Why China is Still the Top Manufacturing Destination in Asia

China has once again secured the top spot in the Asia Manufacturing Index (AMI) 2026, marking its third consecutive year as the region’s premier manufacturing economy. This enduring leadership is no accident – it reflects a unique combination of industrial scale, deeply integrated supply chains, and technological sophistication that few competitors can match. While many Asian economies are actively diversifying their production bases, China’s manufacturing ecosystem continues to set the benchmark for depth, efficiency, and resilience.

Accounting for nearly 30 percent of global manufacturing output, China operates the world’s most comprehensive industrial network, spanning every major category in the UN system, from raw material processing to high-end component production and final assembly. This completeness allows China to internalize critical inputs, shorten lead times, and maintain cost competitiveness even amid rising labor costs and geopolitical uncertainties. Moreover, the country is not standing still; it is rapidly moving up the value chain through strategic investments in semiconductors, advanced batteries, robotics, and green technologies, reinforcing its position as a global manufacturing powerhouse.

In this article, we walk you through the factors supporting China’s manufacturing dominance. We also explore how these strengths compare with emerging manufacturing hubs in Asia and what they mean for businesses planning their regional strategies.

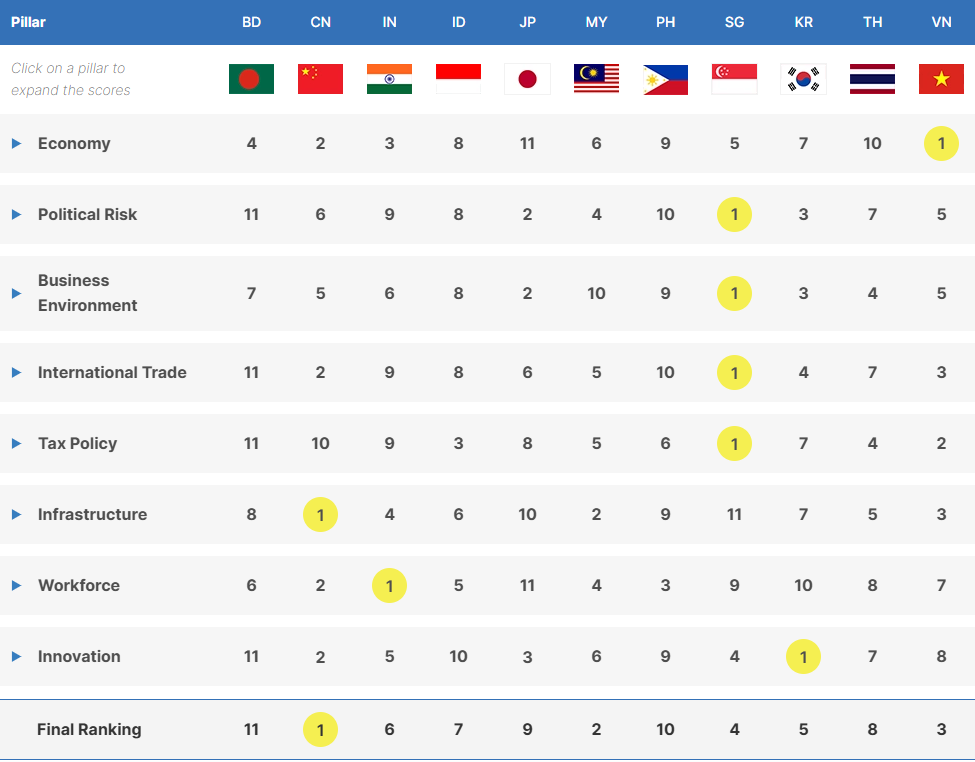

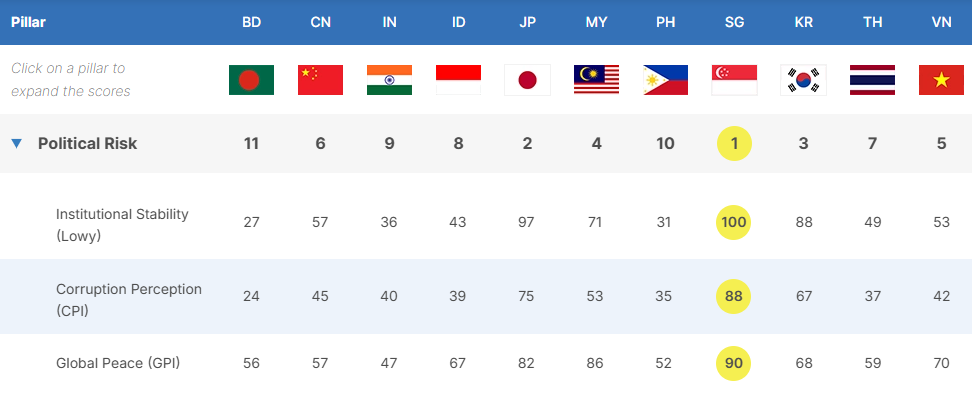

The 2026 Asia Manufacturing Index Rankings

Parameters are scored on a scale of 0-100, with 100 being the highest. Pillars are ranked 1-11, 1 being the best.

BD (Bangladesh); CN (China); IN (India); ID (Indonesia); JP (Japan); MY (Malaysia); PH (Philippines); SG (Singapore); KR (South Korea); TH (Thailand); VN (Vietnam)

Infrastructure: The backbone of China’s manufacturing strength

Infrastructure remains one of China’s most decisive advantages in sustaining its manufacturing leadership. The country has built an integrated network of highways, high-speed rail, inland waterways, coastal mega-ports, and multimodal corridors, enabling seamless domestic distribution and efficient export operations. Flagship routes, such as the China-Europe Railway Express and the New Western Land-Sea Corridor, provide manufacturers with cost-effective and time-sensitive connectivity to global markets, thereby reinforcing supply chain resilience.

China’s logistics ecosystem is complemented by advanced digitalization, which has modernized freight handling, customs clearance, and real-time supply chain monitoring. These innovations reduce bottlenecks and ensure predictable timelines, critical for industries operating on just-in-time models.

Furthermore, the country offers a stable and increasing green power supply, supported by rapid expansion in renewable energy sources, aligning with global sustainability requirements and helping manufacturers meet stricter carbon footprint targets.

Data from the AMI 2026 demonstrates China’s infrastructure superiority. Ranked #1 in Asia for infrastructure, China scores 97 in infrastructure investment, far ahead of most regional peers. It also boasts high electricity reliability (95) and competitive water costs compared to other economies. This robust foundation translates into operational efficiency and scalability, giving manufacturers confidence in long-term planning and cost control.

Innovation capability: Driving China’s move up the value chain

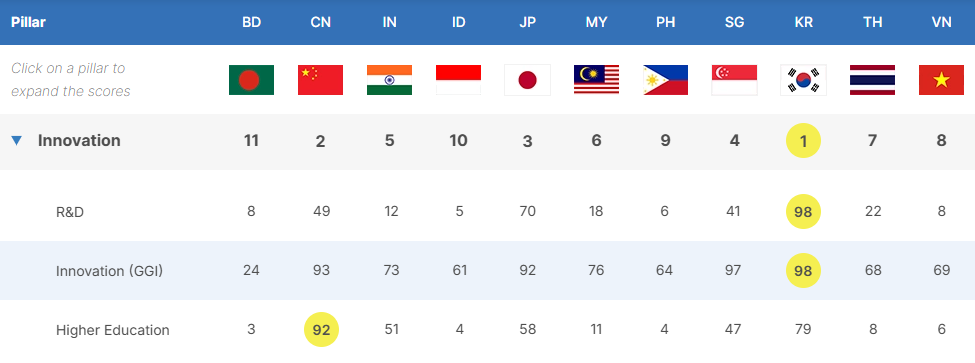

Innovation has become a defining pillar of China’s manufacturing strength, enabling the country to transition from a low-cost production base to a global technology leader. China consistently outperforms most Asian markets in innovation metrics, ranking #2 in Asia for innovation in the AMI 2026. This leadership is underpinned by robust R&D investment, a strong higher education system, and an increasingly sophisticated industrial ecosystem.

China’s innovation progress is evident in global benchmarks. In 2025, the country entered the top 10 of the Global Innovation Index, climbing from 14th in 2020, a clear signal of its growing technological competitiveness. R&D spending reached 2.68 percent of GDP in 2024, making China the world’s second-largest R&D investor in absolute terms. The country also boasts the largest talent pool globally, producing over five million STEM graduates annually and employing more than seven million full-time R&D personnel. This depth of resources fuels breakthroughs in critical sectors such as AI, biotechnology, advanced manufacturing, and green technologies.

Industrial clusters in Shenzhen, Suzhou, Shanghai, Guangzhou, and Chengdu serve as hubs for innovation, attracting both domestic and foreign investment. Strategic initiatives like Made in China 2025 and subsequent industrial policies have accelerated China’s climb up the value chain, enabling large-scale production of complex, high-tech products such as electric vehicles, semiconductors, robotics, and renewable energy equipment. These capabilities position China as an indispensable node in global supply chains, offering foreign investors access to advanced production networks that are difficult to replicate elsewhere.

Data from AMI 2026 reinforces this advantage: China scores 93 in innovation (GGI) and 92 in higher education, far ahead of most regional peers. While its R&D score (49) reflects room for improvement compared to Japan and Korea, China’s scale and speed compensate significantly. Domestic firms excel in compressing design-to-market timelines from months to weeks, leveraging deep integration between research institutions and industry. This agility ensures that innovation moves rapidly from concept to mass production, strengthening China’s role as a global manufacturing powerhouse.

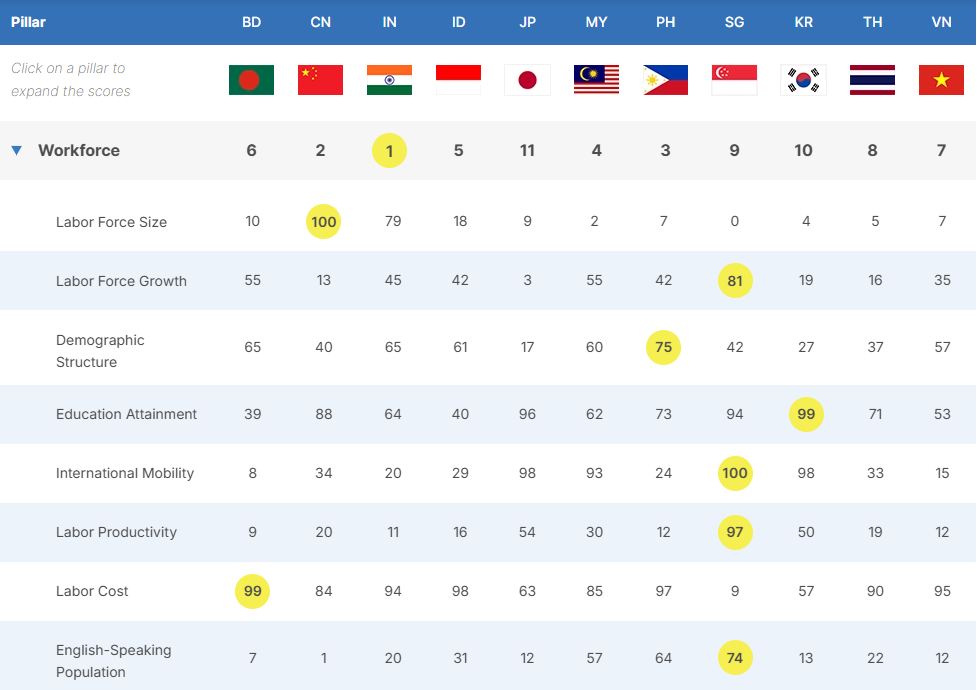

Workforce: Scale and skills powering manufacturing competitiveness

China’s workforce remains a cornerstone of its manufacturing dominance, combining sheer scale with improving skill levels. Ranked #2 in Asia for workforce in the AMI 2026, China offers the largest labor force in the region (score: 100), ensuring unmatched capacity for large-scale production. This size advantage provides manufacturers with flexibility and scalability that few competitors can replicate.

Beyond scale, China’s workforce is becoming increasingly skilled. The country scores 88 in education attainment, reflecting decades of investment in vocational training and higher education. As mentioned earlier, each year, China produces over five million STEM graduates, feeding talent into advanced manufacturing sectors such as electronics, automotive, and high-tech industries. Industrial clusters in regions like the Yangtze River Delta and Pearl River Delta benefit from this deep talent pool, supporting both traditional and emerging industries.

Labor cost remains competitive despite gradual increases, with China scoring 84 in labor cost, indicating cost advantages relative to developed economies like Japan and South Korea. While labor productivity (score: 20) still trails behind advanced economies, ongoing automation and digital adoption are narrowing this gap. The integration of robotics and smart manufacturing systems is expected to further enhance efficiency in the coming years.

Demographically, China faces challenges from an aging population, but its current workforce size and skill development initiatives continue to provide strong support for manufacturing. For foreign investors, this means access to a vast, increasingly skilled labor pool capable of supporting both high-volume production and complex, high-value manufacturing.

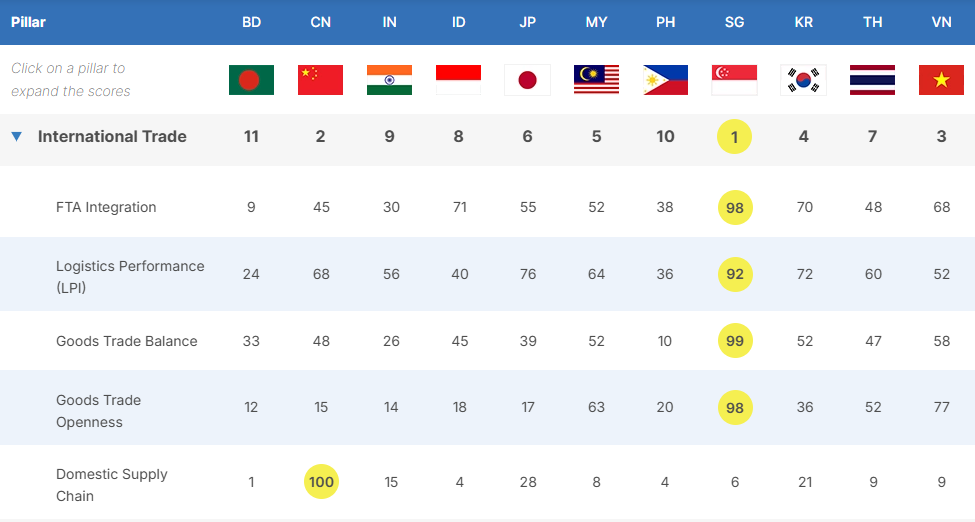

International trade and supply chain integration: Expanding China’s global reach

China’s manufacturing strength is reinforced by its extensive network of international agreements and trade frameworks, which facilitate market access and supply chain integration across Asia and beyond. Ranked #2 in Asia for international trade in the AMI 2026, China combines strong domestic supply chain capabilities with a growing portfolio of trade agreements that enhance its role as a regional hub.

Currently, China has signed 23 Free Trade Agreements (FTAs) covering 30 countries and regional blocs, including all 10 ASEAN member states. These agreements provide preferential tariff rates and streamlined customs procedures, reducing costs and improving speed-to-market for manufacturers. In addition, 10 FTAs are under negotiation, with seven more under consideration, signaling China’s continued expansion of its trade footprint. On the investment side, China maintains 110 bilateral investment treaties (BITs) in force, with another 17 signed but pending implementation, offering foreign investors greater protection and predictability. Furthermore, 114 double taxation agreements (DTAs) have been concluded, mitigating tax risks for cross-border businesses.

China’s position within the Regional Comprehensive Economic Partnership (RCEP), the world’s largest trade bloc, further strengthens its appeal. For European and global companies, leveraging RCEP through China provides access to preferential tariffs, advanced industrial clusters, and integrated supply chains that connect seamlessly with other member states. This strategic positioning enables businesses to expand across Asia more efficiently and integrate into one of the most dynamic regional economies globally.

Data from AMI 2026 highlights China’s dominance in supply chain integration: it scores a perfect 100 in domestic supply chain strength, reflecting its unmatched ability to internalize production inputs and minimize dependency on external suppliers. While its FTA integration score (45) trails behind Singapore (98), China’s scale and logistics infrastructure compensate significantly, supported by a logistics performance score of 68 and strong trade openness indicators.

Policy and business environment: Commitment to openness and investor confidence

China’s policy framework continues to evolve toward greater openness, reinforcing its attractiveness as a manufacturing and investment destination. Ranked #5 in Asia for business environment in the AMI 2026, China demonstrates strong performance in foreign investment climate (score: 85) and setup efficiency (78), supported by ongoing reforms aimed at reducing barriers and improving predictability for global businesses.

A cornerstone of these reforms is the revision of the Negative List for Foreign Investment Access, which defines industries subject to special administrative measures. The 2024 Negative List marked a major milestone by removing all restrictions on foreign investment in China’s manufacturing sector, signaling a long-term commitment to liberalization. Further reforms target critical service industries such as telecommunications, education, and healthcare, expanding opportunities for foreign participation in high-growth sectors.

Challenges and risk factors: Navigating headwinds while maintaining strength

Despite its dominant position, China’s manufacturing sector faces several structural and external challenges. Rising labor costs, geopolitical friction, and increasing pressure from trade restrictions have prompted multinational firms to adopt China+1 strategies, diversifying production to other Asian economies. These trends reflect concerns over supply chain resilience and exposure to tariff risks.

Data from the AMI 2026 highlights these vulnerabilities. China ranks 10th in Asia for tax policy, with a moderate score of 80 for tax incentives and 63 for tax rates, indicating competitive but not leading advantages compared to peers like Vietnam (tax incentives: 95). Tariff exposure remains relatively low (score: 21), which helps mitigate trade-related risks, but geopolitical uncertainty continues to weigh on investor sentiment.

Political risk indicators show mixed performance. China scores 57 for institutional stability, trailing Japan (97) and Singapore (100), and 45 for corruption perception, suggesting governance challenges compared to regional leaders. Global Peace Index (57) also reflects geopolitical tensions that could impact long-term investment strategies.

However, these headwinds are partially offset by China’s strong productivity gains, rapid automation adoption, and ongoing structural reforms. Investments in robotics, AI-driven manufacturing, and digital supply chain systems are helping reduce reliance on labor and improve efficiency. Policy measures such as market-opening reforms and tax incentives for high-tech sectors further strengthen China’s competitiveness in capital-intensive and innovation-driven industries.

China manufacturing outlook 2026

China offers unique speed, scale, ecosystems, and capabilities that are difficult to replicate elsewhere. Its deep manufacturing base, integrated supply chains, abundant engineering talent, and vast consumer and industrial markets allow companies to experiment, scale, and commercialize new products more quickly than in most other economies. These advantages provide a strategic edge that continues to anchor foreign investors to the market. For many companies, staying in China has become a defensive necessity rather than an expansion driven solely by superior profit potential.

Against this backdrop, foreign investment is expected to continue flowing into China, and the number of newly established foreign-invested enterprises is likely to keep rising. While sentiment is more cautious and geopolitical factors persist, companies still view China as essential to maintaining global relevance and operational resilience.

Optimize Your Supply Chain with Confidence

Partner with Dezan Shira Associates to design supply chain models that reduce cost and risk while meeting trade, logistics, and tax planning goals. Our experts provide:

- Regional sourcing and component localization advisory

- Customs optimization and logistics structuring

- Risk mitigation across multi-jurisdiction production

- Trade agreement utilization and re-export planning

- Supplier audits and compliance support

Contact us here to build a resilient, cost-efficient supply chain for Asia’s dynamic markets.

About Us

China Briefing is one of five regional Asia Briefing publications. It is supported by Dezan Shira & Associates, a pan-Asia, multi-disciplinary professional services firm that assists foreign investors throughout Asia, including through offices in Beijing, Tianjin, Dalian, Qingdao, Shanghai, Hangzhou, Ningbo, Suzhou, Guangzhou, Haikou, Zhongshan, Shenzhen, and Hong Kong in China. Dezan Shira & Associates also maintains offices or has alliance partners assisting foreign investors in Vietnam, Indonesia, Singapore, India, Malaysia, Mongolia, Dubai (UAE), Japan, South Korea, Nepal, The Philippines, Sri Lanka, Thailand, Italy, Germany, Bangladesh, Australia, United States, and United Kingdom and Ireland.

For a complimentary subscription to China Briefing’s content products, please click here. For support with establishing a business in China or for assistance in analyzing and entering markets, please contact the firm at china@dezshira.com or visit our website at www.dezshira.com.

- Previous Article Sports Medicine in China: Market Outlook, Regulatory Landscape, and Investment Insights

- Next Article US-China Relations in the Trump 2.0 Era: A Timeline