Where to Invest in China: A Primer on its Economic Development Zones

Contributed to by Zoey Zhang

China’s economic development zones (EDZs) are areas with preferential business policies that differ from those governing the country as a whole. First experimented with in the 1970s, China has created a range of EDZs to attract foreign direct investment (FDI) and boost domestic growth.

EDZs provide a broad range of FDI incentives, which vary depending on the specific EDZ. Businesses operating in EDZs can expect, among other incentives, a higher level of autonomy over their operations, a variety of tax exemptions, land and building subsidies, and preferential employment policies.

In this article, we look at the different types of EDZs in China and the benefits they offer to foreign investors.

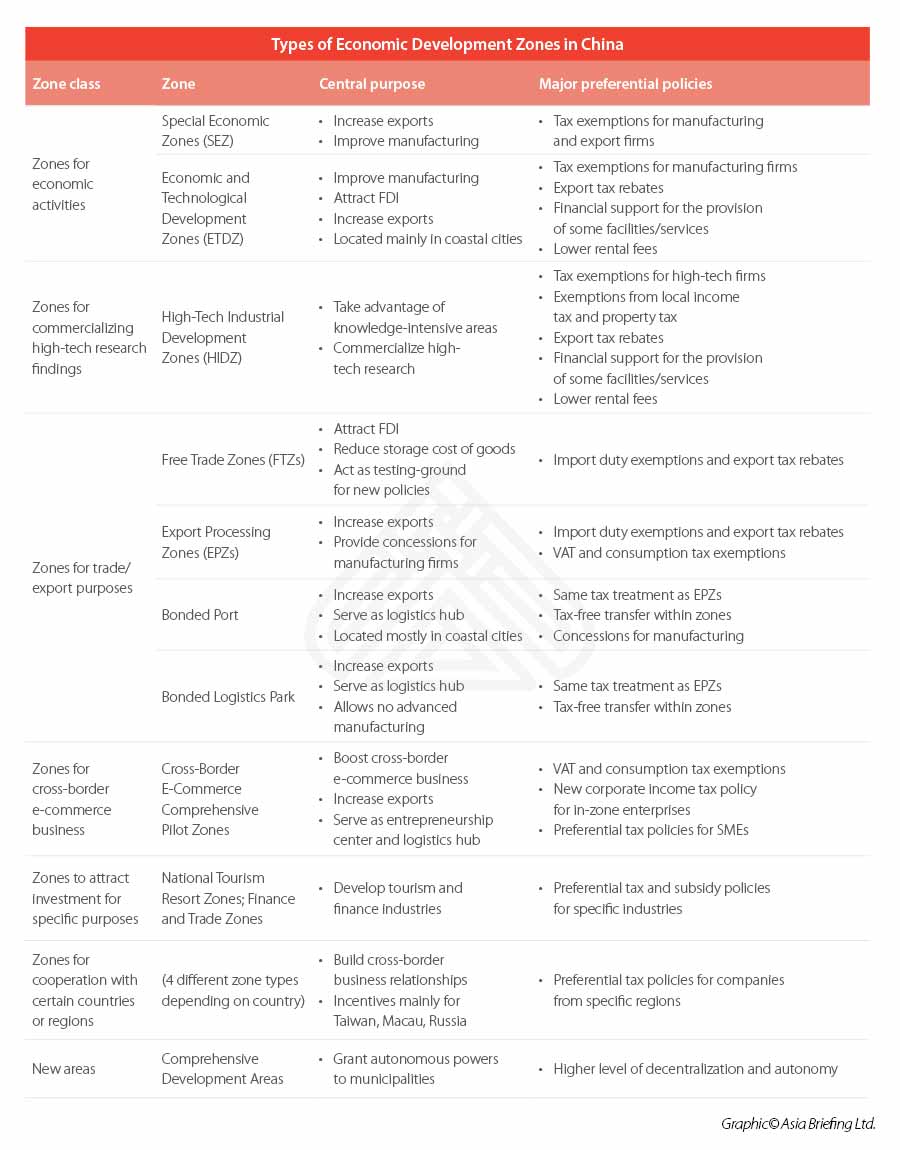

Types of economic development zones in China

There are at least 15 types of national-level EDZs. When considering investment into an EDZ, it is important to be aware of the subtle differences in the incentives that distinctive zone types provide.

The 15 EDZ types can be split into seven classes, with zones falling in the first three being the most popular locations for FDI:

- Zones for specific economic activity;

- Zones for commercializing high-tech research;

- Zones for trade and exports;

- Zones for cross-border e-commerce business;

- Zones to attract investment for specific purposes;

- Zones for cooperation with specific countries; and

- New Areas.

Zones for specific economic activity

Special Economic Zones (SEZ) and Economic and Technological Development Zones (ETDZ) fall into the first category. They are both heavily focused on attracting FDI and tend to provide incentives for manufacturing.

SEZs are only seven in number, cover much larger areas, and tend to have more generalized policies rather than incentives for specific sectors. For example, China’s first SEZ was set up in Shenzhen, which now covers the whole city and primarily provides a preferential tax environment for manufacturers oriented towards export markets across a wide range of industries.

ETDZs, however, tend to focus on providing incentives for specific kinds of activities, such as international trade, utilizing local resources, or developing technological innovation. There are almost 200 national-level ETDZs, each of which covers a much smaller area than an SEZ.

To set up in the ETDZ, interested enterprises are recommended to check the official website or consult with the ETDZ to see whether they meet the requirements in terms of registration capital, operation period, and professional qualifications of management personnel in advance (national-level ETDZs usually have the highest standards).

Taking the Tianjin Economic – Technological Development Area (TEDA) as an example, if the eligible enterprise has already been registered in Tianjin, then it only needs to prepare all the required materials and physically submit them to the TEDA to be registered in the area.

Foreign-invested enterprises (FIE) newly setting up in the TEDA need to have their names pre-approved by the local Administration for Market Regulation (AMR). They will also need to check if their industry is on China’s negative list for foreign investment. If it is, the FIE must seek approval from the examination and approval department; If not, the enterprise can just complete a record filing. The FIE will also need to go through registration procedures with taxation, foreign exchange, and customs. After successful registering with the AMR, the enterprise can submit the required materials to the zone authority for registration in the zone.

Zones for commercializing high-tech research findings

High-Tech Industrial Development Zones (HIDZ) aim to use the technological resources of research institutions, universities, and private companies to develop innovative high-tech products. Many HIDZs provide incentives for foreign tech firms with the aim of building collaboration between institutions to expedite the commercialization of research and development.

Innovation-focused ETDZs and HIDZs have similarities as they both focus on promoting innovation.

However, ETDZs often have a specific industry focus, are located further away from city centers, and are more heavily linked to manufacturing. HIDZs are instead located inside city centers and tend to create clusters of high-tech research institutions to foster research collaboration rather than manufacturing capabilities.

HIDZs usually welcomes foreign investment in industries that are encouraged by the state, such as high-end or smart manufacturing, green manufacturing, new materials, technical services, etc. However, each HIDZ has its own promoting industries. Interested FIEs are advised to check whether they fall under the wanted category.

Similarly, newly established FIEs will need to get their enterprise names pre-approved. The FIE will need to consult with the HIDZ on the establishment procedures and prepare the required application materials for registration in the zone.

Zones for trade and export purposes

There are four zones in this category, namely Free Trade Zones (FTZs), Export Processing Zones (EPZs), Bonded Logistic Parks, and Bonded Ports. Among other purposes, they collectively focus on attracting FDI to increase imports and exports through cost reductions.

FTZs focus on developing trade and the internationalization of the renminbi (RMB), while also acting as a testing ground for new policies before nationwide implementation. FTZs provide favorable environments for FDI primarily through less restrictive investment policies and administrative systems, as well as tax incentives for import and export.

The purpose of EPZs is similar, but they are primarily set up to develop export-orientated industries through export processing management. Bonded Ports, meanwhile, provide highly competitive trade-focused tax and subsidy policies, and Bonded Logistics Parks have a clear focus on the movement and storage of goods within the zones.

To enter the FTZs, foreign investors must check whether their industry is listed on the free trade zone negative list for foreign investment. If it is in a restricted industry, they’ll need to seek the approval in advance to enter the industry.

In addition, FTZs may also have various requirements in terms of registration capital, operation period, and professional qualifications of management personnel for different types of enterprises. For example, Shenzhen Qianhai FTZ requires FIEs to have registered capital of more than RMB 5 million (US$ 0.73 million), while wholly Hong Kong-invested enterprises don’t need to meet this requirement. Qianhai FTZ also requires that the minimum registered capital of a finance leasing company is RMB 10 million (US$ 1.45 million).

Investors need to check the guidance on FIE establishment on the official website, prepare the application materials as required. They’ll may have to file the application online and physically submit the required application materials as well.

Zones for cross-broader e-commerce business

China’s Cross-Border E-Commerce Comprehensive Pilot Zones were set up to boost the development of cross-border e-commerce. These pilot zones will try new technological standards, business models, and methods of supervision for cross-border e-commerce transactions, payments, logistics, customs clearance, tax refund, foreign exchange settlement, and others. Successful practices will be replicated nationwide.

As of January 2020, China has set up 59 Cross-Border E-Commerce Comprehensive Pilot Zones in four batches, attracting a large number of e-commerce platforms, payment, logistics, warehousing, and financial service enterprises.

Eligible in-zone enterprises may enjoy tax exemptions on value-added tax (VAT) and consumption tax for exported products, new corporate income tax policy, tax preferences for small and medium-sized enterprises (SMEs), and a more robust cross-border business chain.

The establishment procedures of FIEs in Cross-Border E-Commerce Comprehensive Pilot Zone varies from regions as specific implementation plan are issued by the provincial governments.

Taking the Hangzhou Cross-Border E-Commerce Comprehensive Pilot Zone as an example; to set up an FIE here, the enterprise needs to contact the administrative committee of the zone to determine the cooperation intention of both sides. The administrative committee may request a brief on the business operation mode, products, business performance, logistics operation mode, etc. of the FIE. Qualified enterprises will need to apply for some certificates as required and follow the registration rules of the zone. They may need to complete the relevant filing procedures at the customs and the inspection and quarantine departments as well (if applicable).

Other zones

The other seven zones types fall into the last three categories, Zones to Attract Investment for Specific Purposes, Zones for Cooperation with Specific Countries, and New Areas. These zones collectively make up only a small proportion of all national-level EDZs.

Zones to Attract Investment for Specific Purposes have preferential tax and subsidy policies that focus specifically on either tourism or finance. They are worth investigating for businesses thinking of entering these sectors in China, as they are generally heavily restricted from FDI.

Zones for Cooperation with Certain Countries or Regions provide tax incentives for conducting trade and business with neighboring regions, focusing mainly on Taiwan, Macau, and Russia.

New Area Zones, such as the Shanghai Pudong New Area and Tianjin Binhai New Area, encompass some of the zones mentioned in other categories. They have been established to grant autonomous regulatory power to the local governments that manage specific EDZs.

Where to invest in China

There are over 2,000 EDZs, each with unique investment incentives and accreditation at different levels of government. Even within zones of the same type, the level of infrastructure, amount of autonomy, and breadth of incentives vary widely, creating an extremely diverse investment environment.

Further complicating the business landscape, EDZs can have accreditation at the national, provincial, municipal, and district levels. Accreditation at a higher level generally means larger tax exemptions and better infrastructure.

However, smaller companies are often better off locating in zones with a lower level of accreditation because they may not be eligible for incentives in zones with higher-level accreditation.

The right EDZ for investment depends heavily on a company’s specific business needs. Among many other factors, businesses need to take into account the location of suppliers and resources, the quality of the surrounding transport network, the cost of land, and which tax exemptions they are eligible for.

The complicated and diverse nature of China’s EDZs mean merely investing in any EDZ does not guarantee success. To ensure their investment pays off, businesses should consult experienced experts who understand the regulatory and business environment, and work with them throughout the investment process.

Our firm has over 25 years of experience in helping businesses set up in China and has professionals on the ground who can assist and know the tax, compliance, and regional incentives available to foreign investors. Contact us at china@dezshira.com.

Editor’s Note: This article was originally published on March 19, 2019. It was last updated April 17, 2020.

Related Reading

Investment Opportunities in China’s Healthcare Sector After COVID-19

Investment Opportunities in China’s Healthcare Sector After COVID-19

How COVID-19 Will Transform the Fresh Food Industry in China

How COVID-19 Will Transform the Fresh Food Industry in China

New Business Opportunities Emerging in China Under COVID-19 Outbreak

New Business Opportunities Emerging in China Under COVID-19 Outbreak

About Us

China Briefing is written and produced by Dezan Shira & Associates. The practice assists foreign investors into China and has done since 1992 through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Dongguan, Zhongshan, Shenzhen, and Hong Kong. Please contact the firm for assistance in China at china@dezshira.com.

We also maintain offices assisting foreign investors in Vietnam, Indonesia, Singapore, The Philippines, Malaysia, and Thailand in addition to our practices in India and Russia and our trade research facilities along the Belt & Road Initiative.

- Previous Article Hong Kong Unveils Anti-Epidemic Fund 2.0: Support for Businesses, Job Retention

- Next Article China wird 2021 die Produktion wieder aufnehmen, die USA und die EU stoßen auf einen trägen COVID-19-Rückschlag