Wage Comparisons and Trade Flows Between China, ASEAN and India

By Chris Devonshire-Ellis, Dezan Shira & Associates

As the cost of manufacturing in China continues to rise, the search for ever-more competitive products becomes increasingly important. While the China situation has an upside – the creation of a 600 million strong middle class consumer base by 2020 – the reality is that a combination of rising wages, welfare and operational costs is encouraging the Asian supply chain to move.

However, there are some important qualities about this shifting dynamic. With high productivity levels, China has largely proven itself as a capable manufacturer for global supply. The country has a relatively well-developed infrastructure – certainly along its coastline – when moving toward inland manufacturers. Although these do begin to deteriorate when moving toward inland manufacturers, the coastal regions remain a hotbed of global production and supply.

These locations, and the manner in which they have matched low wages and taxes with a well-constructed supply chain infrastructure, have served both the global consumer and foreign manufacturers in China for well over the past two decades. China’s cost-effectiveness has benefited foreign investors very well, to the extent that many MNCs have, over the years, moved an increasing percentage of their overall global manufacturing capability to the PRC.

However, China wages – and the associated welfare costs – have been rising by an average of 15 percent per annum for the past six years, and those profit margins are fast being eroded. This is in fact a state driven policy – the Chinese government wishes to move China further up the added value supply chain and to create a more consumer-based, rather than export-based, economy. This makes long term strategic sense for China, but means that while global manufacturers can look forward to a large and developed Chinese middle class consumer society, this is being achieved at the expense of low cost manufacturing.

The impact of rising wages now means the China focused purchasing manager needs to start looking elsewhere. This then becomes a strategic issue, meaning the following questions need to be answered:

- What is the new best purchase price?

- Where can I obtain it?

- Do productivity and delivery standards match my criteria?

- Can I also re-sell parts onto the middle class Asian consumer?

- Are there applicable tax or free trade agreements?

RELATED: China Business Will Be Harder Next Year

RELATED: China Business Will Be Harder Next Year

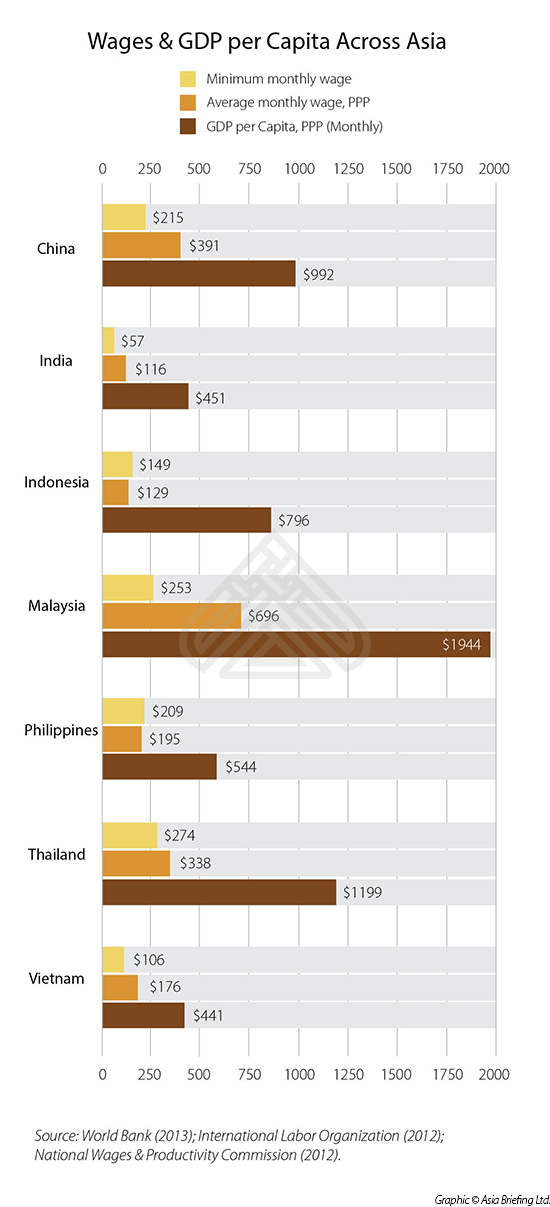

How Much Are Wages in Asia?

These charts look at wages from two perspectives: the average minimum wage, and the overall average wage. Generally speaking, it can be observed that wage levels across Asia are starting to become extremely competitive when compared to the China price. Of note are India and Indonesia, which have very large and available workforces. Both these countries are now fairly well downstream in creating and managing factories staffed with several thousand assembly line workers at a time, with dormitory facilities just as in China. Others of note include The Philippines and Vietnam, both of which are emulating China and beginning to organize large factory premises with facilities for thousands of workers at a time.

These charts look at wages from two perspectives: the average minimum wage, and the overall average wage. Generally speaking, it can be observed that wage levels across Asia are starting to become extremely competitive when compared to the China price. Of note are India and Indonesia, which have very large and available workforces. Both these countries are now fairly well downstream in creating and managing factories staffed with several thousand assembly line workers at a time, with dormitory facilities just as in China. Others of note include The Philippines and Vietnam, both of which are emulating China and beginning to organize large factory premises with facilities for thousands of workers at a time.

As can be seen, Chinese workers earn at least double and, in some cases, quadruple that of workers in other emerging Asian manufacturing hubs. This is a significant enough amount to justify considering alternative locations for production capacity.

That being said, salaries across the Asia-Pacific as a whole are expected to increase this year. Once inflation is taken into account, a report by Towers Watson shows that China will lead the way in wage increases in 2015, with a rise of 5.2 percent. Vietnam follows closely behind with 4.1 percent, with India (3.5 percent), Indonesia (3.3 percent), Malaysia (2.2 percent) and Singapore (2.2 percent) making up the remainder.

The results are in keeping with recent salary trends in the Asia-Pacific, especially with regard to India and China. Salary increases in India for 2014 were forecast to increase by 10 percent, but inflation ensured that the rise in real terms was far less. In reality, the increase barely affected overall wages in the country. Wages in China, meanwhile, seem to now be irrevocably on the rise.

RELATED: China-ASEAN Wage Comparisons and the 70% Benchmark

RELATED: China-ASEAN Wage Comparisons and the 70% Benchmark

There have been several minimum wage developments in Asia over the past several months. Of particular note is the 15 percent minimum wage increase that the Vietnamese government promised to introduce in November 2014. That rise has now been implemented, with region-dependent monthly minimum wage increases of VND 250,000-400,000 (US $11 – 19).

The rise will be the country’s fourth in just five years. Regional minimum wages in VND across Vietnam grew on average by 9.9 percent in 2010, 30.1 percent in 2012, and 15.2 percent in 2013. While these increases may seem significant, they have been catching up with inflation rates of 8.9 percent in 2010, 18.7 percent in 2011, 9.1 percent in 2012, and 6.6 percent in 2013.

For the Vietnamese government, the challenge over the past five years has been to strike a balance between income equality and making Vietnam an attractive destination for foreign investment. Vietnam has succeeded in bringing inflation below target levels, and is nurturing its nascent consumer class. The country’s income gap has been shrinking, with the World Bank measuring a GINI coefficient of 39.3 in 2010, and 35.6 in 2012.

While this year’s hike will ensure that Vietnam has the highest minimum wage of ASEAN’s five smallest economies, businesses needn’t be overly concerned. The country boasts one of the best manufacturing sectors within ASEAN, and its minimum wage is still competitive relative to the organization’s biggest economies.

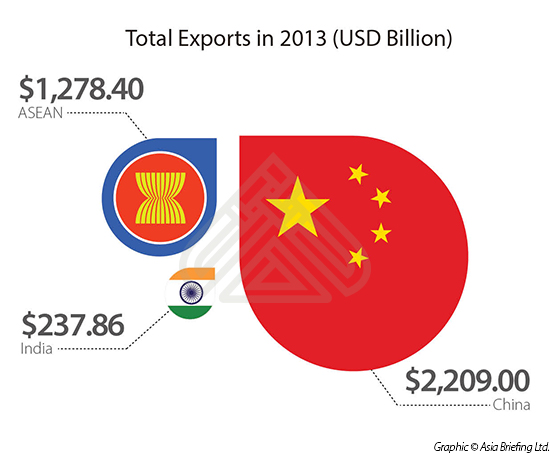

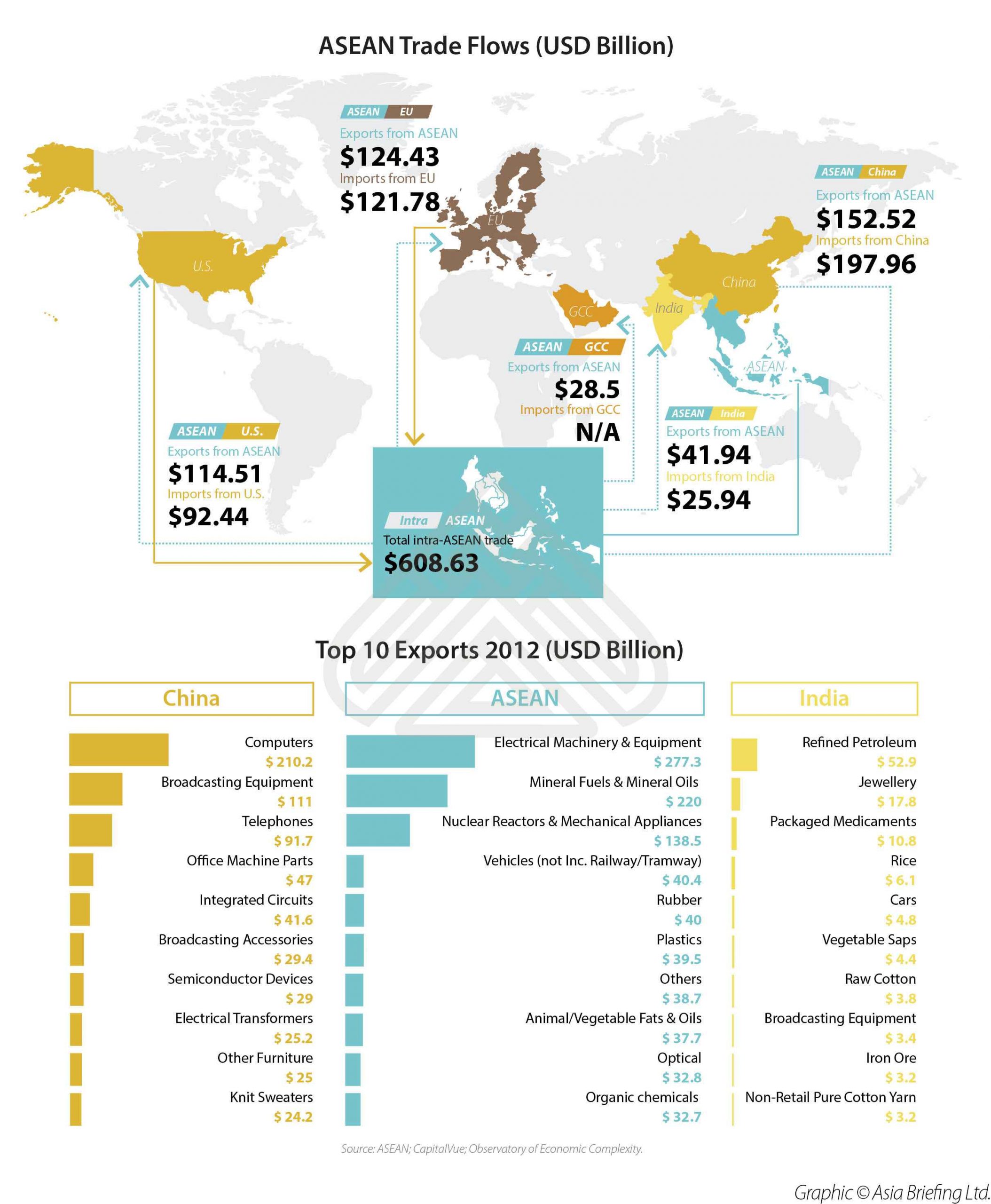

The Significance of ASEAN’s FTAs with China and India

ASEAN has FTAs in place with both China and India. These have removed import/export tariffs on 90 percent of all goods manufactured between these countries to essentially zero. As a result, manufacturing in ASEAN now not only gives access to the entire ASEAN bloc, but also the markets of China and India. In total, that provides access to a market of some 3.2 billion, with an estimated 1 billion of those to have obtained middle class consumer standards by 2020. This is separate to the already well-established middle class consumer markets in the U.S. and E.U..

ASEAN has FTAs in place with both China and India. These have removed import/export tariffs on 90 percent of all goods manufactured between these countries to essentially zero. As a result, manufacturing in ASEAN now not only gives access to the entire ASEAN bloc, but also the markets of China and India. In total, that provides access to a market of some 3.2 billion, with an estimated 1 billion of those to have obtained middle class consumer standards by 2020. This is separate to the already well-established middle class consumer markets in the U.S. and E.U..

Looking within ASEAN, the organization’s 10 nations have largely cancelled all import and export duty taxes on items traded between them, with the exception of Cambodia, Laos, Myanmar and Vietnam, who continue to impose nominal duties on certain items. However, these too will be completely lifted as of December 31st, 2015, meaning that the entire bloc will be duty free from this date.

![]() RELATED: China-ASEAN Trade Routes Key for 2015 Development

RELATED: China-ASEAN Trade Routes Key for 2015 Development

In addition to the China and India FTAs, ASEAN also has a combined FTA with Australia and New Zealand, known as the AANZFTA. The deal has eliminated tariffs on 67 percent of all traded products between the regions, and will expand to 96 percent of all products by 2020. It is the first time ASEAN has embarked on FTA negotiations which covers all sectors, including goods, services, investment and intellectual property rights, making it the most comprehensive trade agreement that the bloc has ever negotiated.

Further ASEAN treaties are in the process of being negotiated, not least with Japan, who already has a series of Comprehensive Economic Partnerships. South Korea, meanwhile, already has an FTA. Both of these are along similar lines to those identified above – the reduction of over 90 percent of all traded goods.

Conclusion

In short, ASEAN is the ideal location to be based to now reach out to countries both within and outside of Asia. While the productivity gap closes between China, and manufacturing faciities in India and countries such as Vietnam, wage considerations and the abolition of duties on goods manufactured in ASEAN is already and will continue to have an increasing impact on where China sources its low cost components and products from. The Asian supply chain – an integral part of the global supply chain – is evolving fast and both sourcing companies and manufacturers need to be aware of the dynamics in order to remain competitive leading into the next decade and beyond. Sourcing is now an Asian strategic play.

This article is an excerpt from the January issue of Asia Briefing Magazine, titled “The Asia Sourcing Guide 2015“. In this issue of Asia Briefing, we explain how and why the Asian sourcing market is changing, compare wage overheads, and look at where certain types of products are being manufactured and exported. We discuss the impact of ASEAN’s Free Trade Agreements with China and India, and highlight the options available for establishing a sourcing model in three locations: Vietnam, China, and India. This article is an excerpt from the January issue of Asia Briefing Magazine, titled “The Asia Sourcing Guide 2015“. In this issue of Asia Briefing, we explain how and why the Asian sourcing market is changing, compare wage overheads, and look at where certain types of products are being manufactured and exported. We discuss the impact of ASEAN’s Free Trade Agreements with China and India, and highlight the options available for establishing a sourcing model in three locations: Vietnam, China, and India.

Chris Devonshire-Ellis is the Chairman of the Dezan Shira Asian Alliance and Publisher of Asia Briefing. Chris can be followed on Twitter at @cde_asia. Dezan Shira & Associates provides strategic advisory, legal incorporation, tax planning and full professional support services to foreign investors throughout China, ASEAN and India. Please contact the firm at asia@dezshira.com or visit www.dezshira.com. |

![]()

Sourcing From China

Sourcing From China

In this issue of China Briefing Magazine, we outline the various sourcing models available for foreign investors and discuss how to decide which structure best suits the sourcing needs of your business. Perhaps the most important factors to consider when choosing a sourcing structure are your staffing requirements, your need for operational flexibility, and which option offers the greatest cost efficiencies.

Establishing Your Sourcing Platform in India

Establishing Your Sourcing Platform in India

In this issue of India Briefing, we highlight the advantages India possesses as a sourcing option and explore the choices available to foreign companies seeking to create a sourcing presence here. In addition, we examine the relevant procurement, procedural and tax duty concerns involved in sourcing from India, and conclude by investigating the importance of supplier due diligence – a process that, if not conducted correctly, can often prove the undoing of a sourcing venture.

Developing Your Sourcing Strategy for Vietnam

Developing Your Sourcing Strategy for Vietnam

In this issue of Vietnam Briefing Magazine, we outline the various sourcing models available for foreign investors – representative offices, service companies and trading companies – and discuss how to decide which structure best suits the sourcing needs of your business.

- Previous Article China Outbound: FATCA Reshapes FDI Flows Through Singapore and Hong Kong, Sourcing from India and Vietnam

- Next Article La Cina Annuncia Tre Nuove Free Trade Zones: Tianjin, Guangdong e Fujian