Closing a Representative Office in China

A Representative Office (RO) is a popular corporate establishment model for foreign investors entering China.

An RO is an extension of a parent foreign enterprise, and does not form its own separate legal entity. They are often used by foreign companies to facilitate activities in China, such as communicating and liaising with China-based agents and distributors.

For various reasons, however, foreign investors might come to a point where they must close their RO.

For example, an investor needs to close its RO when:

• The RO is required to shut down in accordance with the law;

• The RO no longer engages in business activities upon the expiry of its period of residence;

• The foreign enterprise terminates its business (meaning the parent company is being closed);

• The foreign enterprise terminates its RO; or

• The RO is no longer suitable for facilitating foreign investor’s business in China, as ROs are unable to engage in profit-making commercial activities.

Investors should note that one cannot simply walk away from the RO without properly closing it. As the RO will soon be in non-compliance with taxes and other regulations, fines and penalties will be imposed.

If no rectification is made, the RO’s license may be revoked. At this point, the foreign company and the RO Chief Representative will be blacklisted and barred from setting up a new RO in China for the next five years.

![]() Company Deregistration Services from Dezan Shira & Associates

Company Deregistration Services from Dezan Shira & Associates

The deregistration procedure

As an RO is not a legal personality, the term “deregistration” is used instead of “liquidation”, though the two processes share many similarities.

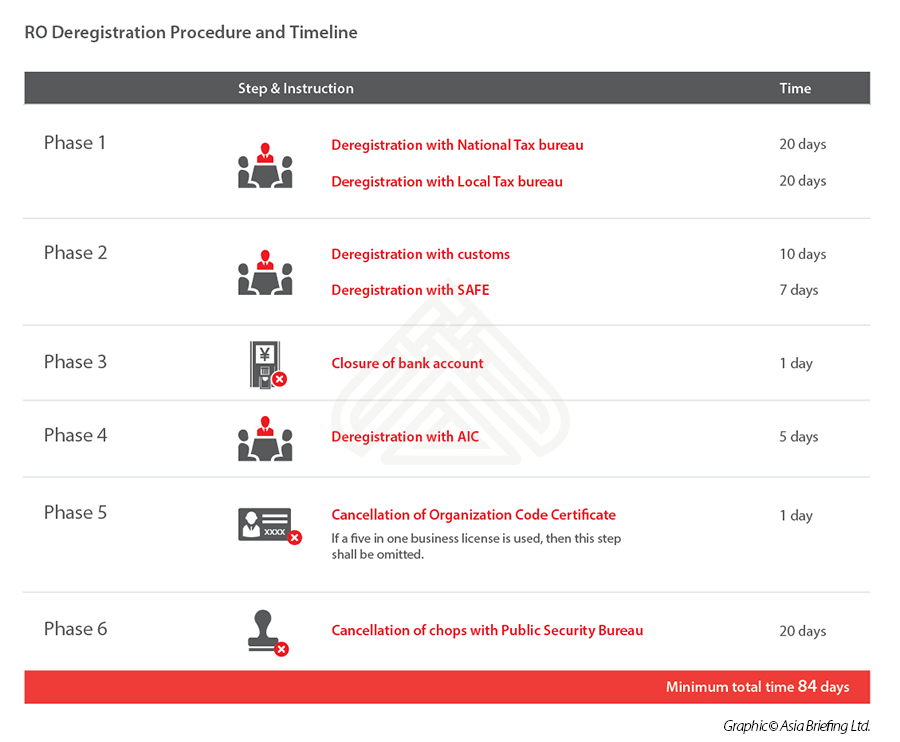

The procedures are as follows:

Step 1: Prior to actual deregistration, the RO must apply to both its local tax bureau and the state tax bureau for tax audit and tax deregistration. To do so, the RO must first undergo an audit by a local Chinese CTA firm for taxes owing from the past three years.

Once the audit is completed, the enterprise should submit to the tax bureau a board resolution affixed with the signature and seal of the chairman of the board of directors, as well as a cancellation application signed by the chief representative of the RO.

Should any unpaid taxes or other irregularities be found by the tax authorities at any point during this process, the RO may be required to submit additional documentation, pay penalties, or settle unpaid taxes with the authorities.

Step 2: The RO should then deregister its foreign exchange registration at the local SAFE and customs registration in the local Customs. In case it does not have such registrations, it still needs to get corresponding official statements from the bureaus in charge as proof.

Step 3: The enterprise should close its bank account. Unissued checks and deposit slips will need to be returned to the bank and any funds remaining in the account should be transferred out. If the RO intends to transfer the account to its parent company, it will be required to provide reasons for doing so and seek approval from the bank.

Step 4: The enterprise can then proceed to deregister with its local AIC where its application will be processed within 10 workdays of receipt. If successful, the enterprise will be issued a “Notice of Deregistration” and all the registration certificates will be cancelled, as well as the chief representative’s working card (工作证).

Announcement of the RO’s deregistration must be listed in a media outlet designated by the AIC. The RO’s business registration and office lease must be valid up until the official notification of deregistration has been issued by the AIC.

Step 5: The enterprise should conduct deregistration in the Quality and Technical Supervision Bureau and Statistics Bureau in case the RO has not received its five-in-one business license.

Step 6: Notification of the RO’s deregistration should then be filed with the Public Security Bureau to cancel its chops.

![]() RELATED: Company Relocation and Land Appreciation Tax in China

RELATED: Company Relocation and Land Appreciation Tax in China

The total time required for deregistration is typically three to six months (depending on the region), but can take over a year in cases containing irregularities, particularly in the tax deregistration phase.

To be noted, obtaining a deregistration certificate from both the SAFE and customs authorities is a mandatory part of the RO deregistration process, regardless of whether the RO has ever obtained a registration certificate from either of these authorities.

Moreover, if the RO business license has expired before this date, the investor will need to pay a fine.

This article is adapted from “Establishing and Operating a Business in China 2018“. Establishing and Operating a Business in China 2018 is designed to explore the establishment procedures for the Representative Office (RO), and two types of Limited Liability Companies – the Wholly Foreign-owned Enterprise (WFOE) and the Sino-foreign Joint Venture (JV) – along with related business considerations that decision-makers should examine at the pre-investment, setup, and operational stages of the expansion cycle.

This article is adapted from “Establishing and Operating a Business in China 2018“. Establishing and Operating a Business in China 2018 is designed to explore the establishment procedures for the Representative Office (RO), and two types of Limited Liability Companies – the Wholly Foreign-owned Enterprise (WFOE) and the Sino-foreign Joint Venture (JV) – along with related business considerations that decision-makers should examine at the pre-investment, setup, and operational stages of the expansion cycle.

This article was originally published on June 3, 2008 and has been updated with the latest regulatory changes.

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices in China, Hong Kong, Indonesia, Singapore, Russia, and Vietnam.. Please contact info@dezshira.com or visit our website at www.dezshira.com.

- Previous Article US Businesses in China Optimistic Despite Trade War

- Next Article Why Businesses Should Pay Attention to China’s Government Inspections