China Expat Tax Filing and Declarations for 2012 Income

Update: For information regarding expatriate income tax filing for the 2013 tax year, please click here.

Individual income tax finalization for foreigners in China

By Eunice Ku

Jan. 14 – Individual income tax (IIT) is normally withheld from wages or salaries by employers and paid to the tax authorities on a monthly basis (within 15 days of the end of each month).

Jan. 14 – Individual income tax (IIT) is normally withheld from wages or salaries by employers and paid to the tax authorities on a monthly basis (within 15 days of the end of each month).

An annual IIT declaration should be submitted to tax authorities within three months of the end of the previous calendar year (i.e., between January 1, 2013 and March 31, 2013 for the 2012 calendar year) for taxpayers who are subject to IIT in China and meet at least one of the following five conditions:

- Have an annual income of more than RMB120,000

- Derive income from two or more places inside the PRC

- Derive income from sources outside the PRC

- Received taxable income for which there is no withholding agent

- Other conditions regulated by the State Council

IIT Liability Determination

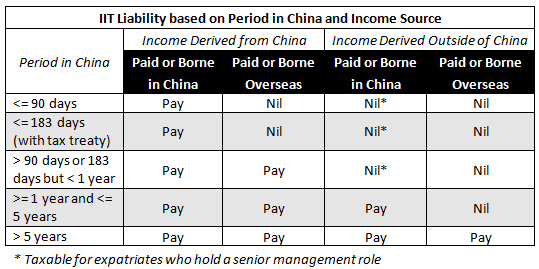

Whether a taxpayer is subject to IIT in China depends on income source and time period spent in China.

Income Source

China-sourced income refers to income paid by your employer (both domestic and foreign) during the period you provide services under your employment in China. Non-China sourced income refers to income received when you work outside the territory of China.

Time Period Spent in China

If you reside in China for less than 90 days (or 183 days for residents of countries that have signed a double taxation agreement with China) continuously or cumulatively during a calendar year, your only taxable income is the China-sourced income you receive from your Chinese employer. If you reside in China for more than 90 days (183 days) but less than one year, all of your China-sourced income would be subject to IIT, but you do not have to pay IIT on income derived from outside of China.

Residing in China for one calendar year means that, in a calendar year, temporary absences from China are less than 30 days continuously or 90 days altogether. Individuals who reside in China for more than one year, but less than five years, are subject to IIT on all China-sourced income as well as foreign-sourced income borne by a China-based entity. Foreign individuals who reside in China for more than five years are taxed on their worldwide income.

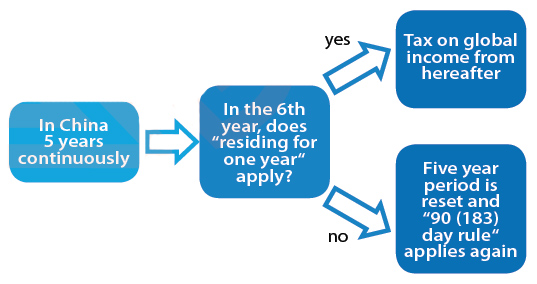

After an individual resides in China for five years, in the sixth year, if the individual resides in China for less than a year, the five year period is reset and the “90 (183) day rule” applies again. This means that you only need to pay tax on China-sourced income, and whether or not you need to pay tax on income paid by employers outside of China depends on whether you were in China for less than 183 days or more than 183 days. If you reside in China for one year during your sixth year, you will need to pay IIT on your salaries and wages derived both from China and outside of China, regardless of place of payment.

IIT Rates and Calculation

Income from wages and salaries is taxed according to progressive rates, with number of days spent in China taken into account. Non-employment income is taxed at different rates depending on income type.

Employment Income

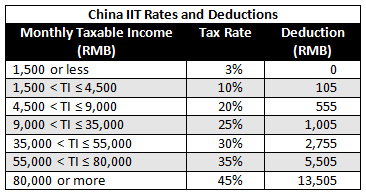

Income from wages and salaries is taxed according to progressive rates, ranging from 3 percent to 45 percent of monthly taxable income.

Monthly taxable income is calculated after a standard monthly deduction of RMB3,500 for local employees. For foreign individuals working in China (including residents of Hong Kong, Taiwan and Macau), the standard monthly deduction is RMB4,800. Money paid into Chinese social insurance can also be added to the pretax deduction.

- Monthly Taxable Income for Foreigner Individuals = Monthly Income – RMB4,800

- Tax Payable = Taxable Income x Applicable Tax Rate – Quick Calculation Deduction

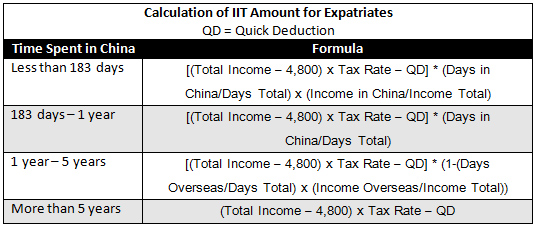

When calculating their IIT amount, foreign expatriates need to apportion their total taxable income based on the income source and time spent in and outside of China. The specific formulas are listed in the accompanying table. When counting the number of days you are in China for IIT calculation purposes, the day on which you enter into or exit China is included in the number of days you actually stay in China.

Non-Employment Income

Aside from wages and salaries, other non-employment income subject to IIT includes:

- Income from individual industrialists and merchants’ production and business operations

- Income from contracting or leasing of operations of enterprises and institutions

- Remuneration for labor services

- Author’s remuneration

- Income from royalties

- Income from interests, stock dividends and bonuses

- Income from lease, transfer of property

- Incidental incomes

Non-employment income is taxed at rates generally ranging from 5 percent to 35 percent, depending on the income source.

Employment Benefits

For IIT purposes, taxable income also includes bonuses, profit shares, allowances or subsidies, or other income related to job or employment. However, certain employment benefits for foreign individuals could be treated as non-taxable under IIT law if certain criteria can be met. These include (with supporting invoices where applicable):

- Employee housing costs

- Reasonable home leave fares of two trips/year for the employee

- Reasonable employee relocation and moving costs

- Reasonable reimbursement of certain meals, laundry, language training costs and children’s education expenses in China

Any cash allowance paid to cover expected work-related expenditures (such as an entertaining or travel allowance) will be fully taxable to an employee. Reimbursement may be a better approach for reducing IIT.

Portions of this article came from the January/February 2013 issue of China Briefing Magazine titled, “Annual Compliance, License Renewals & Audit Procedures.” In this issue of China Briefing Magazine, we discuss annual compliance requirements for China foreign-invested entities and detail the full audit processes for representative offices, wholly foreign owned enterprises, and joint ventures in China. We also discuss IIT liability for expatriates in China, IIT rates and calculation methods, permissible tax deductions, and how working for a permanent establishment can change tax liabilities.

Portions of this article came from the January/February 2013 issue of China Briefing Magazine titled, “Annual Compliance, License Renewals & Audit Procedures.” In this issue of China Briefing Magazine, we discuss annual compliance requirements for China foreign-invested entities and detail the full audit processes for representative offices, wholly foreign owned enterprises, and joint ventures in China. We also discuss IIT liability for expatriates in China, IIT rates and calculation methods, permissible tax deductions, and how working for a permanent establishment can change tax liabilities.

Dezan Shira & Associates is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in emerging Asia. Since its establishment in 1992, the firm has grown into one of Asia’s most versatile full-service consultancies with operational offices across China, Hong Kong, India, Singapore and Vietnam as well as liaison offices in Italy and the United States.

For further details or to contact the firm, please email china@dezshira.com, visit www.dezshira.com, or download the company brochure.

You can stay up to date with the latest business and investment trends across China by subscribing to The China Advantage, our complimentary update service featuring news, commentary, guides, and multimedia resources.

Related Reading

The China Tax Guide: Tax, Accounting and Audit (Sixth Edition)

The China Tax Guide: Tax, Accounting and Audit (Sixth Edition)

This edition of the China Tax Guide, updated for 2013, offers a comprehensive overview of the major taxes foreign investors are likely to encounter when establishing or operating a business in China, as well as other tax-relevant obligations. This concise, detailed, yet pragmatic guide is ideal for CFOs, compliance officers and heads of accounting who need to be able to navigate the complex tax and accounting landscape in China in order to effectively manage and strategically plan their China operations.

The Asia Tax Comparator

The Asia Tax Comparator

Here we discuss corporate income tax, value-added tax, business tax, goods and service tax, withholding tax, and individual income tax as these apply in China, India, and Vietnam, and in the popular holding company destinations of Hong Kong and Singapore. This includes tax rates, descriptions, incentives, and deadlines, as well as main FDI source countries/regions and industry-specific notes.

- Previous Article New Issue of Asia Briefing: Are You Ready for ASEAN 2015?

- Next Article China’s SAT Releases Clarifications on Capital Gains Under DTAs