Made in China 2025: Implications for Foreign Businesses

By Zolzaya Erdenebileg and Weining Hu

Made in China 2025 (MIC 2025) – an initiative to transform China into a hub for advanced manufacturing – has been met with curiosity, and some confusion, by observers since it was unveiled in 2015.

The international business community is curious about how effective the policy will be. Many wonder whether MIC 2025 will end up like Germany 4.0, which was successful in increasing Germany’s national industrial capacity, or Make in India, an initiative to encourage manufacturing in the country, which has not fully lived up to expectations.

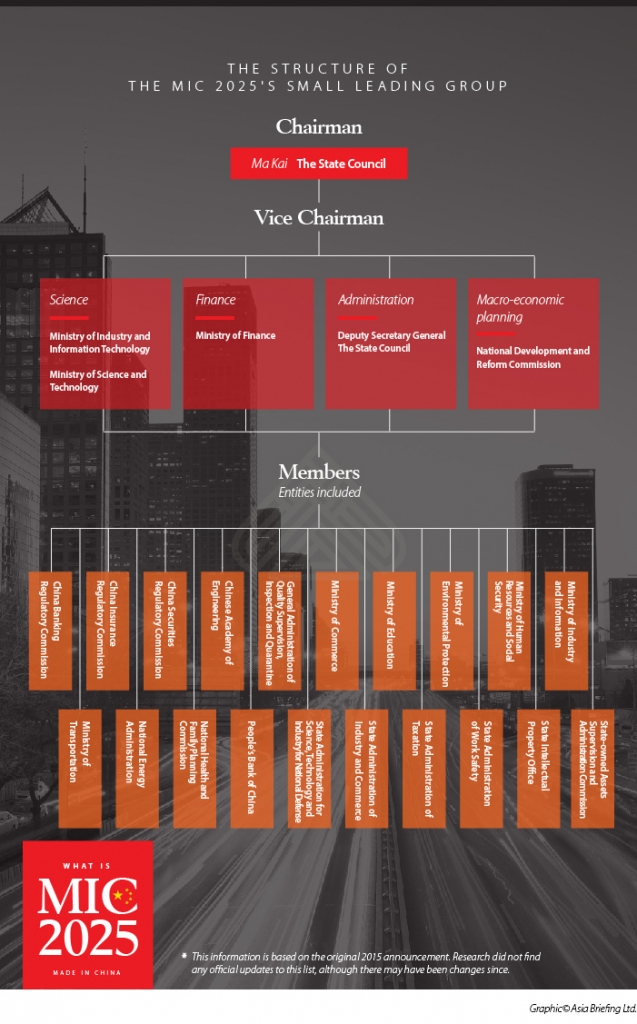

While many aspects of MIC 2025 are a work in progress, the government has released two important sets of information since 2015: the leadership and membership of MIC 2025’s Small Leading Group (SLG) and 12 documents called “1+X” that serve as a general outline for how MIC 2025 will be implemented.

Given the heavy hitting roster of high-level officials in MIC 2025’s Small Leading Group (SLG), it is clear that MIC 2025 has administrative weight, which is unsurprising given that the policy will guide China’s economic development. The SLG has the capability to effect real and meaningful economic reforms.

The SLG’s main implementation tool, as defined in 1+X, is financial support for R&D that will in turn support indigenous innovation.

This support will primarily come from increased access to capital and subsidies, which will not be available to foreign companies.

A closer examination of both the SLG and the 1+X sheds further light on MIC 2025 and what it means for business in China.

Who’s who in the Small Leading Group?

SLGs are common for government initiatives, particularly large ones. Made up of several ministerial bodies, they are created in order to build consensus and implement policies. While SLGs do not write the actual policies, they have considerable influence over government direction.

As a result, examining the make-up of an SLG can help explain the support for a policy and its overall capacity to realize its goals. The MIC 2025 SLG includes 26 members from various areas of government.

Chairman, Ma Kai

Heading the SLG as Chair is Ma Kai, the current Vice Premier in the State Council responsible for overseeing national manufacturing. This is particularly telling as Ma Kai is the highest-ranking official overseeing manufacturing.

As Vice Premier, he sits below Premier Li Keqiang in the State Council along with his three other Vice Premiers. A party member since 1965, he is an influential economic planner, and serves as manager of a number of other central bodies, such as the National Development and Reform Commission (NDRC), the Chinese Academy of Governance, and the State Council Safety Production Committee, among others.

Vice-Chairmen

The vice-chairmen serve an important role. As more than 25 ministries are equally ranked in the SLG for MIC 2025, the presence of vice-chairmen can reduce the risk of indecision due to internal disagreements.

The appointments of Miao Wei, Xiao Yaqing, Lin Nianxiu, Cao Jianlin, and Liu Kun as vice-chairs suggest that their respective ministries have a leading role throughout implementation. It is worth noting that excepting for Liu Kun, all of the Vice Chairmen have engineering and physics backgrounds.

Miao Wei is Minister of the Ministry of Industry and Information Technology (MIIT), an agency under the State Council responsible for industrial planning, policies, and standards. Xiao Yaqing is currently the Director of the State-Owned Assets Supervision and Administration Commission.

Lin Nianxiu is the Vice Minister of the NDRC, a body of central importance to MIC 2025 as the NDRC is responsible for formulating and implementing medium and long-term economic and social development plans. Cao Jianlin is Vice Minister of the Ministry of Science and Technology (MoST). Liu Kun is Vice Minister of the Ministry of Finance, which is the national executive agency responsible for administering macroeconomic policies and the national annual budget.

Members

A myriad of other ministries and government bodies are included in the general membership.

These specific ministries are included because they are the branches of the economy needed for the government to achieve MIC 2025 goals.

In particular, they can be divided into three segments: high-tech research and development; talent attraction, retention, and incubation; financial channels to support the entire initiative.

Viewed from this angle, the arrangement of the MIC 2025 SLG appears to answer, in the most general sense, how the government envisions implementation of MIC 2025.

Viewed from this angle, the arrangement of the MIC 2025 SLG appears to answer, in the most general sense, how the government envisions implementation of MIC 2025.

First, the technical and scientific goals are set. Then, the human resources are found and set to work. Finally, capital is made available to those who will contribute to MIC 2025’s goals.

Foreign observers should note that the existing Chairman and Vice-Chairmen have had long experiences dealing with domestic development, rather than international trade and cooperation.

This makes sense because MIC 2025 is a domestic policy, unlike the One Belt, One Road initiative, which is heavily dependent on regional cooperation. But this underlines the limited scope for international cooperation on MIC 2025.

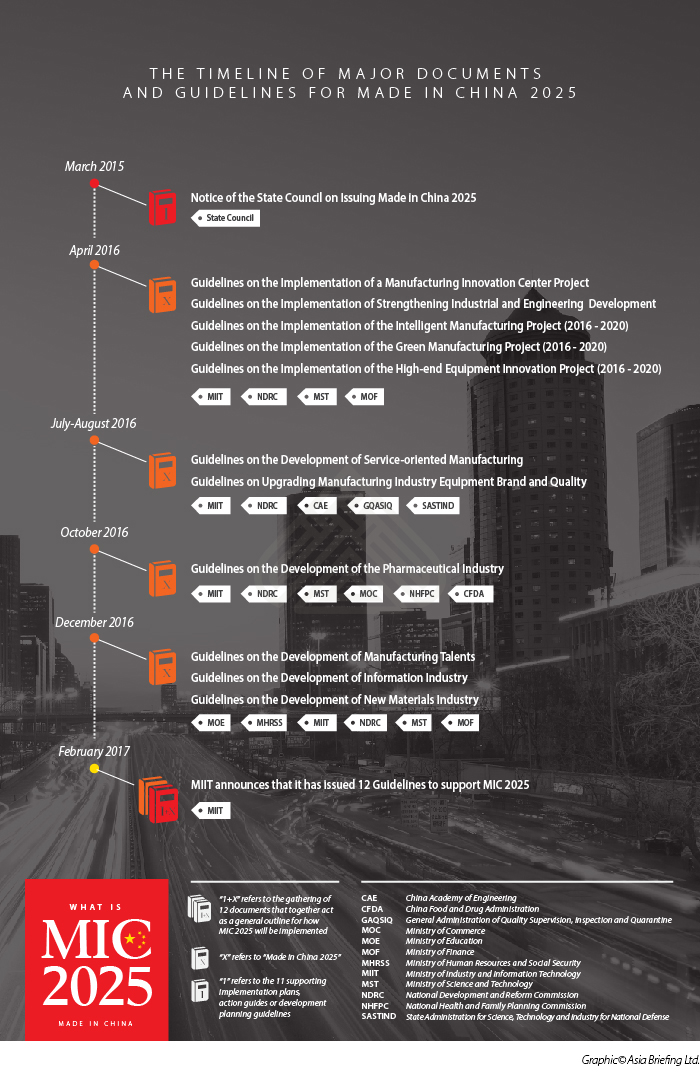

1+X implementation guidelines

1+X is likely confusing to anyone who reads it: the entire concept was labeled retrospectively.

From mid-2016 until the beginning of 2017, the government released 11 implementation guidelines meant to provide roadmaps for different sectors of MIC 2025 (such as innovation center, infrastructure, pharmaceuticals, and more).

In February of 2017, the government clarified that these documents form what they call “1+X” – the “1” representing the original MIC 2025 promulgation from 2015, and the “X” representing the 11 individual guidelines that were released.

The point that the government wants to make, albeit in a convoluted way, is that several reform all working simultaneously to meet its goals by 2025.

Additionally, it is worth noting that these guidelines are suggestions, not administrative requirements.

This is a sentiment repeated by the SLG leadership, and the softness of the language appears to indicate that MIC 2025 is a guiding light, not an abrupt push.

While the government claims that “1+X” was in the works since 2015, it is unclear given that it was only announced ex post facto.

While the government claims that “1+X” was in the works since 2015, it is unclear given that it was only announced ex post facto.

Perhaps they thought that it would help tie the guidelines together under a unified banner, particularly as many did not understand how these documents were related.

More likely than not, the government wished to bring further attention onto the 11 documents, which received little notice outside of the domestic industry when they were originally released.

Foreign businesses should take a closer look at the document of relevance to their industry.

While some firms may be able to help the government meet MIC 2025’s goals, they should closely examine terms that may directly or indirectly demand technology and knowledge transfer.

Others, however, may want to examine the documents to understand how domestic competitors may be using incentives to develop or expand their position in the market.

Judging the efficacy of MIC 2025

Many foreign businesses are worried about longer-term access to the market, particularly after technical knowledge has been transferred onto domestic firms.

After that happens, foreign players may become less relevant in the Chinese market, while local players may become global competitors, edged on by favorable government policies.

However, foreign observers can afford to take ‘wait and see’ approach.

While the SLG has the capacity to effect change, the nature of the 1+X guidelines suggest that MIC 2025 will not truly hit its stride until a few years before the 2025 deadline.

MIC 2025 only provides a direction on which industries can focus its capital and research efforts.

MIC 2025 has high ambitions, but a relatively short period to achieve its goals. In this way, MIC 2025 appears more aspirational than Germany 4.0 or Make in India.

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices in China, Hong Kong, Indonesia, Singapore, Russia, and Vietnam. Please contact info@dezshira.com or visit our website at www.dezshira.com.

- Previous Article New Data Localization Rule in China’s Cybersecurity Law to Impact HR

- Next Article The Beijing Belt-Road Forum: What We Learned About China’s Intentions