Setting up a Representative Office in China

Choosing the right company structure for your business is an important first step for any company entering the Chinese market. Whether it be WFOE, FICE, RO, or JV— each structure present certain advantages that can assist a company in its business strategy.

A Representative Office (“RO”), is an attractive way for foreign investors to get a feel for the Chinese market without making a full commitment, as it is easy to set up and has no capital requirements.

It differs from the other company structures in that it merely serves as an extension to the parent foreign enterprise and does not form its own separate legal entity. In this way, if an RO breaches a contract, it is the foreign company that assumes liability.

An RO has no legal personality—meaning it does not possess the capacity for civil rights and conduct and cannot independently assume civil liability.

As a consequence, an RO is also limited in its business scope, as it is forbidden from engaging in any profit-seeking activities, and can only legally engage in:

- Market research, display and publicity activities that relate to company product or services; and

- Networking activities that relate to company product sales or service provision and domestic procurement and investment.

Establishing an RO

1. Pre-requisite to establishing an RO

To set up an RO, the overseas parent company must have already been in existence for two years.

To setup a business in China, the business must have a relevant lease agreement that can be submitted to the Administration of Industry and Commerce (AIC).

When selecting an office location, investors should be careful to obtain a series of key documents from the landlord to ensure that the building is itself certified to accommodate a business and to lease units to ROs.

These key documents are:

- Premises Ownership Certificate, affixed with the landlord’s company seal;

- Landlord’s Business License, affixed with the landlord’s company seal;

- Commitment letter or agreement of sub-leasing issued by the property owner for sub-leasing; and

- Real estate filing record issued by local government.

However, as the RO is technically not a Chinese enterprise, special attention needs to be paid to finding a suitable premise for AIC registration, as businesses RO applicants may be under heightened scrutiny during this process.

2. Set up procedure

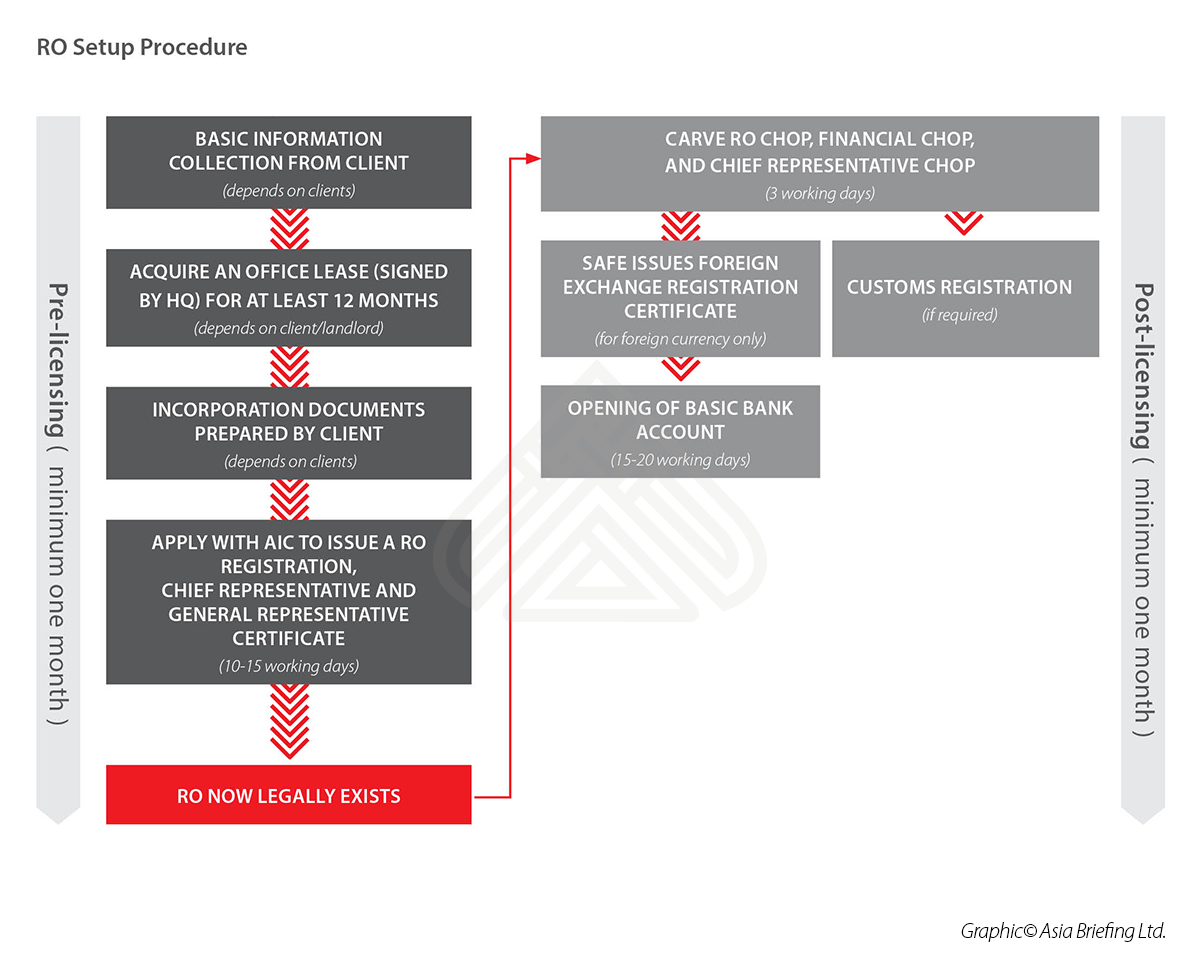

Once the required information and documents are submitted to local government, it typically takes at least 2 months to set-up a fully operational RO — including a minimum one month for the requisite documents to be notarized and legalized and for the AIC to issue the necessary certificates for establishment of the RO and another one month to set up the necessary accounts and chops for the business operation of the RO.

The AIC will usually issue an RO Registration Certificate, Chief Representative Certificate, General Representative Certificate within 10-15 working days and another three days is needed to carve the relevant chops including the RO Chop, Financial Chop, and Chief Representative Chop.

The set-up procedure is summarized below.

Foreign investors should open a Chinese bank account to handle the daily operation in China. Foreign currency settlement account also could be opened subject to foreign investor’s actual needs. In this regard, registration with State Administration of Foreign Exchange (SAFE) shall be done properly in advance.

The above RO incorporation procedure could be completed by foreign investors or to outsource to an experienced service company in order to avoid exposure to undue risk.

In addition, the RO chops are required to be managed properly to add a third-party consulting company of security. This prevents the RO chops falling into the wrong hands such as disgruntled employees who exert pressure on the company for various reasons by seizing the RO chops.

Limitations of an RO

Limitations of an RO

As an RO is merely an extension of its parent company, there are some considerable limitations to its business operational capacity and hiring capacity.

Chinese staff working for an RO, must be employed through a human resources agency that will sign a contract with the RO on the one hand and with the Chinese staff on the other in order to ensure social security and housing fund contributions are paid on a regular basis. While there is normally no limitation to the number of Chinese staff a RO is able to employ, no more than four foreign employees can be hired per RO.

In addition, foreign staff working for ROs should have an employment relationship with the parent company abroad, and any disputes should be settled under the laws of that country.

While relatively easy to establish and maintain, ROs are also fairly limited in terms of operational scope since they cannot actually issue invoices (i.e., fapiao, the basis for obtaining tax deductions in China) or sign contracts.

Taxation and reporting requirements

ROs are required to submit an annual report by June 30 every year providing information on the legal status and standing information of the foreign enterprise, ongoing business activities of the RO, and payment balance audited by their accounting agencies.

The registration authorities will issue fines if the RO fails to provide such reports on time or if it provides false information.

ROs are usually taxed on gross expenses with the overall tax burden and the deemed profit rate for general RO is 15 percent; however, these rates may be adjusted by the relevant tax bureau according to the industry.

If the chief representative is a foreign national who is fully based in China, the chief representative shall be fully subject to individual tax based on the income derived from the RO. If the chief representative works for the RO only occasionally, his/her individual tax shall be calculated based on the days he/she stays in China per month.

Editor’s Note: This article was originally published on October 25, 2013 and has been updated to reflect the latest regulatory developments.

About Us

China Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices in China, Hong Kong, Indonesia, Singapore, Russia, and Vietnam. Please contact info@dezshira.com or visit our website at www.dezshira.com.

- Previous Article New Laws in China to Impact Business, Trade from January 1, 2019

- Next Article La Ley de contaminación del suelo de China: nuevos requisitos