Chris Devonshire-Ellis on China RO vs. FICE

Op/Ed Commentary: Chris Devonshire-Ellis and Richard Hoffmann

Mar. 5 – Recent changes in China’s tax treatment of representative offices in the country have started to push the viability of using RO as a vehicle of “investment” into China in terms of increasing financial pressure.

While often stated as being an “investment” vehicle, alongside wholly foreign-owned enterprises and foreign-invested commercial enterprises, the reality is they have never been considered as a vehicle for foreign investment in the strictest sense. Firstly, there is no capitalization requirement, and therefore no “investment” by the foreign owner, and secondly, because they were not permitted to trade (trading may be allowed for ROs following new regulations issued in February, but this has not been clarified yet).

Instead, RO have over the past 15 to 20 years been used as a type of “getting to know you” vehicle, whereby foreign companies, perhaps feeling their way in China, could establish a presence to see what the market conditions were like. China used to also be wary of letting foreign companies enter the China market en mass. Early representative offices could only be established for example in specific, security controlled Chinese-owned hotels, and were not originally permitted to rent genuine office space. This is why, in many second tier cities and older hotel buildings, you can still see hotel floors devoted to small offices. RO were originally even more confined than they are today.

However, the use of the RO in China by foreign investors has fallen into some disrepute. By clever – if still illegal – use of offshore billing, many ROs are able to conduct trade and source income for their parent company. Often they will conduct actual work in China, yet avoid taxes by have an offshore, Hong Kong or other holding company invoice for services carried out in China. There have been moves by the Chinese State Administration of Tax to combat this, however dealing with traceable, taxable income overseas has proven difficult. Hence a situation arises where work is carried out in China, but no proper tax treatment is applied as regards China-derived income and the applicable income tax.

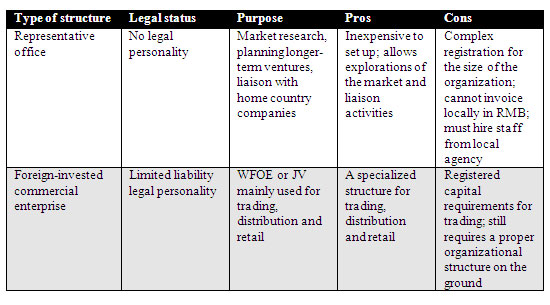

Accordingly, the SAT are placing RO under increasing domestic tax pressure to conform. This has now developed to the extent whereby for many foreign investors, a foreign-invested commercial enterprise may now be a more valid vehicle for trade in China. RO are now subject to increased amounts of tax, and are unable to obtain certain licenses that FICE may adopt. Therefore it is pertinent to examine the differences between RO and FICE from the trading perspective as follows:

Most ROs are taxed based on their expenses. This means, for any salary, rent, traveling costs, telephone bills that are related to the Representative Office taxes has to be paid. The tax rate is roughly 10.94 percent (according to the new regulations) and therefore an RO can be very expensive. If your expenses for example amount to US$100,000 per month you would need to pay roughly US$10,940 in taxes which is quite a burden because they have not been permitted to trade.

A FICE is taxed differently. If you are a general value-added taxpayer you are allowed to reduce your input VAT against the output VAT. This means, that your tax burden could be very low. Further, while you will have to pay corporate income tax, CIT will only be applicable on profits as you are allowed to deduct expenses. In addition, you are allowed to hire staff directly, to trade and to issue local RMB invoices (fapiaos). Therefore it is worth considering setting up a FICE, especially in light of China’s recent regulatory changes to the RO laws.

In terms of establishing sourcing offices or import-export businesses, in addition to service companies, the FICE now offers a reasonably inexpensive way to get legal, obtain import-export licenses of your own, and obtain the crucial ability to offset VAT. These are important considerations that should certainly be taken into account for businesses wishing to newly set up in China, and also for existing Representative Offices whose overheads may now become a burden considering their previous advantages. The February issue of China Briefing dealt with the closure of representative offices, and consequently small-medium enterprises in China may now wish to consider the implications of doing so and converting their China business model from the RO to the FICE vehicle. Working out the financial implications of offsetting VAT and lower import-export costs via not having to use agents should be a prerequisite.

Chris Devonshire-Ellis is the founding partner of Dezan Shira & Associates. Richard Hoffmann is the senior legal counsel in the firm’s Beijing office. Dezan Shira & Associates has been establishing representative offices in China for international clients for 18 years. Readers who may wish to consider changing their RO to a FICE, or readers who are considering a FICE registration in China may contact Richard Hoffmann at legal@dezshira.com.

Related Reading

China Representative Offices vs. India Liaison Offices

China Representative Offices vs. India Liaison Offices

Establishing Liaison Offices in India

Setting Up Wholly Foreign Owned Enterprises in China (includes full details of FICE applications)

- Previous Article Chris Devonshire-Ellis: Expatriates Going Offshore in China Contracts? Think Again

- Next Article China Curbs Property Speculation to Avert Real Estate Bubble