Haikou: An Emerging Industrial City

By Rainy Yao

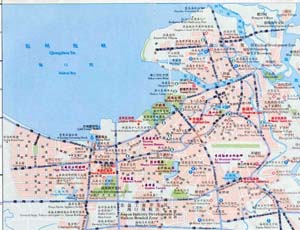

Often referred to as the “Coconut City,” Haikou is a prefecture-level city situated on the northern coast of Hainan known for its crystal waters and coconut trees. Haikou literally means “sea mouth”—i.e. the place where rivers and streams meet before joining the sea and accordingly was viewed by its ancient inhabitants as being blessed by Heaven. Rainy Yao from Dezan Shira & Associates takes a look at how this “paradise” is fast becoming the economic and industrial center of Hainan Island.

Often referred to as the “Coconut City,” Haikou is a prefecture-level city situated on the northern coast of Hainan known for its crystal waters and coconut trees. Haikou literally means “sea mouth”—i.e. the place where rivers and streams meet before joining the sea and accordingly was viewed by its ancient inhabitants as being blessed by Heaven. Rainy Yao from Dezan Shira & Associates takes a look at how this “paradise” is fast becoming the economic and industrial center of Hainan Island.

Economic Overview

Since the Song Dynasty, Haikou has been a trading port and main courier station to the countries to the southeast of China. Following the establishment of the Hainan Special Economic Zone in 1988, Haikou began vigorously promoting itself as China’s Outstanding Tourism City, with an advanced service sector. In 2005, the city established “Haikou Industrial Day” and rolled out various preferential policies to support the development of industry.

In 2013, Haikou’s GDP exceeded RMB 90.46 billion and grew at an annual rate of 9.9 percent. The city’s primary industry contributed RMB 5.85 billion (6.3 percent growth) and its secondary, RMB 21.7 billion (8.9 percent growth). The remaining RMB 62.9 billion came from the service sector, which grew at an annual rate of 10.5 percent.

Tourism, the pillar industry of Haikou’s service sector, brought in close to RMB 12.02 billion in 2013, with 10.44 million foreign and domestic tourists visiting the city last year.

The city’s three other pillar industries, namely, pharmaceuticals, tobacco and the electromechanical industry, brought in RMB 7.1 billion in 2013, accounting for 53 percent of growth in large scale industries .

Last year, growth in foreign investment was boosted by 37 newly established foreign-invested enterprises (FIEs), an increase of 94 percent from the year previous.

Development Zones

Haikou’s main development zones include:

Haikou Integrated Free Trade Zone

The Haikou Integrated Free Trade Zone was approved by the State Council in 2008 and has four pillar industries: bio-pharmaceuticals, digital information, automobiles and the electromechanical industry. The zone’s major functions include foreign trade, logistics and deliveries, international transfers, goods processing and exhibitions.

Haikou National New Hi-Tech Industrial Development Zone

This is the only national-level new hi-tech industrial development zone in Hainan approved by the State Council. The zone consists of six parks, namely, Medicine Valley Industrial Park, Hippocampus Industrial Park, Shiziling Industrial Garden, Yunlong Industrial Park, International Creative Port and Mei’an Science & Technology Park. Hi-tech industry clusters have been established in the zone for biological pharmacy, automobile manufacturing, new energy and new materials.

Haikou Guilingyang Economic Development Zone

Approved in 1991, the Guiling Economic Development Zone (EDZ) covers an area of 41.3 square kilometers and features industry clusters in biological pharmacy, agricultural and aquatic product processing, yacht manufacturing and logistics.

Investment Opportunities

The municipal government has implemented various preferential policies to promote industrial development in Haikou, including tax incentives, financial support and subsidies.

According to “Several Provisions on Promoting Industrial Development,” released by the municipal government in 2011, the city will make efforts to develop a “headquarters economy”—i.e. conditions suitable for on-site hosting of corporate headquarters—and encourage the establishment of R&D centers.

Moreover, the municipal government grants financial support to foreign investment projects in the following fields:

- Modern Agriculture

- “New” Industry (a catch-all for high-tech, low-waste industries)

- Modern Services

- Marine Industry

Tax Incentives

Enterprises established within the Haikou Integrated Free Trade Zone shall be exempt from value-added tax (VAT). Machinery, equipment and other construction materials used in the construction of infrastructure shall be exempt from import tariffs and import VAT. Goods traded within the zone shall be exempt from VAT.

Land Policies

Newly established factories, employee cafeterias and R&D centers shall be exempt from urban infrastructure construction fees.

Financial Support

The Haikou government has established a special fund of RMB 38 million for eligible hi-tech enterprises in bio-pharmaceuticals, automobile manufacturing and other industries. Manufacturing enterprises’ purchase of machinery and equipment costing RMB 5 million or more shall receive a subsidy of three percent of the total price.

Asia Briefing Ltd. is a subsidiary of Dezan Shira & Associates. Dezan Shira is a specialist foreign direct investment practice, providing corporate establishment, business advisory, tax advisory and compliance, accounting, payroll, due diligence and financial review services to multinationals investing in China, Hong Kong, India, Vietnam, Singapore and the rest of ASEAN. For further information, please email china@dezshira.com or visit www.dezshira.com.

Stay up to date with the latest business and investment trends in Asia by subscribing to our complimentary update service featuring news, commentary and regulatory insight.

Related Reading

Using China WFOEs in the Service and Manufacturing Industries

Using China WFOEs in the Service and Manufacturing Industries

In this issue of China Briefing Magazine, we provide a detailed overview of the WFOE establishment procedures as well as outline the typical costs associated with running these entities in China. We hope that this information will give foreign investors contemplating entry into the Chinese market a better understanding of the time and costs involved.

Manufacturing Hubs Across Emerging Asia

Manufacturing Hubs Across Emerging Asia

In this issue of Asia Briefing Magazine, we explore several of the region’s most competitive and promising manufacturing locales including India, Indonesia, Malaysia, Singapore, Thailand and Vietnam. Exploring a wide variety of factors such as key industries, investment regulations, and labor, shipping, and operational costs, we delineate the cost competitiveness and ease of investment in each while highlighting Indonesia, Vietnam and India’s exceptional potential as the manufacturing leaders of the future.

Adapting Your China WFOE to Service China’s Consumers

Adapting Your China WFOE to Service China’s Consumers

In this issue of China Briefing Magazine, we look at the challenges posed to manufacturers amidst China’s rising labor costs and stricter environmental regulations. Manufacturing WFOEs in China should adapt by expanding their business scope to include distribution and determine suitable supply chain solutions. In this regard, we will take a look at the opportunities in China’s domestic consumer market and forecast the sectors that are set to boom in the coming years.

- Previous Article China’s Domestic Consumer Market in 2020

- Next Article The Competitive Advantages of Manufacturing in Vietnam