Why is China’s Tax System so Complex?

![CB-China’s-tax-system[76340]](https://www.china-briefing.com/news/wp-content/uploads/2017/09/CB-China’s-tax-system76340.jpg)

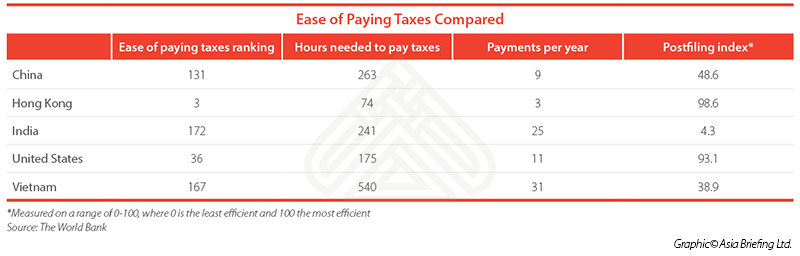

China’s tax system can be bewildering for foreign investors unaccustomed to its intricacies and idiosyncrasies. Despite recent efforts to streamline the tax system, the World Bank ranked China 131 out of 190 jurisdictions for ease of paying taxes in 2017 – down from 127 in 2016.

Several factors contribute to China’s financial complexity, from ambiguous value-added tax (VAT) rate application to the country’s unique fapiao invoice system. Given the challenges presented by China’s tax system, identifying the areas where foreign businesses are most vulnerable to irregularities can help ensure compliance and avoid triggering an audit.

China’s tax system in context

China’s low ranking for ease of paying taxes can partially be explained by the fact that it is still a developing country, but that alone does not explain its complexity. While China’s World Bank ranking for paying taxes is higher than other booming Asian economies like India (172) and Vietnam (167), it ranks below other developing Asian countries such as Malaysia (61) and Indonesia (104), and is a far cry from its Special Administrative Region, Hong Kong (3).

According to the World Bank, it takes 263 hours annually to prepare taxes in China, compared to an average of 198 hours in East Asia and the Pacific and 163.4 hours in the OECD. Post-filing in China is particularly time-consuming, as shown by its 48.6 post-filing index rating (where zero is the least efficient and 100 the most), which also lags behind the regional average (59.6) and OECD average (85.1).

While China is not Asia’s worst offender in terms of accounting and compliance complexity, it underperforms for its level of economic development.

Transition to VAT

China’s tax system underwent an overhaul with the 1994 Tax System Reform Act, which brought it more in line with China’s market-based reforms, and in 2016 with the business tax (BT) to VAT transition.

Prior to the VAT reform, businesses in China were subject to different taxes depending on their industry. Broadly speaking, BT applied to the service sector, while VAT applied to manufacturing.

The VAT reform, besides aiming to reduce the tax burden of companies in the service sector, sought to streamline China’s tax system by applying VAT to essentially all industries. Although this will simplify China’s tax system in the end, the transition has inevitably introduced some growing pains.

For instance, it is not always clear which VAT rate should be applied to a given product or service. Hannah Feng, Senior Manager of Corporate Accounting Services at Dezan Shira & Associates, said, “Under China’s current VAT regime, there are six VAT rates for exporting goods and services, including zero. It is not always easy to identify the applicable VAT rate for complicated transactions.”

The State Administration of Taxation has recognized this issue, recently cutting the 13 percent VAT bracket to lower the tax burden and simplify the system. However, many businesses remain uncertain about which VAT category applies to their goods and services.

![]() RELATED: China Deepens VAT Reform to Combat Financial Complexity

RELATED: China Deepens VAT Reform to Combat Financial Complexity

Fapiao

A fapiao is a legal receipt that serves as proof of purchase for goods and services, and is unique to China. Businesses in China must purchase fapiao from the government in advance of their sales, meaning that they essentially pay taxes before actually making sales.

There can therefore be an element of guesswork in the process, as businesses might under- or over-estimate the amount of fapiao they need. Increasing one’s fapiao quota can be a costly and time-consuming process.

Individuals must collect fapiao to obtain business expense reimbursements, while businesses need special VAT fapiao to claim tax deductions. Businesses unable to produce a fapiao upon request face legal jeopardy, making it essential for their fapiao systems to be well organized.

There are multiple types of fapiao – including electronic ones – and complicated systems for their management, issuance, and verification. With all these considerations, China’s fapiao system invariably causes confusion and accounting issues for foreigners unfamiliar with the concept.

Chinese GAAP and CIT regulations

Chinese Generally Accepted Accounting Principles (GAAP), also known as Chinese Accounting Standards (CAS), are increasingly in line with US GAAP and International Financial Reporting Standards (IFRS), but elements unique to the Chinese system often confuse foreigners. These challenges mostly take shape in the discrepancies between the formal standards and practical realities.

For example, Chinese GAAP prescribes that sales revenue and cost of sales should be recognized when the risks and rewards associated with the product have been transferred to the buyer. In practice, however, accountants prioritize issuing or receiving special VAT fapiao as the basis for deciding when to record a transaction, as this offers more practical resource to determine when a transaction has been completed. Such practices, however, do not technically follow Chinese GAAP and can cause issues in fapiao management.

The differences in Chinese and international accounting standards become most pronounced when an overseas parent company requests financial information from its Chinese subsidiary.

As many small and medium-sized entities cannot afford the tax software used by larger multinationals, they often resort to converting reports manually. This process can lead to errors and distortions, as accountants in the company’s home country may not be trained in China’s unique system.

Transfer pricing

Reforms to China’s transfer pricing regime in 2016 have increased reporting requirements, making transfer pricing a more important – and more time consuming – tax consideration for businesses in China. China supports the international Base Erosion and Profit Shifting (BEPS) Action Plan, which aims to curb tax avoidance.

The new transfer pricing regulations increase the number of related-party filing forms from nine to 22, requiring far more information about entities on both sides of a given transaction than before. Of these 22 forms, six are Country-by-Country reporting forms – which must be prepared bilingually – while the other 16 must be prepared in Chinese. Further, entities with related party transactions above certain thresholds must prepare their contemporaneous documentation in Chinese before May 31 of the following year and be prepared to submit them to authorities within 30 days of a request. Enterprises that display certain risk characteristics may be subject to an investigation by China’s special BEPS task force.

Transfer pricing is an issue of particular note for foreign businesses in China, as they often transfer money across related parties and branches in other jurisdictions. Beyond simply complying with transfer pricing regulations, businesses must walk the line between strategic tax optimization and illegal tax avoidance.

![]() Tax Compliance Services from Dezan Shira & Associates

Tax Compliance Services from Dezan Shira & Associates

Ensuring compliance in a complex environment

Besides the challenges noted above, other requirements – such as strict foreign exchange controls – can complicate accounting and audit in China. While China’s tax regime can be complicated, and sometimes inefficient, recent reforms should streamline the system in the long term. However, certain particularities of China’s tax system, such as fapiao, should be expected to remain in place for the foreseeable future.

Although China continues to reform its tax system, some changes may not be happening fast enough. Tammy Tian, Manager of Corporate Accounting Services at Dezan Shira & Associates, noted, “Technology is developing quite fast, and most multinational corporations are adopting ERP management systems with basically no paper material turnover. However, although China updated accounting archive regulations to accommodate digitalization, in practice most companies cannot get rid of the need to keep paper documents.”

Tax authorities appear to be aware of the practical tax issues facing businesses in China; many observers expect authorities to continue to roll out reforms to streamline the tax regime. Tian continued, “China is in the age of tax reform. China is seeking reform not only in tax collection, but also in control and management. It is believe that there will be more and more changes in tax practices going forward.”

|

China Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, India, Indonesia, Russia, the Silk Road, and Vietnam. For editorial matters please contact us here, and for a complimentary subscription to our products, please click here. Dezan Shira & Associates is a full service practice in China, providing business intelligence, due diligence, legal, tax, IT, HR, payroll, and advisory services throughout the China and Asian region. For assistance with China business issues or investments into China, please contact us at china@dezshira.com or visit us at www.dezshira.com

|

Dezan Shira & Associates Brochure

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing legal, tax and operational advisory to international corporate investors. Operational throughout China, ASEAN and India, our mission is to guide foreign companies through Asia’s complex regulatory environment and assist them with all aspects of establishing, maintaining and growing their business operations in the region. This brochure provides an overview of the services and expertise Dezan Shira & Associates can provide.

An Introduction to Doing Business in China 2017

This Dezan Shira & Associates 2017 China guide provides a comprehensive background and details of all aspects of setting up and operating an American business in China, including due diligence and compliance issues, IP protection, corporate establishment options, calculating tax liabilities, as well as discussing on-going operational issues such as managing bookkeeping, accounts, banking, HR, Payroll, annual license renewals, audit, FCPA compliance and consolidation with US standards and Head Office reporting.

China’s Investment Landscape: Identifying New Opportunities

China’s Investment Landscape: Identifying New Opportunities

China’s foreign investment landscape has experienced pivotal changes this year. In this issue of China Briefing magazine, we examine how foreign investors can capitalize on China’s latest FDI reforms. First, we outline new industry liberalizations in both China’s FTZs and the country at large. We then consider when an FTZ makes sense as an investment location, and what businesses should consider when entering one. Finally, we give an overview of China’s latest pro-business reforms that streamline a wide range of administrative and regulatory measures.

- Previous Article Investment Opportunities in China Open Up Following Regulatory Changes

- Next Article Investing in China’s Free Trade Zones