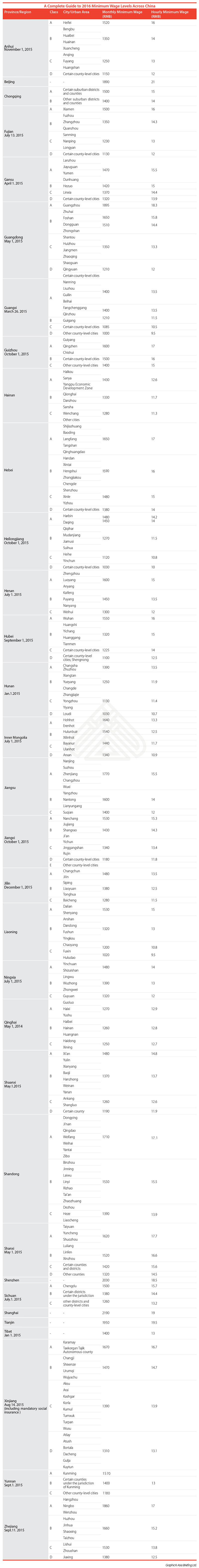

A Complete Guide to 2016 Minimum Wage Levels Across China

By Dezan Shira & Associates

Editor: Mia Yiqiao Jing

Editor’s note: This article was originally published on May 26, 2016, and has been updated to include the latest regulatory changes.

Rising labor costs in China have been putting pressure on foreign investors in recent years, forcing corporations to either cut down staff size or relocate to other countries with cheaper labor. The annual rates of increase from 2011 to 2015, despite slowing down, have exceeded production rates by more than 200 percent and have significantly affected China’s investment climate.

Unlike the 12th Five Year Plan, which pushed an annual 13 percent increase for minimum wages across China, the 13th Five Year Plan addresses the need for more reasonable wage levels and introduces a controlled mechanism for wage adjustment. Through a much decreased growth of minimum wage levels and stable wage adjustments, the 13th Five Year Plan aims to improve the competitiveness of enterprises in China by shortening the wage difference with other developing economies, partly in order to create stronger incentives for foreign investors to remain in or enter China. Against the backdrop of these changes, here we provide a comprehensive list of minimum wages across China for 2016 and highlight some of the major changes to the Chinese labor market.

Minimum wages in China are determined and adjusted by governments at the provincial level. Several factors should be taken into consideration for any revision: economic development, local employment conditions, the minimum cost of living and consumption price index in the area, individual costs associated with social insurance and housing funds, and enterprises’ average response to labor costs. Following the 13th Five Year Plan, the minimum wage will be adjusted at an average increase of 10 percent annually, and should fall between 40 and 60 percent of an area’s average monthly wage. Unlike revision cycles in the past, where minimum wage levels were adjusted at least once every two years, an extended revision cycle is now expected to reduce labor costs and keep them aligned with production rates. As of February 28, 2016, the Guangdong provincial government announced that it would maintain the same minimum wage level as 2015 for both 2016 and 2017. In order to reduce pressure for enterprises, especially those with poor business performance, the Guangdong provincial government also recommended that, for businesses with relatively better performance, wages will rise by 8.5 percent but no more than 12.5 percent.

Minimum wages in China are determined and adjusted by governments at the provincial level. Several factors should be taken into consideration for any revision: economic development, local employment conditions, the minimum cost of living and consumption price index in the area, individual costs associated with social insurance and housing funds, and enterprises’ average response to labor costs. Following the 13th Five Year Plan, the minimum wage will be adjusted at an average increase of 10 percent annually, and should fall between 40 and 60 percent of an area’s average monthly wage. Unlike revision cycles in the past, where minimum wage levels were adjusted at least once every two years, an extended revision cycle is now expected to reduce labor costs and keep them aligned with production rates. As of February 28, 2016, the Guangdong provincial government announced that it would maintain the same minimum wage level as 2015 for both 2016 and 2017. In order to reduce pressure for enterprises, especially those with poor business performance, the Guangdong provincial government also recommended that, for businesses with relatively better performance, wages will rise by 8.5 percent but no more than 12.5 percent.

![]() RELATED: Payroll and Human Resource Services

RELATED: Payroll and Human Resource Services

At the time of writing, there were nine provinces that changed their minimum wage levels in 2016, compared to 17 and 27 at the same point in 2014 and 2015, respectively. Compared to the previous year’s rate of 17 percent, the average wage increase rate of 2016 is 14.5 percent. This change reflects the Chinese government’s effort to reduce pressure on enterprises that results from the uneven growth between labor costs and production rates. Special attention should be given to Shanghai, whose rate of increase in the minimum wage level has dropped from 12.3 percent to 8.4 percent since 2015. It is also noteworthy that other developed regions, such as Fujian, Jiangsu, Zhejiang, and Sichuan, have all controlled the growth of their minimum wages. Guizhou, on the other hand, stands out as the only region with a hike of 55 percent in minimum wages since last year, and carries the most significance for foreign investors in China.

China’s divergent income levels, with much smaller increases for developed regions and more rapid growth for less developed regions, requires that foreign investors pay close attention to the locations that they channel their investment. The latest figures and government policies indicate that overall labor costs in China will not significantly increase.

|

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com. Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight. |

Human Resources and Payroll in China 2015

Human Resources and Payroll in China 2015

This edition of Human Resources and Payroll in China, updated for 2015, provides a firm understanding of China’s laws and regulations related to human resources and payroll management – essential information for foreign investors looking to establish or already running a foreign-invested entity in China, local managers, and HR professionals needing to explain complex points of China’s labor policies.

How IT is Changing Payroll Processing and HR Admin in China

How IT is Changing Payroll Processing and HR Admin in China

In this edition of China Briefing magazine, we examine how foreign multinationals can take better advantage of IT in the gathering, storing, and analyzing of HR information in China. We look at how IT can help foreign companies navigate China’s nuanced payroll processing regulations, explain how software platforms are becoming essential for HR, and finally answer questions on the efficacy of outsourcing payroll and HR in China.

Labor Dispute Management in China

Labor Dispute Management in China

In this issue of China Briefing, we discuss how best to manage HR disputes in China. We begin by highlighting how China’s labor arbitration process – and its legal system in general – widely differs from the West, and then detail the labor disputes that foreign entities are likely to encounter when restructuring their China business. We conclude with a special feature from Business Advisory Manager Allan Xu, who explains the risks and procedures for terminating senior management in China.

- Previous Article Preventing Insolvency: How to Plan the Cash Flow and Financing of a WFOE in China

- Next Article Q&A: Labor Disputes and Labor Law Compliance in China