An Introduction to China’s M&A Market

By Dezan Shira & Associates

Editor: Zolzaya Erdenebileg

This article is an excerpt from the June-July edition of China Briefing Magazine, “Understanding Mergers & Acquisitions in China”. Download the full issue here.

The year 2015 was a transformative year for mergers and acquisitions (M&A) in China. During the first half of last year, China’s outbound M&A volume exceeded its inbound, with 382 deals worth US$67.4 billion by the year’s end, making the country a net capital exporter. Inbound foreign M&As, meanwhile, have continued their upward yet slow expansion. Their piecemeal development is due in part to China’s ostensibly complex regulatory framework surrounding acquisitions, foreign apprehension about slower growth, and strong domestic players.

While inbound M&A growth in China has not been keeping pace with its outbound, the M&A remains one of the key investment vehicles with which foreign companies can enter the Chinese market. However, there are many potential pitfalls when conducting a company acquisition in China. Failure to flag operational, financial and legal problems in the acquired company, as well as a lack of understanding of the Chinese market, can prove extremely costly. Conducting a thorough due diligence is therefore essential.

Latest M&A Market Trends

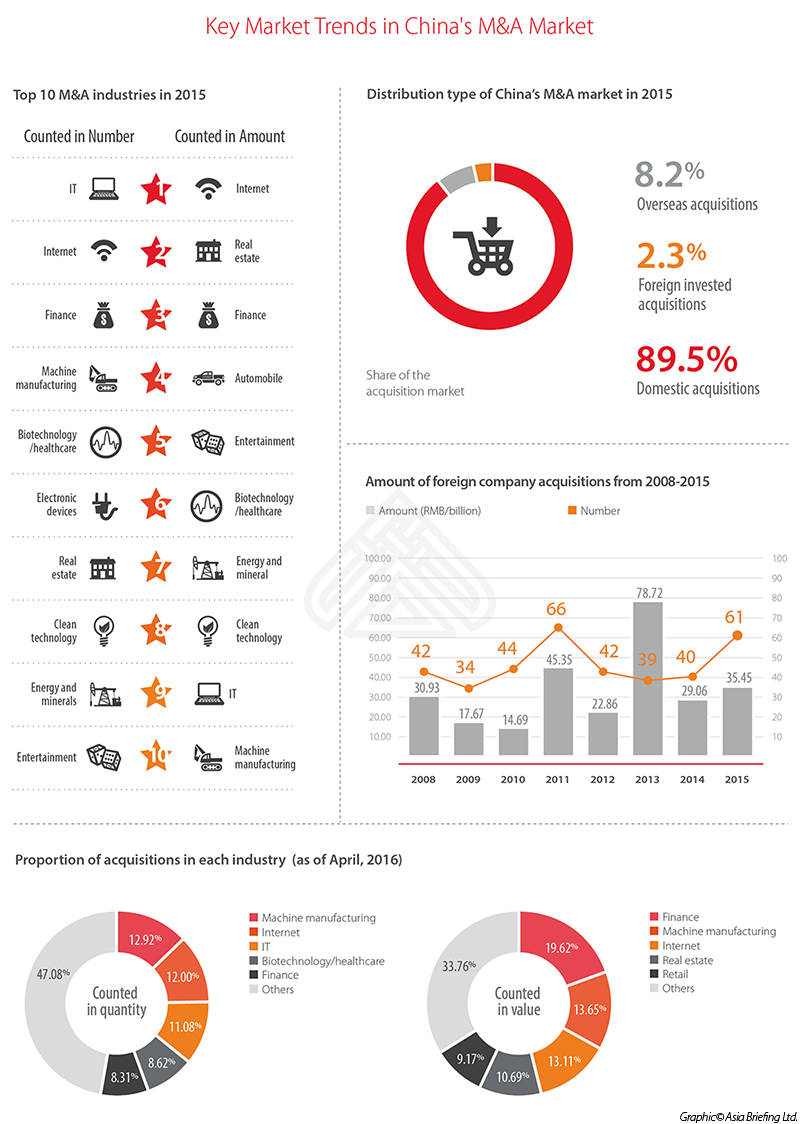

The number of inbound M&A deals in China increased 39 percent from 2010 to 2015, with total deal value increasing by approximately 141 percent. The environment for M&As continues to be dynamic, with China particularly interested in projects that can help reform state-owned enterprises (SOEs) and improve national technological capabilities.

The majority of M&A activities in China are domestic, making up 89.5 percent of all M&A transactions in 2015. However, foreign outbound M&A transactions are on the rise, making up 8.2 percent of all transactions and 18.6 percent of deal value in 2015. Foreign inbound M&A made up 2.3 percent of total M&A transactions in 2015.

Advantages & Disadvantages

The effectiveness of an acquisition hinges on the makeup of both the acquiring company and the acquired company. If the two are compatible, then the acquiring company stands to gain a quick and strong foothold in the Chinese market; if not, it can quite easily prove to be unsustainable within its first year of operations.

After committing to the M&A, foreign investors should be prepared and willing to use different acquisition structures, sometimes in several parts, to ensure that the process runs smoothly. Provided all of these conditions have been met, the M&A has the potential to be the best means for a foreign firm to enter the Chinese market.

|

|

![]()

Human Resources and Payroll in China 2015

Human Resources and Payroll in China 2015

This edition of Human Resources and Payroll in China, updated for 2015, provides a firm understanding of China’s laws and regulations related to human resources and payroll management – essential information for foreign investors looking to establish or already running a foreign-invested entity in China, local managers, and HR professionals needing to explain complex points of China’s labor policies.

Labor Dispute Management in China

Labor Dispute Management in China

In this issue of China Briefing, we discuss how best to manage HR disputes in China. We begin by highlighting how China’s labor arbitration process – and its legal system in general – widely differs from the West, and then detail the labor disputes that foreign entities are likely to encounter when restructuring their China business. We conclude with a special feature from Business Advisory Manager Allan Xu, who explains the risks and procedures for terminating senior management in China.

Internet Challenges & Solutions When Doing Business in China

Internet Challenges & Solutions When Doing Business in China

In this special edition of China Briefing magazine, we highlight how and why foreign companies will be negatively affected by China’s internet, and provide methods to help solve these problems. We discuss ISP selection, internet connection types, CDNs and VPNs, and internal control systems. Finally, we examine the importance of network security in China and how it can help augment a company’s internet connection.

- Previous Article China Introduces Wide-Sweeping New Transfer Pricing Rules

- Next Article Labor Case Study: Navigating China’s Laws Surrounding Employee Termination During Probation