China’s Healthcare Reforms Underscore Market Growth

By Dezan Shira & Associates

Editor: Qian Zhou

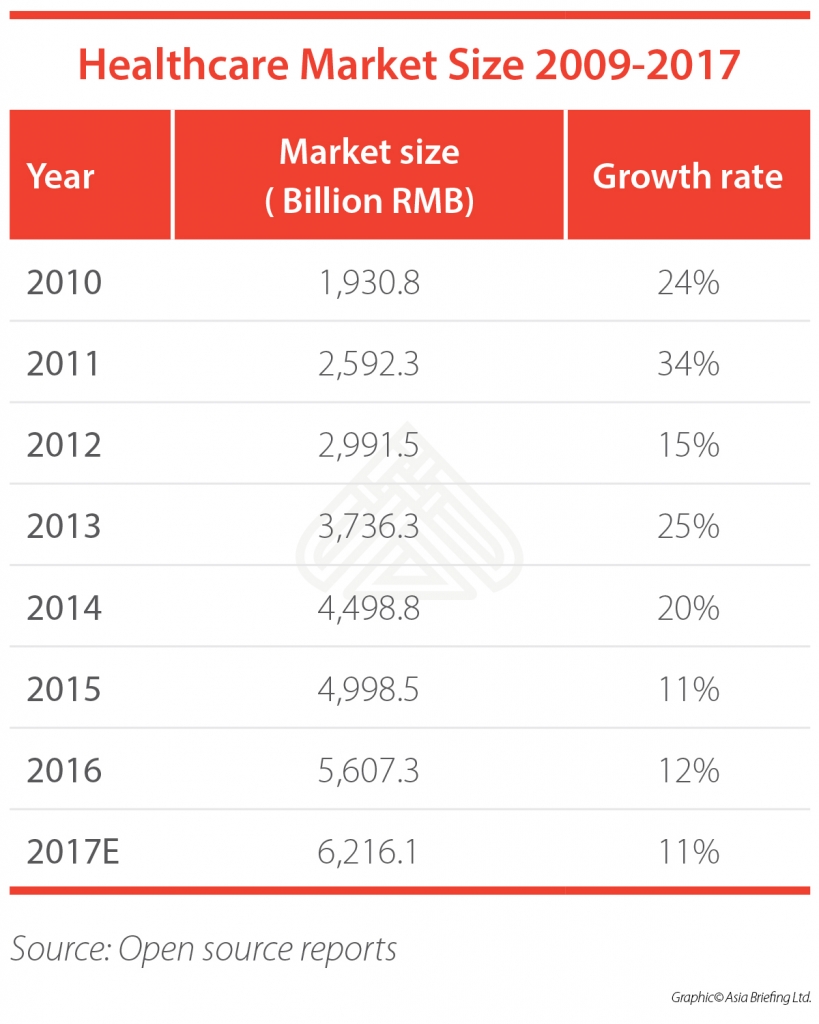

Due to its size and growth potential, China’s healthcare market is one of the most attractive in the world for foreign investors. China surpassed Japan to become the world’s second-largest healthcare market in 2013 and continues to develop at double-digit rates. Indeed, it’s the fastest-growing healthcare market of all large emerging economies.

Recently in 2016, China’s healthcare market reached RMB 5,670.3 billion (US$853.7 billion), an increase of 12 percent in local currency when compared with that of 2015. Among others, the medical device market grew 20.1 percent to RMB 370 billion (US$56 billion) in 2016, while pharmaceutical and health products sales reached RMB 1,839 billion (US$277 billion), up 10.4 percent year-on-year.

Yet, the Chinese healthcare market is still relatively immature. Although healthcare expenditures in the country has increased more than four-fold – from RMB 1,096.6 billion (US$126.1 billion) in 2006 to RMB 4,634.5 billion (US$697.7 billion) in 2016 – healthcare spending per capita is only around six percent of its GDP.

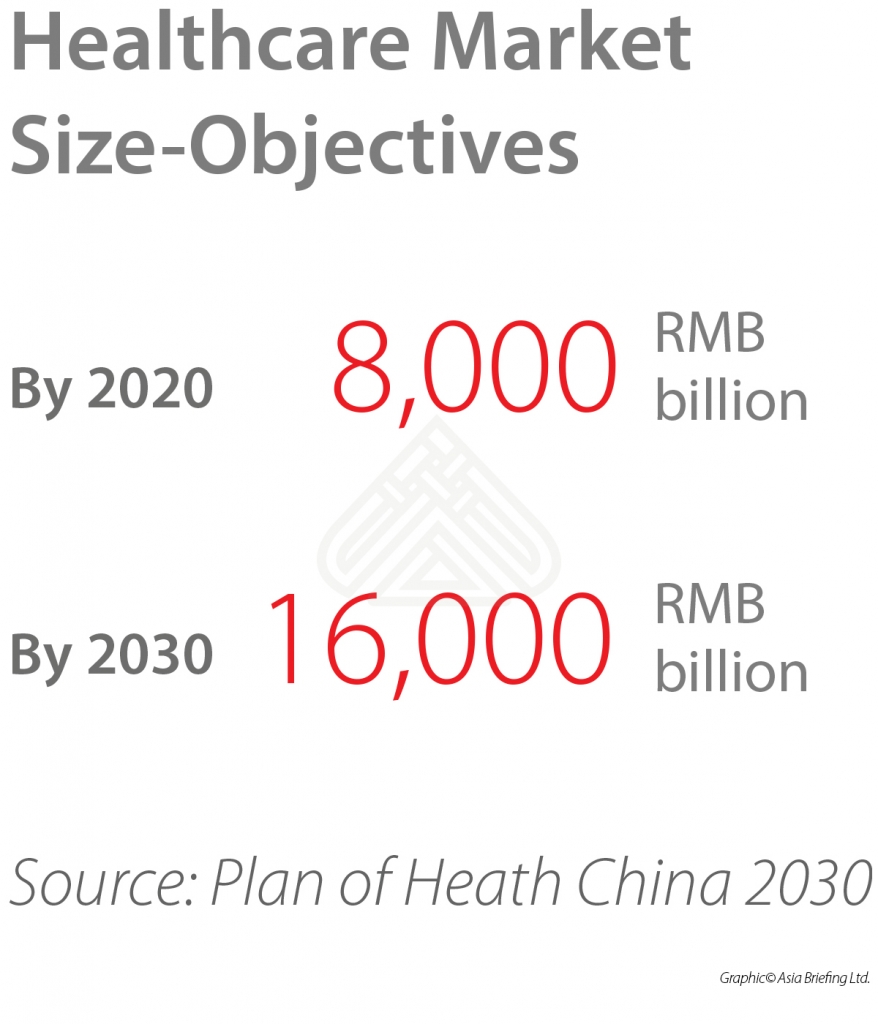

This compares unfavorably with the 17 percent in the US, 10 percent in Japan and Europe, and the average nine percent in OECD countries. By 2020, China’s healthcare spending is expected to account for 6.5 to 7 percent of its total GDP, which is around US$1 trillion. And by 2030, China’s healthcare market is targeted to reach RMB 16,000 billion (around US$2 trillion), as it is stipulated in the Plan of Health China 2030 released by the State Council in October 2016. Every health sector – from pharmaceuticals to medical devices – will have more opportunities.

While many market factors are positive, foreign investors must study the rapidly-changing regulatory environment for the industry. Healthcare reform in China started in 2009 and is still ongoing, often with different goals each year. We summarize the major 2017 reforms below.

![]() Pre-Investment, Market Entry Strategy Advisory Services from Dezan Shira & Associates

Pre-Investment, Market Entry Strategy Advisory Services from Dezan Shira & Associates

The two invoices system for pharmaceutical distribution

The “two invoice system” means that during the distribution process from drug manufacturer to hospital, only two tax invoices (or fapiao) may be issued. The manufacturer issues a first invoice to the distributor, while the distributor issues a second invoice to the hospital or medical service provider. Unlike the previous system where drug distribution chains were typically comprised of manufacturers and multiple distributors, the new “two invoice system”allows only one commissioned distributors in the procurement chain.

First piloted in selected provinces in 2016, this pilot program was expanded to 11 provinces and 200 pilot cites in 2017. According to a circular in January, the government intends to implement the two invoices system nationwide in 2018; many expect the program to be expanded to the medical devices sector as well.

The “two invoices system” is designed to streamline pharmaceutical distribution channels, reduce the cost of pharmaceuticals, and prevent corruption, In practice, the system will change the way manufacturers (importers), distributors, sales, and compliance teams in the pharma industry operate from both a business and tax perspective.

To maintain compliance in this new system, distribution channels of pharmaceutical products have to change from a hierarchical structure to a flat one.

Pharmaceutical companies also need to reconsider their pricing strategies, as the disparity in pricing between the hospital purchase price and manufacturer’s (or importer’s) ex-factory price is much greater in the two invoice system.

If companies decide to increase the ex-factory price to match the purchase price, excluding distribution fees, this may affect the retail price, resulting in a higher VAT payable by the manufacturer (importer). If companies decide not to increase the ex-factory price, the pricing information will be made available for hospitals to review, possibly resulting in demands for lower sales prices and thus affect the manufacturer’s (importer’s) margins.

It is important for pharmaceutical companies to keep abreast of the healthcare reform and the “two invoice system”, assessing and adjusting business models. Preemptive measures to absorb tax implications relating to transfer pricing and promotional activities, such as pricing adjustments regarding ex-factory prices, and revisiting existing arrangements with e-distributors.

Registration for drugs and medical devices

The Communist Party of China’s Central Committee and the State Council jointly released the Opinions on Encouraging the Innovation of Drugs and Medical Devices by Deepening the Reform of Review and Approval System (“the Opinion”), which came into effect on October 8, 2017.

The Opinion lays out several primary objectives, including an overhaul of clinical trials management, accelerating the drug and medical device approval process, promoting drug innovation and the development of generic drugs, enhancing the administration of drug and medical devices throughout products’ life cycle, and improving technical review infrastructure.

Notably, the Opinion stipulates that qualified overseas clinical trial data can now be used in the drug and medical device registration and approval process, while drug and medical device registration approvals shall be fast-tracked. In addition, a rare disease catalogue will be set up and new products that can treat these rare diseases will be eligible for fast tracked trials.

Following the release of this Opinion, the China Food and Drug Administration (CFDA) released a decision to adjust the registration of imported drugs, explicitly permitting phase I clinical trials to be carried out in China. Previous requirements that imported drugs used in the clinical trials must be registered abroad or have been used in the phase II or III trials have now been scrapped.

More measures on drug and medical device registration reform are coming out, including: the new Medical Device Classification Catalogue, the pilot Medical Devices Registrant program in the Shanghai Free Trade Zone, the proposed “Drug Market Authorization Holder” (MAH) system, as well as other supportive documents in the registration and approval of drug and medical devices.

While the evolving regulatory environment may result in increased compliance cost in the short term, the reforms are designed to cut red tape in the long run to help drugs and medical device sectors grow domestically and become more competitive internationally.

![]() RELATED: An Overview of China’s Elder Care Industry

RELATED: An Overview of China’s Elder Care Industry

Private healthcare services encouraged

The General Office of the State Council issued the Opinions on Encouraging Development of Diverse Private Healthcare Services (“the Opinions”) in May 2017 to encourage private investors to participate in the medical service sector. In 2017, the government said the policy was a main goal for its plans to develop the healthcare sector.

The Opinions stated that eligible private healthcare institutions will be treated equally to public institutions and enjoy the same benefits in areas such as patient referral, charges and payments, performance assessment, as well as incentives.

Foreign investors with advanced medical technology, notable management experience, and best-in-industry operation models are encouraged to set up medical institutions through joint ventures. Foreign investors are granted pre-establishment national treatment plus negative list market-entry treatment; items subject to examination and approval are simplified and optimized.

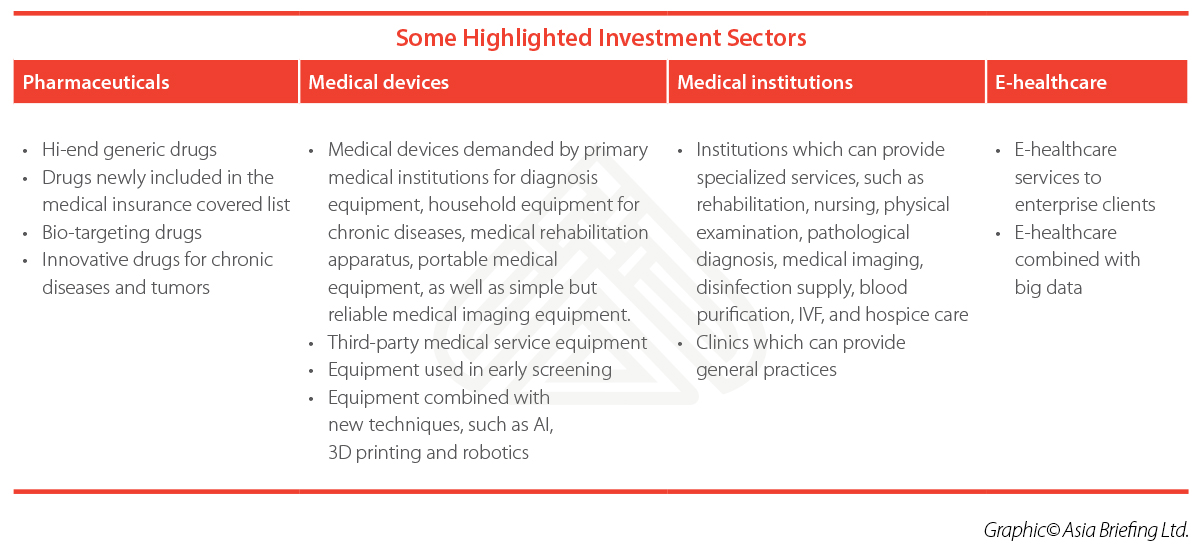

Notably, institutions that can provide specialized services – such as rehabilitation, nursing, physical examination, pathological diagnosis, medical imaging, disinfection supply, blood purification, and hospice care – will receive more preferential policies. Following this Opinions, the government issued more supportive measures. For example in August 2017, the National Health and Family Planning Commission released a notice providing a “Two- in-One” reform to simplify the approval procedures of setting up a medical institution. For institutions categorized as Class B and below, the two licenses required previously – the Approval to Establish a Medical Institution and PRC Medical Institution Practice License – will be combined into one.

Foreign investors who plan to engage in the long- restricted medical service sectors will now find it easier to enter China’s enormous and promising market.

Investment outlook

The country’s market for healthcare will continue to grow with China’s rapidly aging population and rising affluence, and policymakers are aware. The 2017 reforms will substantially reshape China’s healthcare industry.

There are other policies that may have important implications in the healthcare sector. For example, the latest Catalogue of Industries for Guiding Foreign Investment adds intelligent medical rescue devices to the encouraged category, meaning that they benefit from special government incentives. In addition, the revised Medicine List for National Basic Medical Insurance, Work-Related Injury Insurance, and Maternity Insurance adds more than 300 new drugs into the insurance funded medicine list, which means more demand for these drugs.

In addition, the government endeavors to expand the hierarchical diagnosis system to 85 percent of all its cities, which should substantially increase demand from primary medical institutions for diagnosis equipment, household equipment for chronic diseases, medical rehabilitation apparatus, portable medical equipment, as well as medical imaging equipment.

In sum, 2017 has seen continuous, robust growth, and dynamic regulatory changes in healthcare market. With the government aiming to ensure all citizens have access to basic healthcare services by 2020, multinational companies should sit up and pay attention.

About Us

China Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Asia, including ASEAN, India, Indonesia, Russia, the Silk Road, and Vietnam. For editorial matters please contact us here, and for a complimentary subscription to our products, please click here.

Dezan Shira & Associates is a full service practice in China, providing business intelligence, due diligence, legal, tax, accounting, IT, HR, payroll, and advisory services throughout the China and Asian region. For assistance with China business issues or investments into China, please contact us at china@dezshira.com or visit us at www.dezshira.com

- Previous Article Registering for Social Insurance and the Housing Fund in China

- Next Article China’s Anti-tax Avoidance Rules