China Facing Competition as Tigers of Opportunity Arrive

Op-Ed Commentary: Chris Devonshire-Ellis

Sept. 20 – China is facing increasing competition from other Southeast Asian nations as regional growth both expands and creates alternative investment markets.

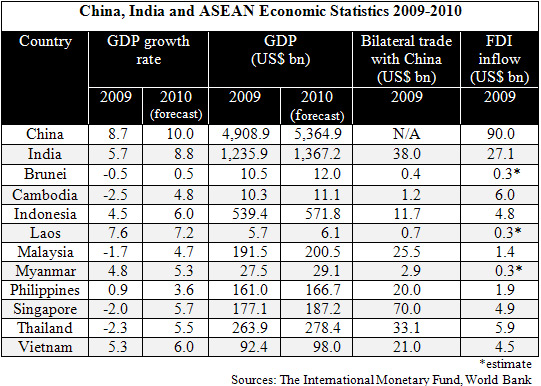

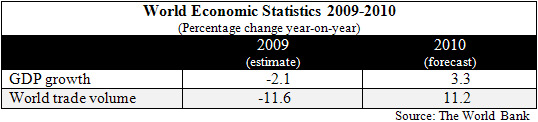

While global growth overall decreased by 2.1 percent last year and global trade dropped off by 11.6 percent, countries in Asia fared far better, with only Brunei, Cambodia, Malaysia, Singapore and Thailand showing negative growth, and these by relatively small margins. That has turned around completely for 2010, with none of the ASEAN members still showing a recessionary position. In all cases across Asia, GDP growth has been robust, and along with it, signs that China especially is also facing increased competition from ASEAN neighbors in chasing lucrative foreign investment.

Those dollars, especially from Europe and the United States, have been increasingly sought after as the traditional flow of investment from these sources has dried up due to weak growth in the United States and EU. Companies in these regions that are looking at investing overseas to balance out against slow domestic growth are now able to enjoy far more choices than before regarding location and investment conditions.

As China shifts from being a massive global exporter to a more consumer driven society, aspects of manufacturing are beginning to take the hint and look to other Asian markets. Cost comparisons are already being made between Laos, Cambodia and Vietnam while destinations such as Bangladesh are also proving to be increasingly attractive – particularly in industries such as textiles, which are highly competitive and require a mass labor force.

While some critics of this may point fingers at “infrastructure,” the reality is that many China investors came to the country when it too, was relatively inefficient. The driver of low wages and a relatively disciplined work force created an economic giant that reinvested its FDI and increased tax revenues into its infrastructure. Yet while wages have now risen, industries that are able to site close to ports and have access to decent supply chains in other nations are beginning to make the economic comparisons.

Pure competition and market dynamics dictate that much of ASEAN’s infrastructure is not as poor as commonly is suggested, and as global accountants sharpen their pencils, it is China’s labor intensive industries that are starting to feel the competitive pinch. Asia’s alternative destinations, the new “Tigers of Opportunity,” are now turning up for the feast as the world moves out of recession and back into growth. China’s own development has kick-started the regeneration of an entire region and, as multinationals recover from the effects of the downturn, a need to regain competitiveness away from the increasing China price is giving way to a new Asian playing field that’s set to welcome them with open arms.

Chris Devonshire-Ellis is the principal and founding partner of Dezan Shira & Associates, establishing the firm’s China practice in 1992. The firm now has 10 offices in China. For advice over China strategy, trade, investment, legal and tax matters please contact the firm at info@dezshira.com. The firm’s brochure may be downloaded here. Chris also contributes to India Briefing , Vietnam Briefing , Asia Briefing and 2point6billion

Related Reading

The Asia Comparator

- Previous Article Pursuing Employee Claims in China

- Next Article China Goes to Africa as New Dynamics Emerge