Pre-investment Capital Planning for China’s Foreign Exchange Control

By Dezan Shira & Associates

Editor: Zolzaya Erdenebileg

In China, companies, banks, and individuals must comply with a “closed” capital account policy. This means that money cannot be freely moved into or out of the country unless it abides by strict foreign exchange rules.

China made promises to liberalize its foreign exchange market when acceding to the World Trade Organization (WTO), but changes are being introduced gradually. Currently, the government is using the China (Shanghai) Pilot Free Trade Zone to test full currency convertibility and further liberalizations for foreign investors. If successful, regulators will likely expand liberalizations nationally.

China’s foreign exchange system

The main bodies responsible for overseeing the flow of foreign exchange is the State Administration of Foreign Exchange (SAFE) and the People’s Bank of China (PBOC), the central bank. SAFE is the administrative agency responsible for managing foreign exchange activities in China, setting relevant regulations, and administering China’s foreign exchange reserves. SAFE’s approval or record-filing is required for a range of transactions involving inbound and outbound forex payments.

![]() Pre-Investment, Market Entry Strategy Advisory Services from Dezan Shira & Associates

Pre-Investment, Market Entry Strategy Advisory Services from Dezan Shira & Associates

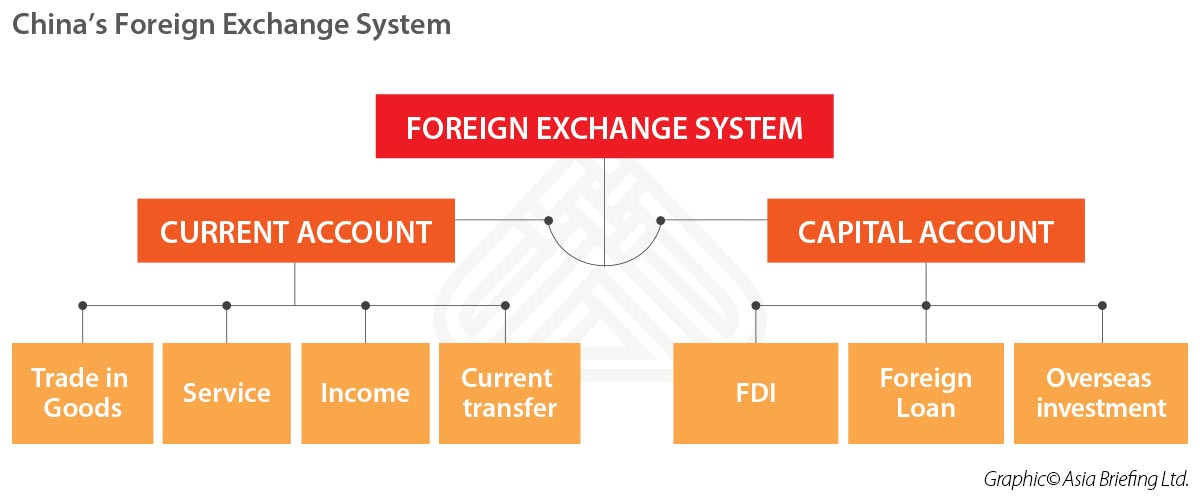

In the Chinese foreign exchange system, there are two main accounts: the current account and the capital account. The current account applies to ordinary recurring business transactions, including trading receipts and payments, payment of interest on foreign debt, and repatriation of after-tax profits and dividends, amongst other transactions.

The capital account, on the other hand, deals with capital import and export, direct investments, and loan and securities, including principal repayment on foreign debts, overseas investments, investment in FIEs, and more.

Compliance requirements

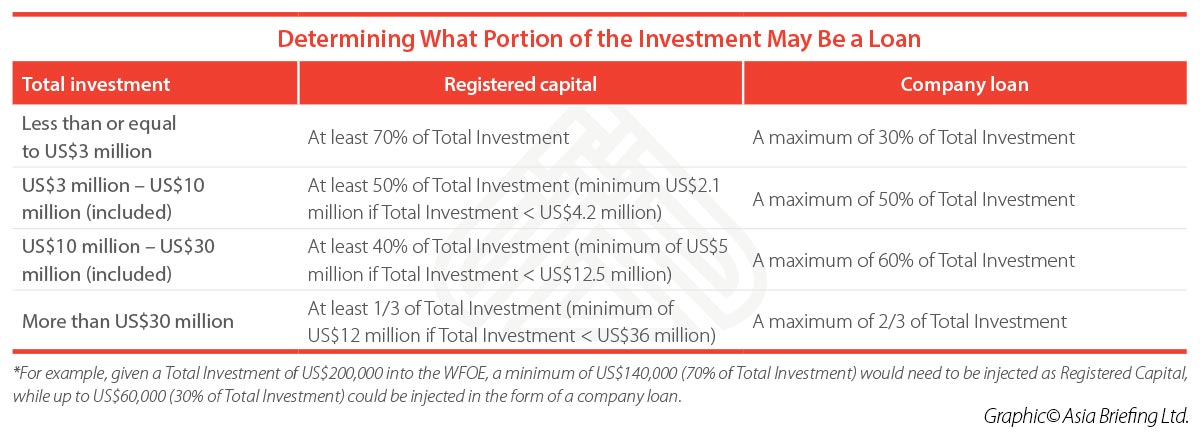

According to SAFE rules, incorporated foreign– invested enterprises (FIEs) are subject toa general debt to equity ratio requirement.This means that out of the total investment of an FIE, a certain percentage must be comprised of capital contributed by the investors.

Previously, SAFE required all FIEs to submit a Statement of Foreign Investors’ Equity in order to clarify and demonstrate the proposed outflow and inflow of foreign currency. Additionally, an authorized domestic CPA firm had to issue a Foreign Exchange Annual Inspection Report.

However, with the issuance of the Notice on Further Simplifying and Improving the Foreign Exchange Management Policies for Direct Investment on June 1, 2015, the foreign exchange annual inspection for foreign investors was cancelled. Instead, investors must submit an“Existing Right Registration” before September 30 of each year.

If the FIE fails to comply with SAFE requirements, the foreign exchange bureaus can take over the capital account information, and banks will refuse to process any foreign exchange business under the FIE’s capital account. Furthermore, if the FIE does not meet SAFE’s conditions, then banks will not allow the FIE to distribute profits to foreign shareholders.

Common challenges for foreign businesses

Given China’s restrictions on foreign currency exchange, companies have to be strategic about their funding plans early in the pre-investment stage.

Running out of funds

A common pitfall for foreign businesses is underestimating their costs, and overestimating their profits, leading to a shortfall of capital.

In one case, Company A optimistically established itself in China with a lower amount of registered capital on the assumption that it would be able to generate revenue quickly. The assumption was based on an agreement with a large client whereby the client would place a sizeable order and settle payment within 90 days. However, the payment was delayed and the company was unable to meet its cash flow target. Company A incurred substantial startup costs, including warehouse rent, raw materials expenses, and salary commitments.

To meet costs, the overseas parent company initiated steps to inject more registered capital, but it would be weeks before the entire process could be completed. In the meantime, Company A was unable to pay its employees and missed mandated social insurance contributions. Therefore, besides its initial costs, the company faced additional penalties including a fine and potential labor disputes.

Restrictions on overseas transfers

FIEs may find that repatriating capital or profits out of China now includes increased layers of inspection and security from the government.

Due to record levels of outbound direct investment (ODI) in recent years, the Chinese government introduced new capital controls through a number of announcements by government agencies at the end of 2016. The announcements indicated that certain outbound transactions would not be approved unless given specific approval. The transactions in question that can affect FIEs include:

- Outbound investments made by limited partnerships;

- FDI involving an acquisition of 10 percent or less of the shares of an overseas listed company;

- Overseas investments made by newly-established entities without substantial operations;

- Outbound transactions inside the core business of the company involving US$1 billion or more;

- Transactions involving domestic capital participation in the delisting of overseas listed Chinese

Government scrutiny of ODI varies based on the amount of money being sent, the industry of the target, the receiving country, and the investor.

Starting July 2017, banks and financial institutions in China have to report all domestic and overseas cash transactions of RMB 50,000 (US$7,600) or more; the previous threshold was RMB 200,000 (US$30,350). Any overseas transfers by individuals of US$10,000 or more will also be reported.

Additionally, those seeking to transfer money will need to explain how they plan to use the foreign currency and fill out an online form pledging not to use foreign exchange to purchase overseas property, securities, life insurance, or similar products.

![]() RELATED: Calculator for Registered Capital and Total Investment in China

RELATED: Calculator for Registered Capital and Total Investment in China

Importance of pre-investment capital planning

The amount of registered capital to be invested into an FIE is a crucial decision. Companies should be careful not to invest too little, as injecting additional capital is a time-consuming process that takes anywhere from eight to 12 weeks. Companies also want to be careful not to invest too much, as excess capital will sit idly in the account and cannot be freely moved to more profitable avenues.

A safe and general rule of thumb is that a wholly foreign-owned enterprise (WFOE) should have enough capital to fund itself for the initial three to five years. If a company does end up running out of capital, then another option may be to obtain a company loan.

The procedures involved in using a company loan to increase working funds is simpler and faster than injecting new capital, generally taking about four weeks to complete. Moreover, a company loan can be returned to the shareholder or related party according to the terms of the loan agreement. However, companies should note that there are regulations on what portion of the total investment of the company will be comprised of registered capital and a company loan, respectively.

Often, FIEs are uncertain about how much to commit towards their registered capital. For some, a company loan may help to bridge differences between theory and reality. However, FIEs should carefully consider various funding options that fit their business model and market aspirations in order to better mitigate risks and additional unforeseen costs.

This article is an excerpt from the November issue of China Briefing magazine, titled “Managing China’s Financial System.” In this issue of China Briefing magazine, we look at the factors that make China’s tax system unique, and identify steps foreign investors can take to manage its challenges. We first examine the issues that most commonly disorient foreign investors. We then discuss the importance of pre-investment capital planning, within the context of tough foreign exchange controls, before examining the ever-maturing regulations for the transfer pricing system. This article is an excerpt from the November issue of China Briefing magazine, titled “Managing China’s Financial System.” In this issue of China Briefing magazine, we look at the factors that make China’s tax system unique, and identify steps foreign investors can take to manage its challenges. We first examine the issues that most commonly disorient foreign investors. We then discuss the importance of pre-investment capital planning, within the context of tough foreign exchange controls, before examining the ever-maturing regulations for the transfer pricing system. |

About Us

China Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, India, Indonesia, Russia, the Silk Road, and Vietnam. For editorial matters please contact us here, and for a complimentary subscription to our products, please click here.

Dezan Shira & Associates is a full service practice in China, providing business intelligence, due diligence, legal, tax, accounting, IT, HR, payroll, and advisory services throughout the China and Asian region. For assistance with China business issues or investments into China, please contact us at china@dezshira.com or visit us at www.dezshira.com

- Previous Article The Senior Care Sector in China: Is it Time to Think Differently?

- Next Article Registering for Social Insurance and the Housing Fund in China