover the current laws pertinent to the e-commerce industry in China, as well as introduce the steps involved in setting up an online shop in the country in order to help provide foreign investors with an overview of the e-commerce landscape in China.

- Previous Article China Regulatory Brief: Company Domicile Registration Requirements & Unified Business License

- Next Article China Regulatory Brief: New Preferential Policies for SMEs, Shanghai Foreign Residence Permit Rules