Corporate Income Tax in China

![CB-China’s tax system[76340]](https://www.china-briefing.com/news/wp-content/uploads/2017/09/CB-China’s-tax-system76340.jpg)

The fundamental regulations on China’s corporate income tax (CIT) are the CIT Law and its Implementation Guidelines. Both regulations were most recently updated in 2007 and entered into force on January 1, 2008.

![]() RELATED: How to Calculate Corporate Income Tax in China

RELATED: How to Calculate Corporate Income Tax in China

Taxpayers

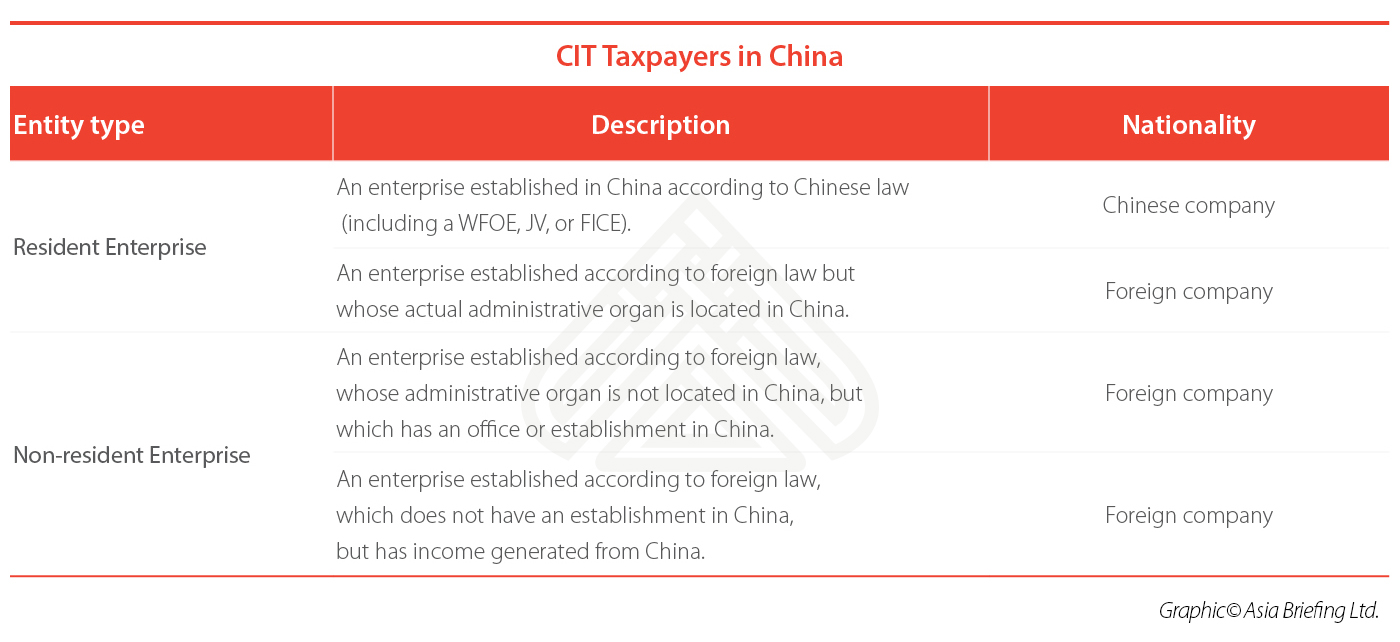

All enterprises (except sole proprietorships and partnerships), including all organizations that generate income in China, are subject to CIT. The CIT Law categorizes enterprises into resident enterprises and non-resident enterprises, which are subject to different tax obligations.

![]() RELATED: Withholding Corporate Income Tax in China

RELATED: Withholding Corporate Income Tax in China

Calculating CIT payable

CIT payable is calculated using the below formula:

CIT payable = CIT taxable income x CIT rate – Tax exemptions or reductions based on tax incentives

![]() Tax Compliance Services from Dezan Shira & Associates

Tax Compliance Services from Dezan Shira & Associates

CIT rate

A 25 percent standard CIT rate is applied to resident enterprises and non-resident enterprises with income-generating establishments in China. A 10 percent withholding rate (temporarily reduced from 20 percent) is applied to China-sourced income not related to a non-resident enterprise’s establishments in China, or China income derived by non-resident enterprises without establishments in China. Small and low-profit enterprises are entitled to a reduced CIT rate of 20 percent, and if a taxpayer qualifies as a high-tech enterprise, a reduced CIT rate of 15 percent applies.

|

|

|

China Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, India, Indonesia, Russia, the Silk Road, and Vietnam. For editorial matters please contact us here, and for a complimentary subscription to our products, please click here. Dezan Shira & Associates is a full service practice in China, providing business intelligence, due diligence, legal, tax, IT, HR, payroll, and advisory services throughout the China and Asian region. For assistance with China business issues or investments into China, please contact us at china@dezshira.com or visit us at www.dezshira.com

|

Dezan Shira & Associates Brochure

Dezan Shira & Associates is a pan-Asia, multi-disciplinary professional services firm, providing legal, tax and operational advisory to international corporate investors. Operational throughout China, ASEAN and India, our mission is to guide foreign companies through Asia’s complex regulatory environment and assist them with all aspects of establishing, maintaining and growing their business operations in the region. This brochure provides an overview of the services and expertise Dezan Shira & Associates can provide.

An Introduction to Doing Business in China 2017

This Dezan Shira & Associates 2017 China guide provides a comprehensive background and details of all aspects of setting up and operating an American business in China, including due diligence and compliance issues, IP protection, corporate establishment options, calculating tax liabilities, as well as discussing on-going operational issues such as managing bookkeeping, accounts, banking, HR, Payroll, annual license renewals, audit, FCPA compliance and consolidation with US standards and Head Office reporting.

Managing China’s Financial System

Managing China’s Financial System

Foreign investors often find China’s financial system to be one of the most difficult areas to navigate when establishing or growing their presence in the country. Navigating China’s tax system, and its complexities, requires time and commitment. In this issue of China Briefing magazine, we look at the factors that make China’s tax system unique, and identify steps foreign investors can take to manage its challenges. We first examine the issues that most commonly disorient foreign investors. We then discuss the importance of pre-investment capital planning, within the context of tough foreign exchange controls, before examining the ever-maturing regulations for the transfer pricing system.

- Previous Article Coworking Space Regulation Coming to China Following Beijing Reform

- Next Article China’s Digital Economy: The Shape of Things to Come