New VAT Rates in China Simplify Tax Administration

Editor’s note: China has since updated its VAT rates since this article was published. For the latest VAT rates, please click here.

By Jake Liddle

China has simplified its value-added tax (VAT) regime as part of its efforts to cut US$55.2 billion in taxes. As of July 1, 2017, China’s State Administration of Taxation (SAT) simplified its four tiered VAT system to three tiers. Previously, four brackets of 17 percent, 13 percent, 11 percent, and six percent existed. Under the new system, the 13 percent bracket has been removed.

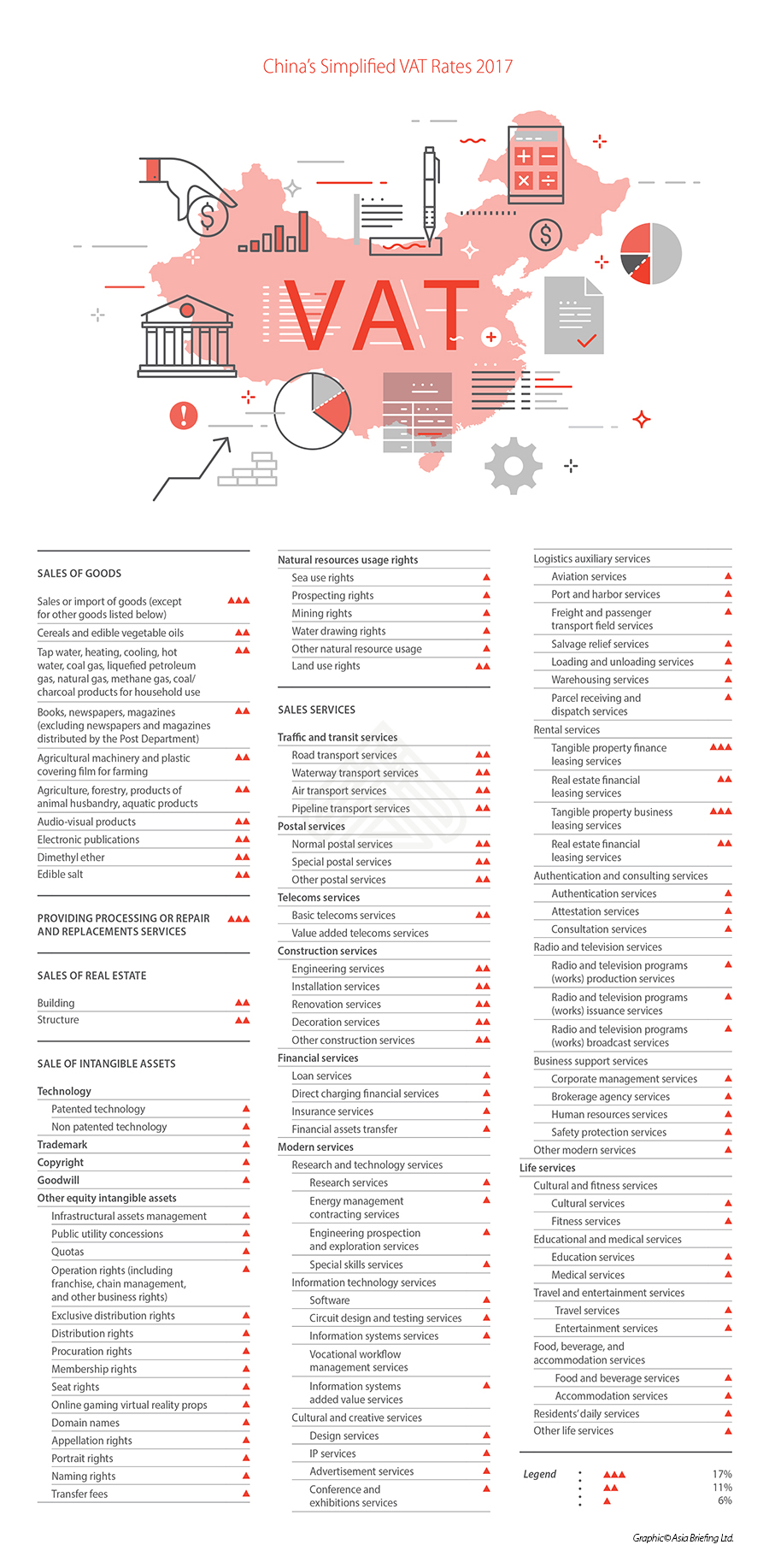

With the update, China’s VAT rates are as follows:

The continuation of China’s business tax to VAT reform further simplifies the way VAT is levied in the country. Most noticeably, the change moves agricultural products and other such items previously contained in the 13 percent bracket to the 11 percent bracket.

The most direct effect of this will be the alleviation of tax burdens for businesses in the agricultural industry. The change will bring corporate tax savings of around RMB 1.6 million (US$237,000) each year for individual entities, and will serve to revitalize the cash flow of enterprises engage in the production of such products.

![]() RELATED: Tax Compliance services from Dezan Shira & Associates

RELATED: Tax Compliance services from Dezan Shira & Associates

The tax reduction for agricultural products represents the government’s support for the traditional agricultural sector and public livelihood. Rice, an important commodity in many people’s everyday life, is one of the more critical products that will see a reduction in retail price. For instance, the retail price of one kilogram of good quality rice before the change was around RMB 22.4. After the change, the same amount will retail for around RMB 21.6.

Though the VAT reform was fully put into place in May last year, perfection and streamlining of the system is still underway. Tax authorities have said they will closely follow the implementation of the new policy, and will iron out any problems arising from the eradication of the 13 percent bracket. The general simplification of the taxation system is welcomed by businesses, and they should be aware of how the change in VAT rates affect their operations and products.

|

China Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, India, Indonesia, Russia, the Silk Road, and Vietnam. For editorial matters please contact us here, and for a complimentary subscription to our products, please click here. Dezan Shira & Associates is a full service practice in China, providing business intelligence, due diligence, legal, tax, IT, HR, payroll, and advisory services throughout the China and Asian region. For assistance with China business issues or investments into China, please contact us at china@dezshira.com or visit us at www.dezshira.com

|

Dezan Shira & Associates Brochure

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing legal, tax and operational advisory to international corporate investors. Operational throughout China, ASEAN and India, our mission is to guide foreign companies through Asia’s complex regulatory environment and assist them with all aspects of establishing, maintaining and growing their business operations in the region. This brochure provides an overview of the services and expertise Dezan Shira & Associates can provide.

An Introduction to Doing Business in China 2017

This Dezan Shira & Associates 2017 China guide provides a comprehensive background and details of all aspects of setting up and operating an American business in China, including due diligence and compliance issues, IP protection, corporate establishment options, calculating tax liabilities, as well as discussing on-going operational issues such as managing bookkeeping, accounts, banking, HR, Payroll, annual license renewals, audit, FCPA compliance and consolidation with US standards and Head Office reporting.

Payroll Processing in China: Challenges and Solutions

In this issue of China Briefing magazine, we lay out the challenges presented by China’s payroll landscape, including its peculiar Dang An and Hu Kou systems. We then explore how companies of all sizes are leveraging IT-enabled solutions to meet their HR and payroll needs, and why outsourcing payroll is the answer for certain company structures. Finally, we consider the potential for China to emerge as Asia’s premier payroll processing center.

- Previous Article Обязательно ли Регистрировать Бизнес в Китае? Различия Между Представительством и Компанией.

- Next Article How to Prevent Corruption in QC Inspections in China