VAT Rates in China Lowered – 2019 Work Report Announcement

China will lower its value-added tax (VAT) rates as part of an RMB 2 trillion (US$298.3 billion) cost cut package, as the government seeks to reduce costs for businesses amid a slowing economy and tariff dispute with the US.

The announcement was made by Premier Li Keqiang on March 5 in his annual Work Report delivered at the Two Sessions, where China’s policy agenda for 2019 was announced.

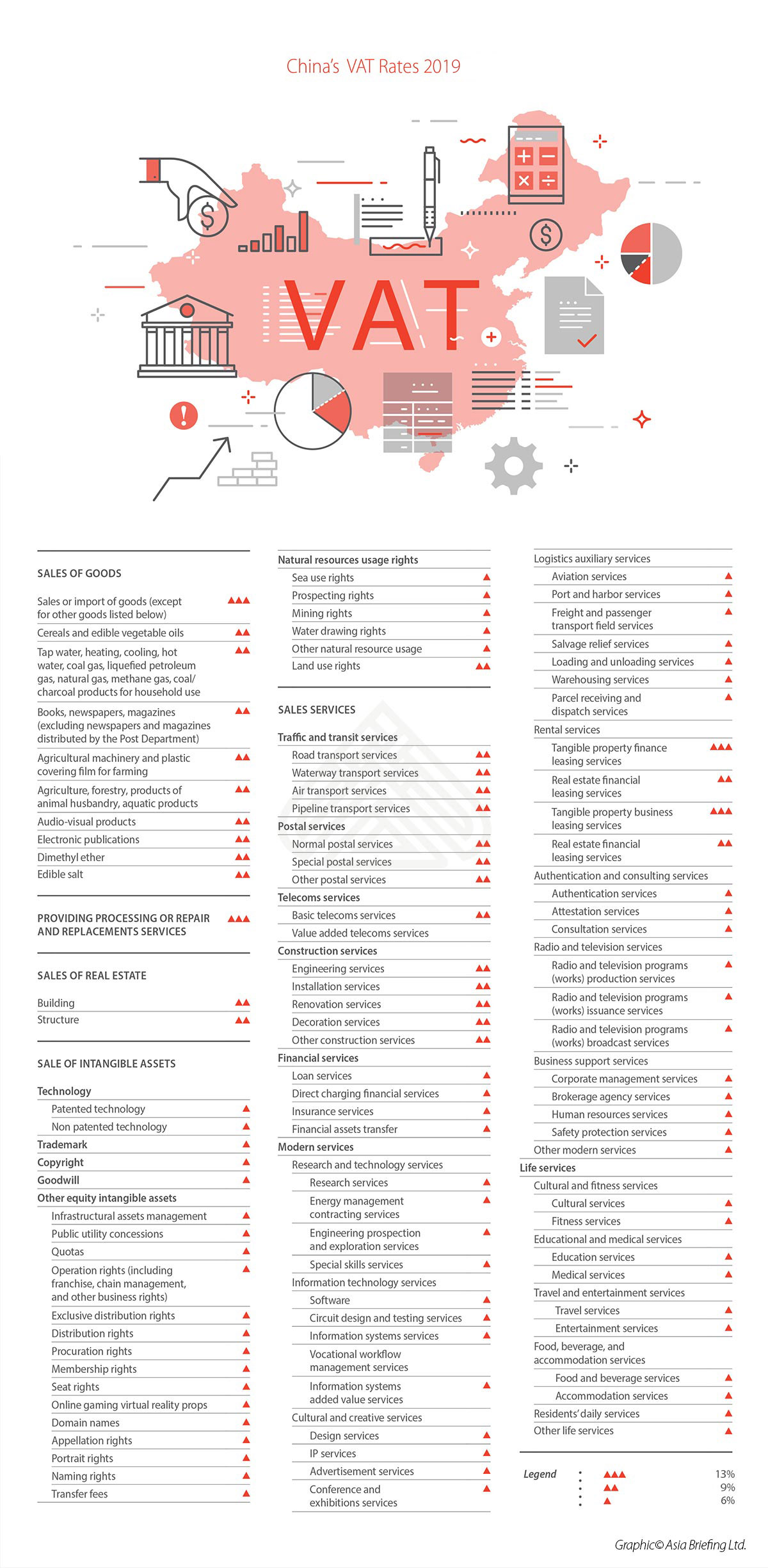

According to Li, China’s VAT rates will change as follows:

- The 16 percent VAT rate, which applies to the manufacturing sector, will be lowered to 13 percent;

- The 10 percent rate, which applies to construction and transport, will be lowered to nine percent; and

- The six percent rate, which applies to services, will remain the same, but more deductions for the bracket will be introduced.

The new VAT rates will come into force from April 1, 2019.

Moreover, from April 1, 2019 to December 31, 2021, taxpayers in the service sector – which is the six percent VAT bracket – will be able to enjoy an addition input VAT deduction of 10 percent.

In addition to lowering VAT rates, Li said that tax authorities will continue to explore the possibility of further streamlining the VAT system by reducing the number of VAT brackets from three to two. China also reduced its VAT rates last year as part of a similar tax cut package.

Government officials have repeatedly stressed that tax cuts and administrative streamlining will be used to boost the economy in the place of broader stimulus spending, as the government seeks to reduce the country’s debt exposure.

As of April 1, China’s updated VAT rates will be as follow.

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia from offices across the world, including in Dalian, Beijing, Shanghai, Guangzhou, Shenzhen, and Hong Kong. Readers may write china@dezshira.com for more support on doing business in China.

- Previous Article China Bans Questions on Marital, Childbearing Status during Hiring

- Next Article Navigating the Internet in China: Top Concerns for Foreign Businesses