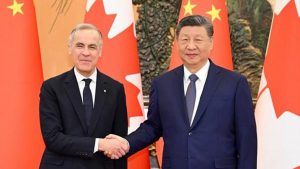

China and Canada Ease Tensions with Signing of Preliminary Trade Deal

China and Canada have reached a preliminary trade roadmap aimed at easing years of tensions. The China-Canada trade deal adjusts tariffs on EVs and agricultural goods while reopening dialogue on broader economic cooperation.

China PIPL: Key Compliance Signals from CAC’s January 2026 Q&A

China’s data protection regime is entering a more operational phase, with regulators placing greater emphasis on definitions, documentation, and accountability. The CAC’s January 2026 Q&A highlights how FIEs should translate legal requirements into practical compliance measures.

China Tax Authority Requests Self‑Inspection of Overseas Income for the Past Three Years

China is moving from CRS information exchange to active overseas income tax enforcement. For foreign tax residents in China, proactive compliance now matters more than complex structuring.

China Minimum Wage Standards 2026

This article offers a guide to minimum wages in the Chinese Mainland and discuss how labor costs are affected by changes to the minimum wage levels. The data is current as of January 22, 2026.

China’s Flourishing Agritech Sector – Opportunities for Foreign Investors

Facing land, labor, and climate constraints, China is turning to advanced agritech solutions to secure long-term food supply and modernize production systems. Policy support and rising demand are opening new investment opportunities across digital farming, smart machinery, and bio-innovation.

China Manufacturing Tracker

Our tracker provides continuous updates on key economic and growth indicators in China’s manufacturing industry. The data for 2025 full year has now been updated.

Trump 2.0 at One Year: What US–China Relations Could Look Like in 2026

After a year of upheaval, China and the US have settled into an uneasy but enduring truce. However, unresolved political, regulatory, and security tensions continue to shape the outlook for the year ahead.

China’s Economy in 2025: GDP Reaches 5.0% Growth Despite Challenges

China’s Economy in 2025 achieved its official growth target, underscoring macro‑level stability despite persistent demand‑side pressures. At the same time, sector‑level performance points to an economy still in the midst of structural adjustment.